FX Traders Brace For The "Unthinkable": An Election With No Clear Winner Tyler Durden Wed, 06/24/2020 - 20:05

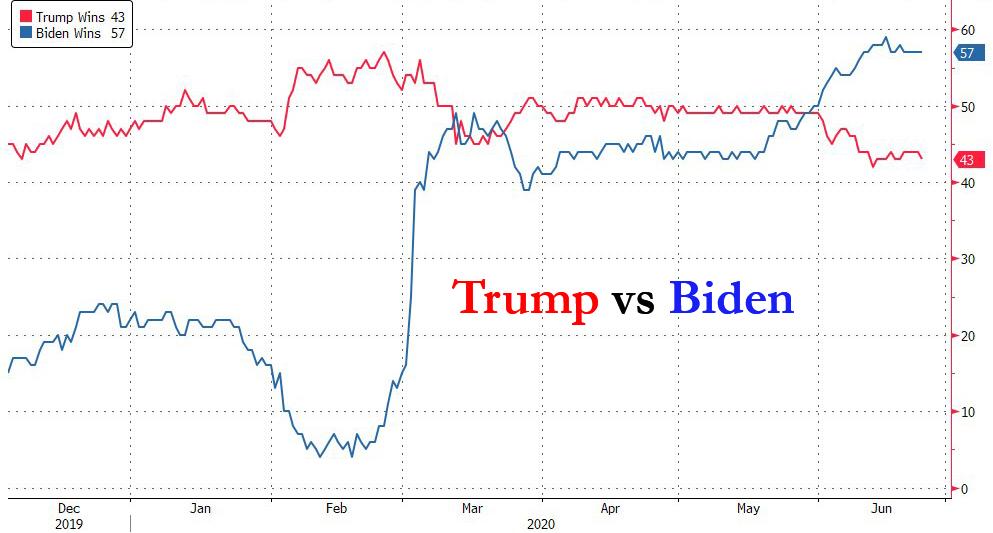

With various polls showing Joe Biden commanding a sizable lead over Donald Trump ahead of the November presidential election, and even online betting sites such as PredictIt representing Biden as a 14 point favorite, the stock market has clearly been surprisingly sanguine about a change in leadership to a Democratic president, even if it entails higher corporate taxes (some possible reasons for this were discussed here).

However, while stocks appear unfazed so far by political events, the same can not be said for FX traders who according to Bloomberg are "starting to contemplate the unthinkable": The possibility that the U.S. presidential election produces no clear winner, leading to protracted uncertainty.

