Futures Tumble, European Tech Stocks Plunge Amid Surging Virus Cases, Reflation Trade Fears Tyler Durden Mon, 10/26/2020 - 08:08

US equity futures, European tech stocks and global shares were hit hard on Monday as surging coronavirus cases in Europe (over the weekend, Spain announced a national curfew) and the United States clouded the global economic outlook, while sliding odds of a "Blue Wave" according to online bettor PredictIt sparked fresh doubt in the reflation trade; meanwhile China’s leaders meet to ponder the future of the world's 2nd largest economy. Emini futures dropped as much as 1.1% in early Monday trading.

Boeing slid 1.3% in pre-market trading after China announced it will impose unspecified sanctions on the defense unit of Boeing, Lockheed Martin and Raytheon after the U.S. approved $1.8 billion in arms sales to Taiwan last week.

Even though by now it's abundantly clear no deal is coming before the election, some traders remained focused on the prospect of a U.S. economic aid package, even as time runs out to finish a deal by the November election after months of wrangling. House Speaker Nancy Pelosi said the burden is on President Donald Trump to push forward on stimulus talks, while Treasury Secretary Steven Mnuchin said there’s been significant progress, but blamed Pelosi for holding up an agreement.

“The current mood in the market is bracing and non committal,” said Peter Rosenstreich, head of market strategy at Swissquote Bank SA. "The concern around the Covid-19 pandemic and U.S. fiscal stimulus is dominating the market. Everyone is talking up the Blue Wave, but behind the scenes ‘what if 2016 repeats?’ is keeping investors cautious."

On the covid front, the United States saw its highest ever number of new COVID-19 cases in the past two days, while France also set case records and Spain announced a state of emergency. The World Health Organization’s director general said some countries in the northern hemisphere are facing a “dangerous moment” after U.S. infections hit a record for the second day. European countries are also tightening restrictions on business. Spain has announced a nationwide curfew and Italy introduced the strongest measures since May. That combined with no clear progress on a U.S. stimulus package and caution ahead of the election to drag the MSCI world equity index down 0.2%.

"The decreasing likelihood of U.S. fiscal stimulus pre-election, possibly even pre year-end, as well as worsening virus numbers and increasing lockdown measures all seem to be taking the shine of what was a rather complacent market view of the outlook," said James Athey, investment director at Aberdeen Standard Investments.

In Europe, the Euro STOXX 600 shed 0.8%, let by Europe’s Stoxx Tech Index which fell as much as 6.3%, its biggest one-day loss since March, as SAP’s outlook cut weighs on software peers and IT services stocks.

Shares of SAP - which accounts for more than 20% of the index - plunged as much as 21%, its worst day since January 1999 after the software company cut its 2020 outlook saying that pandemic will hurt business through mid-2021. Analysts saw this as a sign that a recovery from pandemic-induced weakness had likely been pushed out, and were particularly disappointed that SAP pushed the timeline for its mid-term goals out to 2025 from 2023, with the targets lower than expectations.

The plunge in SAP shares dragged the German DAX index as much as 2.7% lower to a three-month low. Milan's blue-chip index sank 1.2% as new curbs on public venues overshadowed Friday's positive news that ratings agency S&P Global upgraded the nation's sovereign outlook to stable from negative. Bayer AG climbed 2.8% after agreeing to buy U.S. biotech company Asklepios BioPharmaceutical Inc. for as much as $4 billion, bolstering its pharma division with experimental gene therapies before patents expire on some key drugs.

