Auto Sales Plunge 33% In May, Set For Worst Year Since 2009 Tyler Durden Mon, 06/01/2020 - 21:10

US auto sales are expected to continue their historic plunge in May, further pressuring an industry that is on the brink of all out collapse due to the pandemic lockdowns, plunging used car prices and suffering from a pre-virus recessionary environment.

Sales figures for May are expected to fall 33% to just 1.05 million units, according to Cox Automotive and CNBC. Even worse, data from Bank of America indicates that demand for new vehicles could be dropping off a cliff at the same time the industry is getting ready to ramp up production again.

The numbers show a sequential improvement from April, but still offer an ominous outlook for the auto industry heading into the second half of 2020. Cox Automotive estimates the pace for U.S. car sales to be about 11.4 million units sold by the end of the year, which would make 2020 the worst year for car sales since 2009. These numbers compare to 17.4 million cars sold in 2019.

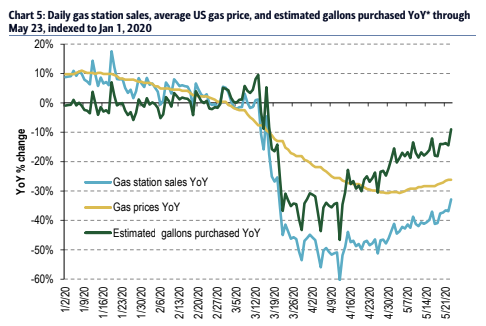

And it may not be because drivers are staying home anymore. Bank of America data from gas stations shows that drivers are back on the road again. "We estimate that gas consumption (in gallons) was still down about 30% YoY in April, but improved to -14% for the week ending May 23rd (latest available)," the bank wrote in a May 29 note.

May's numbers are in focus since the month kicks off summer sales season, traditionally the point in the year when dealers try to move inventory to make room for new models. Last weekend, some dealers offered incentives like 0% financing and 84 month financing offers to try and entice buyers into showrooms.

Some of the most generous incentives, offered around the time the virus started, are already being roped in as sales dead-cat bounce off their 2020 monthly lows. Auto analysts are blaming a lack of readily available inventory for the drop in sales, which is hilarious since the country is suffering from an unprecedented glut.

“At a minimum, selection may become more limited as the desired model may be in stock but not in the consumer’s preferred color or trim, potentially resulting in the consumer delaying purchase, switching brands, or moving into the used-vehicle market,” Cox Automotive explains.

Jessica Caldwell, Edmunds’ executive director of insights, said: “We can safely say that April was the bottom for auto sales during the coronavirus pandemic. There’s still a long road to recovery ahead, but May auto sales are a really encouraging sign for the industry.”

But experts that are sure the bottom is in are focused on manufacturing without any regard as to whether or not demand is going to pick up.

Thomas King, president of the data and analytics division and chief product officer at J.D. Power, said Thursday: “The good news is that in general manufacturing is restarting. Even with our diminished sales pace, we are still in an environment where the industry is selling more vehicles than it produces.”

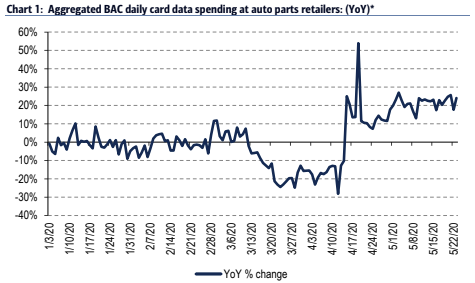

With manufacturing picking up, we'll see how long that lasts. Meanwhile, Bank of America notes that spending in auto parts is ramping up, indicating that OEM demand could be slipping as car owners may be more inclined to fix their current cars instead of buying new ones.

The bank thinks that many Americans spend their stimulus checks on fixing their cars:

"This data remained weak in the first two weeks of April, but took a sharp uptick in mid-April as stimulus checks began to reach US consumers. This benefit has lingered since mid-April, and auto parts demand now has additional support from increased driving activity as US markets begin to reopen for business. Daily auto parts spending was up approximately 23% YoY on average during the week ending May 23rd (latest available) according to the aggregated card data."

The industry is expected to have a lost a total of 1.2 million to 1.6 million total sales as a result of the pandemic.

King concluded: “Many of those will be recovered in the future, but some of them will be lost. Many consumers have lost the accountability to purchase a new vehicle or no longer need one because they no longer commuting to work."

We'll take the "under"...

https://ift.tt/2TXucOX

from ZeroHedge News https://ift.tt/2TXucOX

via IFTTT

0 comments

Post a Comment