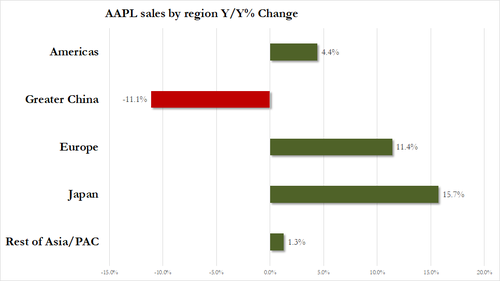

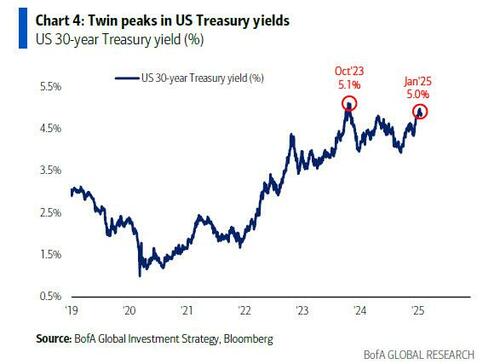

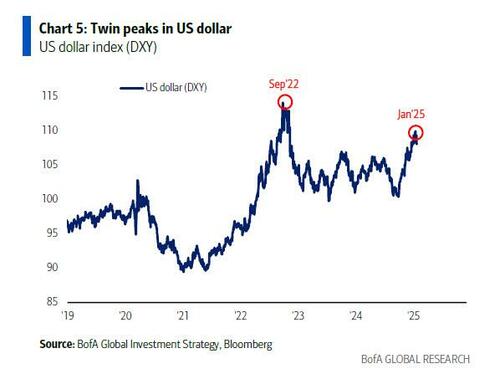

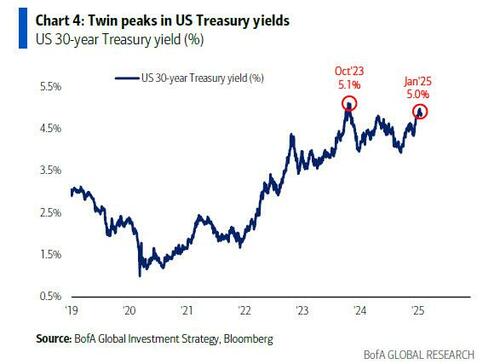

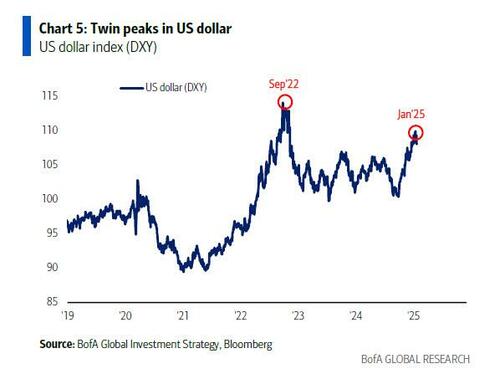

There was a lot to unpack in Michael Hartnett's latest Flow Show, in which he detailed the just released report from BofA's thematic group analyzing "The Big 10 Themes for the Next 5 Years" (available to pro subs), and we'll get to that in a bit, but first a quick recap of his latest qualitative observations which are for the most part, a continuation of his "bond bullish" theme discussed last week, with the CIO once again underscoring that there is a potential "twin peaks" in bond yields (5% on 30-year UST)...

... but also in the US$ ...

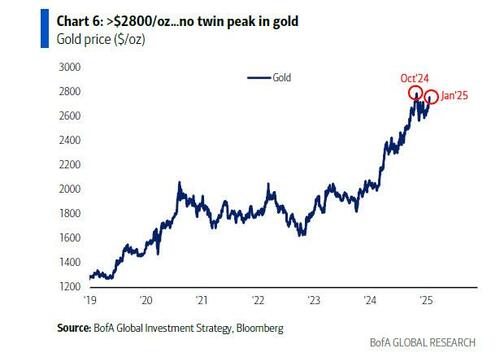

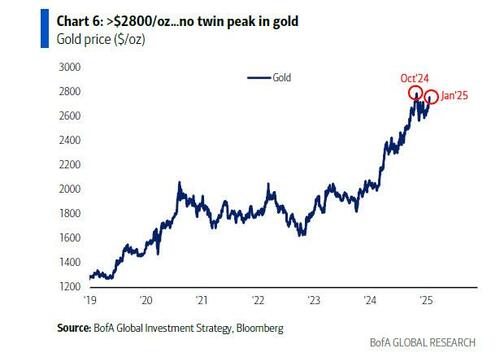

… which he views as risk-on catalysts if gold rises above $2800/oz (just $30 away)...

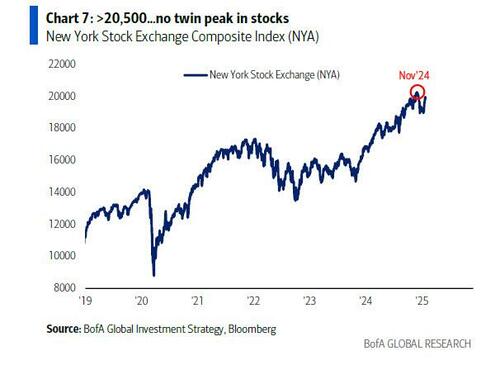

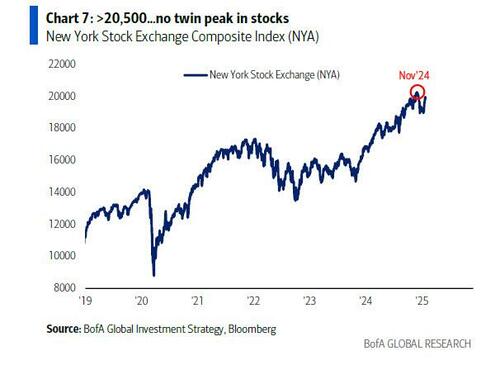

... and if the NYSE can rise above 20,500.

