"Insanely Stupid" To Chase Stocks As Economy Plunges? Tyler Durden Sun, 08/02/2020 - 11:35

Authored by Lance Roberts via RealInvestmentAdvice.com,

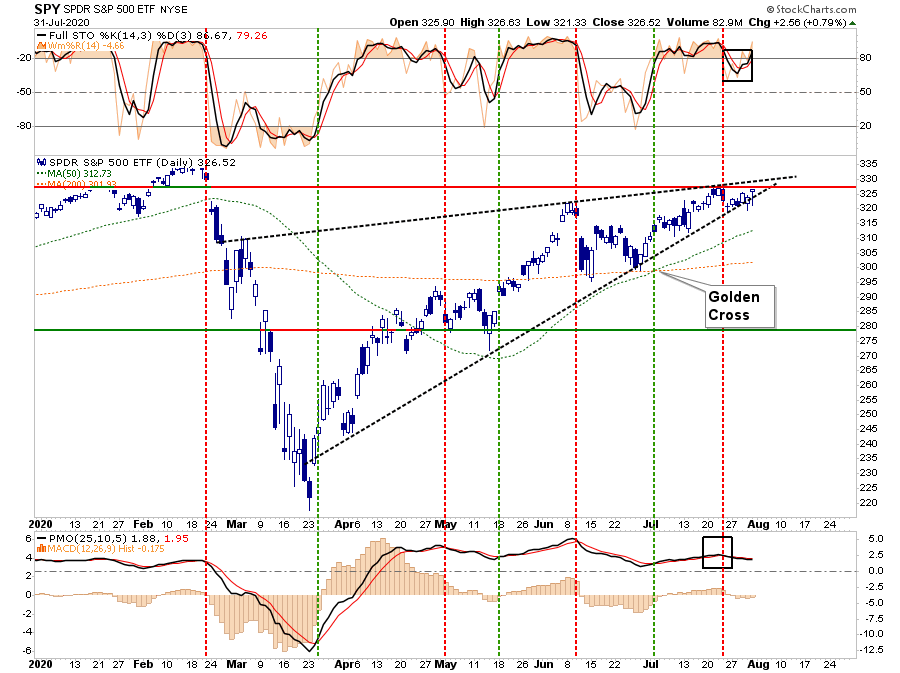

Stocks Hug The Bullish Trend

As discussed previously in “The Cobra Effect,” we noted the market remained confined to its consolidation channel.

“Unfortunately, the market failed to hold its breakout, which keeps it within the defined trading range. The market did hold its rising bullish uptrend support trend line, which keeps the “bullish bias” to the market intact for now. “

That remained the case again this week and keeps our allocation models primarily on hold at the moment.

While the market has not been able to push above the recent July highs., support is holding at the rising bullish trend line. With the short-term “buy signals” back in play, the bias at the moment is to the upside. However, as we have discussed over the last couple of weeks, July held to its historical trends of strength. With a bulk of the S&P 500 earnings season behind us, we suspect the weakening economic data will begin to weigh sentiment in August and September.

Such is why we are keeping our hedges in place for now.

