Key Events This Week: Peak Earnings Season, Record US GDP And Central Banks Tyler Durden Mon, 10/26/2020 - 09:25

With pre-election jitters set to dominate markets, the other highlights include the ECB and BoJ meetings on Thursday. With regards to the former, DB's Jim Reid writes that while the bank's European economists expect the policy stance to be left unchanged, they do expect the ECB to warn of growing downside risks amid an already weak outlook for inflation, which will open the door to an easing of policy in December. By then, there’ll be more information on the status of the pandemic, and the ECB staff will have updated their macroeconomic projections, including the publication of the first estimates for growth and inflation for 2023. For the BoJ, consensus expects no policy stance change in light of the slow-but steady economic recovery and stable exchange rate.

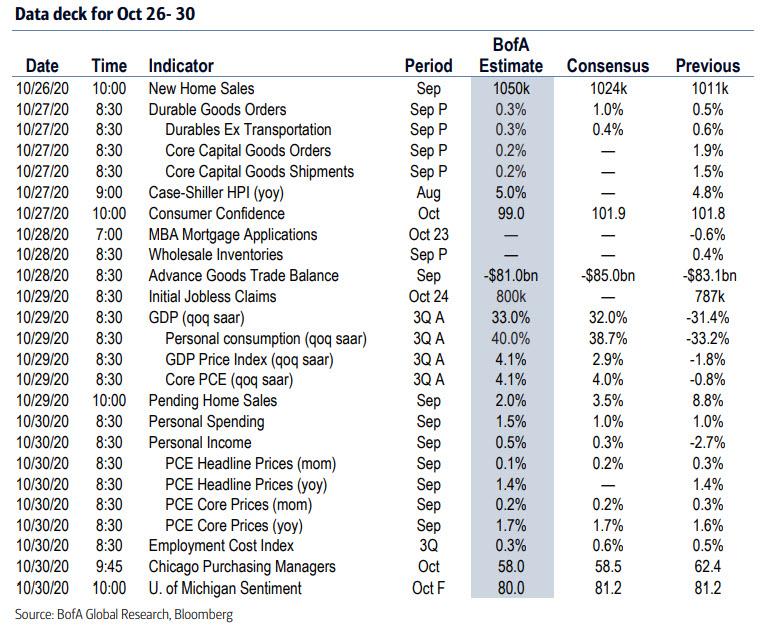

Elsewhere, datawise next week we’ll get a first look at Q3 GDP in the US and Europe and given the record contractions seen in Q2, it’s quite possible that the Q3 numbers will be among the best ever quarterly performances since records began. Economists forecast an eye watering +33.8% as an example which, if realized, would be by far the strongest quarterly growth number since comparative data starts back in the 1940s. Also expect Trump to parade that number in the days ahead of the Nov 3 election. Clearly a lot of this is a mechanical bounceback from the shutdowns and it’s worth reminding that economic activity is still expected to remain well below its pre-Covid peak for some time. Additionally, we will get the durable goods report on Tuesday, the initial Q3 GDP estimate on Thursday, and the personal income and spending and UMich consumer sentiment reports on Friday.

Finally, if that wasn’t enough, it’s another big week for earnings too with 184 S&P 500 companies and 94 STOXX 600 companies reporting. The former includes tech heavyweights like Microsoft, Apple, Facebook, Amazon and Alphabet.

