China's Too-Big-To-Fail Real Estate Giant Averts Liquidity Crisis Tyler Durden Tue, 09/29/2020 - 21:25

Last week, we reported that Beijing was suddenly on edge after a core pillar of China's housing market - China Evergrande, the mainland's second largest and the world’s most indebted property developer, saw its stock plunge and its bonds briefly halted following reports it was seeking government help to stave off a cash crunch caused the price of its shares and debt to tumble, and sparking a crisis of confidence among creditors who’ve lent the world’s most indebted developer more than $120 billion.

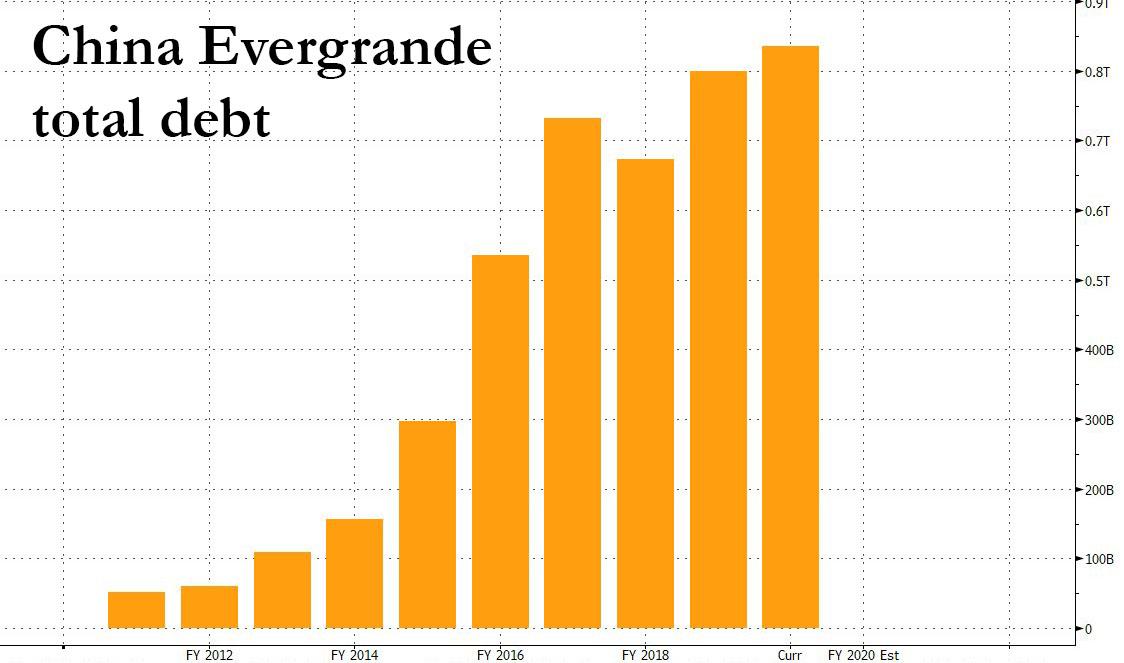

At the heart of Evergrande's problems was its massive debt which had hit the brick wall of China's suddenly careening housing market, leaving the company in a liquidity crunch and locked out from capital markets, preventing it from continuing its unprecedented debt expansion at a time it was facing a brutal debt maturity schedule which sees billions in existing yuan and dollar bonds set for repayment.

As we concluded, "If the company remains locked out of capital markets, if it can't restore access to its line of credit, and unless it can complete its reverse merger, it just may be over for Evergrande, and also for China's gargantuan housing bubble."

Fast forward to Tuesday, when the Chinese conglomerate - on the edge of a liquidity and solvency abyss - took a critical step toward avoiding a cash crunch that had threatened to roil the nation’s $50 trillion financial system and reverberate across global markets.

As Bloomberg reports, following a turbulent few days which saw Evergrande bonds plunge and in which banks, bondholders and senior government officials grew alarmed about Evergrande’s financial health, the world’s most indebted developer said it reached an agreement with a group of strategic investors to avoid repayments that would have soaked up most of the company's available liquidity and potentially crippled the junk-rated company’s balance sheet.

On Tuesday, Evergrande said that investors holding equity stakes worth about 86.3 billion yuan ($12.7 billion) agreed to keep their shares and not require the company to buy them out. That group represents the majority of the 130 billion yuan in shares held by strategic investors in its Hengda Real Estate unit, who could demand repayment in January under certain conditions. Evergrande is also in talks with the remaining investors on similar deals. The developer has finished negotiations with investors holding 15.5 billion yuan of equity interests, who are seeking further approvals. Talks with investors holding the remaining 28.2 billion yuan are ongoing.

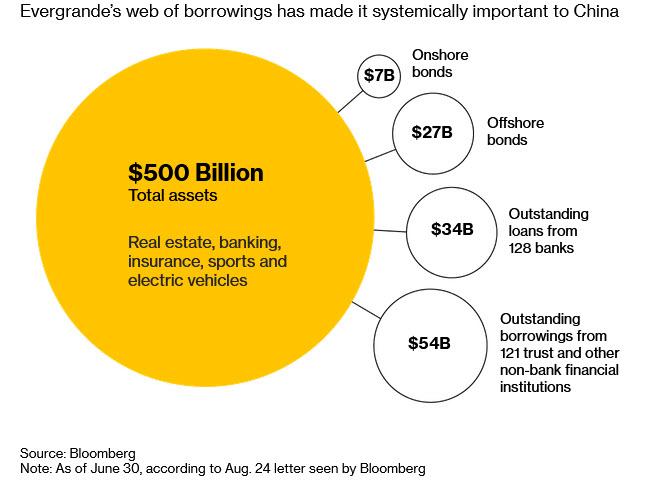

The deal buys crucial time for Evergrande to rein in a complex web of liabilities that some analysts have said makes the property behemoth too big to fail.

