What 1930 Thought About 1929 Tyler Durden Mon, 10/26/2020 - 22:45

By Nicholas Colas of DataTrek Research

We recently picked up an original copy of then-NYSE president Edward Simmons’ 1930 report on the 1929 stock market crash. In recognition of that event’s upcoming anniversary, we have a summary of Simmons’ key observations. The comparisons to 2020 are remarkable, ranging from uncertainty on how technology might change business, to questions regarding sustainable corporate earnings, and even a sudden rush of retail investors.

We want to introduce you to Edward Henry Harriman Simmons. Born in 1876, he was the nephew and namesake of the famed US railroad magnate. He trained to be a doctor at Columbia University, but switched from the healing arts to finance in 1900. Simmons became a member of the New York Stock Exchange in that year and was named president of the institution in 1924.

The reason for this introduction is that we recently acquired a copy of Simmons’ May 1930 annual report to the NYSE’s Governing Committee, which includes his detailed analysis of the October 1929 stock market crash. Since we are coming up on the 91st anniversary of the event next week, this week’s story is his near-contemporaneous review of that event.

As a starting point, here is a brief description of what sorts of companies were listed on the NYSE at the time of the October 1929 Crash, as listed in the Appendix to Simmons’ report. At the time there were 821 companies on the Big Board, with 1,261 issues (common, preferred, etc.) between them.

Half of all NYSE stocks were in eight capital-intensive industry sectors:

- Railroads: 11.1 percent of all listed companies

- Autos: 7.1 pct

- Machinery and metals: 6.9 pct

- Foods: 6.3 pct

- Chemicals: 6.0 pct

- Petroleum: 5.8 pct

- Mining: 5.0 pct

- Steel and Iron: 4.1 pct

Despite the Roaring 20’s reputation for rampant consumerism, outsized Wall Street profits, and the growth of innovative technologies like telephony and mass market radio, industries related to these trends were not heavily represented on the NYSE:

- Chain stores/department stores: 6.7 percent combined of all listings

- Finance: 2.9 pct

- Cable, Telegraph, Telephone and Radio: 1.1 pct

This brings us to our first observation: unlike the world today, the stock market of 1929 wasn’t just “the economy”; it represented the highest fixed cost, most operationally levered parts of America’s economic output, employing millions of workers.

Moving on to Simmons’ own thoughts about the 1929 Crash, 3 quotes from his report and our thoughts.

Pages 3 and 4, where he lays out his analysis of what has just occurred in American capital markets:

“… it is particularly difficult to draw comprehensive and at the same time positive conclusions upon the business and financial developments of 1929, for the very fact that the period in American economic history since 1924 or 1925 has so largely been one of almost universal change and flux.”

“In the field of manufacturing, the steady installation of quantity production and standardization methods had in recent years wrought a transformation in industrial earnings power which astonished the economists and business men of the whole world; at the same time, newly invented products superseded old ones so rapidly as to render accurate estimation of corporate earnings power highly speculative.”

“Some students, bewildered by these and other novel changes in business, declared that we were living in a ‘new era’. This phrase … has been much ridiculed after the 1929 stock market collapse… Nevertheless … it is an equally serious error to disregard these momentous changes occurring through American business and economic life.”

Our take: the comparisons to today are clear. Just as now, the 1920s saw dramatic advances in the use of technology. What Simmons failed to appreciate in that upbeat final sentence was that a severe economic contraction could, and did, reverse adoption rates for technologies like the telephone and companies could, and did, cut their workforces in response to economic conditions regardless of technological advancement. Thanks to fiscal and monetary stimulus, the 2020 recession has not created the same negative feedback loop.

