Fed's Balance Sheet Shrinks For Second Consecutive Week Tyler Durden Thu, 06/25/2020 - 22:08

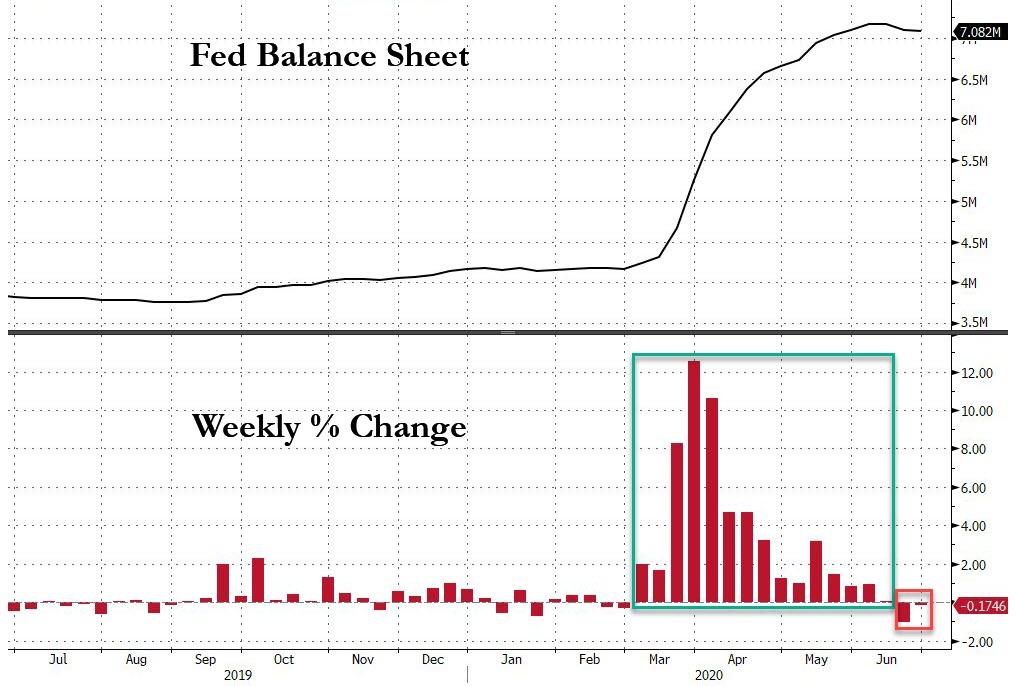

After three months of record gains, which saw an increase of $3 trillion to $7.2 trillion, the Fed's balance sheet has posted its second consecutive weekly decline since the start of the corona crisis according to the latest H.4.1 statement.

While not nearly as large as last week's decline which was the largest since May 2009, the $12 billion weekly decline to $7.082 trillion was certainly notable in a time when virtually every asset class now is driven by the rise and fall of the Fed's balance sheet.