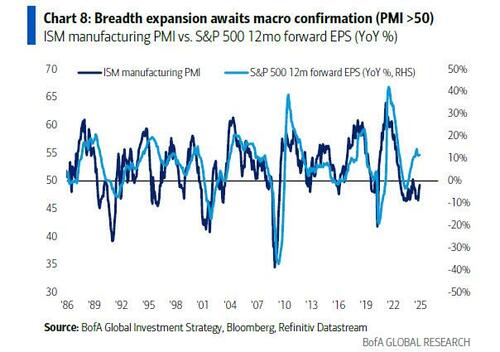

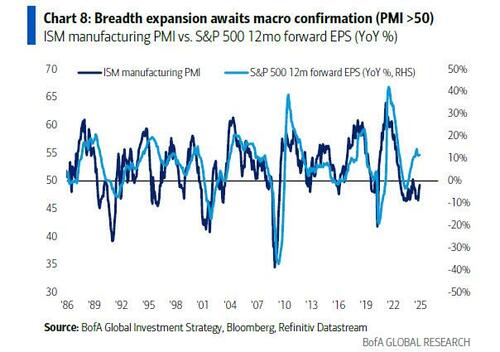

That said, equity breadth still remains very poor (SPW/SPX & ACWX/SPX pinned to lows) but global PMIs are once again in expansion territory and rising >50

... which when coupled with potential monetary policy divergence (Fed set to hike again as the RoW cutting), would result in better breadth.

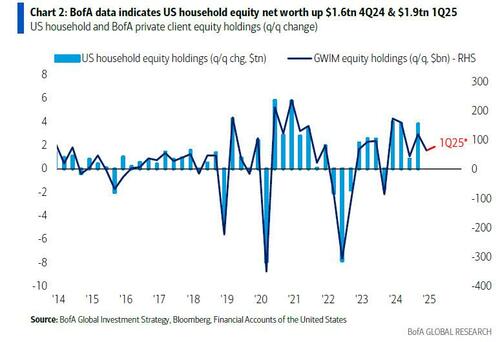

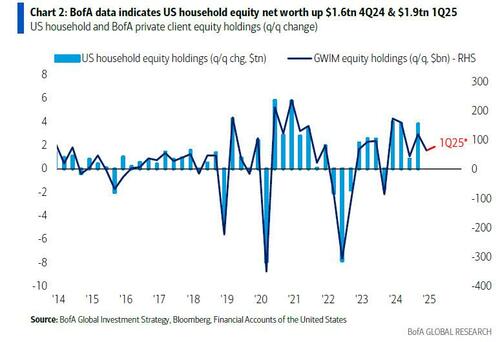

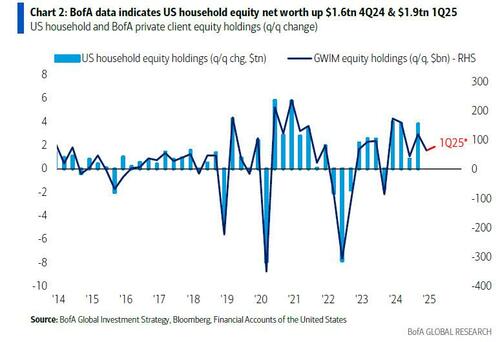

Hartnett then looks at the latest BofA Private Client data, and finds that it maps perfectly into the Fed’s quarterly estimate for US household equity net worth ($55.7tn in 3Q24), which also reveals that US equity wealth was up $1.6tn in 4Q24, and set to gain another $1.9tn in 1Q25 (unless the market crashes).

Taking a step back, the BofA strategist reveals that the bank's high net worth clients are holding on to $3.9tn AUM, broken down into a near-record 63.2% in stocks, 18.8% in bonds, and 11.2% cash...

... where Hartnett urges readers to note the contrast in position in "Magnificent 7" stocks ($430bn) vs. gold ($9bn); Another highlights: BofA's private clients have been big bond buyers past 2 weeks (biggest since Jul’24), and remain buyers of stocks ($13bn since election, biggest 2-month add since 2022), while in ETFs, private clients buying bank loans, staples, discretionary, selling low-volatility, healthcare, resources past 4 weeks.

Ok, but if the high net worth client list is already near record stock capacity, do they have the capacity to buy more? Well, looking at the source of funds - for future stock buying - Hartnett makes the following observations:

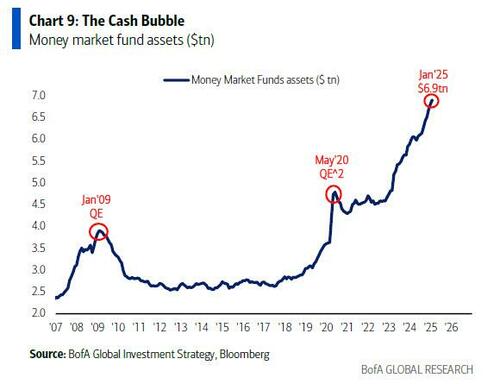

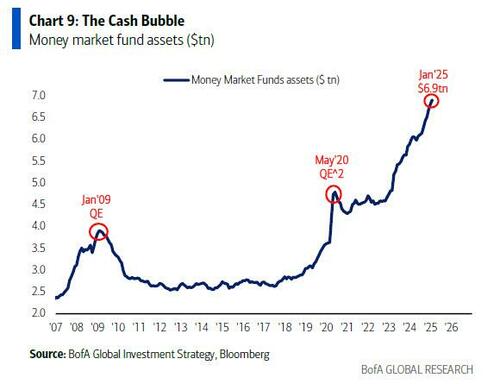

Conventional wisdom is money market fund asset AUM, which is at a record $6.9tn...

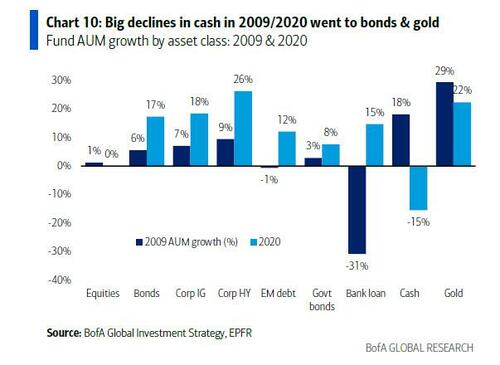

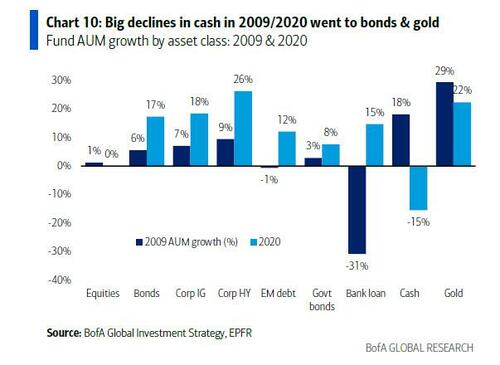

... will be a big 2025 source of funds for risk assets; But Hartnett warns that conventional wisdom will likely be disappointed as history shows MMFA inflows continue for 9 months after 1st Fed cut for 9 months, i.e. peak MMFA AUM will hit in June ’25, and the past 2 cycles of big Fed easing in '09 & '20 saw sharp drop in MMFA/cash but bonds & gold were big beneficiaries (bear markets & recession are when cash rates are slashed).