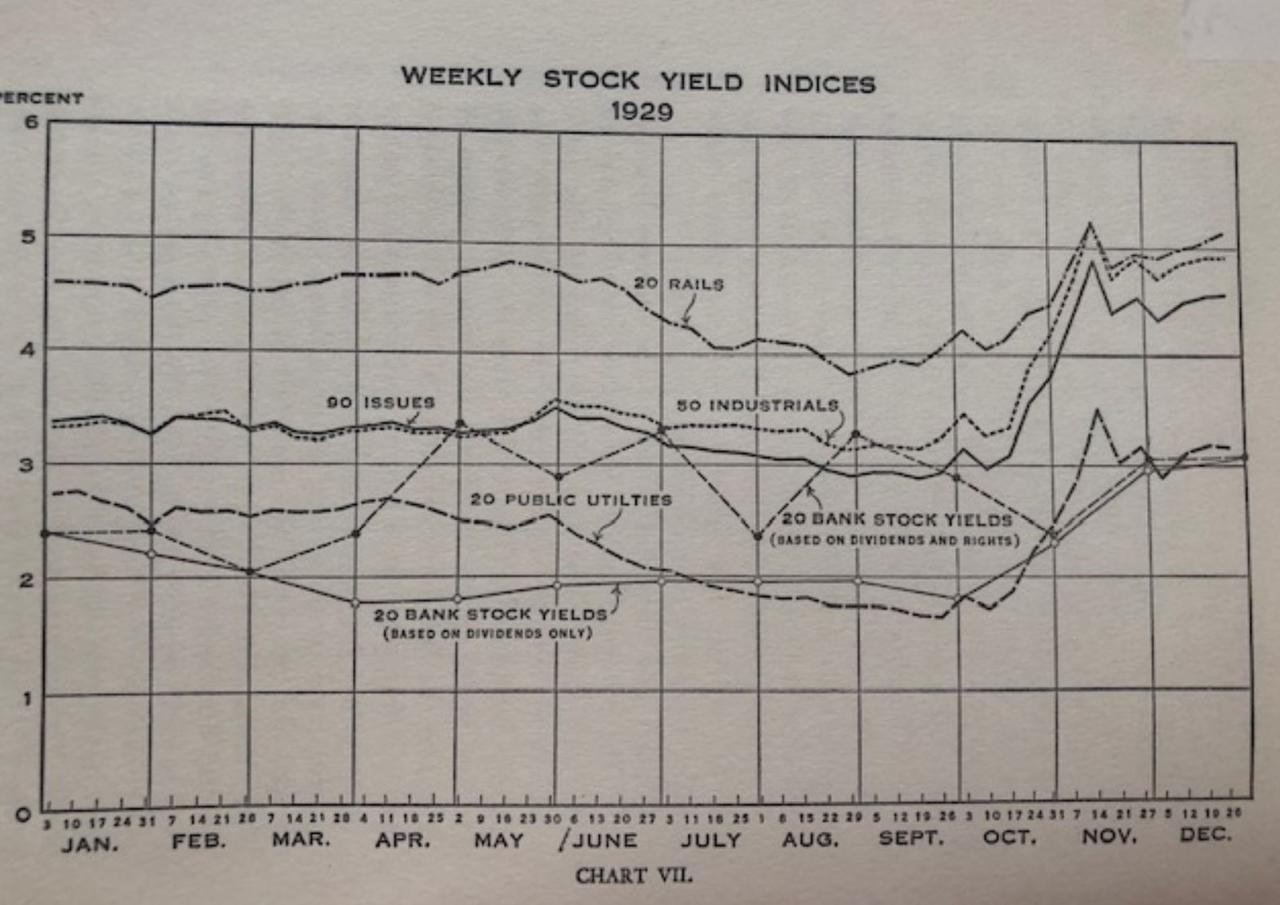

Page 21, where Simmons discusses US stock market valuations through the lens of dividend payouts:

“While it seems apparent that low yields in the summer of 1929 constituted an important reason for the readjustment of stock prices the following autumn, at the same time it is not equally certain what should be considered normal share yields, particularly under the many complicated circumstances of that extraordinary financial year.”

“While security buyers should undoubtedly consider this factor of yields more carefully in the future, at the same time dogmatic formulas in this regard are also capable of producing much misunderstanding.”

This is the chart opposite the page where that text appears:

Our take: price earnings ratios and other more modern valuation approaches make no appearance in Simmons’ 112-page analysis, but his thoughts on dividend payouts capture the right message. 1929/1930 saw a large dislocation in the US economy, and he was right to question the validity of using historical yield analysis as it did not capture uncertainty about future cash flows. There is much the same debate about 2021 earnings at the moment, of course.

Page 52, where Simmons outlines an explanation for why the American public suddenly embraced stock investing in the 1920s, which had been considered a rich person’s game before:

“The vast spread of security investment in this country which followed the gigantic Liberty Loans fundamentally altered this situation. Where previously American security buyers had been few and – supposedly at least – fairly well posted as a class in regard to Stock Exchange technique, now millions of small and often quite experienced investors appeared as a permanent factor with which American finance and the American security market must reckon.”

Explanation/Our take: the US issued 4 tranches of Liberty Bonds in 1917/1918 to fund World War I, and the first 3 were partially/fully repaid in the 1920s. These were very large issues, the first 3 amounting to $92/person for every US citizen, or $1,585 in today’s dollars. Simmons’ point is that it was this capital, often held in brokerage accounts, that when redeemed for cash ignited public interest in equity investing. The similarities to 2020’s stimulus checks and the recent increase in retail investing is, needless to say, uncanny.

Summing up: whenever we do one of these historical retrospectives, we can’t help but think there’s literally nothing new under the sun and policy makers in many ways still look at the 1929 Crash and Great Depression as their “don’t do this” playbook. Simmons, as both a member of a powerful family and NYSE Chair, could and should have been ringing the alarm bell in his 1930 review but his report is nothing more than a detailed recitation of fact and figure. He did not see 1929 as a historical turning point. While his name is mostly lost to history now, no policy maker wants to replicate his error. They may end up doing too much (we’ll see if that proves to be the case in 2020), but they never want history to judge them as doing too little.

https://ift.tt/34txbob

from ZeroHedge News https://ift.tt/34txbob

via IFTTT

0 comments

Post a Comment