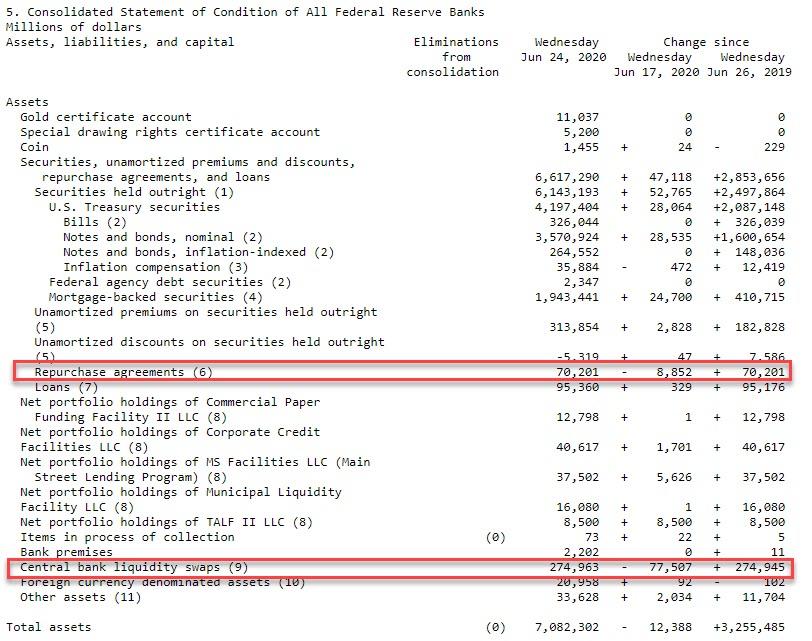

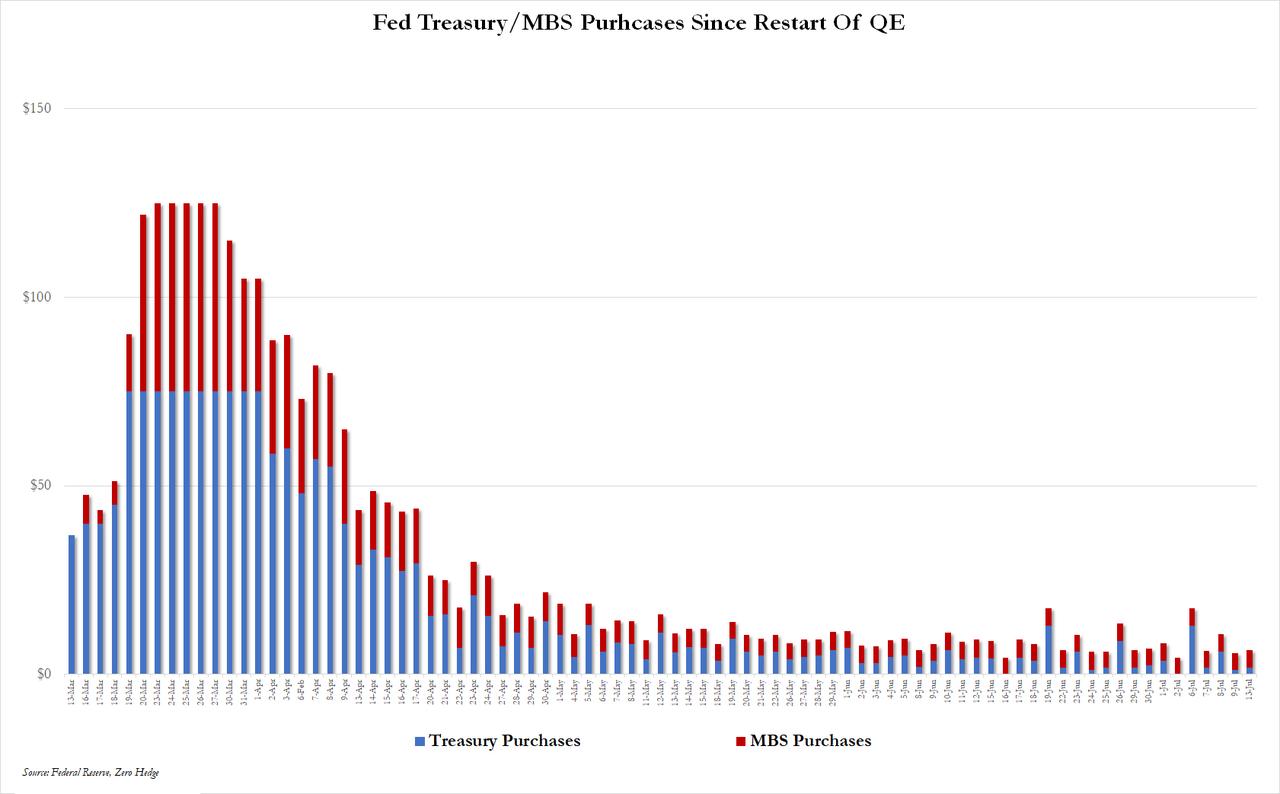

The drop, however, was not due to a reversal or even slowdown in QE which continues almost every single day, with the Fed adding over $52 billion in Treasurys and MBS in the 7 days ended June 24, but due to a second consecutive decline in liquidity swap, which shrank by $77.5 billion to $275 billion, after a $92 billion decline in the week prior. The amount of outstanding repo agreements also declined for a second consecutive week by a modest $8.9 billion.

The total amount outstanding in the swap lines, designed to ease a surge in demand for U.S. currency in the participating banks’ jurisdictions during the early weeks of the crisis, was the lowest since early April.