Turning to "unconventional wisdom", Hartnett notes that housing is a source of funds for both stocks & crypto, and especially now for the following reason: the US housing affordability index is hovering at 40-year lows, US home price-to-rent ratio close to all-time highs...

... which has pushed the median age of the US first-time homebuyer to a record-high 38 years old (was 29 years in 1985); As a result of this housing unaffordability, the millennial & Gen Z “can’t-buy-a-home” liquidity recycled into risk assets.

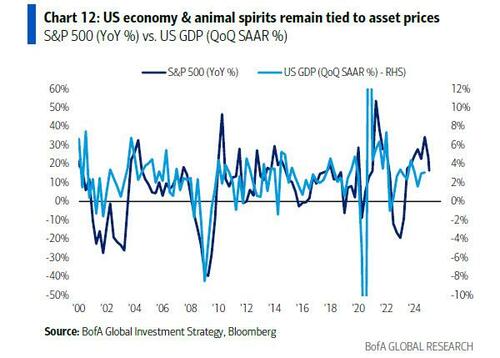

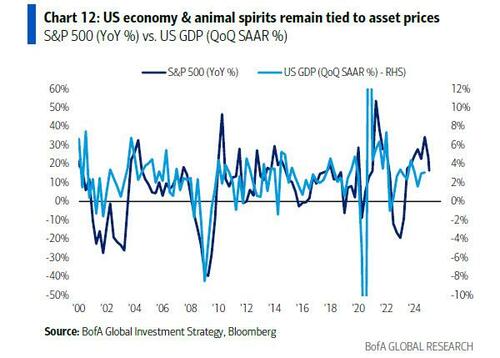

All of this leads to a virtuous cycle: since the US economy has become "exceptionally" sensitive to asset prices in the post QE/financial crisis era ...

... the higher equity net worth means more wealth that either supports consumption or is recycled into risk assets; for context, US household equity net worth is $55.7tn in 3Q24; and while the Fed has yet to release 4Q24 data (due in March) as noted above the BofA private client equity holdings data maps perfectly into Fed estimate of US household equity net worth, and it reveals equity wealth rose $1.6tn in 4Q24, and is set to gain another $1.9tn in 1Q25, which makes the stock market a self-fulfilling catalyst for “US exceptionalism".

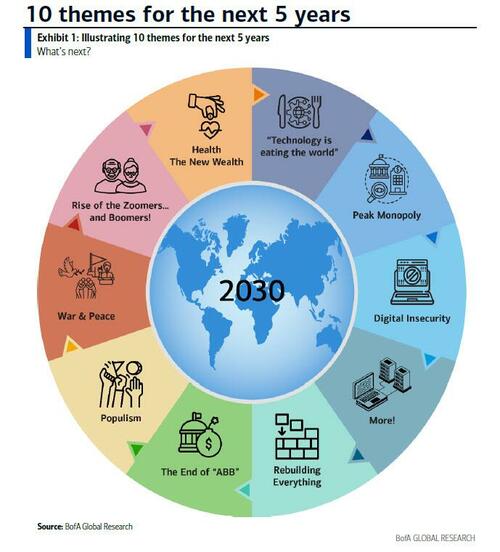

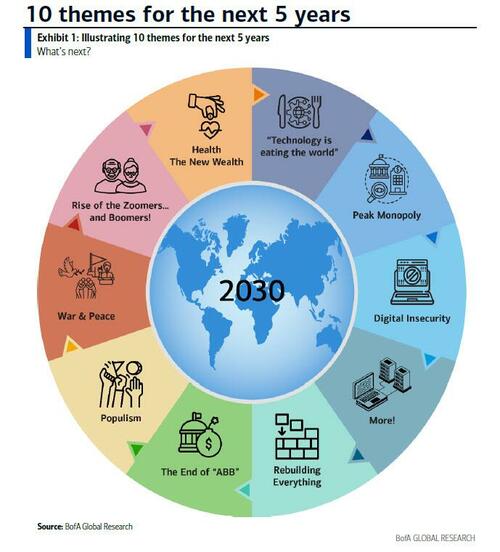

Which then brings us to the punchline of the latest Flow Show: Hartnett recaps of the latest must read BofA thematic research report, looking at the "World In 2030" (full note available to pro subscribers), and specifically what the bank thinks will be the 10 biggest themes in the next 5 years.

We excerpt from the full must-read report:

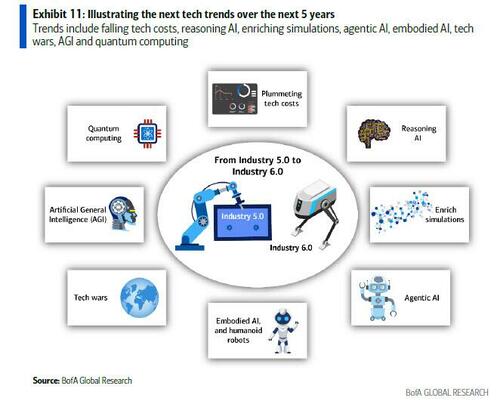

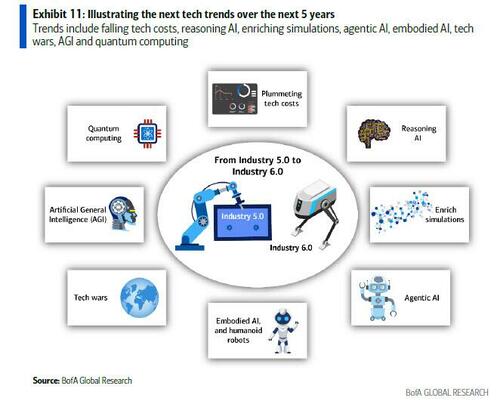

1. "Technology is eating the world": Agentic AI + Reasoning + Rich Simulations + Embodied AI = Industry 6.0 which is minimizing human intervention.

