Futures, Global Stocks Dip On Last Day Of Record Month For Markets Tyler Durden Mon, 11/30/2020 - 07:55

US equity futures and world shares paused on Monday, dropping modestly on the back of weakness in oil and energy stocks even as they were set to finish a record-breaking month sparked by major progress toward a coronavirus vaccine and yet more free money from central banks.

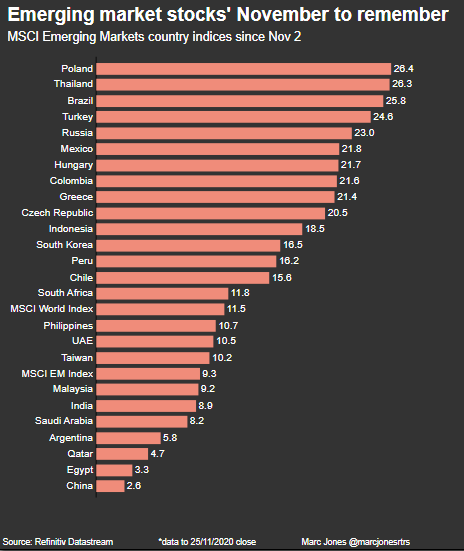

Trading volumes were muted with European stocks holding steady, reversing an earlier loss while U.S. futures dropped as lows as 3,600 before rebounding. The MSCI World Index has soared 13% in November, the best performance on record. IHS Markit Ltd. jumped 16% in U.S. premarket trading. The research firm with more than 5,000 analysts, data scientists agreed to be bought by S&P Global Inc. for about $39 billion in stock.

Early downbeat sentiment was reversed by yet another case of "Medical Monday", after Moderna became the latest company to apply for emergency COVID vaccine approval in the US and Europe after new analysis showed the vaccine was highly effective in preventing Covid-19, with no serious safety problems. The news came after a weekend, in which U.S. Surgeon General Jerome Adams said the federal government hopes to quickly review and approve requests from two drugmakers for emergency approval of their Covid-19 vaccines. The rapid pace to a vaccine has given investors the confidence to price in a return to normalcy and faster economic growth, helping lift shares of companies that were hardest hit by the pandemic.

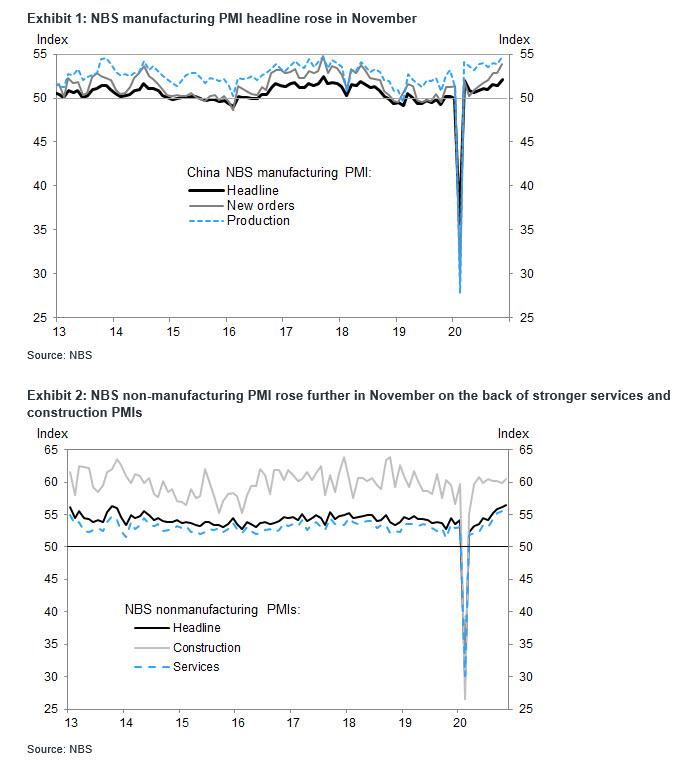

Sentiment also got a boost from the latest Chinese PMI data showed manufacturing and service activity handily beat forecasts in November, even as the country’s central bank surprised with a helping of cheap loans.

