Futures Flat On Lack Of "Trade Deal Optimism"; Traders Puzzled By Sudden Hang Seng Tumble

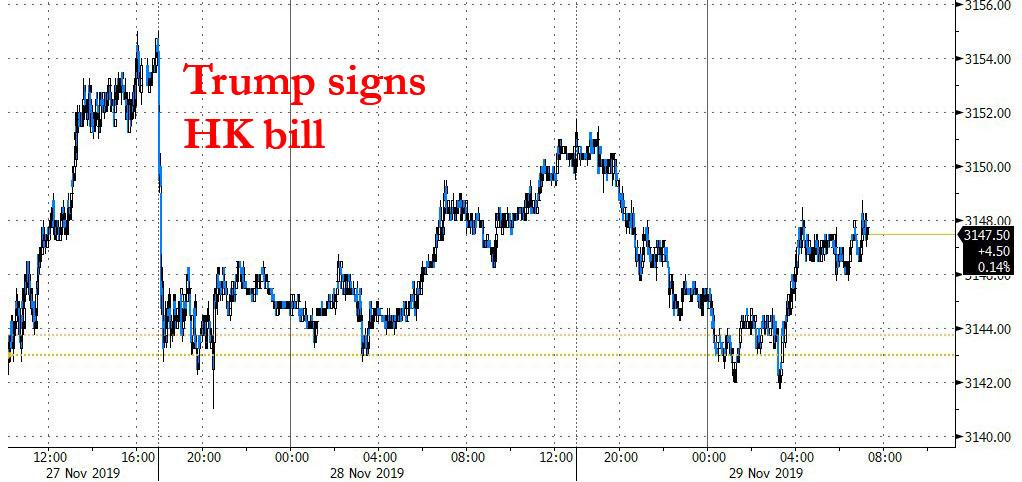

Futures were caught in the narrow range in which they traded for much of Thanksgiving Day holiday amid a lack of both trade deal optimism but more importantly, a lack of an actual retaliatory act from China which appears satisfied to jawbone in response to the passage of HK law, but is unwilling to do anything else to risk the trade deal as reported overnight.

And with the failure to break out to fresh highs, world shares also slipped on Friday as the MSCI World index strained for a record high, with investor nerves from Asia to Europe frayed over how or when the United States and China can agree a truce in their damaging trade war. The MSCI All Country world index again fell 0.2% to 548.48 points, remaining just short of the record 550.63 scaled in January 2018 before the eruption of tensions over trade between Washington and Beijing.

In Europe, the Stoxx 600 recovered from an early drop but after levitating modestly in the green, as declines in mining and construction shares offset increases in technology and travel, was back to unchanged if still near a four-year high. In holiday-thinned trade, stronger than expected eurozone inflation data was the main piece of economic data. The data showed inflation accelerated in November, comforting EcoCB policymakers, even if some factors pushing up prices may be only temporary. The ECB will next meet on Dec. 12, with its loose policy stance not expected to change for months to come. It may, however, decide to dump all bonds issued by companies that are not determined "green" by Christine Lagarde (we are only joking... we hope).

Earlier in the session, Asian stocks declined for a second day, led by tech firms, as investors awaited China’s possible retaliation against a U.S. bill supporting Hong Kong protesters. Most markets in the region were down, with Hong Kong leading losses and Indonesia rebounding. Despite Friday’s weakness, the MSCI Asia Pacific Index is heading for a third straight month of gains. The Topix fell 0.5% in thin trading, driven by Toyota Motor and Recruit Holdings. Japan looks set to re-embrace the power of public spending with one of its biggest ever stimulus packages. The Shanghai Composite Index closed 0.6% lower, capping a third week of declines, as signs of financial stress in China are putting the nation’s policy makers to the test. India’s Sensex retreated ahead of a quarterly economic report, which is expected to show the weakest growth in more than six years.