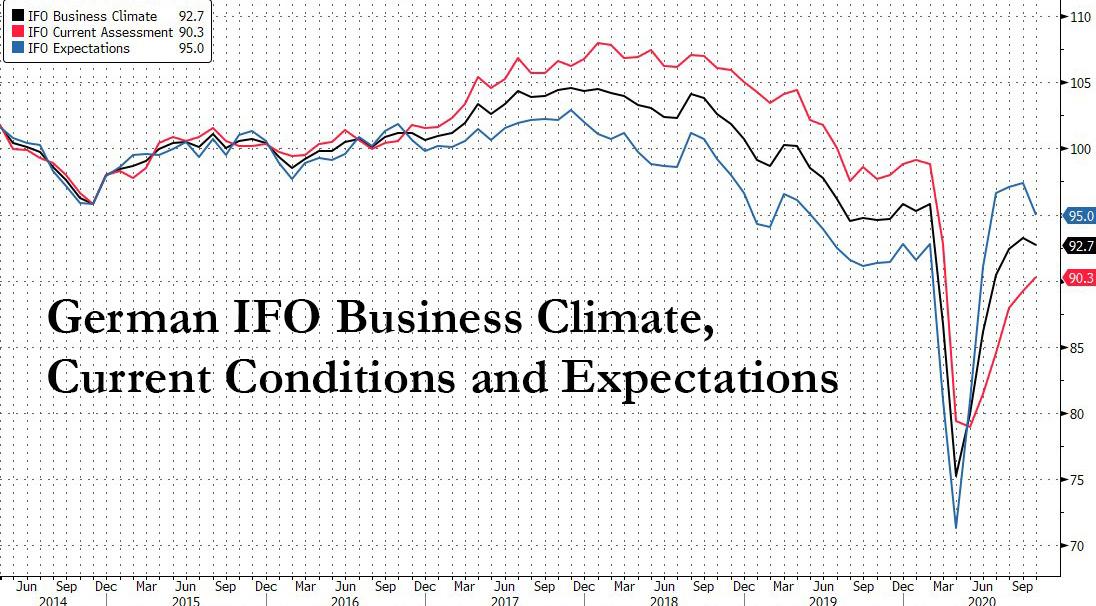

Not helping the dour European mood was the latest German IFO data whose expectations component came at 95.0, below the 96.0 expected and down from 97.7 last month, prompting fears of a double dip for Europe's largest economy.

Earlier in the session, Asian shares dropped with MSCI's index of Asia-Pacific shares outside Japan shedding 0.2%. Japan's Nikkei finished 1% lower, and South Korea's main index lost 0.7%. Chinese blue chips shed 0.6% as the country's leaders met to chart the nation's economic course for 2021-2025, balancing growth with reforms amid an uncertain global outlook and deepening tensions with the United States.

In rates, as markets increasingly price in the likelihood of a Democratic president and Congress and resulting rise in government spending and borrowing, U.S. 10-year Treasury yields hit their highest since early June last week at 0.8720%. However, the risk off mood pushed 10Y yields down to 0.81% on Monday. Treasuries outperformed in the early European session, outperforming bunds and gilts as U.S. stock futures eased from Friday’s levels. Yields lower by 0.5bp to 3bp across the curve in a bull-flattening move, tightening 2s10s, 5s30s by 2.1bp and 1bp; 10- year yields around 0.813% outperforming bunds by ~4bp and gilts by 2.5bp. Italian bonds outperform in Europe session after S&P’s outlook revision to stable on Friday: the benchmark 10-year yield dropped 9 basis points to 0.68% and the spread over German bonds tightened to 126 bps.

"We have raised the probability of a Democratic sweep, already our base case, from 40% to just over 50% and have increased our expectation of Biden to win from 65% to 75%," NatWest Markets analysts said in a note. "We see steeper U.S. yield curves and a weaker USD as likely to prevail in our base case."

In FX, the standout was the Turkey lira which for the first time ever weakened through 8 per dollar for the first time. The country’s central bank rattled investors last week by unexpectedly keeping rates on hold, and geopolitical risks have sapped interest in Turkish assets.

Elsewhere, surging coronavirus cases sent investors to the safety of the dollar after it fell broadly last week; as a result the dollar rose against most G-10 peers as waning prospects for a near-term U.S. stimulus deal and rising coronavirus infections fueled haven bids. The euro extended its Asia session decline in early European trading, closing in on $1.18; bunds rise on haven demand as coronavirus case surge sends stocks lower. The Canadian dollar and Norway’s krone led the decline among Group-of-10 currencies as oil prices fell. The pound swung between losses and gains on the back of a broadly stronger dollar mixed with positive signals emerging from Brexit negotiations, with the U.K. government indicating optimism about signing a deal. Trade talks between Britain and the European Union will continue in London until the middle of this week.

In commodities, gold was flat just above $1,900. Oil prices extended last week’s losses as the prospect of increased supply and resurgent coronavirus infections worried investors. Brent crude was down 3% at $40.52 a barrel. U.S. West Texas Intermediate (WTI) dropped 3.2% to $38.57.