On Monday, the rotation in equities showed signs of a slight reversal. Futures on the tech-heavy Nasdaq 100 Index were little changed, while small-caps, banks and energy producers dropped, according to Bloomberg. The MSCI Asia Pacific Index sank 1.6%, the biggest loss in a month. The risk-on mood across markets has hurt demand for haven assets. Gold extended a retreat on Monday and is on course for its largest monthly decline in four years. The dollar is poised for a 2.7% drop in November.

"I suspect that investors have become cautious after big gains in the last few weeks that were driven by the vaccine news," said Peter Rosenstreich, head of market strategy at Swissquote Bank. "It’s a big positive as it’s really provided an endgame for Covid-19."

“Markets are overbought and at risk of a short term pause,” said Shane Oliver, head of investment strategy at AMP Capital. “However, we are now in a seasonally strong time of year and investors are yet to fully discount the potential for a very strong recovery next year in growth and profits as stimulus combines with vaccines.” Cyclical recovery shares including resources, industrials and financials were likely to be relative outperformers, he added.

Today's drop in oil and energy names notwithstanding, November's rush to value names benefited oil and industrial commodities while undermining safe-haven dollar and gold. “It has been a very, very strong month for markets, especially on the equity side but also on the fixed income side too,” said Rabobank’s Head of Macro Strategy Elwin de Groot. "And this market still remains very much supported by liquidity from the central banks,” De Groot added. With the ECB set to provide more stimulus next month “the market view seems to be, what can possibly go wrong?”

The positive developments on vaccines and swiftness with which they are likely to be rolled out had been key drivers.

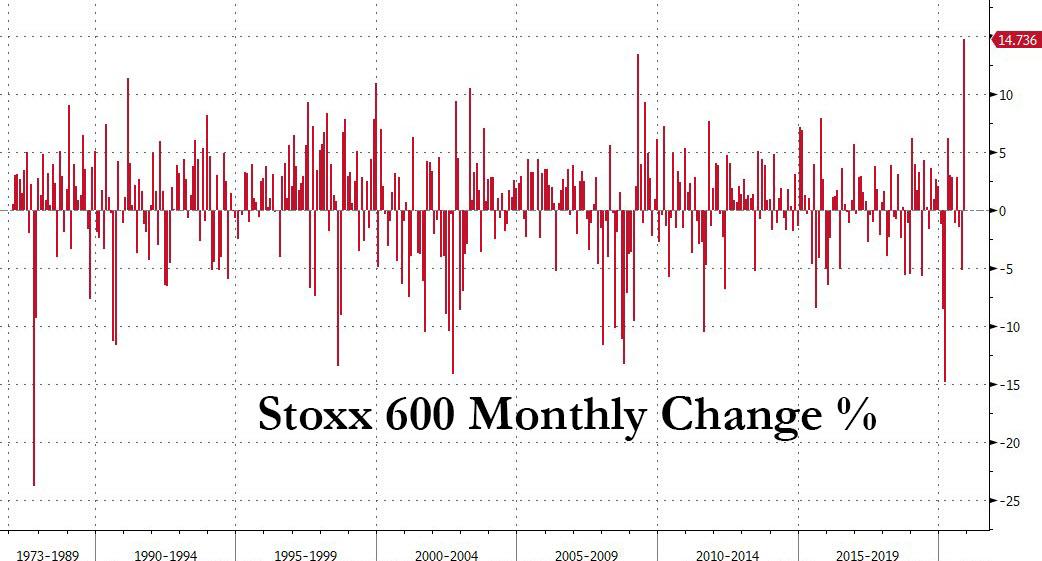

European bourses boasted their best month ever with France up 21% and Italy almost 26%. The MSCI measure of world stocks is up nearly 13% for November, while the S&P 500 has climbed 11% to all-time peaks. The Stoxx is also having its best month on record.