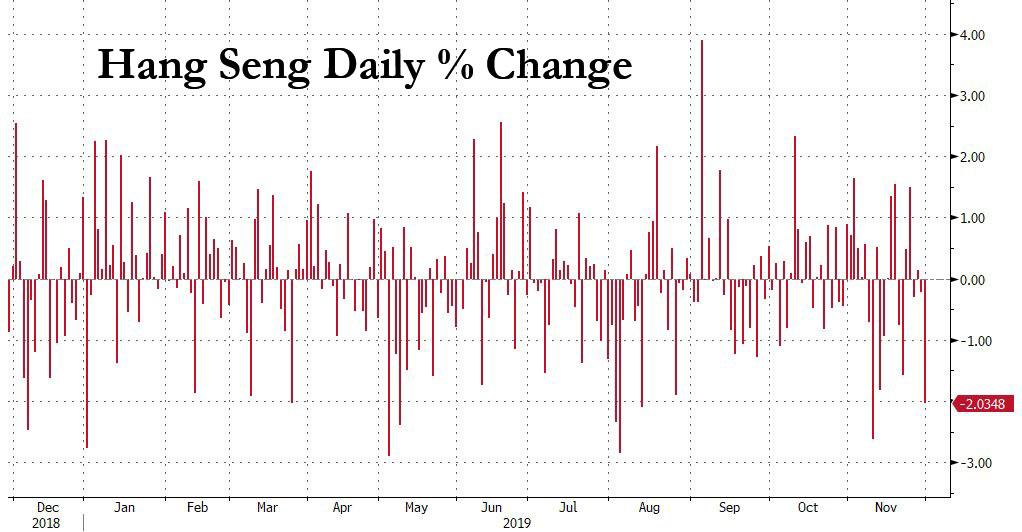

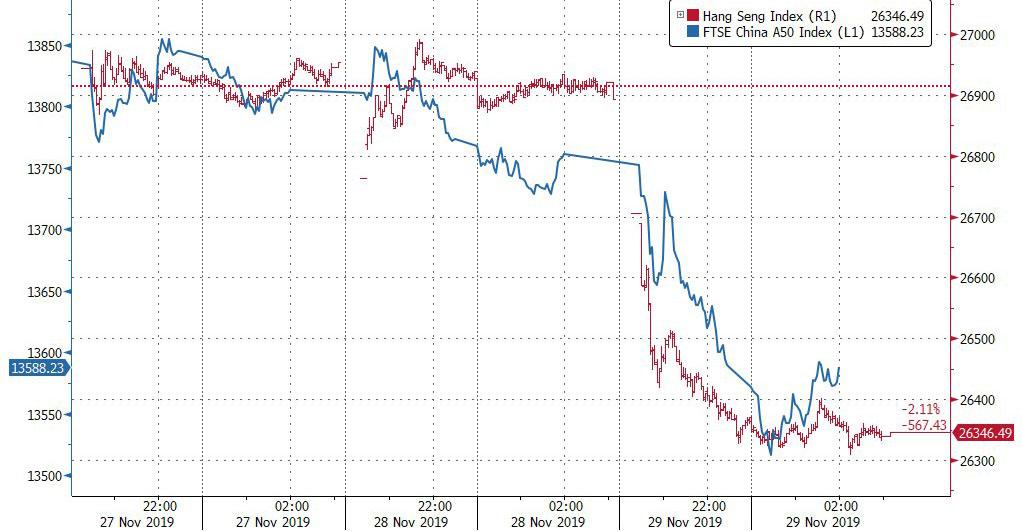

The big surprise in Asian trading was the a sudden, unexplained tumble in Hong Kong stocks which spread to the onshore market, with selling reflexively accelerating amid nervousness over a lack of clear triggers for the slump. As Bloomberg reports, the market was rife with speculation for the cause: health-care shares tumbled in Hong Kong when a document circulating on social media suggested Beijing could add dozens of new drugs to another round of procurement. Others said there was too much macro risk going into the weekend, with increasing uncertainty on the trade-war front. In onshore trading, the selling accelerated in the afternoon session as investors took profits in crowd favorites like Kweichow Moutai.

