Which Industries Are Suffering The Biggest Job Losses? Tyler Durden Mon, 06/01/2020 - 23:10

With trader attention turning to Friday's May jobs report, where consensus expects an 8 million increase in unemployment after April's record 20 million, we took a closer look at which industries are set to report the biggest job losses.

To do that, we looked at the weekly initial jobless claims report where many states release claims on an industry level, which as BofA writes, can be used to think about how national payrolls will evolve. While initial claims only reflect outflows, they are still a crucial component for the net job growth trajectory and therefore useful as a leading signal according to BofA's economists. As a result, collecting and aggregating these data allows to create proxies that provide a read on national conditions.

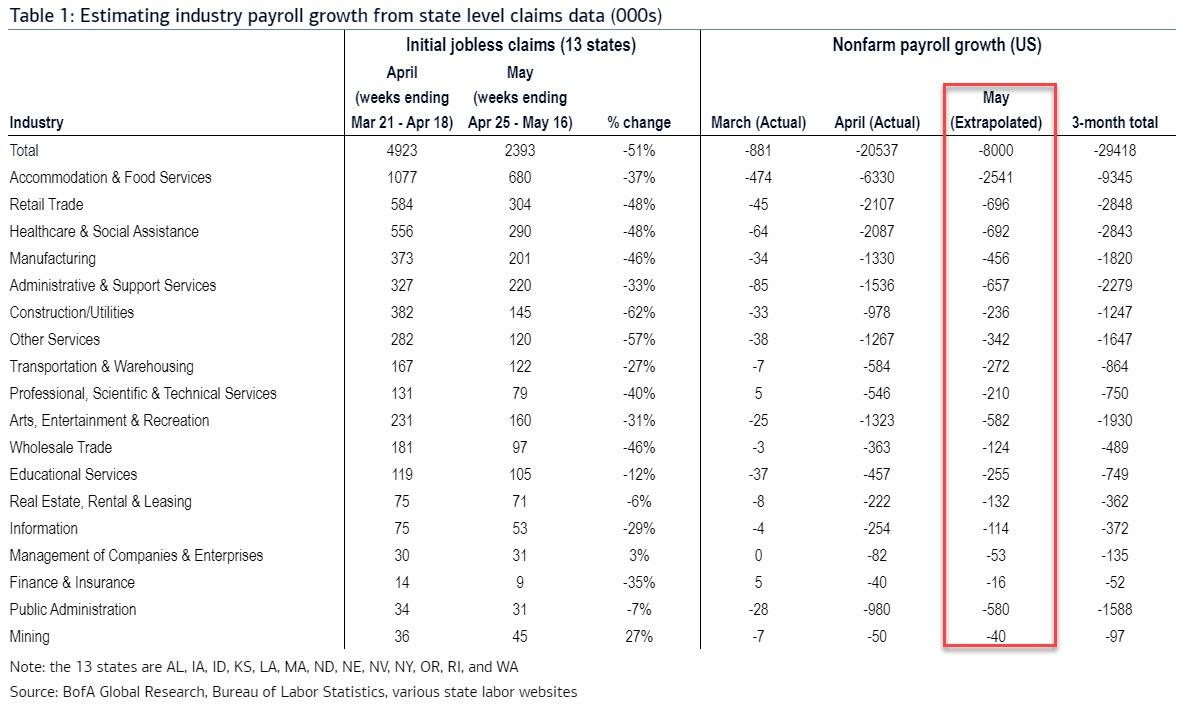

To extrapolate the bigger picture, the bank calculates the % change in cumulative initial claims for each industry during the relevant weeks for the April and May jobs reports, apply that to April payroll growth, and then scales to the total NFP forecast of -8.0 million. The exercise suggests that job losses in accommodation & food services-the most pandemic-sensitive sector-could be in the 2.5mn range in May, bringing three month total losses to 9.3mn. Meanwhile, we could see more than 500k job losses in each of the retail trade, healthcare / social assistance, administrative/support services, arts/entertainment/recreation, and public administration sectors. While not scientific, as these remain rough estimates, the table below helps give a sense of the magnitude of the pain that each sector could experience in Friday's report.