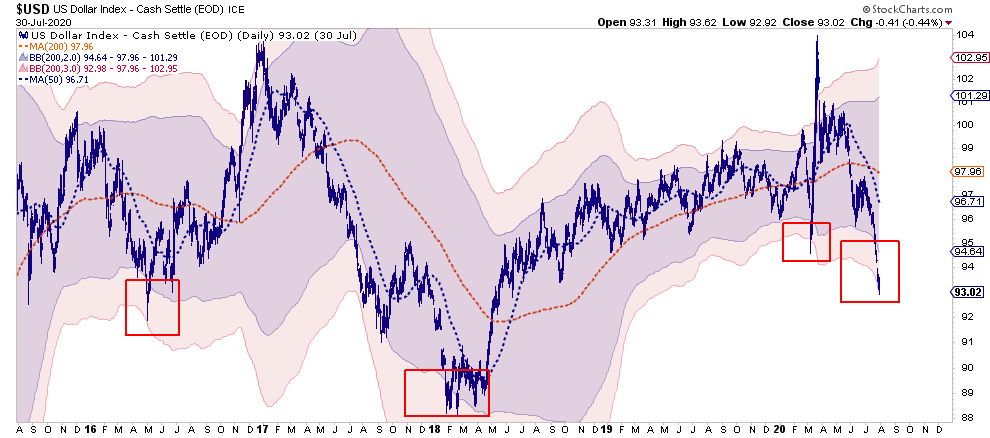

The Gold / Dollar Battle

Speaking of hedges, we began to accumulate a long-dollar position in portfolios this past week. There are several reasons for this:

-

When the financial media discusses the dollar’s demise, such is usually a good contrarian signal.

-

The dollar has recently had a negative correlation to stocks, bonds, gold, commodities, etc.

-

The surging exuberance in gold also acts as a reliable contrarian indicator of the dollar.

-

The dollar is currently 3-standard deviations below the 200-dma, which historically is a strong buy signal for a counter-trend rally.

Given our portfolios are long weighted in equities, bonds, and gold currently, we need to start hedging that risk with a non-correlated asset. We also trimmed some of our holdings in conjunction with adding a dollar hedge.