After initially dropping as much as -0.7%, European stocks were unchanged after Moderna said it plans to request clearance for its coronavirus vaccine in the U.S. and Europe. The Eurostoxx 50 reversed an initial 0.6% drop to trade in the green. DAX and FTSE 100 lead peers. Peripheral indexes remain in the red, with Spain’s IBEX underperforming. Retail, chemical and healthcare stocks lead gains with banks, while oil & gas and travel the weakest sectors following Sunday's failure of OPEC+ to reach a preliminary deal on whether to extend output curbs. ABN Amro Bank NV fell as much as 6.5% in Amsterdam trading. The Dutch lender plans to cut about 2,800 jobs over four years as it retreats from large parts of its investment bank.

Earlier in the session, Asia closed November on a weak note with MSCI’s index of Asia-Pacific shares ex-Japan ending 1.5% lower on the day but was still up almost 10% for the month. The Topix lost 1.8%, with Toyota and Daiichi Sankyo contributing the most to the move. The Shanghai Composite Index retreated 0.5%, driven by China Merchants Bank and Kweichow Moutai. Chinese blue chips ended lower but up nearly 6% for the month. Trading volume for MSCI Asia Pacific Index members was 88% above the monthly average. Japan’s Nikkei 225 eased 0.8%, but was still 15% higher on the month for the largest rise since 1994.

Emerging-market stocks fell on the last day of November, their best month since March 2016, as investors weighed the failure of an OPEC+ ministers panel to reach a supply agreement and renewed coronavirus restrictions from Hong Kong to Europe. MSCI’s gauge tracking developing-nation equities headed for the biggest daily drop this month.

The surge in stocks has put competitive pressure on safe-haven bonds but much of that has been cushioned by expectations of more asset buying by central banks. Sweden’s Riksbank surprised last week by expanding its bond purchase program and the European Central Bank is likely to follow in December.

In rates, European fixed income markets were relatively quiet, ignoring comments from ECB’s Lagard; Bunds bear flatten, semi-core spreads tighten marginally to core. German 10-year Bund yield were down 1.1 basis points at -0.598%, its lowest since Nov. 9. The rest of the core market also fell by around 1 bp.

Treasury futures were near session lows in early U.S. trading as stock futures pare declines, despite expectations that a large month-end index duration extension at the end of the day will support the long end. Yields were higher across the curve led by 10- to 30-year sectors, 10-year by nearly 2bp at 0.857%, slightly lagging bunds and gilts; front-end yields are little changed. As a result, U.S. 10-year yields are ending the month almost exactly where they started at 0.84%, a solid performance given the exuberance in equities.

The U.S. dollar has not been as lucky: "The idea that a potential Treasury Secretary (Janet) Yellen and Fed chair Powell could work more closely to shape and coordinate super easy monetary policy and massive fiscal stimulus that could drive a rapid post pandemic recovery saw the dollar under pressure," said Robert Rennie, head of financial market strategy at Westpac.

Against a basket of currencies, the dollar index was pinned at 91.771 having shed 2.4% for the month to lows last seen in mid-2018. The Bloomberg dollar index was headed for its biggest monthly decline since July, as G-10 peers tested multi-year highs against the greenback. The euro has caught a tailwind from the relative outperformance of European stocks and climbed 2.7% for the month to reach $1.1967. A break of the September peak at $1.2011 would open the way to a 2018 top at $1.2555.

Elsewhere, the pound rose the most in nearly a week on optimism a Brexit trade deal is close, though signs of caution showed up in the options market. GBP/USD rose as much as %0.4 to 1.3364 in its biggest move since Nov. 24. The U.K. and European Union are close to a breakthrough on fishing with an acceptance of a British proposal for a transition period on fishing rights after Jan. 1, the Telegraph reported. In Switzerland, the USD/CHF fell as much as 0.5% to 0.9019, its lowest since Nov. 9; The Swiss franc was initially supported as the nation’s voters rejected two proposals that had the potential to alter the corporate landscape of a country known for low taxes and light-touch regulation.