Summary: Technology is moving us to a new phase in the next 5 years. Powered by the AI revolution, we will watch technology prices plummet. We will see AI’s integration in all aspects of our lives. We will witness its game-changing role in leap-frogging innovation. Agentic AI will influence the job market, rich AI simulations will develop new products in healthcare, industrials and financial services. Furthermore, AI will interact with the physical environment, enabling the next generation of automation. At the same time, we are likely to see a tech war “arms race” between the Superpowers, complicated by accelerated deglobalization and tech protectionism, as well as privacy and demographic concerns.

Welcome to Industry 6.0 – minimizing human intervention

The AI large language model (LLM) revolution has accelerated the adoption of Industry 5.0, which aimed to build on the Industry 4.0 digitalization era by integrating “humancentric” approaches into industrial processes. Industry 5.0 emphasized collaboration between humans and advanced technologies, such as AI-driven robots, to optimize workplace processes. We are now seeing AI integrated in every aspect of our economy and our lives, and “humanizing” automated processes. This is moving us from the humanization era (Industry 5.0) to Industry 6.0, which aims to minimize human intervention by creating a fully integrated, intelligent manufacturing systems based on the next generation of technologies.

- Tech-onomy: Technologies powering themselves towards lower prices - Investments in automation, AI and tech are reducing prices across the board and increasing returns. For example, while drive capacity has risen by more than 20,000x in the past 20 years, the price per gigabyte has fallen by >99%. More technology gets deployed to satisfy demand, leading to falling prices. Then these technologies become cost-effective in new applications, feeding increased demand again.

- “Reasoning AI”: adding the human element, one step before AGI - AI model capabilities are expanding to include tasks that require reasoning. All LLMs thus far have used algorithms for tasks that can be solved with rapid thinking, with increasingly sophisticated versions owing to their emergent properties. However, the new versions of models, like OpenAI’s o1 and o3 models, can now break down complicated problems into separate tasks and hypothesis, using “reasoning” to get to a solution – like human thinking.

- Agentic AI: A world of 100bn AI agents working alongside us - Agentic AI is the next big trend in commercializing AI models. It is able to use reasoning capability and build upon that to choose and use the right tools to complete the tasks it is set. At our Transforming World Conference, Steve Brown gave examples such as a marketing plan or a travel booking. He described using AI agents as a way to scale an organization and transform a company’s workforce, as well as their ability to interact with other AI agents, e.g., to obtain an approval or review (e.g., legal or compliance). This doesn’t mean human workers would be completely out of the loop, in his view, but that AI agents could be partners or subordinates that work for humans.

- AI-enriched simulations changing industries - AI-enriched simulations are being leveraged for other innovations; for example, simulation for drug discovery and material breakthroughs. AI has helped to discover 45x times more crystals ever known to man. Using AI in drug discovery facilitated the finding of a candidate for liver cancer in just 30 days. Many of our everyday products are complex and over time designers have come to rely on computer-driven simulations, but they often take time to run. Even once possibilities are found, additional simulations are needed to ensure safety. AI simulation combines techniques from quantum physics and deep learning to enable sampling a vast dataset quickly and efficiently. AI and simulation technologies bring the ability to take a molecular structure and simulate it billions of times, making small changes each time to see which structure is optimal. We can now do this in a matter of weeks and months – a task that would take 10 years in the physical world.

- Embodied AI, physical intelligence & humanoid robots - AI is enabling rapid progress in robots, given the ability to programme and interact with them via language models. The term “embodied AI” was first used to describe the branch of AI that focuses on how computers, systems and technology can interact with the physical world. It typically includes AI for sensorimotor skills, navigation, and realworld interactions. But with the rise of generative AI, embodied AI is also being used to give this technology a physical form, typically a robot including autonomous vehicles and drones. The next half a decade will be the breakthroughs years of robotics thanks to AI.

- Welcome to the quantum era. Quantum advantage as soon as 2025? We are currently in the early prototype phase of quantum. Scaling up a quantum computers’ qubit number involves solving for many problems such as error correction, cost, speed, and energy efficiency. Current quantum computing companies will need to solve these problems but will reach a limit on the qubit number they can achieve because of the complex architecture that they employ e.g., cabling and racks.

- Artificial General Intelligence (AGI)…by 2028? AI smart enough to automate AI research to improve itself, providing feedback loops where superintelligence is possible. Since the first discussions about general AI and technological singularity by mathematician Von Neumann in the mid-20th century, scientists and technologists have repeatedly predicted the coming of human-level intelligent machines in the near term. NVDA’s CEO projected we will reach AGI by 2030, while futurist Steve Brown claimed it could be sooner than that in our Transforming World Conference, that AGI is between 1 year away and never being achieved. The assumption at the moment is 2027-28, as per company/press reports.

* * *

2. Peak Monopoly: Dominance of the "Magnificent 7" peaks as AI benefits broaden & politics pressures mega-caps via taxation and regulation.

Summary: The US stock market has never been so concentrated, dominated by a handful of mega-cap companies, aka the “Magnificent 7”. However, the monopoly of capital and returns by monopolistic tech peaks in coming years as AI gains broaden to a much wider array of corporations, and populist politicians target the monopoly of megacap wealth via taxes & regulations to ease deficits and placate impact of AI on labour market.