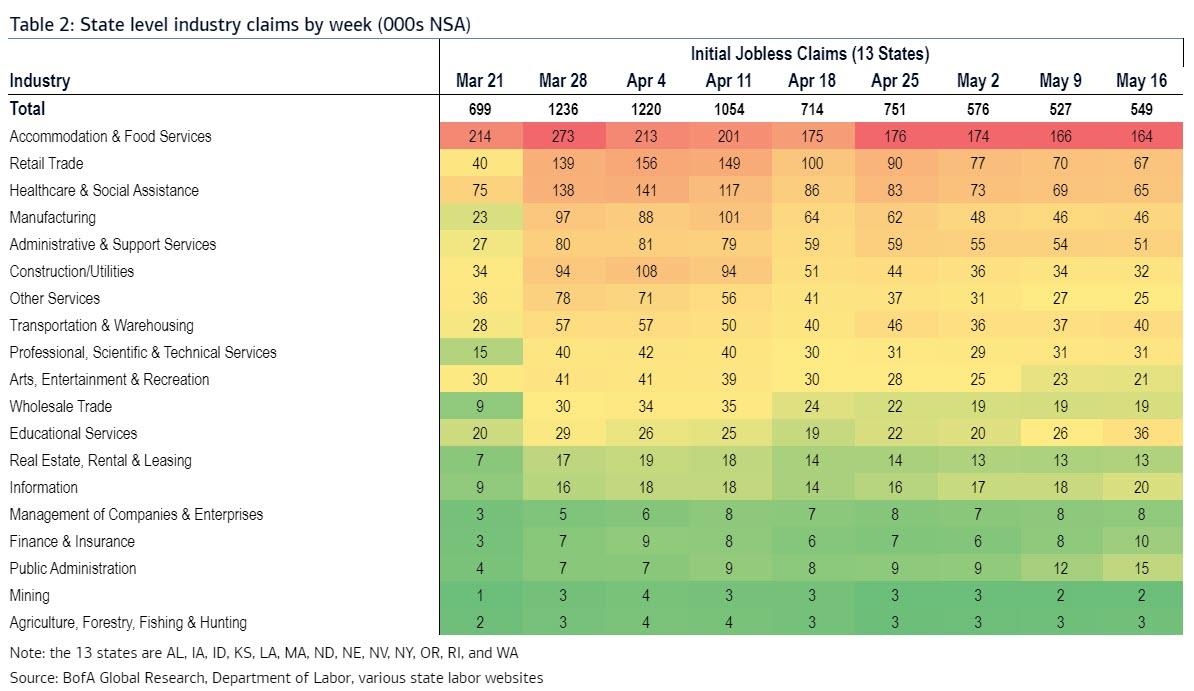

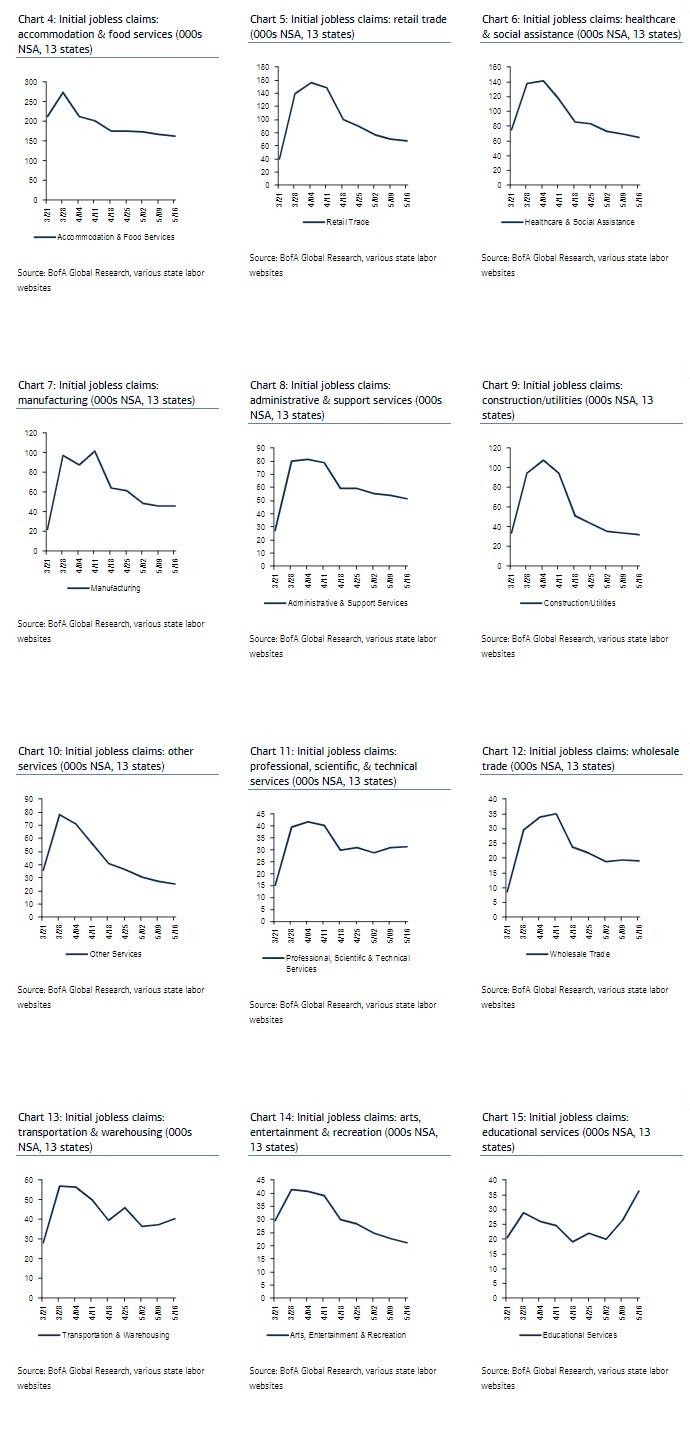

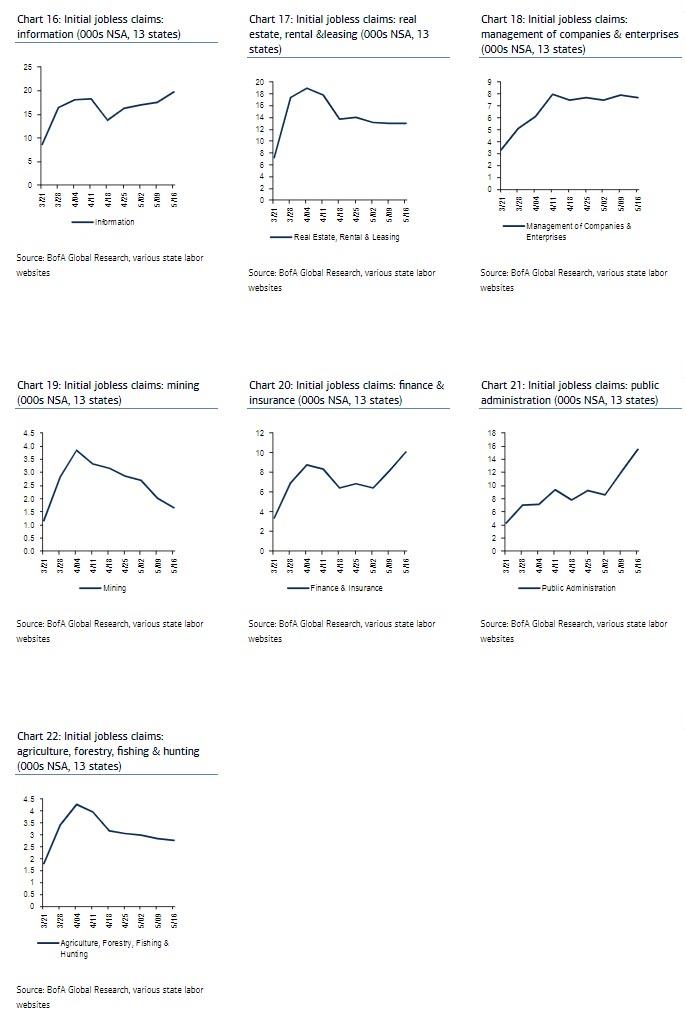

In addition to the aggregate level data, the weekly trajectory of these industry claims data are also insightful.

For most of the sectors, initial claims follow the broad trend of a peaking in early April followed by a gradual decline. However, initial claims are trending sideways in professional /scientific / technical services and management of companies/enterprises - two of the major sub-sectors of professional/business services. Even worse, initial claims are rising and reaching new highs in the educational services, information, finance / insurance, and public administration sectors. Thus, in several sectors we are not seeing improvement, which according to BofA "argues for more persistent labor pain and a more delayed recovery."

So what will the recovery look like?

According to BofA's Alex Lin, as states are gradually re-opening, focus is shifting towards what kind of recovery we can expect. A key question will be how many laid off workers will be rehired? At this stage, consumer expectations remain optimistic- an April 27-May 4 Washington Post/Ipsos poll found that 77% of laid off workers expect to hired back to their old job. However, the reality may prove grimmer given such an uncertain outlook. A vaccine for the virus may still be two years away, and businesses cannot discount the risk of another wave of infections as the economy reopens, which would slow the economy. Meanwhile, a recent paper by Barrero, Bloom, and Davis argue that 42% of jobs lost will be permanent which would be a concerning outcome.

https://ift.tt/2U1pYG7

from ZeroHedge News https://ift.tt/2U1pYG7

via IFTTT

0 comments

Post a Comment