In commodities, one major casualty of the rush to risk has been gold, which was near a five-month trough at $1,771 an ounce having shed 5.6% in November, its largest monthly decline in four years.

Oil, in contrast, benefited nearly 30% from the prospect of a demand revival should the vaccines allow travel and transport to resume next year. Some profit-taking set in early on Monday ahead of an OPEC+ meeting to decide whether the producers’ group will extend large output cuts. Brent crude futures fell 52 cents to $47.66, while WTI dropped below $45 a barrel in New York on Monday. An informal meeting of OPEC+ ministers didn’t reach an agreement on whether to delay January’s oil-output increase. A full meeting of the cartel is planned for later today, where a deal is still seen as the most likely outcome.

As Bloomberg notes, looking at Monday's calendar, OPEC holds a virtual full ministerial meeting to make a final decision on whether a production supply hike should proceed as scheduled in January. Further into the week, the Reserve Bank of Australia holds a policy meeting on Tuesday, while Fed Chairman Jerome Powell testifies before Congress on Tuesday and Wednesday. The U.S. jobs report on Friday is expected to show more Americans headed back to work in November, though at a slower pace than last month.

Market Snapshot

- S&P 500 futures down 0.2% to 3,628

- STOXX Europe 600 up 0.01% to 393.28

- German 10Y yield rose 0.5 bps to -0.583%

- Euro up 0.1% to $1.1977

- Italian 10Y yield fell 0.7 bps to 0.483%

- Spanish 10Y yield rose 0.6 bps to 0.064%

- MXAP down 1.6% to 189.96

- MXAPJ down 1.5% to 625.40

- Nikkei down 0.8% to 26,433.62

- Topix down 1.8% to 1,754.92

- Hang Seng Index down 2.1% to 26,341.49

- Shanghai Composite down 0.5% to 3,391.76

- Sensex down 0.3% to 44,149.72

- Australia S&P/ASX 200 down 1.3% to 6,517.81

- Kospi down 1.6% to 2,591.34

- Brent futures down 1.8% to $47.30/bbl

- Gold spot down 0.6% to $1,777.30

- U.S. Dollar Index down 0.2% to 91.64

Top Overnight News from Bloomberg

- Boris Johnson’s officials believe a Brexit trade deal could be reached within days if both sides continue working in “good faith” to resolve what the U.K. sees as the last big obstacle in the talks -- fishing rights

- Boris Johnson is battling to convince his own Conservative Party colleagues to back plans to keep most of England under strict pandemic controls when the national lockdown ends this week

- Germany can’t continue compensating businesses for lost sales beyond next month and more targeted measures will be needed instead, according to senior officials in Chancellor Angela Merkel’s government

- China’s economic rebound is gathering pace toward the end of the year, with an official gauge of manufacturing rising faster than expected in November, fueled by exports

- China unexpectedly added medium-term funding to the financial system on Monday, as the central bank sought to ease liquidity tightness in the final weeks of the year

- The Bank of England is seeing old fault lines open up as officials lock horns on whether to take interest rates below zero for the first time. That’s what the math on the nine-member Monetary Policy Committee is starting to look like, as the so-called “internals” on the panel with full-time operational roles at the central bank show the greatest signs of resistance to the measure. The minority of part-time “external” officials tend to be more open to subzero policy