The bigger, the better

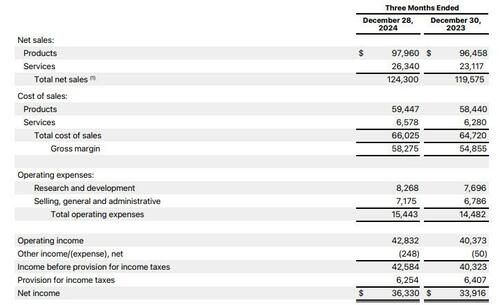

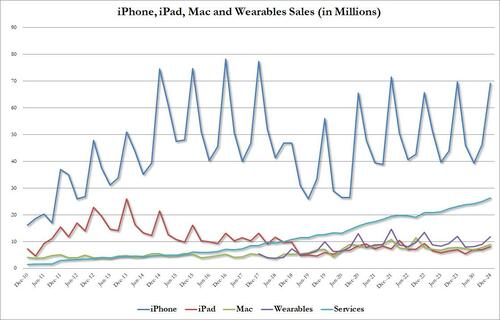

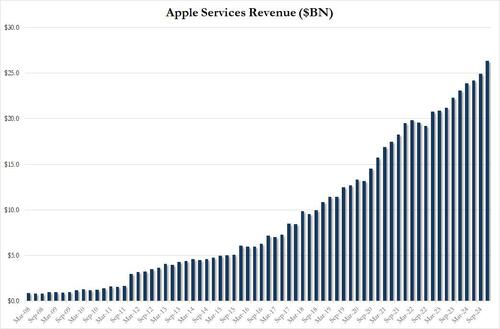

AI has been the positive exogenous shock of the 2020s, as “Technology is eating the World” indicates. And AI has dominated investor bull psychology in the past two years encapsulated by the rise of the “Magnificent 7” (Microsoft, Nvidia, Apple, Amazon, Google, Meta & Tesla). Even before the AI-shock, these seven companies had become the “leadership” of the US stock market driven by their first-class products, brands & management. Investors also rewarded their strong balance sheets that could withstand the rise in interest rates in the early-2020s, and their monopolistic market positions that guaranteed revenue streams and low-cost suppliers. AI has added to their lustre whether via ability to fund AI capex (Microsoft, Apple, Amazon, Meta, Google spent US$62bn on capex in Q3’24), lead the provision of AI services (e.g., cloud computing), and provide the chips best suited to handle the computing required by AI (Nvidia).

The combined market cap of the Magnificent 7 has risen to US$18tn, roughly equivalent to the GDP of China, and representing 35% of the market cap of the S&P 500. The US stock market is now the most concentrated in many, many decades.

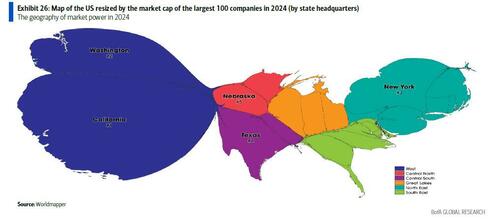

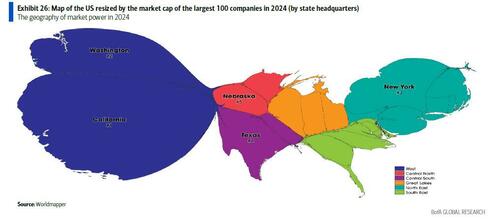

In the past two years nearly 60% of S&P 500 returns have been driven by these 7 companies (the number of companies outperforming the index has fallen to its lowest since 1998/99). In addition, the dominance of the “Magnificent 7” has caused the US to rise a record-high 67% of the global stock market capitalization and has led to big shifts in regional wealth concentration (Exhibit 26).

3. Digital Insecurity: Ending the decade with the "death" of privacy, job market disruption, 10 deepfakes for every person on the planet and cybercrime as the 3rd largest GDP in the world.

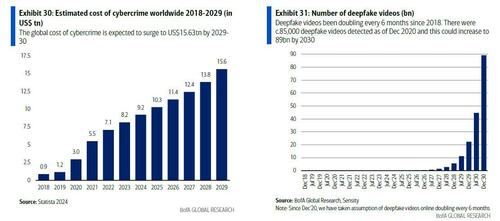

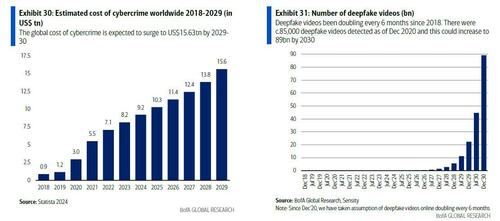

Summary: Many of us feel more anxious than ever before about technology risks given everything from cybersecurity hacks, AI agents displacing human workers, the rise of fake news and the spread of mis/disinformation through deepfakes, and social media addiction leading to loneliness. The global cost of cybercrime is expected to surge to US$15.63tn by 2029-30 (source: Statista). At the same time, an attempted deepfake attack occurs every 5 minutes (source: Onfido, Entrust). The number of deepfake videos has been doubling every 6 months since 2018 (source: Sensity, Information Matters). And deepfake damage costs are projected to reach US$40bn by 2027 (source: Deloitte). Finally, we need to reskill 1bn people by 2030, which is a third of all jobs worldwide, because of technology disruption (source: WEF, OECD).

Cybersecurity: the digital black swan for 2030? - Cybersecurity is the #1 risk in a Transforming World because of how reliant we are on technology, in our view. Most of the world managed to get through COVID lockdowns and physically social distance, but would this have been possible without access to the digital world? The rise of Generative AI now creates a new ‘threatscape’. For example, using the compute power of 10,000+ A100 Nvidia GPUs to train ChatGPT, it would take just 1 second to crack a password today (source NetSec, Hive Systems). Hacks now take an average of 277 days or about 9 months to identify and contain (source: IBM). And cybersecurity is increasingly becoming a matter of national security, with critical infrastructure more vulnerable to attacks. The costs of cybercrime are eyewatering and set to hit US$10.5tn by 2025E, making it the world’s 3rd largest ‘economy’ behind only the US and China.

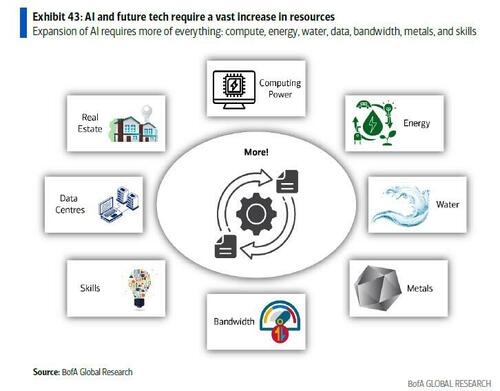

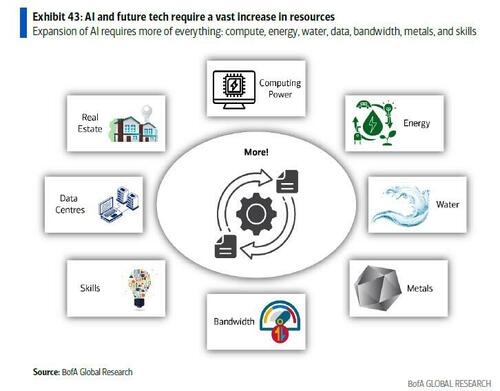

4. More! Exponential growth of tech requiring more resources like infrastructure, compute, bandwidth, human capital, energy, water, skills, and data centers.