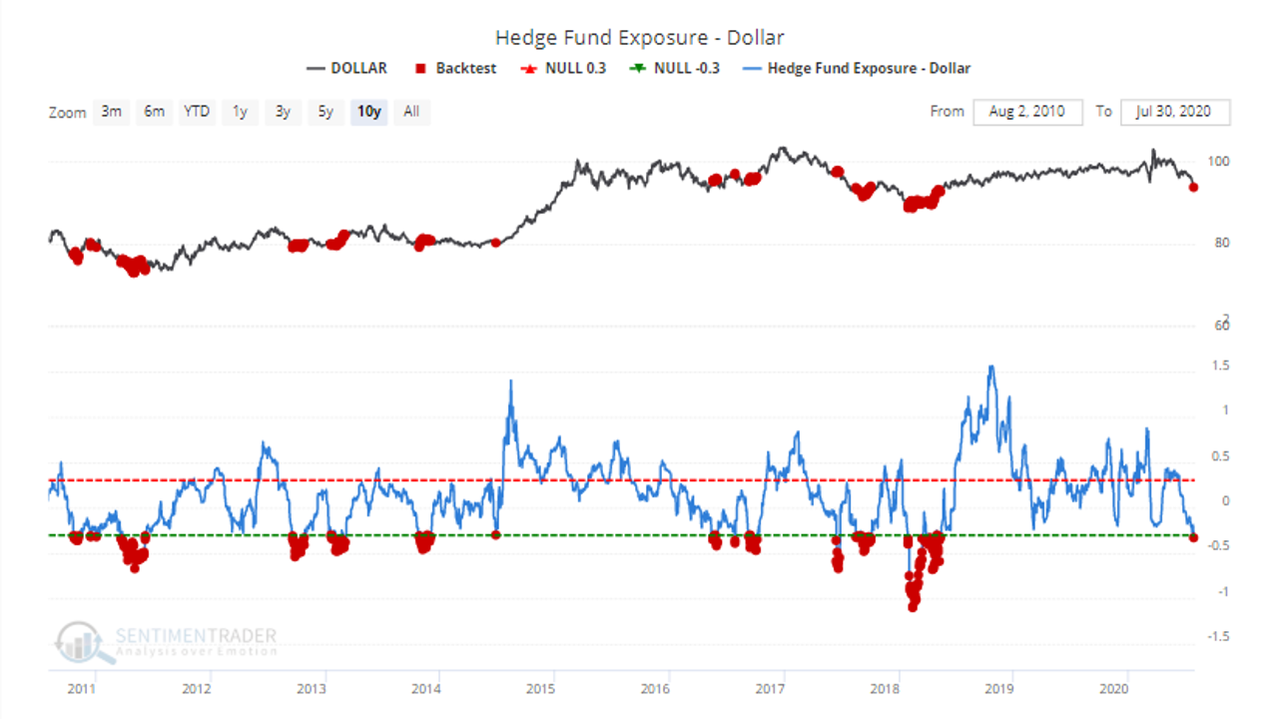

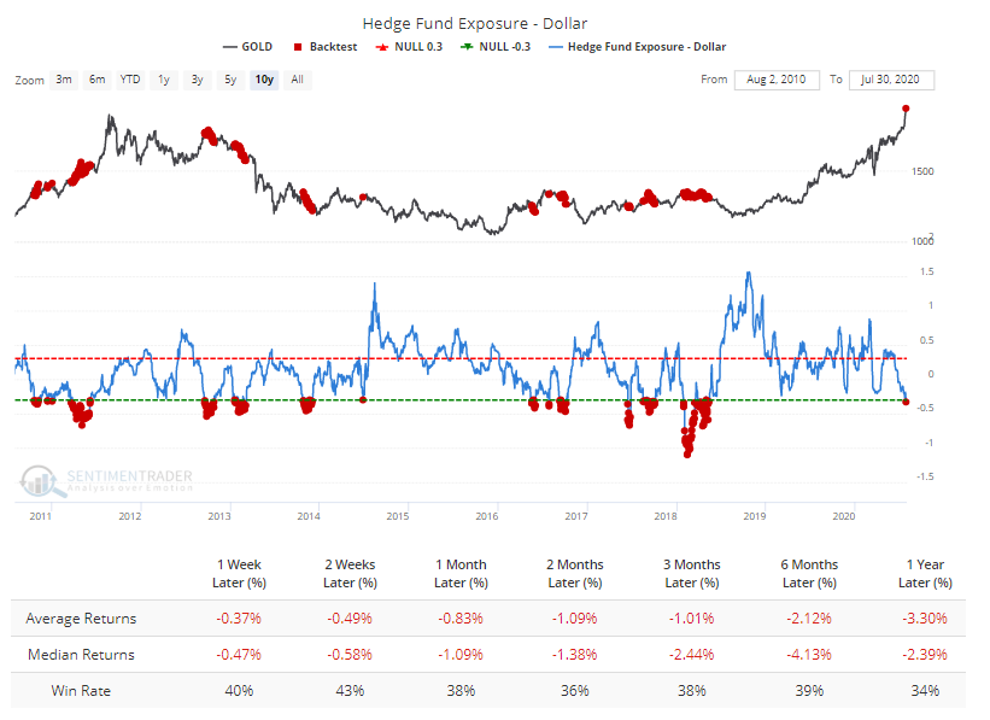

Our friends at Sentiment Trader also picked up on the same idea and published the following charts supporting our thesis. As shown, hedge fund exposure to the dollar has reached more bearish extremes.

As noted previously, the dollar has a non-corollary relationship to gold. Whenever there is extreme negative positioning in the dollar, forward returns are negative across every time frame.

The vital thing to note here is that opportunity generally exists as points of extremes. When stocks, gold, and bonds are stretched beyond normal bounds (200-dma), reversions tend to occur. The only question is timing.

However, with that said, the disconnect between the economy and the market remains a conundrum.