Looking ahead, we find a packed week for monetary policy decisions, Canada’s and Japan’s central banks are expected to hold fire for now, while the market assumes the European Central Bank will sound cautious on inflation and growth even if it skips a further easing. Data due out Thursday is forecast to show a record, consumer-led 31.9% rebound in U.S. economic output in the third quarter, after the second’s quarter’s historic collapse. Analysts at Westpac noted such a bounce would still leave 2020 GDP around 4% below last year’s, with business investment still lagging badly.

Market Snapshot

- S&P 500 futures down 1.1% to 3,415.50

- STOXX Europe 600 down 1.1% to 358.60

- MXAP down 0.3% to 175.62

- MXAPJ down 0.2% to 583.81

- Nikkei down 0.09% to 23,494.34

- Topix down 0.4% to 1,618.98

- Hang Seng Index up 0.5% to 24,918.78

- Shanghai Composite down 0.8% to 3,251.12

- Sensex down 1.7% to 39,991.53

- Australia S&P/ASX 200 down 0.2% to 6,155.63

- Kospi down 0.7% to 2,343.91

- German 10Y yield fell 1.0 bps to -0.584%

- Euro down 0.3% to $1.1823

- Italian 10Y yield fell 4.5 bps to 0.555%

- Spanish 10Y yield fell 3.1 bps to 0.164%

- Brent futures down 2.9% to $40.58/bbl

- Gold spot down 0.3% to $1,897.06

- U.S. Dollar Index up 0.2% to 92.99

Top Overnight News from Bloomberg

- Rates traders are starting to question the big short position that’s built up in long-maturity Treasuries on the expectation of a Democratic sweep in next month’s U.S. elections. In the market for options on Treasury futures, trades emerged in the past week that wager against a leap in volatility or a major breakout in yields heading into year-end

- German Ifo Institute’s business climate index dropped for the first time in six months, just as coronavirus infections in the country reached new records. The reading of 92.7 in October was lower than the median forecast of economists in a Bloomberg survey, and compares to 93.2 the previous month. A gauge of expectations also deteriorated

- China will impose unspecified sanctions on the defense unit of Boeing Co., Lockheed Martin Corp., and Raytheon Technologies Corp. after the U.S. approved $1.8 billion in arms sales to Taiwan last week. The sanctions will be imposed “in order to uphold national interests,” Chinese Foreign Ministry spokesman Zhao Lijian told reporters Monday in Beijing.

- House Speaker Nancy Pelosi said she’s waiting for the another counteroffer Monday from Treasury Secretary Steven Mnuchin, as she and White House Chief of Staff Mark Meadows accused each other of “moving the goalposts” in negotiations

- Amy Coney Barrett is on the cusp of confirmation, with the Senate ready to vote Monday night to elevate her to the Supreme Court a week before the presidential election and create a 6-3 conservative majority on the court

- Investors wondering how China plans to evolve its financial markets in the coming years need look no further than the commentary from the weekend’s Bund Summit in Shanghai for guidance. PBOC Governor Yi Gang said that promoting broader use of the yuan will continue alongside the opening of financial markets

- Europe took a step closer to the stringent restrictions imposed during the initial wave of the coronavirus pandemic as leaders struggle regain control of the spread

- Libya is set to restart the last of its major oil fields following a ceasefire in its civil war, a milestone for the OPEC member that’s been largely offline since January

A quick look at global markets courtesy of NewsSquawk

Asian equity markets began the week lacklustre and US equity futures were pressured with risk appetite subdued by the deteriorating COVID-19 situation in Europe after France and Italy reported record surges in daily infections, which prompted Italy to announce tougher restrictions and Spain also declared a state of emergency, as well as a nationwide curfew. ASX 200 (-0.2%) was initially buoyed by M&A news including an approach by Coca-Cola European Partners to acquire Coca-Cola Amatil which saw shares in the latter surge by more than 15% and Link Administration received a revised takeover proposal, although gains in the index were eventually offset by weakness in the commodity-related sectors and with financials on edge after Westpac flagged a AUD 1.2bln hit to H2 earnings. Nikkei 225 (-0.1%) was indecisive with price action choppy around the 23,500 level amid a mixed currency and the KOSPI (-0.7%) failed to hold onto opening gains in the absence of any significant follow-through to the early nostalgic lift in Samsung Group shares after the death of its Chairman Lee Kun-hee. Shanghai Comp. (-0.8%) was the worst performer amid commodity-related weakness, with demand also subdued by the absence of Hong Kong participants due to a holiday closure and tentativeness as China begins its 4-day plenum where policymakers will hammer out details of the next 5-year plan. Finally, 10yr JGBs traded higher as they made their back towards the 152.00 focal point with support provided by the cautious mood and with the BoJ in the market for a total of JPY 920bln of JGBs.