Summary: A Transforming World has transforming needs. Exponential growth of technology will require significantly more resources and infrastructure, adding to the already growing requirements from population growth. The rise of artificial intelligence (AI) in particular is accelerating demand for data, computing power, bandwidth and expanded infrastructure such as energy, water, commodities and data centres. Several bottlenecks are already emerging in these areas, as well as gaps in the skills and human capital required to deliver them. New technologies and solutions are needed to avoid structural deficits between 2025 and 2030.

Our Transforming World is hungry – and thirsty – for more

Exponential technology requires a lot more of…everything: Simply put, deepening technology adoption alongside population growth means we need significantly more resources to enable the productivity gains and economic growth potential from AI and future technologies. The key investment opportunities in the next 5 years include:

- Compute: AI is set to accelerate demand for more powerful chips such as GPUs, with the TAM for AI accelerators set to treble between 2024-2030 to c.US$360bn (BofA Global Research). Manufacturing capacity and supply chains are expanding to accommodate, with an overall market opportunity of over US$1tn (McKinsey).

- Energy: increased power generation, storage and grid connections will be required for the electrification of industry, transport and buildings, adding c.7,000 TWh of electricity demand globally by 2030 (IEA). Within that, data centres could add c.250TWh in the US alone by 2030 (McKinsey).

- Water: cooling data centres and advanced manufacturing adds demand to already strained freshwater supplies. Global data centres consumed 309m gallons of water a day on average in 2023, projected to rise to 468m by 2030 (Bluefield Research).

- Metals: increased demand for critical minerals from AI, renewable energy and electric vehicles is expected to lead to structural shortages of several metals by 2030, including copper, nickel, lithium, cobalt and silver. Trade tensions are already increasing, such as China’s recent ban on exports of gallium and germanium – both required in semiconductor chip manufacturing (BofA Global Research).

- Bandwidth: rising AI/tech adoption will stress internet infrastructure, requiring more fibre and advanced networks such as 5G, and beyond (6G, plus new satellitebased networks). In the US, the largest network provider, Verizon, said network traffic doubled between 2020-24, and it predicts it will double again between 2025 and 2030 owing to demand from AI tools (Bloomberg/Verizon).

- Skills: shortages in skilled labour, e.g., in AI, data science and hardware engineering, could worsen in the next 5 years; 1bn people are set to retrain/reskill by 2030 owing to tech disruption (OECD).

- Real Estate: more land will be needed to accommodate growing technology requirements. Per Bloomberg >7,000 public data centres are either built or in development, but more will be needed – ABI research forecasts 8,400 will be in operation by 2030 (vs 5,700 in 2024, and 3,600 in 2015).

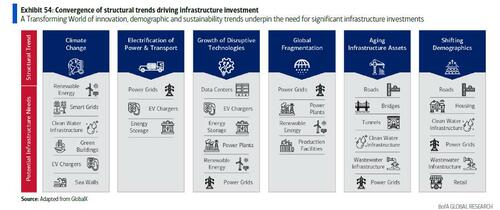

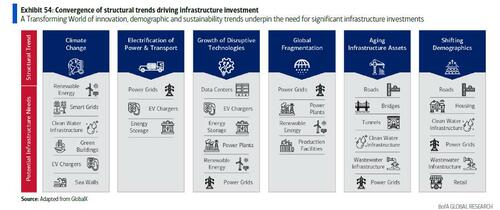

5. Rebuilding Everything: US$94tn of funding needed by 2040 to rebuild ageing assets and expand the infrastructure supporting tech.

Summary: Global Infrastructure needs to be expanded and modernised to accommodate converging demographic, sustainability and innovation trends. But there’s a funding gap – US$94tn is required globally by 2040 (source: Oxford Economics), and an estimated US$500bn is needed each year by 2030 on top of available public funds (source: Brookfield). This spans several structural trends - including decarbonisation, electrification, disruptive technologies, reshoring, shifting demographics and ageing of existing assets – all requiring a significant increase in infrastructure investment.

The long and winding road to nextgen infrastructure - The relationship between technology, economic growth and infrastructure is closely tied to both expansion and modernisation requirements.

Addition: Expanding infrastructure to support digital technologies and several structural trends, including data centres, high-speed data networks, and energy installations to power them.

Rebuilding ageing assets: Older infrastructure such as power grids, water systems and transport networks require replacement and modernisation to integrate new technologies such as IOT/sensors, AI monitoring and intervention.

Energy transition: towards a decarbonised, decentralised, digital energy system The global energy system is transitioning towards more diversified sources of power generation and storage, which requires significant infrastructure and technology. Global investment trends are beginning to reflect this, with close to US$2tn invested in a range of clean energy assets in 2023 (double that of 2020). However, much more is needed. BNEF projects investment needs will rise to US$3tn per year based on current technologies/policies on average over 2023-30, and could reach US$5tn on average per year if further policies were instated. Power generation, EVs and grids made up c.90% of this investment in 2023, but the range of sectors is diversifying to clean industry (steel, ammonia, bioplastics), storage and electrified heat, for example

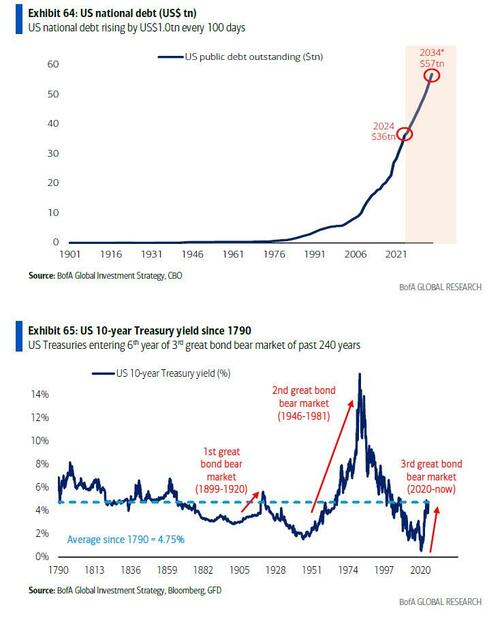

6. The End of "Anything But Bonds": Self-driven or market-imposed, era of government fiscal excess ends, reversing the primal "Anything but Bonds" theme in asset markets.

Summary: The end of 5,000-year lows in interest rates, fiscal excess, inflation....the "Anything but Bonds" trade has been the most powerful Wall St trend of the past 5 years; in the next 5 years either self-driven or market-imposed, we believe the era of government fiscal excess ends, reversing “Anything but Bonds” pricing in asset markets.

