Crude Carnage Continues Across Asia As Another Futures Contract Roll Looms

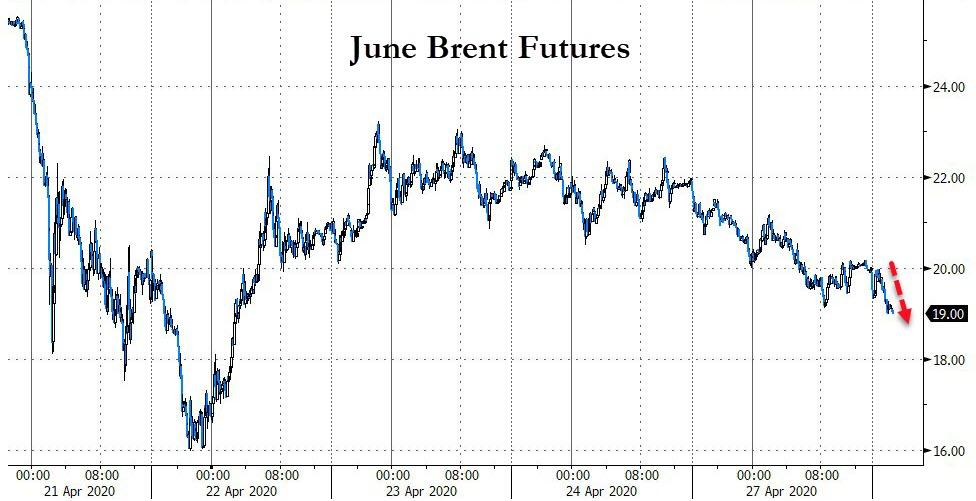

Following last week's bloodbathery in WTI as its May contract expired and the biggest oil ETF (US-Oh!) wreaked havoc between spot and futures markets, it appears we are set for deja vu all over again this week - except this time it's the Brent contract that may suffer.

“Some of this downward pressure particularly in the June contract is an increasing lack of liquidity,” said John Kilduff, a partner at hedge fund Again Capital LLC.

This is not coming only from the USO, but also due to brokerage firms, like Marex Spectron and TD Ameritrade, restricting client’s abilities to add new positions to certain crude contracts, according to Kilduff.

“It’s going to exacerbate the whole marrying of the June contract with the over supplied physical conditions and the lack of storage,” Kilduff said.

As Bloomberg notes, With the Brent contract for June settlement expiring Thursday, any contracts that haven’t been closed out by then will be cash settled at a price set by the Intercontinental Exchange based on cash sales of North Sea crude on the day. Right now, physical prices are trading well below futures - Dated Brent was $16.01 a barrel on Friday.