In total, Hong Kong’s Hang Seng Index tumbled 2% on volume that was 36% higher than the 30-day average. Quoted by Bloomberg, some traders said Thursday’s U.S. holiday meant investors lacked cues in Friday’s Asian session.

“There’s no obvious trigger” for the selloff according to First Shanghai Securities strategist Linus Yip who speculated that continued uncertainty over the outcome of U.S.-China trade negotiations could be one factor weighing on sentiment.

The Hong Kong sell-off came as investors grew uncertain over how U.S. markets will perceive the latest clash between Washington and Beijing over Hong Kong. “The more recent news on the trade front is how the Hong Kong situation might play into the U.S.-China trade negotiations,” said Hugh Gimber, strategist at J.P. Morgan Asset Management. “The market is now waiting on the next clear steer on when investors might be able to expect a deal to be reached.”

Meanwhile, across the Pacific, Wall Street will start the half-day session on Friday following Thanksgiving with futures gauges suggesting losses of around 0.2%, just shy of all time highs.

The lack of a more powerful selloff following Trump's Wednesday's night signature indicates that markets do not believe the trade deal will collapse as a result as investors bet it remains in the interest of both Washington and Beijing to move forward with talks to get a trade deal. Meanwhile, the MSCI world index climbed 2.5% this month, its third straight month of gains, helped in part by hopes the world’s two biggest economies are moving toward a resolution. The trade conflict has upset financial markets and disrupted supply chains even if stocks have continued to climb buoyed by nonstop optimism and hope that a deal is just around the corner... ever since the summer of 2018!

Meanwhile, what really matters is central bank policy and the Fed's NOT QE: for the year, the MSCI world index is up over 20% this year, helped by a lowering of interest rates and injections of government stimulus around the world.

In rates, 10Y Treasurys were unchanged from Wednesday, trading at 1.764%; Benchmark European bonds, including Germany’s 10-year Bund yield, were also little changed, trading off one-month lows hit the previous session.

In FX, the dollar traded initially flat at 98.387, and edged up slightly against the Japanese yen. In early London trading, the greenback reached 109.55 yen, not far off a six-month peak of 109.61 set on Wednesday. The dollar then took off and the Bloomberg dollar index rose again, spiking above 1,210, headed for its biggest monthly gains since July. The pound eyed its longest monthly run of advances against the euro in more than 4.5 years, while the relative cost of hedging sterling climbed ahead of next month’s U.K. election. The euro stood at $1.1005, and has been stuck in a tight range for the past week. As trading in major currencies slumbers, their implied volatilities, key gauges of expected swings measured by their option prices, plumbed record lows this week.

Elsewhere, bitcoin gained 1.5%, with the original cryptocurrency on course for its worst month in a year. Bitcoin had been heavily sold off by investors as expectations fade that China’s embrace of blockchain would help cryptocurrencies enter the mainstream.

In commodities, oil prices dipped, with investors awaiting a meeting of OPEC and its allies next week. OPEC watchers expect an extension to a pact to throttle oil output but no deeper cuts to be agreed by the producer group and its allies next week. Brent crude futures were down 44 cents, or 0.7%, at $63.43 a barrel.