Courtesy of Deutsche Bank, here is a day-by-day calendar of events:

Monday

- Data: Japan final August leading index, Germany October Ifo business climate indicator, US September Chicago Fed national activity index, new home sales, October Dallas Fed manufacturing index

- Earnings: SAP

Tuesday

- Data: China September industrial profits, Euro Area September M3 money supply, US preliminary September durable goods orders, nondefence capital goods orders ex air, August FHFA house price index, October Conference Board consumer confidence, Richmond Fed manufacturing index

- Central Banks: Fed’s Kaplan speaks

- Earnings: Microsoft, Novartis, Pfizer, Merck & Co., Eli Lilly & Co, Caterpillar, HSBC, BP

Wednesday

- Data: France October consumer confidence, US weekly MBA mortgage applications, preliminary September wholesale inventories, Japan September retail sales (23:50 UK time)

- Central Banks: Monetary policy decisions from the Bank of Canada and the Central Bank of Brazil

- Earnings: Visa, Mastercard, United Parcel Service, Amgen, Boeing, GlaxoSmithKline, Ford Motor Company, General Electric, Nomura

Thursday

- Data: Germany October unemployment change, preliminary October CPI, Italy October consumer confidence index, UK September mortgage approvals, Euro Area final October consumer confidence, October economic confidence, US weekly initial jobless claims, advance Q3 GDP, personal consumption core PCE, September pending home sales, Japan September jobless rate (23:30 UK time) and preliminary September industrial production (23:50 UK time)

- Central Banks: Monetary policy decisions from the ECB and the Bank of Japan, ECB’s Villeroy speaks

- Earnings: Apple, Amazon, Alphabet, Facebook, Comcast, Sanofi, AB InBev, American Tower, Starbucks, Royal Dutch Shell, Volkswagen, Twitter, Credit Suisse, Lloyds Banking Group, Airbus

Friday

- Data: Japan September housing starts, France preliminary Q3 GDP, preliminary October CPI, Germany preliminary Q3 GDP, Italy preliminary September unemployment rate, preliminary October CPI, preliminary Q3 GDP, Euro Area September unemployment rate, advance Q3 GDP, October flash CPI, Canada August GDP, US September personal income, personal spending, PCE core deflator, Q3 employment cost index, October MNI Chicago PMI, final October University of Michigan sentiment

- Central Banks: ECB’s Weidmann speaks

- Earnings: Novo Nordisk, AbbVie, ExxonMobil, Charter Communications, Chevron, Total, NatWest Group

* * *

Finally, looking at just the US, Goldman writes that the key economic data releases this week are the durable goods report on Tuesday, the initial Q3 GDP estimate on Thursday, and the personal income and spending and UMich consumer sentiment reports on Friday. There are limited speaking engagements from Fed officials this week, reflecting the FOMC blackout period.

Monday, October 26

- 10:00 AM New home sales, September (GS +1.5%, consensus +1.3%, last +4.8%): We estimate that new home sales rose by 1.5% in September as mortgage loan applications increased.

- 10:30 AM Dallas Fed manufacturing index, October (consensus 13.3, last 13.6)

Tuesday, October 27

- 08:30 AM Durable goods orders, September preliminary (GS +1.5%, consensus +0.5%, last +0.5%); Durable goods orders ex-transportation, September preliminary (GS +0.3%, consensus +0.4%, last +0.6%); Core capital goods orders, September preliminary (GS +0.3%, consensus +0.7%, last +1.9%); Core capital goods shipments, September preliminary (GS +0.4%, last +1.5%): We expect durable goods orders will increase 1.5% in the preliminary September report, reflecting fewer aircraft cancellations but softer growth in core measures. We expect a 0.3% increase in core capital goods orders, mirroring the pullback in business equipment production in the month.

- 09:00 AM FHFA house price index, August (consensus +0.7%, last +1.0%)

- 09:00 AM S&P/Case-Shiller 20-city home price index, August (GS +0.7%, consensus +0.40%, last +0.55%): We estimate the S&P/Case-Shiller 20-city home price index increased by 0.7% in August, following a +0.55% increase in July.

- 10:00 AM Conference Board consumer confidence, October (GS 101.8, consensus 101.9, last 101.8): We estimate that the Conference Board consumer confidence index was unchanged at 101.8 in October, reflecting a worsening virus situation but little change in other confidence measures.