Source: Bloomberg

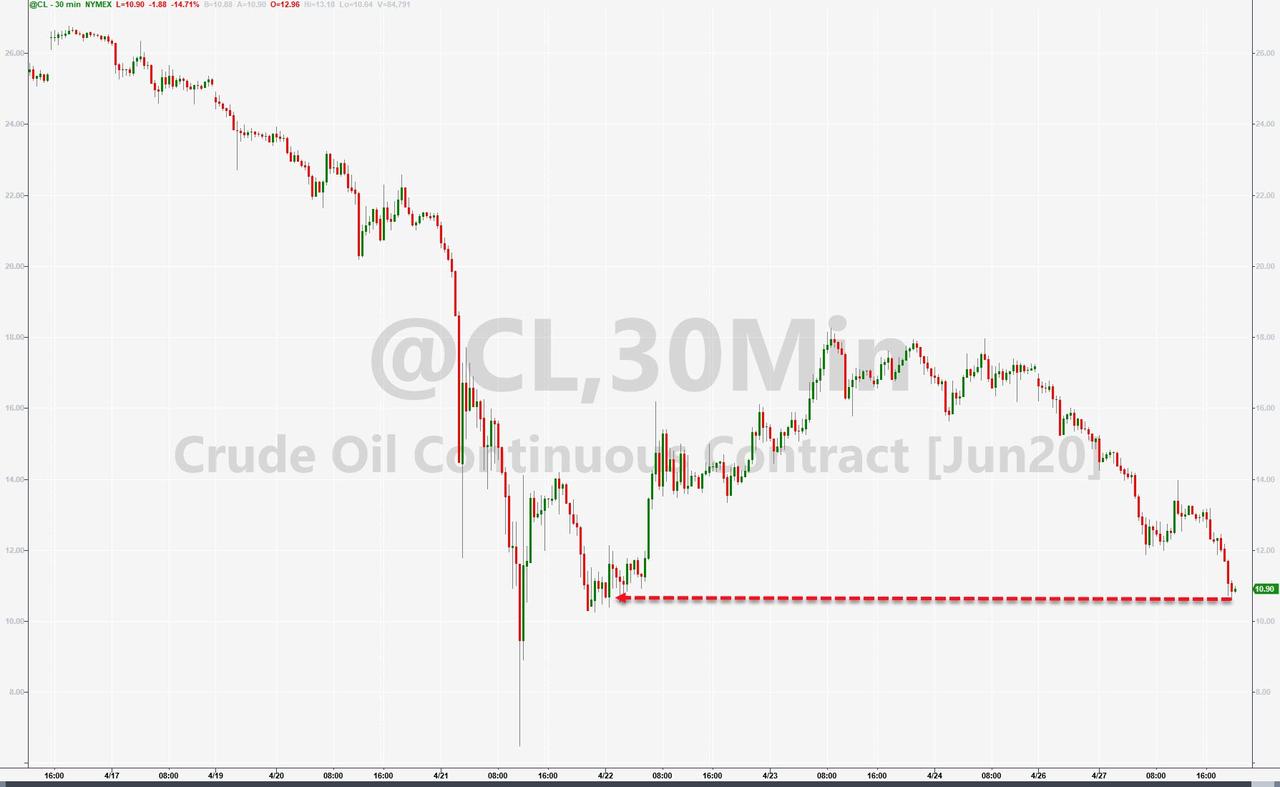

But it appears the unwinds in US-Oh! are also weighing more on the heavier-weighted (in the ETF) WTI contract - most notably June...

...which is down 15% further after settlement today, trading back at a $10 handle...

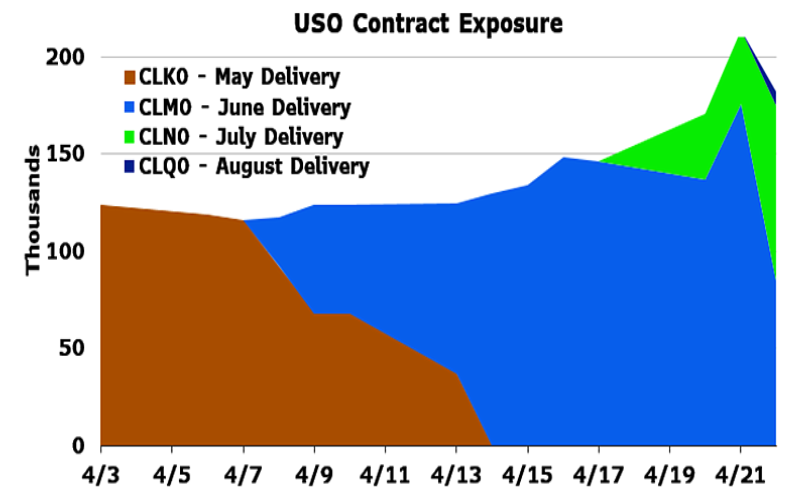

As a reminder, the ETF has changed its investment policy five times in the last two weeks, as shown in the following chart which depicted the ETF's holdings as of Friday's close:

It also warned investors its valuation may deviate significantly from the underlying oil price, in effect acknowledging that it’s momentarily less focused on the price of WTI crude.

"While it is USO’s expectation that at some point in the future it will be able to return to primarily investing in the Benchmark Futures Contract or other similar futures contracts of the same tenor based on light, sweet crude oil, there can be no guarantee of when, if ever, that will occur,” it said in the filing, adding that USO investors “should expect that there will be continued deviations between the performance of USO’s investments and the Benchmark Oil Futures Contract, and that USO may not be able to track the Benchmark Oil Futures Contract or meet its investment objective."

All of which suggests we have crossed the eye of the hurricane as Goldman expects the market to test global storage capacity in the next 3-4 weeks - unlike WTI which was merely a Cushing event - which will likely create substantial volatility with more spikes to the downside until supply finally equals demand, as with nowhere to store the oil, supply has no other option but to be shut-in down in-line with the expected demand losses.

Alternatively, we could see another "Monday massacre" with producers of oil willing to pay buyers to take physical possession right around the time all global capacity is full, unless of course US shale producers drastically cut output in the coming days, not weeks.

https://ift.tt/2yK89DP

from ZeroHedge News https://ift.tt/2yK89DP

via IFTTT

0 comments

Post a Comment