Markets Snapshot

- S&P 500 futures down 0.2% to 3,147.00

- STOXX Europe 600 down 0.07% to 408.97

- MXAP down 0.9% to 163.88

- MXAPJ down 1.1% to 524.25

- Nikkei down 0.5% to 23,293.91

- Topix down 0.5% to 1,699.36

- Hang Seng Index down 2% to 26,346.49

- Shanghai Composite down 0.6% to 2,871.98

- Sensex down 0.7% to 40,839.78

- Australia S&P/ASX 200 down 0.3% to 6,846.00

- Kospi down 1.5% to 2,087.96

- German 10Y yield fell 1.2 bps to -0.373%

- Euro down 0.02% to $1.1007

- Italian 10Y yield rose 2.7 bps to 0.888%

- Spanish 10Y yield fell 1.4 bps to 0.397%

- Brent futures down 0.6% to $63.49/bbl

- Gold spot little changed at $1,456.71

- U.S. Dollar Index little changed at 98.37

Top Overnight News from Bloomberg

- Banks have been wrong for most of the past 10 years with their krona predictions as Sweden’s economy, often seen as a barometer for global trade, found itself battered by recessionary fears and tariff wars

- The worst is over for the European economy, according to buyers of exchange-traded funds. Investors have poured $1.5 billion into U.S. ETFs focused on European assets in November, data compiled by Bloomberg show

- Chancellor Angela Merkel’s government plans to tighten restrictions on foreign takeovers amid growing concerns China is scooping up Germany’s technology jewels

- The ECB should integrate climate change and energy transition into its forecasting and assessment of collateral, Governing Council Member Villeroy said

- For the last year, Saudi Arabia has largely turned a blind eye to cheaters within the OPEC+ alliance, cutting its own output more than agreed to offset over-production from the likes of Iraq and even Russia. Now, Riyadh’s had enough

- Police said they had lifted lifted their blockade on Hong Kong Polytechnic University after officers cleared a campus that’s been besieged for nearly two weeks amid a violent standoff with demonstrators

Asian markets were mostly subdued after the holiday closure stateside for Thanksgiving Day and amid continued trade uncertainty, despite a more conciliatory tone from China’s State Council and with the retaliation so far to US President Trump's Hong Kong bill signing seen as a mere slap on the wrist. ASX 200 (-0.3%) initially prodded record levels but with gains later reversed by underperformance in miners and the largest weighted financials sector, while the opening gains for the Nikkei 225 (-0.5%) eventually succumbed to the pressure from currency flows and substandard data in which Industrial Production matched its worst contraction since January last year. Hang Seng (-2.0%) and Shanghai Comp. (-0.6%) declined as markets second-guessed China’s retaliation measures for the HK bill and after PBoC’s inaction this week resulted to a CNY 300bln net liquidity drain, with the losses in the Hong Kong benchmark exacerbated as all its components resided in negative territory following the recent increased IPO activity and as the city braces for a resumption of protests over the weekend. Finally, 10yr JGBs weakened in an extension of yesterday’s post-2yr auction selling pressure and with demand also kept subdued by the lack of BoJ presence in the market, as well as mixed Japanese data releases.

Top Asian News

- Ambani Said in Talks to Sell News Assets to Times Group

- BOJ Cuts Buying Range for 10-25 Year Bonds in December Plan

- India Braces for Shock GDP as Modi Scrambles to Spur Economy

- Indiabulls Erases Gain as Court Allows More Time for Findings

Major European bourses (Euro Stoxx 50 +0.1%) are mixed and off of morning lows, after a broadly negative Asia-Pac session during which sentiment was undermined by the hangover from recent trade concerns. Month-end factors coupled with low liquidity also seem likely to distort the price action. Sector performance is mixed with no clear standout. In terms of individual movers; Ocado (+12.4%) shares shot higher on the news that the Co. has agreed to a partnership with Japanese grocer Aeon, the companies first partnership in the region. Elsewhere, positive broker moves for Bouygues (+1.5%) and Scout24 (+0.8%) saw their respective shares supported. In terms of the laggards; St James’ Place (-3.5%) fell to the bottom of the Stoxx 600 following a downgrade at Goldman Sachs. Elsewhere, negative broker movers put Remy Cointreau (-1.2%), Air France (-1.5%) and Royal Mail (-2.2%) shares under pressure. Separately, E.ON (+2.0%) posted strong Q3 earnings, which were roughly 20% above the prior year’s figures, while the Co. also raised the outlook on the completion of Innogy’s (-0.2%) transaction. On which note, Innogy and E.ON presented proposals for the restructuring of Innogy’s Npower unit - which could lead to 4.5k in job losses and closures of a number of call centres. Finally, Renault (+1.4%) shares are supported amid reports that the Co. is reportedly mulling a program that would boost efficiency with Nissan and Mitsubishi.