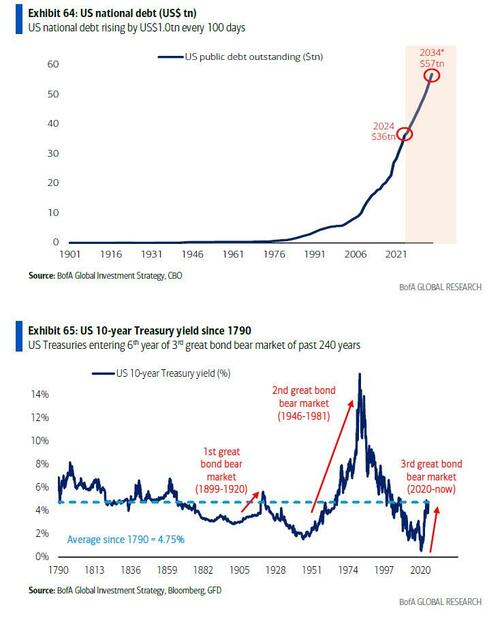

Big Government, Big Debt, Big Bond Bear

Big government has been one of the biggest themes of the 2020s. Central banks dominated economic policy making for much of the past 30 years. Fiscal policy was secondary. Asset prices in the 2010s were particularly driven by extreme monetary policies such as Quantitative Easing, Zero Interest Rates, Negative Interest Rates. By the start of the 2020s, interest rates had fallen to 5000-year lows. This has changed dramatically in recent years as a global pandemic, wars, and fiscal excess ended the 40-year long bond bull market (1981-2020). Now both governments and central banks share responsibility for economic growth.

The US federal budget deficit has averaged 9% of GDP in the past 5 years, the 2020s, with the past two administrations running the largest deficits since FDR in the '30s/'40s. The US$7tn US government sector is now the 3rd largest economy in the world in GDP terms. Big government has aided and abetted big nominal GDP growth (up almost 50% in past 5 years). The trend is global. Governments running budget surpluses have become rare…last time China ran a budget surplus was 2007, US 2001, Japan 1992, France 1974, Italy 1905.

7. Populism: "incumbents" were voted out in 26 of 32 elections in '24…populism means less globalization, immigration, and central bank independence.

Summary: Populism is politically very popular in the 2020s; populist policies in coming years mean less globalization, less immigration, less central bank independence, and fiscal policy divergence between the US (less government spending) & Europe (more government spending).

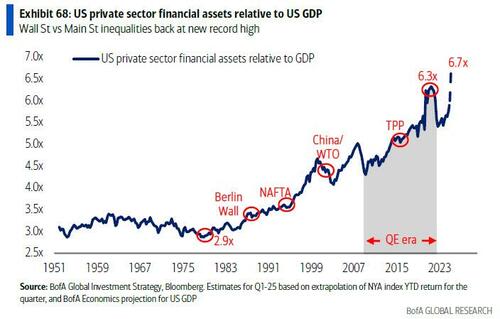

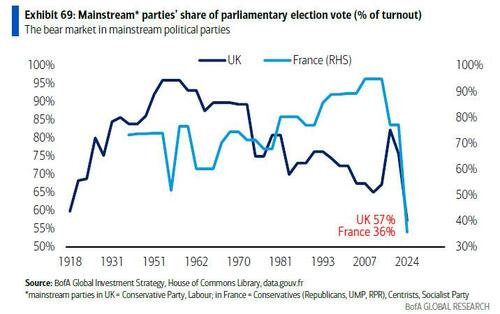

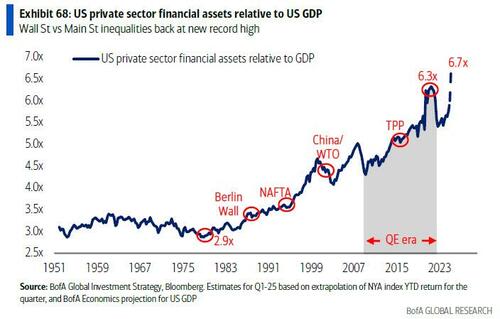

A global political theme - Populism is politically on the rise in the 2020s. Occupy Wall Street, Brexit, Trump 1.0 were all harbingers in the 2010s, and the political trend has deepened in the 2020s. Electorates are increasingly shunning mainstream political leaders and parties in response to rising inflation, rising immigration, and rising inequality (the asset prices on Wall St are 6.7x the size of the GDP of Main St – Exhibit 68).

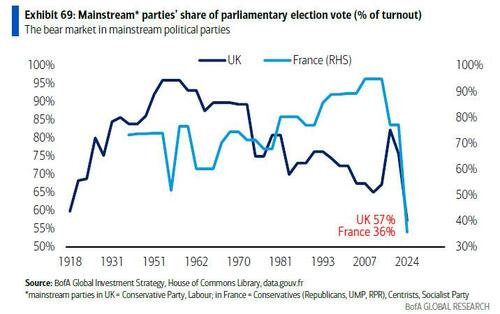

In 2024, elections were held in countries that accounted for 40% of the world's population, 60% of world GDP, and 80% of the world's equity market cap. Trump's sweep in the US Presidential election was the most consequential populist victory, but voters notably ousted “incumbents” in 26 of the 32 elections in 2024, a year that saw the share of votes won by mainstream parties fall to its lowest in the UK since 1918 in (57%), to its lowest level in France since 1945 (36% - Exhibit 69). The German election on February 23rd looks set to be the next populist milestone. The German economy has been stagnant for 10 years, and "far-left" and "far-right" parties have recently attracted over 40% of regional election votes.

8. War & Peace: Protectionism to continue; but "forever wars" set to end & America First policies to spur Asian & European stimulus & reform.

Summary: Global trade & tech protectionism is set to continue; for Trump, tariffs address “unfair trade practices”, raise US import duty revenues, achieve non-trade objectives; but the US “forever wars” are set to end to the benefit of Europe; and America First policies will spur Asian & European stimulus & reform.

