South Korea Extends Short-Selling Ban To 2021 As Volatility 'Explosion' Could Be Nearing Tyler Durden Thu, 08/27/2020 - 20:45

South Korea's financial regulator on Thursday extended a ban on short-selling of listed shares for another six months, as COVID-19 cases jump to the highest level since the pandemic.

The current ban on short-selling Korea Composite Stock Price Index, or KOSPI, shares will be extended through March 15, 2021, as "widening of market volatility due to concern over the resurgence of the Covid-19" is expected, the Financial Services Commission (FSC) said in a statement, reported Reuters.

The initial ban was first imposed on March 13 following an extreme surge in equity volatility due to the virus pandemic crashing the global economy.

"Considering the rising volatility in markets with the fresh waves of Covid-19, we decided to extend the six-month short-selling ban imposed since March," FSC said.

"During the extended ban, we will seek to improve rules to offer retail investors' better access to short-selling and tighten punishment for illegal practices for short sales on equities."

The KOSPI Volatility Index rose 7% to 27.22 on Thursday following a new report from the government of 441 new coronavirus cases, the highest since March.

In relation to KOSPI price, here's where FSC has imposed the short-selling ban and extension this year.

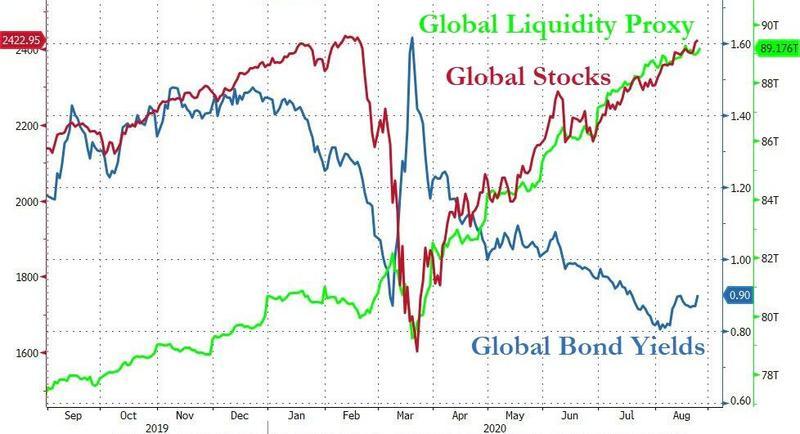

The extension of the ban suggests as global equities power to new highs (as measured by the MSCI World Index), effectively clawing back all losses from the February-March crash, that a renewed period of volatility could be ahead.

Morgan Stanley's Michael Wilson explained this week why a growth scare could produce another round of volatility (see: "Morgan Stanley Warns "The First Tradable Correction Could Begin Imminently"").

https://ift.tt/3jjwG4D

from ZeroHedge News https://ift.tt/3jjwG4D

via IFTTT

0 comments

Post a Comment