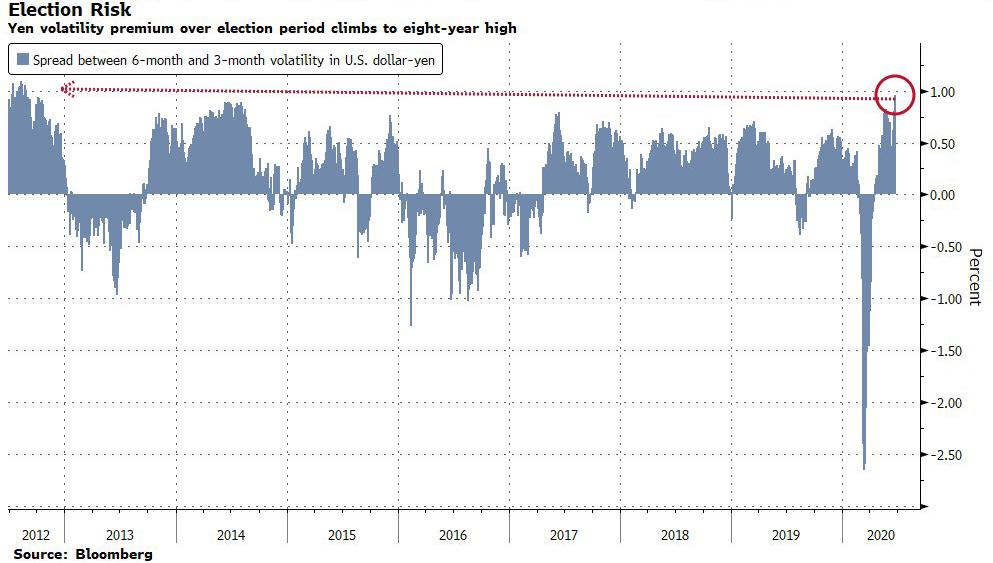

According to yen implied volatility, there is a sharp jump in expected price moves around election day which is expected to persist into 2021. That is in contrast with the run-up to the 2016 election, when turmoil indicator in FX land reflected only a temporary minor uptick in volatility as investors broadly overlooked the likelihood of a Trump presidency - or any controversy surrounding the results - leaving them painfully exposed to those events.

This time however, traders are far more cautious and according to the spread between 3M and 6M JPY vol, they are concerned the election could spill into late November due to recounts and court challenges, according to Greg Anderson, Bank of Montreal’s global head of FX strategy. This added political uncertainty - which may also be due to fears over the coronavirus or the economy - has lifted the premium on dollar-yen options for just after the November elections to an eight year-high versus shorter-term counterparts.

Which means that unlike equities, where so far the Fed remains fully in control, investors will "have to consider how the FX market would react to a protracted phase of uncertainty if the outcome was unclear," said Ned Rumpeltin, European head of FX strategy at Toronto-Dominion Bank.

A possible delay in the election results brings up memories of the 2000 election match-up between George Bush and Al Gore, when a recount dispute fueled a month-long legal fight.

It was a wake-up call for traders, who’d seen the options premium remain subdued throughout the vote and suddenly had to price in political uncertainty.

One potential complication this time around is the rise in requests by Americans to vote by mail, which according to Bloomberg could complicate the tallying process. And in what could be a hint of things to come, New York State’s election board said it won’t begin counting votes in Tuesday’s Democratic primary until July 1, so that it can double-check county records. Indicatively, the state has seen a 10-fold increase in requests for absentee ballots.

A surge in absentee voting in November, which may be unavoidable if the nation is gripped by a second covid wave, will cause delays in certifying races up and down the ballot, said former New York State Board of Elections deputy director Joe Burns said in a conference call organized by the Lawyers Democracy Fund, a conservative group that works on elections issues.

It is no wonder then that traders are racing to take cover, and as Bloomberg notes, implied volatilities for this year’s Election Day are as elevated as they were during the height of the turmoil seen in mid-March, at over 30%. Four years ago, overnight volatility in the dollar-yen pair spiked past 50% the night election results were being tallied.

And while there has been a modest increase in equity options hedges against losses around the Nov. 3 voting period,

for investors across asset classes there may be no better place to express a view on the U.S. outlook months down the road than the currency market, which offers a way to bet on America’s prospects relative to practically every other country.

SocGen FX strategist Olivier Korber suggests watching the options spread between the dollar-yuan and dollar-yen currency pairs as one way to track investors’ perception of the Trump-Biden match-up, as these pairs capture global risk sentiment, geopolitical tensions and trade relations.

"Past elections did not have such geopolitical implications” given Trump’s actions on trade and tariffs, Korber said. "Compared to past elections, the economic agenda of the two candidates will matter more than ever because 2020 will be a recession year."

The real question now is what kind of year will 2021 be: “Economic uncertainty is likely to be compounded by political uncertainty" said JPM strategist Paul Meggyesi who said that investors should buy a six-month dollar-yen versus dollar-franc correlation swap to take advantage of an increase in implied volatility around that time. And as volatility increases, correlations usually follow, resulting in weakness across all asset classes.

https://ift.tt/37YaPv7

from ZeroHedge News https://ift.tt/37YaPv7

via IFTTT

0 comments

Post a Comment