Top Asian News

- Amazon Set For Face-Off With Ambani For India Retail Dominance

- Lira Weakens Past 8 per Dollar as Currency Rout Deepens

- Hyundai Motor Posts Loss on Engine-Problem Costs; Sales Rise

- Australia Joins Global IPO Mania With Best Month in 2020

European equities (Eurostoxx 50 -1.5%) have kicked the week off with heavy losses as the region contends with the deteriorating COVID-19 situation in Europe after France and Italy reported record surges in daily infections, which prompted Italy to announce tougher restrictions whilst Spain declared a state of emergency and a nationwide curfew. The German DAX (-2%) is the laggard in Europe amid losses in SAP (-18.3%) who carry a 10.2% weighting in the index. Losses for the German tech heavyweight followed Q3 earnings in which the Co. reported declines in revenues and operating profits, cut guidance for 2020 and removed its forecast that profitability would expand over the medium-term. As such, the Stoxx 600 tech sector (in which it carries a 24% weighting) is the clear laggard in Europe. Elsewhere from a sectoral standpoint, health care names are bucking the trend and are modestly firmer on the session with AstraZeneca (+1.0%) shares supported by news that its COVID-19 vaccine is said to have triggered protective antibodies and T-cells in the elderly according to early results which offers hope to the most vulnerable. The upside in AstraZeneca, allied with gains in UK banks (Natwest +1.1%, HSBC +0.5%, Lloyds +0.4%, Barclays +0.5%) has helped stem the losses in the FTSE 100 (-0.2%) with support seen for the domestic banking sector in the wake of reports noting that UK regulators are reportedly mulling plans to permit banks to begin paying out dividends again next year. In contrast, in the Eurozone, regulators that were previously in favour of lifting the current ban on dividends are reportedly now more concerned and are looking at dividend caps as a compromise. In terms of M&A activity, Bayer (+0.9%) are to acquire Asklepios Biopharmaceutical for USD 2bln in up-front payments with a potential further USD 2bln in milestone payments. Finally, Rolls Royce (-2.5%) are lower on the session amid source reports in The Times suggesting that major investors in the Co. will only put their support behind its emergency fundraising bid if a massive overhaul of the "sprawling" business is undertaken.

Top European News

- Italy’s Bonds Surge After S&P Holds Off From Downgrading NationEuropean Stocks Fall as SAP Leads DAX Down After Cutting Outlook

In FX, the Dollar is back on a firmer footing and in demand as a safe-haven even though the US is far from immune to the 2nd pandemic waves sweeping through many countries and the upcoming election poses uncertainty alongside the ongoing stimulus stalemate. However, aversion is taking a toll on the more cyclical, activity and commodity currencies, with the DXY revisiting 93.000+ territory within 93.069-92.784 parameters as a result ahead of the national activity index, new home sales data and the Dallas Fed manufacturing business survey.

- CAD/NOK/EUR/CHF – Another retreat in crude prices and the more severe coronavirus resurgence in Spain, Italy, France and Germany to name just a few Eurozone member states, is weighing on the Loonie, Norwegian Krona and Euro in particular. As such, Usd/Cad has rebounded further from recent lows towards 1.3200 in the run up to Canada’s by-elections, Eur/Nok has retested 11.0000+ resistance and Eur/Usd has retreated from 1.1850+ through decent option expiry interest between 1.1840-35 (1 bn). Note also, Ifo metrics were softer than expected to keep the single currency pressured, while the Franc will have noted a rise in Swiss bank sight deposits as it straddles 0.9050 again.

- JPY/GBP/AUD – Also weaker vs the Greenback as the Yen trades at the lower end of a 104.97-66 band, Sterling recoils from 1.3060+ to probe support around 1.3000 in the form of the 50 DMA (1.3012) and 10 DMA (1.2996), and Aussie wanes from just shy of 0.7150 despite Australia looking to lift more of its anti-COVID measures intime for Xmas.

- NZD – The relative G10 outperformer, albeit largely due to cross flows than anything NZ specific, as the Kiwi pivots 1.0650 against its Antipodean counterpart and hovers just below 0.6700 vs its rival awaiting trade data for some independent direction.