The GDP Crash

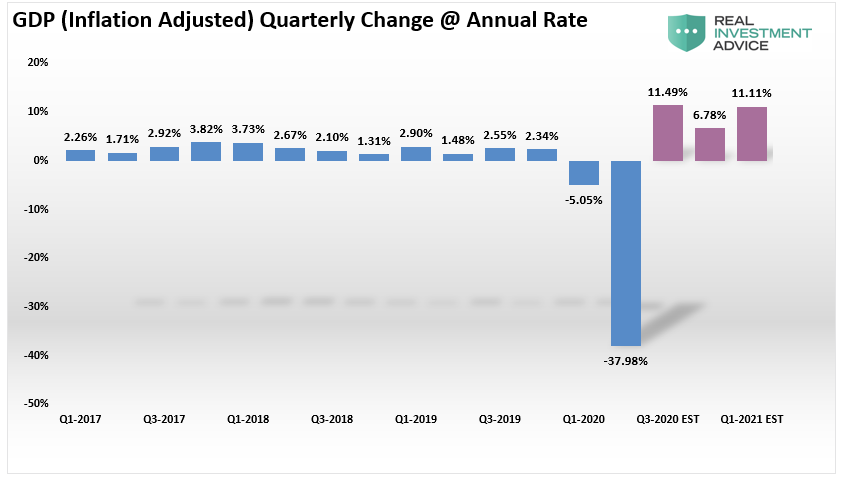

On Friday, we got the first official estimate of GDP for the second quarter. It many ways it was just as bad as we had feared. As shown in the chart below, the print of a nearly 38%, inflation-adjusted decline was stunning.

However, the “return to economic normality” faces immense challenges. High rates of unemployment, suppressed wages, and elevated debt levels, make a “V-shaped” recovery unlikely. Nonetheless, the current estimates for Q3 forward suggest record-setting rates of GDP growth.

Such is where the “math” becomes problematic. A 38% drawdown in Q2, requires about a 67% recovery to return to even. In the more optimistic recovery scenario detailed above, three-quarters of record recovery rates still leave the economy running in a deep recession.

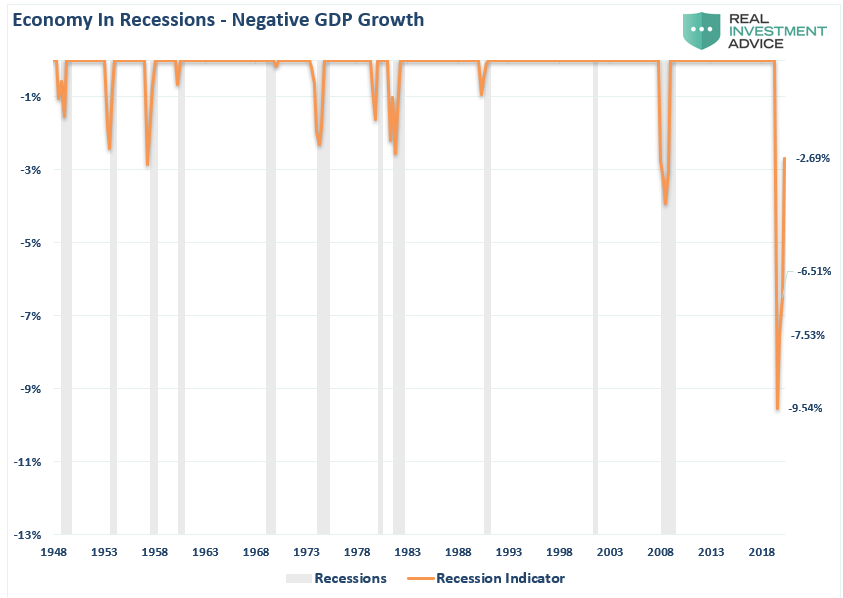

Even if the economy achieves high recovery rates, it won’t change the recession. The resulting 2.7% economic deficit will remain one of the deepest in history. While we would welcome such a recovery, it is not enough to support more substantial employment, wage growth, or corporate earnings.

A Whole New (Lower) Trend

Here is the issue missed by the majority of mainstream economists.