Top European News

- German Unemployment Unexpectedly Drops as Optimism Edges Up

- Euro- Area Inflation Quickens, But Remains Far Below ECB’s Goal

- Merkel’s Fate Rests With Disgruntled Members of Battered Partner

- Ocado Expands Into Asia With Japan Robot Warehouse Deal

In FX, the major outperformers and movers outside of recent ranges, as an improvement in NZ consumer confidence gives the Kiwi a further fillip following more upbeat business sentiment or less bleak to be precise on Thursday. Nzd/Usd is extending gains above 0.6400 and threatening to break free from the 0.6425 level that has been keeping the pair tethered, while Eur/Sek is now eyeing the psychological 10.5000 mark in wake of firmer than forecast Swedish Q3 GDP that has given the Swedish Krona a fundamental lift on top of renewed bullish technical impetus after the cross retreated through 10.5500 chart support more convincingly.

- GBP - Far from hero to zero, but Sterling is losing more of its YouGov pre-UK election poll mojo with negative month end cross winds also weighing on the Pound via Eur/Gbp demand. Cable has now lost grip of the 1.2900 handle and briefly slipped below the 21 DMA (1.2884), while 0.8500 continues to cushion the aforementioned cross.

- AUD/EUR/JPY/CAD/CHF - All narrowly mixed vs the Dollar that is still doing well if not quite defying gravity amidst rebalancing models flagging various strains of Greenback selling for month end (DXY holding ‘comfortably’ above 98.000 and towards the upper end of a 98.412-301 range). The Aussie is trying to piggy-back its Antipodean counterpart, but remains top heavy into 0.6800 and Aud/Nzd has pulled back from 1.0550 again after weaker than expected private sector credit data overnight. In similar vein, Eur/Usd seems destined to stay anchored around 1.1000 with yet more hefty option expiries hampering attempts to the upside vs decent technical support limiting losses beneath the big figure, while mixed Eurozone data is broadly being ignored. Elsewhere, Usd/Jpy, Usd/Cad and Usd/Chf are also treading familiar ground in narrow parameters of 109.60-45, 1.3292-79 and parity-0.9980 respectively, with the Yen torn between conflicting Japanese data and standard BoJ policy rhetoric from Governor Kuroda, Franc largely shrugging off a decline in the Swiss KOF indicator and Loonie awaiting Canadian GDP along with any USMCA developments for some independent direction.

In commodities, crude markets are subdued (albeit off intraday lows) amid a lack of fresh catalysts, as prices pull back slightly following a strong finish to yesterday’s session. In terms of crude specific news; OPEC’s Economic Commission Board yesterday reportedly suggested that OPEC does not need to implement deeper cuts over H1 2020, premised on the assumption that the surplus in production over the first half of the year will be later offset by a deficit in the latter part of the year. This is broadly in line with expectations for the outcome of the 5-6 December meeting, as indicated by multiple sources in recent weeks. Elsewhere, Russian oil production for the month of November stood at 11.24mln BPD, according to IFAX citing sources, which is relatively unchanged from the prior month. In terms of metals, gold prices are subdued and well within recent ranges; the precious metal managed to meander just under yesterday’s 1458.32/oz high, but has since pulled back slightly, and remains well off this week’s USD 1470/oz high. Copper prices, meanwhile, continue to slip, with poor Industrial Output/Production readings out of Japan and South Korea overnight doing little to help sentiment.

