How Do You Say (Way) Off-Balance-Sheet In Chinese? Tyler Durden Thu, 06/25/2020 - 20:30

Authored by Jeffrey Snider via Alhambra Investments,

Where central banks are concerned, it’s not conspiracy theory so much as the term “off-balance sheet.” There’s a reason Enron kicked off that mass-migration into the footnotes. For monetary officials, there’s the choice to be like Montagu Norman and what he thought of good practice at central banks. Silence.

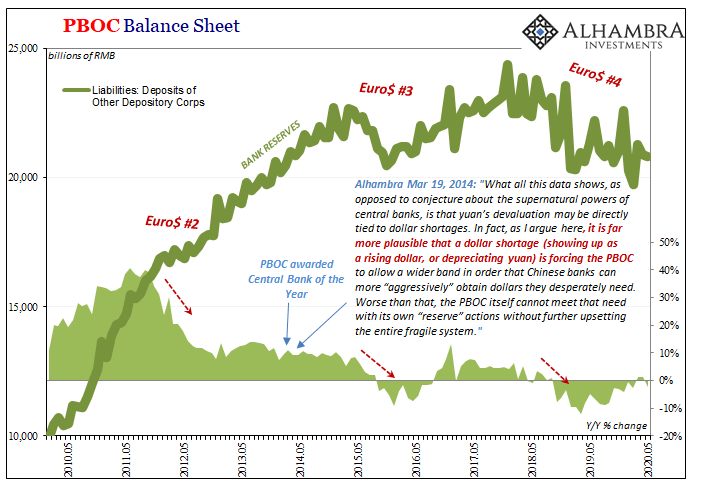

For years, the Chinese have tried it the other way. Big Mama typically left huge muddy footprints wherever its clumsy feet might land. It certainly was that way back in 2015 when Euro$ #3 was strangling CNY and thus confusing the hell out of everyone over here (and more than a few over there):

By far the most openly audacious intervention came starting in March 2015. China’s currency for reasons the mainstream just couldn’t fathom had been falling and unsteady for over a year. At the same time, the Chinese economy had shown equally unsteady signs, the accumulation of shocking weakness.

There was no way Communist authorities would allow it go any further. The PBOC intervened first in February 2015 with a “double shot”, rate and RRR cuts, followed in March by a CNY exchange rate that looked like it was purposely put under control. Many were relieved by what they saw as Big Mama very publicly and skillfully planting a green shoot at just the right time.

No dice; the whole thing blew up later that summer, making August 2015 memorable for all the wrong reasons (and people today still call falling currencies “stimulus”).

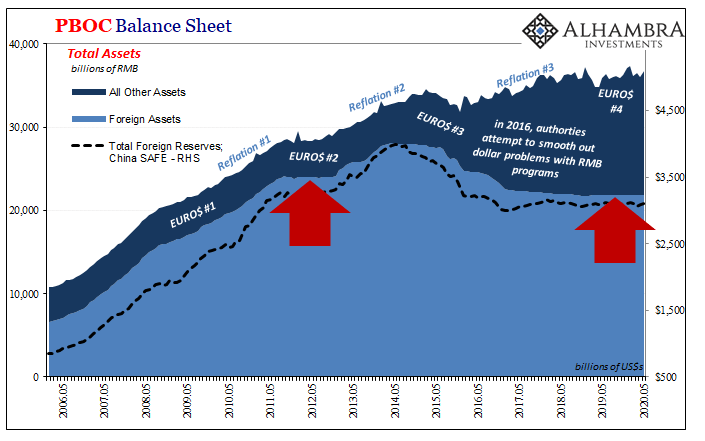

Here’s the thing, though. While that was taking place, you could tell the PBOC was involved because of its own balance sheet figures. Each month SAFE would first report lower levels of foreign “reserves” which then got confirmed by the PBOC’s balance sheet lines, a central bank system which begins and often ends at the number for forex.

What’s going on now is a mockery – or an intentional shift in programming. Both SAFE and the PBOC report that foreign assets have been stable; in terms of the monetary base of the latter, suspiciously stable. I mean, hardly any variation month to month, a trend that’s gone on so long now it’s really year to year.

That can’t be an organic result, not in a dynamic world particularly the one we inhabit being ravaged by any number of potentially titanic forces that so often seem to get their start in this very country. What I’m saying is that there is almost certainly effort to the straight line (not the first time, either).