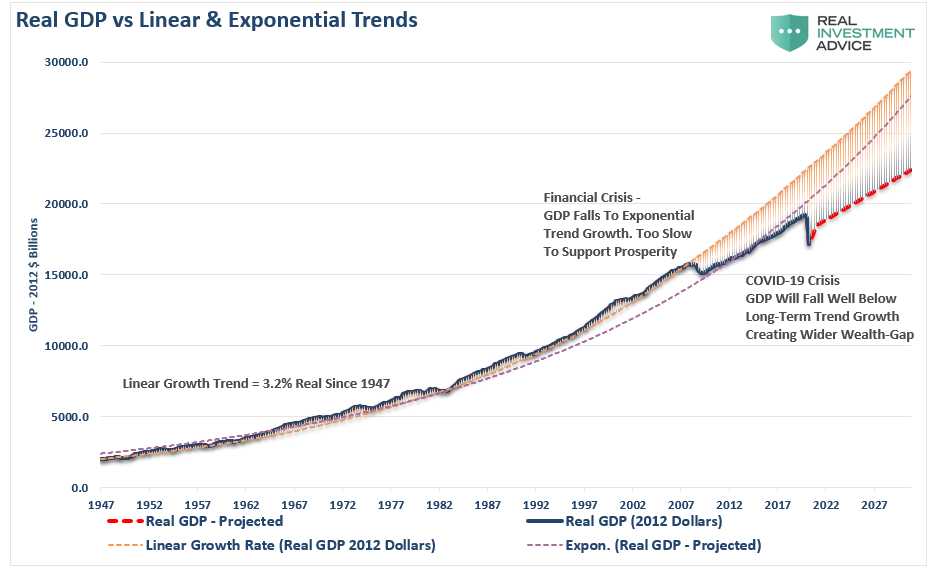

Before the “Financial Crisis,” the economy had a linear growth trend of real GDP of 3.2%. Following the 2008 recession, the growth rate dropped to the exponential growth trend of roughly 2.2%. Instead of reducing the debt problems, unproductive debt, and leverage increased.

The “COVID-19” crisis led to a debt surge to new highs. Such will result in a retardation of economic growth to 1.5% or less. As discussed previously, while the stock market may rise due to massive Fed liquidity, only the top-10% of the population owning 88% of the market will benefit. Going forward, the economic bifurcation will deepen to the point where 5% of the population owns virtually all of it.

“That is not economic prosperity. It is a distortion of economics.”

All Hat, No Cattle

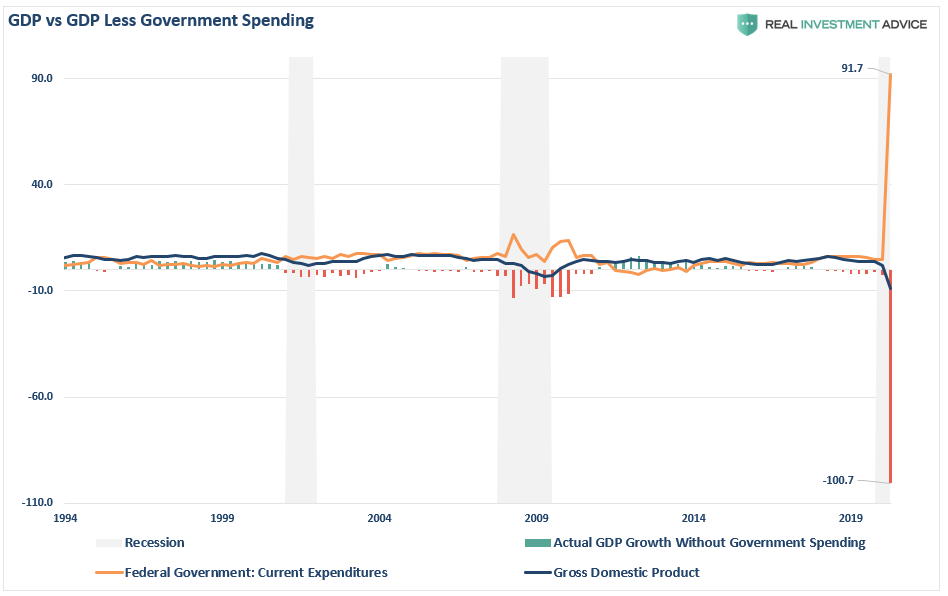

Importantly, these are all extremely optimistic assumptions based on massive interventions by the Federal Government. While the economic plunge was terrible, had it not been for the massive infusions of Government stimulus, it would have been far worse.

