What Crypto Is (And Isn't) Tyler Durden Thu, 05/28/2020 - 22:45

Authored by Omid Malekan via Medium.com,

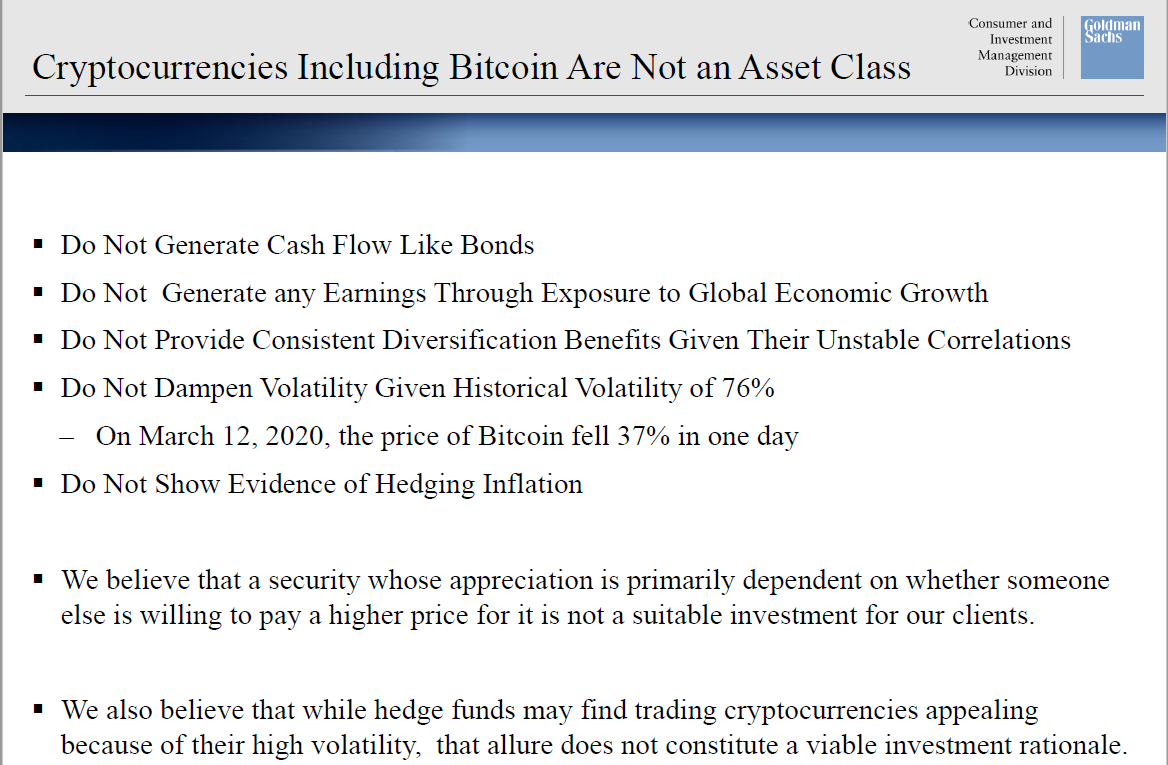

The first thing to note about the slide below, which comes from a recent Goldman Sachs presentation that got some crypto enthusiasts in a tizzy, is that all of the listed characteristics of Bitcoin are accurate.

The second thing to note is that it’s just one slide inside a 45 page presentation that’s mostly about gold, and why people shouldn’t invest in either.

If we go back a few years and tell most crypto enthusiasts that come 2020, a major Wall Street outfit would be discussing 10 year old Bitcoin in the same conversation as antediluvian gold, they’d be ecstatic. So most of the complaints on crypto twitter are somewhat misplaced, and betray the inferiority complex that still defines our young industry. Anyone convinced that crypto will go up substantially should celebrate a presentation like this. It gives them something to joke about when they cash out their millions and call Goldman Sachs to open up a private bank account.

That said, I do have a few bones to pick here, starting with the title of the slide.

There is something preposterous about the conclusion that “XYZ is not an asset class.” It’s sort of like saying that a style of painting is not art, or that a certain person is not cool. Who gets to decide such things? Are inverse volatility ETFs prone to the occasional blow up an asset class? How about futures tied to a commodity that may trade deep into negative territory?

Better yet, what about bonds with negative interest rates? The first bullet of the above slide calls out crypto because it “doesn’t generate cash flow like bonds.” Thanks to extreme central bank intervention, neither do an ever growing list of, well, bonds. As with Bitcoin, German Bunds currently “Do Not Generate Cash Flow.” Does that mean European sovereign debt is no longer an asset class?

There are few things in life that I hate more than semantic arguments. They are a waste of my time and never teach me anything. They are also a sign of a lesser mind, a favorite tool of those who can’t engage in a substantive debate and instead distract with pointless arguments over what the meaning of the word is is.

I have no problem with the Consumer and Investment Management division of an investment bank telling its clients not to invest in crypto. It’s probably sage advice given the risk profile and return expectations of their audience. But the reasons given betray a lack of sophistication. For example, consider the following critique found later in the same presentation:

Though individual cryptocurrencies have limited supplies, cryptocurrencies as a whole are not a scarce resource. For example, three of the largest six cryptocurrencies are forks — i.e., nearly identical clones — of Bitcoin (Bitcoin, Bitcoin Cash, and Bitcoin SV).

True enough - and moronic.

Akin to saying

“though gold itself has limited supplies, metals as a whole are not scarce. For example, aluminum and iron are the third and fourth most abundant elements in the earth’s crust.”

Or better yet:

“though individual social media networks enjoy certain network effects, anyone can start a new social media service by writing a few lines of code. For example, my cousin Joey recently made a knockoff of Instagram called Joeygram”

Bitcoin’s hash rate - the total amount of computing power dedicated to mining - is currently over 30x that of Bitcoin Cash and 50x that of Bitcoin SV. Hash rate is synonymous with security, and security is fundamental to the coin’s scarcity - one reason why Cash and SV both trade at a fraction of the dollar value of Bitcoin (and why cousin’ Joe’s newest venture, Bitcoin Joey, is totally worthless).

There is more cherry picked foolishness within the deck that I won’t spend too much time on, like the “parabolic price appreciation indicates bubble” argument (Zoom stock is up over one million percent since its seed funding round) and the “used in illicit activity” canard (more crime gets committed using dollars in a single day than crypto in a full year).

The biggest takeaway here is the fact that crypto was singled out as something not to invest in, and that this conclusion was communicated by declaring what Bitcoin isn’t. I come across this sort of double-negative analysis in my work within academia and on Wall Street all of the time. The professors say Bitcoin is not money and the bankers announce that crypto is not an asset class. Both remind me of the great Marshall McLuhan, and the observation that the medium is the message.

More telling than what either group believes is how they go about communicating it. It tells us that all of these people, the elites of the old guard, suffer from their own inferiority complex. Some part of them understands that the world is about to change, and that once it does, those who cannot grapple with its unique attributes — things like hash rates, algorithmic scarcity, and the like — will not be as important as they are today. So they perseverate on what the technology isn’t and how the future can’t be.

What they don’t realize is that making something a taboo only accelerates the pace of adoption. There was a time when rap wasn’t music and playing video games wasn’t a career, and it wasn’t that long ago. I don’t know what happened to the experts who said those things, but doubt anyone cares what they have to say about hip-hop or e-sports today.

https://ift.tt/2Xabi9C

from ZeroHedge News https://ift.tt/2Xabi9C

via IFTTT

0 comments

Post a Comment