Coupled with other indications of slackening demand for the Fed’s bevy of emergency liquidity facilities, the reduction in currency swap line usage is for many analysts a sign that global financial markets are returning to near-normal after being upended by the coronavirus outbreak in February and March. “We expect a more rapid decline over the coming months as the majority of the swaps will roll off,” Citigroup economists wrote in a note last Friday.

The flipside is that it also means that the system is once again seeing a shrinkage in the circulation of the world's reserve currency, an explicit tightening in financial condition, and the adverse global impact of any macroshock will be substantially greater if and when one hits in the coming weeks.

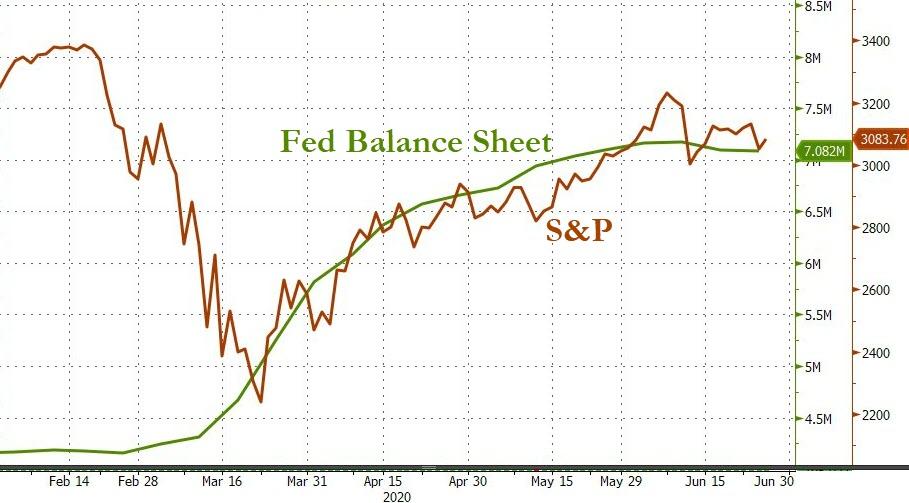

Meanwhile, with the S&P500 closely tracking the Fed's balance sheet in the past three months, which has served as the primary factor behind the rebound in the market, the latest weekly drop coincides with the period of heightened volatility in the past three weeks.

The shrinkage comes at a time when the Fed's monthly liquidity injection has been tapered to approximately $120 billion, which suggests that while the balance sheet is likely to resume growing in the next week, it will be at a more gradual pace.

It also means that for the stock market to surge from this point on - since the market is now fully disconnected from fundamentals and is simply a derivative of endogenous liquidity and fund flow - Powell will need to find another justification to expand the Fed's QE aggressively. Something like a second wave of the coronavirus pandemic...

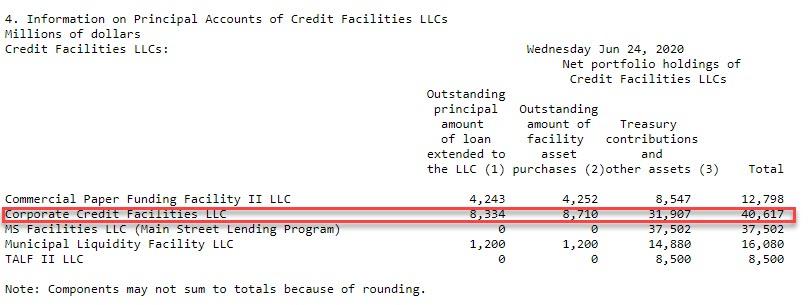

Finally, those keeping track of how much corporate bonds the Fed has bought, the latest total for the Fed's Corporate Credit Facilities LLC which includes purchases of both ETFs and corporate bonds, the Fed disclosed that as of June 25, there was $8.3 billion in book value of holdings (the Fed does not break out how many actual bonds it has bought vs ETFs), and increase of $1.7 billion from the $6.6 billion a week prior. Which means that the Fed is now buying around $350MM in corporate bonds and/or ETFs every single day.

https://ift.tt/2YzQAkr

from ZeroHedge News https://ift.tt/2YzQAkr

via IFTTT

0 comments

Post a Comment