- EM – Broad losses due to the downturn in risk appetite impacting oil and other commodities, but with Lira losses exacerbated by heightened diplomatic tensions as Usd/Try finally clears the 8.0000 level that was being defended. Ahead, CBRT minutes and the latest inflation report may explain why the Bank opted to shock markets and stand pat last Thursday, while an improvement in manufacturing confidence has hardly helped the worsening mood with the pair elevated between 8.0658-7.9628 extremes.

In commodities, WTI and Brent futures are subdued this morning following the substantial losses seen in the equity space alongside poor earnings from European heavyweight SAP (see equity section). At present, WTI and Brent are lower by just shy of USD 1.0/bbl but similarly to the equity space have lifted off lows most recently with a number of factors in play for the crude complex this morning. On the demand side, the rising COVID-19 cases and new restrictions implemented in areas such as Italy and France have served to bring existing concerns back to the forefront; while updates from Lufthansa that additional craft are to be grounded for the Winter period will be an area of concern. Moving to the supply side where factors are both supporting and hindering the crude complex; firstly, Tropical Storm Zeta is expected to become a Hurricane later on today and has already prompted BP to commence shut-in procedures within the Gulf of Mexico. However, updates out of Libya indicate that the force majeures on all ports and fields have now been lifted after El Feel field reopened this morning following such action for the Ran Lanuf and Es Sider ports on the weekend. As such, the NOC believes production will surpass the 1mln BPD mark in around 4-weeks’ time. Moving to metals, spot gold is essentially flat on the day but has been attempting to move higher throughout the morning given the general risk-tone. However, any potential shine for the metal has been halted by the USD’s upside which has seen the DXY eclipse 93.00. Elsewhere, steel output for the year from China is forecast to eclipse 1bln/T which would be a 3-5% YY increase according to the CISA industry association. An increase which is explained by increased consumption globally as well as support domestic gov’t policies for China’s steel industry.

US Event Calendar

- 8:30am: Chicago Fed Nat Activity Index, est. 0.6, prior 0.8

- 10am: New Home Sales, est. 1.02m, prior 1.01m; New Home Sales MoM, est. 1.34%, prior 4.8%

- 10:30am: Dallas Fed Manf. Activity, est. 13.3, prior 13.6

DB's Jim Reid concludes the overnight wrap

We’re into the business end of the US Election now with tomorrow marking the one week countdown to Election Day. Over the weekend there hasn’t been much of a shift in the polling averages with the main polling sites still showing a fairly consistent lead for Biden with the FiveThirtyEight average at 9.2pts and the RealClearPolitics average at 8.0pts. The same goes for the Senate race where FiveThirtyEight give the Democrats a 73% chance of winning control. Expect the market to remain fixated on these polls as the days tick down from here however.

It’ll be hard to knock the spotlight too far from Congress this week too with the daily stimulus deal headlines unlikely to show any sign of tiring just yet. The weekend has seen both sides trade barbs – Pelosi and Meadows accusing each other of “moving the goalposts” in interviews yesterday - with time as good as up for a pre-election deal. Pelosi did hint at a pandemic relief plan this week however our US economists think the odds of a much larger deal with the White House before year end are fairly slim with the start of next year a more realistic timeframe. On that, at the back end of last week the team published a detailed report looking at what fiscal prospects mean for the US economic outlook next, with unsurprisingly a Democratic clean sweep providing the most upside. See the full report here.

In other news, the latest on the virus includes the US reaching a record number of daily cases at just over 85k over the weekend, including Marc Short, US Vice President Pence’s chief of staff. While that raises the risk of the virus spreading to the Vice President’s inner circle, Pence has been confirmed negative and will continue to campaign this week. In Europe we’ve seen Italy introduce the strongest virus restrictions since the end of a national lockdown in May as the country reported a daily record of cases while Spain approved a new national curfew. France also reported a record number of infections at over 52k yesterday with the positive test rate increasing to 17% from 16%. On the vaccine front there was good news as the FT reported that AstraZeneca’s vaccine candidate produced a robust immune response in elderly people while J&J said that first batches of its vaccine could be available for emergency use as soon as January. J&J is set to resume its US trials after they had been paused earlier due to safety concerns.