But what, exactly, is going on isn’t showing up anywhere. Not even on the one or two lines where in the past we could link them to hypothetical backdoor activities (the ubiquitous and useful “other”).

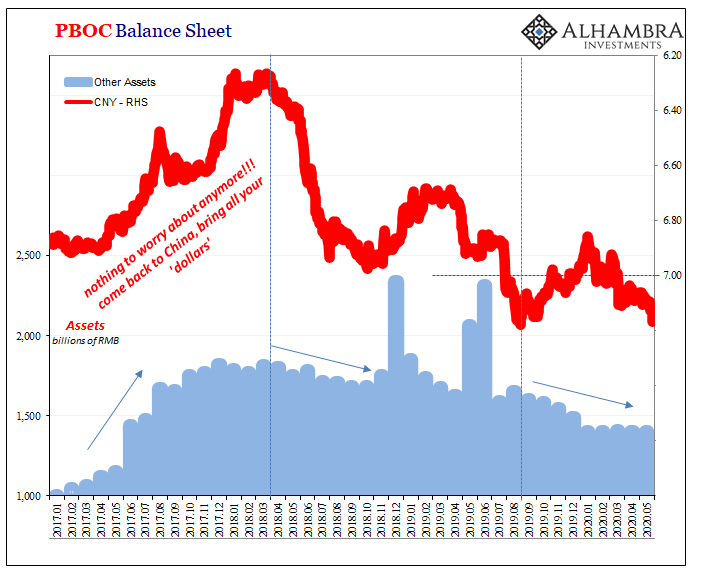

The ticking clocks became too noticeable and obvious? I think so; as did the decline in visible “reserves” which created the opposite effect of what was intended, amplifying negative monetary pressures market-wide (the nightmare scenario). The PBOC, unlike Western Economists, may just have found out that following the orthodox textbook where these things (the basics like money and dollars) are concerned will get your economy killed.

Reserves aren’t insurance against a dollar shortage, they are confirmation you’re the big target. Maybe better not to so blatantly advertise your dollar struggle?

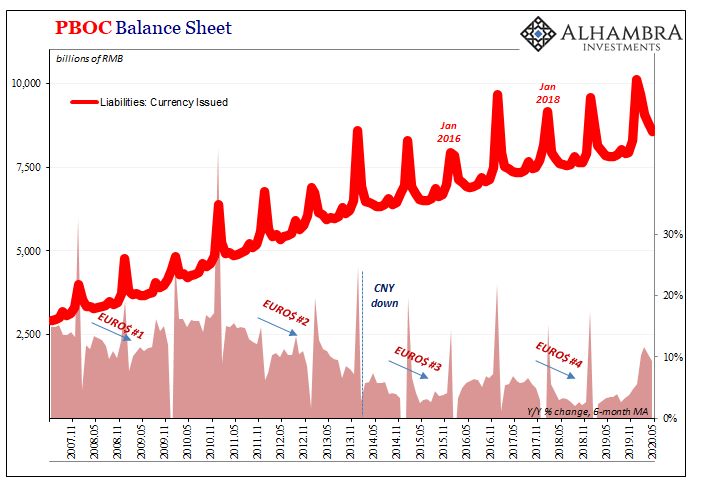

Purposefully or not, a straight line isn’t expansion, either. And that still means the same thing in China: very little room for monetary growth. In what to me looks like more Xi vs. Li, currency growth has been bumped up for COVID-19 and the shutdown depression; bank reserves have not.

Quality growth in the real economy as opposed to quantity growth led by flooding banks.

Eurodollar University’s Making Sense; Episode 14: LI V XI II (Li versus Xi, The Rematch)

Though it may be more difficult to see it as it unfolds because of the PBOC’s sideways baseline, what I wrote in the middle of 2015 might still apply today especially where CNY remains concerned:

Even the Chinese yuan has become far more stable despite the rash of nasty economic indications and even more uncertainty about what the PBOC might or might not do about it. In other words, forget what is happening in China, the yuan is all about the “dollar” in the purest financial sense.

Especially when there are, curiously, no more muddy footprints at all.

https://ift.tt/2B42sCm

from ZeroHedge News https://ift.tt/2B42sCm

via IFTTT

0 comments

Post a Comment