Unprecedented Surge In New CMBS Delinquencies Heralds Commercial Real Estate Disaster Tyler Durden Tue, 06/02/2020 - 20:25

One month ago, we thought that the unprecedented implosion in US commercial real estate in the month of April following the near-uniform economic shutdown following the coronavius pandemic, manifesting in the surge in newly delinquent CMBS loans would be one for the ages, even though as we predicted May would likely be worse as a result of the spike in specially services loans.

And indeed while April was catastrophic, May was even worse.

According to the latest remittance data by Trepp, the surge in CMBS delinquencies that most industry watchers were anticipating came through in May. After Trepp’s CMBS Delinquency Rate registered at 2.29% in April, in May the Delinquency Rate logged its largest increase in the history of this metric since 2009. The May reading was 7.15%, a jump of 481 basis points over the April number. Almost 5% of that number is represented by loans in the 30-day delinquent bucket.

There was some good news: given that about 8% of loans had missed payments for the April remittance cycle (in the grace period), the fact that delinquencies went up less than 5% has to be viewed as a small "win." That, or simply the backlog of delinquencies has prevented the proper accounting of all deals.

Alas, that "win" won't last, and will be reversed next month, when the delinquency rate will hits double digits as about 7.61% of loans by balance missed the May payment but remained less than 30 days delinquent (i.e., within the grace period).

On the other hand, as more forbearances receive approval, some delinquent loans could revert to current status based on expectations of how loan statuses will be reported in servicer data going forward, if reported correctly. For instance, if a loan’s last payment was made in March, it would not show up as 60 days delinquent in June if a forbearance had been granted. Of course, this step merely delayed the inevitable, and once forbearances are exhausted, all those loans which are classified as current will all slide right into the default bucket without passing go.

Some other overall statistics:

The percentage of loans in special servicing rose from 4.39% in April to 6.07% in May. According to May servicer data, 16.2% of all lodging loans were in special servicing, up from 11.4% in April. In addition, 9.3% of retail loans are with the special servicer, up from about 6% the month prior. The percentage of loans on servicer watchlist in May was 19.9%.

The Overall Numbers

- The overall US CMBS delinquency rate climbed 481 basis points in May to 7.15%. The all-time high on this basis was 10.34% registered in July 2012. We expect this number will be surpassed in the June update.

- The percentage of A/B loans (i.e. loans in “grace period” or “beyond grace” period) was 7.61% in May.

- Year-to-date, the overall US CMBS delinquency rate is up 449 basis points.

- The percentage of loans that are seriously delinquent (60+ days delinquent, in foreclosure, REO, or nonperforming balloons) is now 2.17%, up six basis points for the month. (As noted above, the largest increase this month was seen in the 30-day delinquency category; expect the percentages for 60+ day delinquencies to move higher in June.)

- If defeased loans were taken out of the equation, the overall 30-day delinquency rate would be 7.56%, up 515 basis points from April.

- One year ago, the US CMBS delinquency rate was 2.66%.

- Six months ago, the US CMBS delinquency rate was 2.34%

The CMBS 2.0+ Numbers

- The CMBS 2.0+ delinquency rate jumped 503 basis points to 6.19% in May. The rate is up 545 basis points year over year.

- The percentage of CMBS 2.0+ loans that are seriously delinquent is now 1.10%, which is up 12 basis points from April.

- If defeased loans were taken out of the equation, the overall CMBS 2.0+ delinquency rate would be 6.54%, up 531 basis points for the month.

The CMBS 1.0 Numbers

- Note: With CMBS 1.0 loans outstanding dwindling, we plan to retire this statistic beginning in Q3 2020.

- The CMBS 1.0 delinquency rate rose 110 basis points to 41.74 % in May.

- The percentage of CMBS 1.0 debt that is seriously delinquent rose 24 basis points to 40.89% last month.

- If defeased loans were taken out of the equation, the overall CMBS 1.0 delinquency rate would be 47.04%

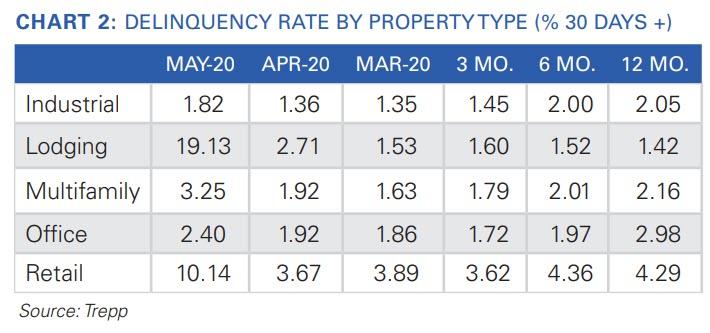

Overall Property Type Analysis (CMBS 1.0 and 2.0+)

- The industrial delinquency rate climbed 46 basis points to 1.82%

- The amount of industrial loans categorized as A/B: 2.41% in May

- The lodging delinquency rate jumped 1642 basis points to 19.13%.

- The amount of lodging loans categorized as A/B: 14.08% in May

- The multifamily delinquency rate rose 133 basis points to 3.25%.

- The amount of multifamily loans categorized as A/B: 2.78% in May

- The office delinquency rate moved up 48 basis points to 2.40%.

- The amount of office loans categorized as A/B: 2.72% in May

- The retail delinquency rate spiked 647 basis points to 10.14%.

- The amount of retail loans categorized as A/B: 12.53% in May

https://ift.tt/3gQmtMs

from ZeroHedge News https://ift.tt/3gQmtMs

via IFTTT

0 comments

Post a Comment