In terms of markets this morning, the latest virus news and stimulus headlines has seen S&P 500 futures trade down -0.59%. Asian bourses have also started the week on the back foot with the Nikkei (-0.12%), Shanghai Comp (-0.72%), Kopsi (-0.42%) and ASX (-0.13%) all down. Hong Kong markets are closed for a holiday. In keeping with the risk off, the US dollar index is up +0.16% overnight while yields on 10y USTs are down -2.7bps. Elsewhere, oil is down just under -2%.

In other weekend news, the latest on Brexit is that EU Chief Negotiator Michel Barnier will remain in London for discussions through October 28 according to Bloomberg after the UK government indicated optimism about signing a deal. Elsewhere, China is rethinking its yuan internationalization strategy and a senior central bank official called for more proactive approach with policies to support markets, including improving bilateral currency swap agreements.

Looking ahead to the rest of this week, the other highlights include the ECB and BoJ meetings on Thursday. With regards to the former, while our European economists expect the policy stance to be left unchanged, they do expect the ECB to warn of growing downside risks amid an already weak outlook for inflation, which will open the door to an easing of policy in December. By then, there’ll be more information on the status of the pandemic, and the ECB staff will have updated their macroeconomic projections, including the publication of the first estimates for growth and inflation for 2023. See our economists’ full preview here. For the BoJ, our economists also expect no policy stance change in light of the slow-but steady economic recovery and stable exchange rate.

Elsewhere, datawise next week we’ll get a first look at Q3 GDP in the US and Europe and given the record contractions seen in Q2, it’s quite possible that the Q3 numbers will be among the best ever quarterly performances since records began. Our US economists forecast an eye watering +33.8% as an example which, if realised, would be by far the strongest quarterly growth number since comparative data starts back in the 1940s. Clearly a lot of this is a mechanical bounceback from the shutdowns and it’s worth reminding that economic activity is still expected to remain well below its pre-Covid peak for some time. Finally, if that wasn’t enough, it’s another big week for earnings too with 184 S&P 500 companies and 94 STOXX 600 companies reporting. The former includes tech heavyweights like Microsoft, Apple, Facebook, Amazon and Alphabet.

Quickly recapping last week now, and politics on either side of the Atlantic remained in focus, particularly the US election. Expectations of fiscal stimulus in the US and moderately improving economic data helped 10-year yields rise globally. US equities pulled back slightly even as the rise in rates helped cyclical industries, especially banks (+3.17%). The S&P 500 fell back -0.53% (+0.34% Friday) as technology stocks lagged and the NASDAQ declined a greater -1.06% (+0.37% Friday). It was the S&P 500’s first weekly decline since September. Equities in Europe generally underperformed as countries are seeing rising coronavirus caseloads and restrictions are being enacted across the continent. The Stoxx 600 ended the week -1.36% lower (+0.62% Friday), with the DAX (-2.04%) falling back further.

Again the story was the sharp rise in sovereign bond yields as growth prospects improved. US 10yr Treasury yields rose +9.7bps (-1.3bps Friday) to finish at 0.843%. It was the largest one week rise in US rates since mid-August and they now sit just below the local highs of June. The US 2-year-10-year yield curve steepened +8.5bps to its steepest weekly level since February of 2018. 10yr Gilt yields rose by +9.8bps (-0.4bps Friday) to 0.28%, while 10yr Bund yields were up +4.8bps (-0.8bps Friday) to -0.57%. Peripheral sovereign debt yields rose as well with Italian (+10.7bps), Spanish (+7.1bps), Portuguese (+6.0bps) and Greek (+13.7bps) 10yr bond yields all significantly.

In terms of data released on Friday, the highlight was the flash PMIs from around the globe. The euro zone flash October PMIs were stronger than expected. Euro Area manufacturing PMIs came in at 54.4 (vs. 53.0 expected) while services, at 46.2, missed (vs. 47.0 expected). Germany manufacturing was 58.0, 3.0 points above expectations on a recovering export business. France saw a sharper decline as the flash services reading of 46.5, down one point from September and the lowest reading in five months. In the US, the Markit PMIs came in largely in line with expectations – with manufacturing at 53.3 (vs. 53.5 expected) and services a touch stronger at 56.0 (vs. 54.6 expected).

https://ift.tt/31L9Yfn

from ZeroHedge News https://ift.tt/31L9Yfn

via IFTTT

0 comments

Post a Comment