US Event Calendar

- Nothing major scheduled

DB's Jim Reid concludes the overnight wrap

Yesterday was spent mostly waiting to see if we’d get a response from China following President Trump’s signing of legislation expressing support for Hong Kong protestors. Other than a statement from the foreign ministry and a tweet from the editor-in-chief of the state run Global Times saying that China was considering putting the drafters of the law on a no-entry list, we didn’t really get any. So we’ll have to wait and see if this impedes “phase one” trade negotiations. This morning Asian markets are down again with the Nikkei (-0.38%), Hang Seng (-1.98%), Shanghai Comp (-0.64%) and Kospi (-1.32%) all in the red. The declines in Hong Kong and China are being led by drugmakers over unconfirmed reports that China will accelerate a centralized procurement program that’s driving down generic drug prices. Elsewhere, futures on the S&P 500 are down -0.28%.

The decline for the Kospi overnight follows the Bank of Korea decision to keep interest rates unchanged; however, they did cut growth forecasts in 2019 and 2020, both by 0.2pp to 2.0% and 2.3%, respectively.

In other news, BoJ governor Kuroda said that the central bank needs to pay attention to downside risks to the economy, especially stemming from overseas, while adding that, to reach its inflation target, the BoJ will continue with powerful monetary easing. He also said that it’s important to weigh costs and benefits of policy and added that Japan needs structural reforms, deregulation to boost its potential growth. Yields on 10y JGBs are up +1.6bps to -0.089%.

As for the rest of markets yesterday, in Europe we ended with modest declines across most equity markets. The STOXX 600 closed down -0.14% for its first decline in a week with volumes close to 40% below average with the auto sector (-0.78%) down notably. The DAX, CAC and FTSE MIB closed -0.31%, -0.24% and -0.61% respectively while the FTSE 100 was -0.18%. European Banks also nudged down -0.69% despite bond markets being a touch weaker. Indeed 10y Bunds were +1.3bps and BTPs +2.9bps higher in yield. The latter seemingly underperforming post a 10y auction, which saw a drop in demand. In FX, having touched a high of $1.2951 on Thursday evening following the release of the YouGov MRP mode, Sterling faded slightly through yesterday’s session and is trading at 1.2914 this morning.

Staying with FX, the rout for the Chilean Peso (-1.17%) continued yesterday and along with the Colombian Peso hit a new all-time low. The Brazilian Real (+1.17%) did manage to strengthen but also remains a shade above its own record low as political turmoil in the region continues following anti-government demonstrations. Meanwhile, Chile’s central bank said overnight that it will sell as much as $10bn on the spot market and provide an equal amount of currency hedges to arrest the currency’s decline. EM FX is now down -0.64% for the year with 4 of the biggest 6 decliners being currencies in LatAm.

Lastly, yesterday’s data included a softer-than-expected November HICP print in Germany (-0.8% mom vs. -0.7% expected) although it was noted that the year-over-year rate printed ahead of expectations (+1.2% yoy vs. +1.1% expected) seemingly due to a methodology change for package holidays. Meanwhile in Spain CPI was also a tad softer than expected (0.0% mom vs. +0.1% expected). Elsewhere the October M3 money supply reading for the Euro Area stayed put at +5.6%, which was a tenth ahead of expectations while finally November confidence indicators for the Euro Area on average improved from October.

Looking at the day ahead, with no data due out of the US the focus will be here in Europe where we’re due to get the preliminary CPI report for the Euro Area, France and Italy, October money and credit aggregates data in the UK, November unemployment and October retail sales in Germany and final Q3 GDP revisions for France. Away from that we’re expecting to get some comments out of the ECB, specifically from Hernandez de Cos, Villeroy and Guindos.

https://ift.tt/35K7f5p

from ZeroHedge News https://ift.tt/35K7f5p

via IFTTT

0 comments

Post a Comment