- 10:00 AM Richmond Fed manufacturing index, October (consensus 18, last 21)

Wednesday, October 28

- 08:30 AM Advance goods trade balance, September (GS -$85.5bn, consensus -$85.0bn, last -$83.3bn): We estimate that the goods trade deficit increased by $2.2bn to $85.5bn in September compared to the final August report, as imports likely rose further while exports remained weak.

- 08:30 AM Wholesale inventories, September preliminary (consensus +0.4%, last +0.4%)

- 10:00 AM Wholesale inventories, September preliminary (consensus +0.4%, last +0.4%)

- 06:00 PM Dallas Fed President Kaplan (FOMC voter) speaks: Dallas Fed President Robert Kaplan will moderate a virtual panel discussion hosted by the Dallas Fed on national and global economic issues.

Thursday, October 29

- 08:30 AM Initial jobless claims, week ended October 24 (GS 765k, consensus 780k, last 787k); Continuing jobless claims, week ended October 17 (consensus 7,800k, last 8,373k); We estimate initial jobless claim decreased to 765k in the week ended October 24.

- 08:30 AM GDP, Q3 advance (GS +35.0%, consensus +31.8%, last -31.4%): Personal consumption, Q3 advance (GS +39.6%, consensus +38.7%, last -33.2%): We estimate a 35% rebound in the initial release of Q3 GDP (qoq ar) following a 31.4% decline in Q2. Our forecast reflects a 39.6% rebound in personal consumption (vs. -33.2% in Q2). We also expect large rebounds in housing (+76.3%) and equipment investment (+68.1%), but we estimate declines in the federal and business structures components.

- 10:00 AM Pending home sales, September (GS flat, consensus +3.5%, last +8.8%): We estimate that pending home sales remained unchanged in September based on regional home sales data, following an 8.8% increase in August. We have found pending home sales to be a useful leading indicator of existing home sales with a one-to-two-month lag.

Friday, October 30

- 08:30 AM Personal income, September (GS +0.5%, consensus +0.3%, last -2.7%); Personal spending, September (GS +1.1% consensus +1.0%, last +1.0%); PCE price index, September (GS +0.15%, consensus +0.2%, last +0.32%); Core PCE price index, September (GS +0.16%, consensus +0.2%, last +0.33%); PCE price index (yoy), September (GS +1.49%, consensus +1.5%, last +1.38%); Core PCE price index (yoy), September (GS +1.68%, consensus +1.7%, last +1.59%): Based on details in the PPI, CPI, and import price reports, we forecast that the core PCE price index rose by 0.16% month-over-month in September, corresponding to a 1.68% increase from a year earlier. Additionally, we expect that the headline PCE price index increased by 0.15% in September, corresponding to a 1.49% increase from a year earlier. We expect a 0.5% increase in personal income in September and a 1.1% increase in personal spending.

- 08:30 AM Employment cost index, Q3 (GS +0.4%, consensus +0.5%, prior +0.8%): We estimate that the employment cost index rose 0.4% in Q2 (qoq sa), with the year-on-year rate falling 0.3pp to 2.4%. Our forecast reflects increased labor market slack, weakness in the Atlanta Fed wage tracker, and our finding that composition effects drove most or all of the acceleration in other wage measures.

- 09:45 AM Chicago PMI, October (GS 61.0, consensus 58.0, last 62.4): We estimate that the Chicago PMI declined by 1.4pt to 61.0 in October, reflecting some moderation following an +11.2pt surge in September.

- 10:00 AM University of Michigan consumer sentiment, October final (GS 81.5, consensus 81.2, last 81.2): We expect the University of Michigan consumer sentiment index to edge up by 0.3 to 81.5 in the final estimate for October. The report’s measure of 5- to 10-year inflation expectations decreased by three tenths to 2.4% in the preliminary report for October.

Source: Deutsche Bank, Goldman, BofA

https://ift.tt/3ku64yM

from ZeroHedge News https://ift.tt/3ku64yM

via IFTTT

0 comments

Post a Comment