The End of Globalization

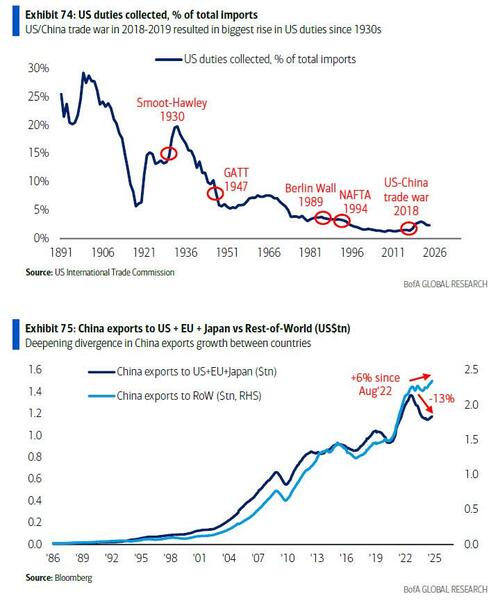

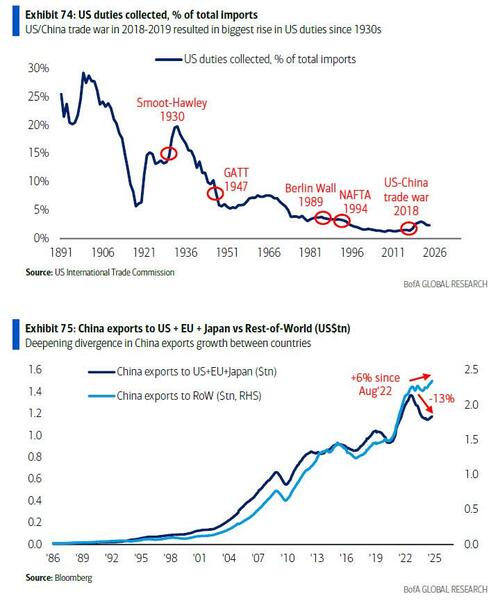

The 1990-2010 era of peace and globalization has been replaced in the past 10 years by trade wars, military wars, greater geopolitical conflict. The US has become more protectionist, and the 2018-2019 trade war resulted in the largest rise in % of US duties collected since 1930 and Smoot-Hawley (Exhibit 74). And the US-China battle for economic, technological, geopolitical supremacy has disrupted global supply chains, causing China to shift its exports to the rest of the world, away from the US, EU, Japan - Exhibit 75), and giving birth to the early-2020s theme of reshoring.

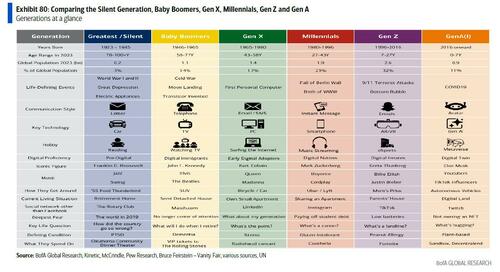

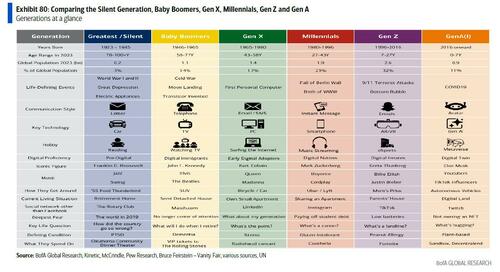

9. Rise of the Zoomers…and Boomers! US Boomers' net wealth = c.80% of world GDP. In 2030, over-65s and Gen Zs could spend c.US$28tn combined.

Summary: Over the next 10 years, we expect increased consumer spending, particularly from Gen Zs and the ageing Boomer population. Why?

- Boomers have amassed significant wealth that they will unwind during their retirement. As an example, US Boomers have built US$82tn in net worth as of 2024 Q3 (source: Federal Reserve, Survey of Consumer Finances and Financial Accounts of the US). Globally, over-65s are projected to spend almost US$15tn a year by 2030, up from US$8.7tn in 2020 (source: Ageing Analytics Agency; Brookings).

- Younger generations will benefit from the Great Wealth Transfer in the coming decades. Some US$84tn could be transferred to them from older generations by 2045 (source: Cerulli Associates).

- Gen Zs will continue to represent the largest cohort of the global population over the next 10 years at c.30% (source: BofA Global Research, United Nations). Their global income levels are set to be the largest of all generations, increasing from US$9tn in 2023 to US$36tn in 2030E and US$74tn in 2040E (source: BofA Global Research, Euromonitor). This generation could also see the largest increase in spend of US$2.7tn between 2024 and 2030, reaching US$12.6tn (source: BofA Global Research, World Data Lab, Generations Forecasts, UN).

With large wealth and spending levels over the next 10 years, the consumption patterns of Gen Zs and ageing Boomers will have a strong influence on the global economy. Gen Z’s preferences are shifting away from the old economy towards tech-compatibility, sustainability, and New Media. And an ageing population entails greater spend on healthcare, aged care, leisure and financials.

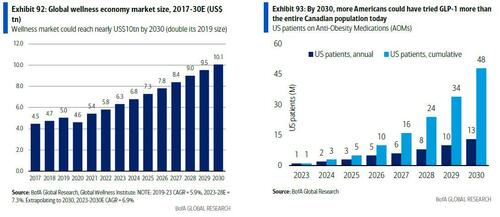

10. Health The New Wealth: 10mn global health worker shortage by 2030. Ageing population stretching resources. Solution - Infusion of technology in biology.

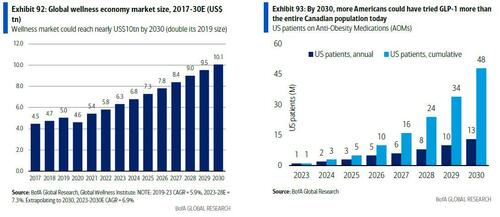

Summary: We believe healthcare is one of the industries set to be most impacted by AI over the next 5 years. AI drug discovery could shorten the time for R&D development from decades to weeks. And AI agents could fill the 10mn global health worker shortage expected by 2030 (source: WHO). However, it’s not just AI transforming healthcare but also demographic trends, with the focus on wellness. It is now a larger market than many other major industries including the green economy, IT, sports, and pharmaceuticals. Worth US$6.3tn today, wellness is 4x larger than the global pharmaceutical industry (US$1.6tn) and 30% larger than the green economy (US$4.8tn). GLP-1 will likely be a key ‘lifestyle’ enabler. By 2030, more Americans will have tried GLP-1 than the entire Canadian population today. Beyond treating obesity, we see many other sectors indirectly being impacted (consumer staples, food retailers, restaurants, apparel retail, gambling, alcohol, tobacco, senior living).

Finally, here is a snapshot of the biggest beneficiaries of the 10 themes over the next 5 years.

Much more in the full "The World in 2030" report (available to pro subscribers), and the full Flow Show (also available to pro subscribers).