“The agreement solves the core issue of Evergrande, which is liquidity concern,” said Raymond Cheng, a property analyst at CGS-CIMB Securities. It's also known as "kicking the can."

As reported last week, as part of an agreement Evergrande struck with some of its largest investors, the company raised about 130 billion yuan ($19bn) by selling shares in its subsidiary Hengda Real Estate which it hoped to float on the Shenzhen’s stock exchange through a merger with an already listed company; Evergrande would need to repay investors if failed to win approval for a backdoor listing on the Shenzhen stock exchange by Jan. 31.

Evergrande owes $88 billion to banks, shadow lenders and individual investors across China and has borrowed $35 billion from bondholders around the world. More than 2 million homebuyers have given the company down payments on yet-to-be-completed properties.

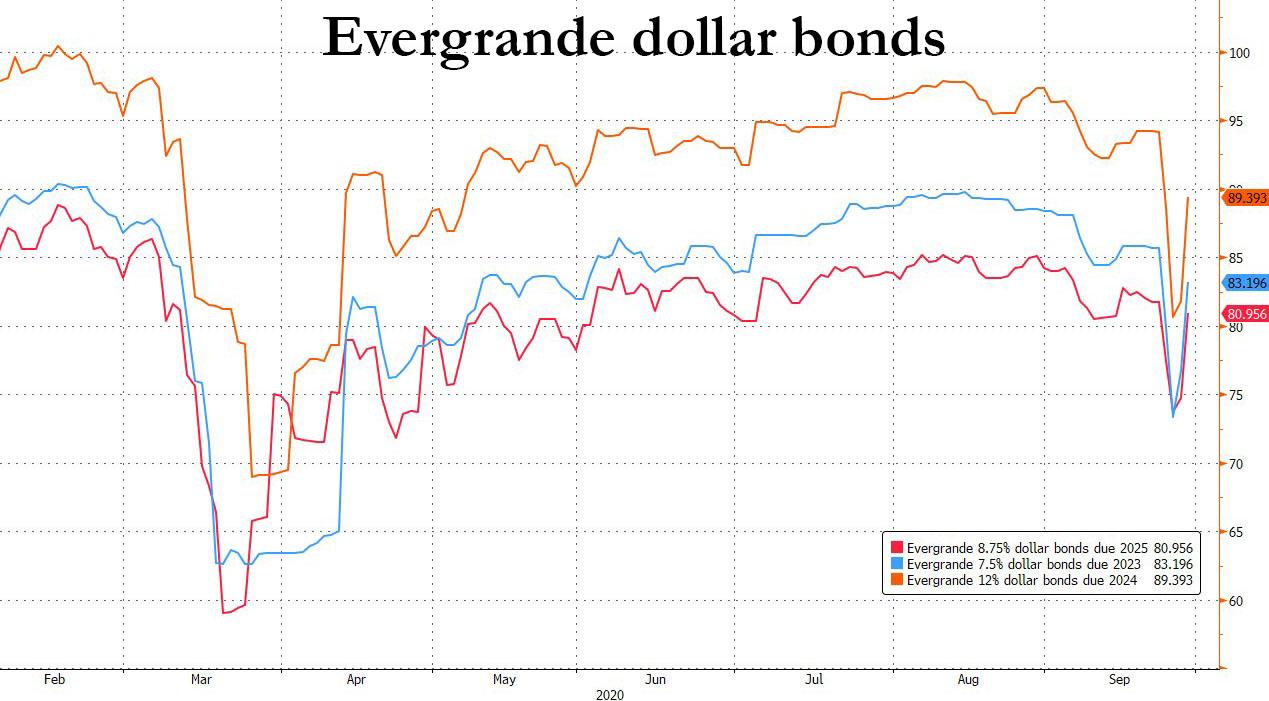

Relief after Evergrande’s announcement late Tuesday in Hong Kong helped send the company’s dollar bonds surging, although at 80 cents on the dollar it was still trading slightly lower than before investor angst exploded to the fore on Thursday.

Last week’s losses came after reports that Evergrande had warned provincial officials of a liquidity squeeze, citing its obligation to return money to some strategic investors if it failed to win approval for a backdoor listing of its main real estate assets in China by Jan. 31. While Evergrande dismissed the reports as based on rumors and “fabricated” documents, the news contributed to a selloff in high-yield bonds across Asia and prompted several Chinese banks to hold emergency meetings to assess their exposure.

While it was unclear if China’s authorities played any role in the agreement, China’s cabinet and its financial stability committee, chaired by Vice Premier Liu He, have discussed risks posed by Evergrande without making any decisions on whether to intervene, Bloomberg reported citing people familiar with the matter said before Evergrande’s announcement.

Had the company failed to reach an agreement with investors, Chinese regulators were considering options to support the developer, such as directing state-owned companies to take stakes in Evergrande or giving the company a green light for its proposed listing of an electric-vehicle unit in China, Bloomberg added, confirming just how "systemic" the company is to Beijing and the local economy.

In the end, those pragmatists who were confident that China would not allow the company to fail were proven right. Indeed, speculation that authorities would bail out the company solve any liquidity problems is one reason why its shares and bonds rallied even before Tuesday’s announcement.

The amusing irony is that even though China’s government has long threatened it would allow critical companies to fail, it boldly continues its long history of bailing out systemically important companies to maintain financial stability. While policy makers have in recent years sought to instill more market discipline and reduce moral hazard, the economic shock caused by the Covid-19 pandemic has refocused their attention on stability.

https://ift.tt/2HB9HV2

from ZeroHedge News https://ift.tt/2HB9HV2

via IFTTT

0 comments

Post a Comment