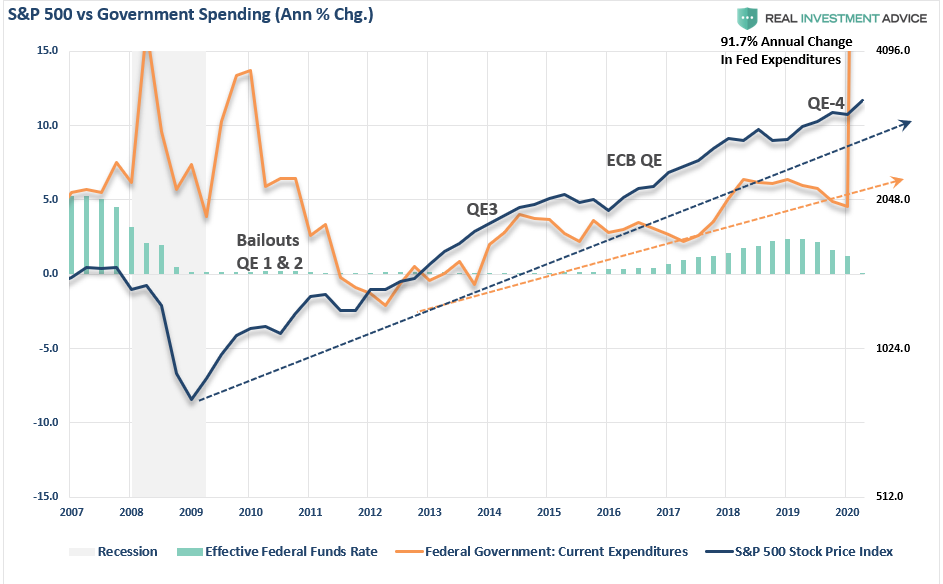

The chart below shows the annual percentage change in Federal expenditures and the rate of GDP growth less Fed expenditures. Essentially, there was ZERO economic growth, ex-federal expenditures.

However, that is also why the stock market has done so well.

The problem is the Government’s ability to continue spending at increasing rates to support economic growth and the markets.

As they say in Texas, the current rally has been “all hat and no cattle.”

Such is the most significant risk for the bulls.

Insanely Stupid

This past week, we discussed with our RIAPro Subscribers (Try Risk-Free for 30-days) the dangers of chasing markets, which have deviated extremely from their long-term means. The risk, of course, is that markets always, without exception, revert to the mean. The only question is the “timing” of the event.

Such was a point recently discussed by Sarah Ponczek and Michael Regan at Advisor Perspectives:

“People buying bubble assets will make money until they don’t. If they don’t have a view of what it will take for me to say, ‘OK, enough already, I’m going to get out,’ then they are doomed to ride the roller coaster over the top and down. So without a sell discipline, buying bubble assets is insanely stupid.” – Rob Arnott, Research Affiliates

As we have discussed in this missive previously, you can’t have a stock market that remains detached from fundamentals indefinitely.

Reversions Happen Fast

Importantly, throughout history, it is not fundamentals that catch up with the market, but the opposite. The only question is, what causes that reversion?

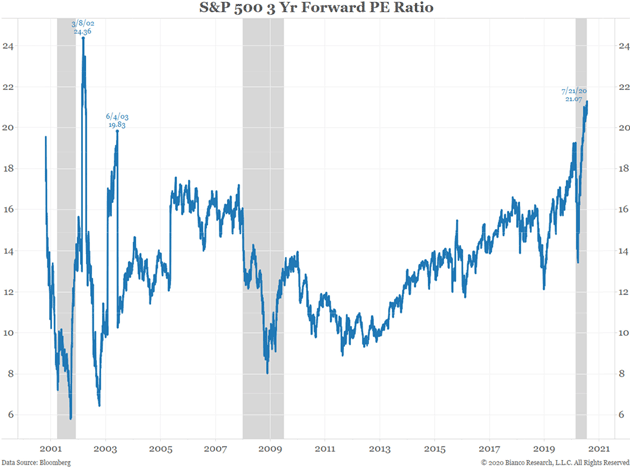

Unfortunately, we don’t, and won’t, know what the catalyst will eventually be. It won’t be COVID, bad economic data, or even weak earnings. All those issues have been factored into the market and “rationalized” by investors using earnings 3-years into the future.

While that is also insanely stupid, investors will get away with it until some exogenous, unexpected event catches the market off-guard. When it happens, like it did in March, it will take investors by surprise and the damage will be just as consequential.

There are a tremendous number of things that can go wrong in the months ahead. Such is particularly the case of surging stocks against a depressionary economy. While investors cling to the “hope” that the Fed has everything under control, there is more than a small chance they don’t.

Regardless, there is one truth about stocks and the economy.

“Stocks are NOT the economy. But the economy is a reflection of the very thing that supports higher asset prices – corporate profits.”

Such is why we continue to manage risk, adjust exposures, and hedge accordingly.

Is it “insanely stupid” to chase stocks here? Probably. But as Keynes once quipped, “the markets can remain irrational longer than you can remain solvent.”

We understand the risk we are taking in this market, and we have a risk management discipline we follow. Or rather, as Rob Arnott suggests, a rigorous “sell discipline.”

Will it absolve us of any downside risk in portfolios?

Absolutely not.

But it will definitely reduce the risk to our capital more than not having one at all.

Managing Into The Unknown

As discussed above, we are heading into seasonally two of the weakest market months of the year. Such comes at a time when Congress is battling over the next relief bill, the Federal Reserve is slowing weekly bond buying, and the economic recovery is faltering. There is also the risk of a Presidential election that goes completely awry.

With the market currently extended, overbought, and overly bullish, we suggest the following actions to manage portfolios over the next couple of months.

-

Re-evaluate overall portfolio exposures. We will look to initially reduce overall equity allocations.

-

Use rallies to raise cash as needed. (Cash is a risk-free portfolio hedge)

-

Review all positions (Sell losers/trim winners)

-

Look for opportunities in other markets (The dollar is extremely oversold.)

-

Add hedges to portfolios.

-

Trade opportunistically (There are always rotations which can be taken advantage of)

-

Drastically tighten up stop losses. (We had previously given stop losses a bit of leeway due to deeply oversold conditions in March. Such is no longer the case.)

The Risk Of Ignoring Risk

There remains an ongoing bullish bias that continues to support the market near-term. Bull markets built on “momentum” are very hard to kill. Warning signs can last longer than logic would predict. The risk comes when investors begin to “discount” the warnings and assume they are wrong.

It is usually just about then the inevitable correction occurs. Such is the inherent risk of ignoring risk.

In reality, there is little to lose by paying attention to “risk.”

If the warning signs do prove incorrect, it is a simple process to remove hedges and reallocate back to equity risk accordingly.

However, if these warning signs do come to fruition, then a more conservative stance in portfolios will protect capital in the short-term. A reduction in volatility allows for a logical approach to making further adjustments as the correction becomes more apparent. (The goal is not to get forced into a “panic selling” situation.)

It also allows you the opportunity to follow the “Golden Investment Rule:”

“Buy low and sell high.”

So, now you know why we are looking for a “sellable rally.”

https://ift.tt/39LWF16

from ZeroHedge News https://ift.tt/39LWF16

via IFTTT

0 comments

Post a Comment