Quick look at global markets courtesy of NewsSquawk

Asian equity markets began the week mixed amid tentativeness heading into month-end and this week’s key risk events, with the region also digesting a slew of data including better than expected Chinese Manufacturing and Non-Manufacturing PMI data. ASX 200 (-1.3%) underperformed as gold miners led the broad retreat seen across sectors after the recent slump in the precious metal and with Treasury Wine Estates hampered again by China’s anti-dumping measures on Australian wine, while Nikkei 225 (-0.8%) was initially kept afloat after Industrial Production data topped estimates but later succumbed to the headwinds from a firmer currency. Hang Seng (-2.1%) and Shanghai Comp. (-0.5%) initially diverged with the mainland bourse outperforming after Chinese official Manufacturing PMI printed its highest reading in more than 3 years and amid PBoC efforts in which it injected funds through Reverse Repo operations and the Medium-term Lending Facility. Conversely, the mood in Hong Kong was subdued with CNOOC and other blue-chip oil peers pressured after reports US President Trump is to add CNOOC and chipmaker SMIC to the defense blacklist, while Alibaba was also among the laggards amid suggestions the Ant Financial IPO faces narrow chances of going through next year. Finally, 10yr JGBs were lacklustre and attempted a breakdown of the psychological 152.00 level with price action failing to take impetus from the bull-flattening last Friday in USTs and the BoJ presence in the market today, while the central bank also recently announced its bond purchase intentions for December whereby it maintained the value amounts but reduced the frequency of buying in 1-3yr and 3-5yr maturities to 5 times from 6 times a month.

Top Asian News

- Suning.com Is Said to Mull E-Commerce Business Stake Sale

- China Unexpectedly Injects $30 Billion Into Financial System

- Meituan’s Sales Surge Alongside China’s Appetite for Takeout

- H.K. Doctor Is Cleared in Massive Securities Fraud Probe

Major European bourses see a mixed performance (Euro Stoxx 50 Unch) after the region trimmed the modest losses seen at the cash open despite a lack of fresh fundamental catalysts, and with some suggesting month-end rotation for the earlier losses ahead of a number of key risk events for the week - including Brexit, OPEC and the US Labour Market reports. State-side futures also sees tepid trade in early European hours ahead of the US entrance from the long Thanksgiving weekend. Back to Europe, sectors kicked the week of with a defensive bias as Healthcare, Utilities and Staples initially performed better than the cyclicals, albeit thereafter, sectors re-calibrated to show more of a mixed picture, with no clear risk tone to be derived as things stand. Energy remains the straddler amid price action in the complex ahead of the OPEC confab, whilst Banks also retain their spot near the bottom amidst a lower yield environment, and as Brexit continues hang over UK financials heading into the crunch week. Further for the banking sector, HSBC (-2%) trades lower following reports the group is looking to exit retail banking in the US as part of a cost reduction plan, whilst ABN AMRO (-6.2%) sees more pronounced losses following its investor update whereby it sees some 15% workforce reduction by 2024. Elsewhere, on the M&A front - AA (-0.5%) trades modestly lower as its largest shareholder is set to oppose the takeover from Warburg Pincus and TowerBrook Capital Partners, with his stake just under the 25% needed to block the deal. Meanwhile, JD Sports (+6.3%) tops the FTSE 100 amid source reports that the group is less likely to make an offer for the Debenhams as its chairman is reportedly concerned that COVID restrictions have had a larger impact. Meanwhile, Siltronic (+9.1%) holds onto gains amid reports the Co. is said to be in talks to be bought by Taiwan's GlobalWafers for EUR 3.75bln. Finally, state-side S&P Global Inc confirmed it is in advanced talks to acquire IHS Markit for a deal worth around USD 44bln.

Top European News

- Swiss Reject Business Liability Plan, Ban on SNB Investments

- Lloyds Names HSBC’s Nunn as CEO to Replace Horta- Osorio

- ABN Amro to Cut About 2,800 Jobs as Investment Bank Shrinks

- Poland Upset With EU But Not Enough to Follow U.K. Exit Path

In FX, the Dollar remains downbeat irrespective of any safe haven demand that might ordinarily be warranted as stocks waver on the last trading day of the month, with bank models flagging a relatively strong sell strong signal against G10 currencies, bar the Yen. Hence, the DXY is depressed below 92.000 and just off a new 2020 low within 91.762-630 parameters and technically weak unless it can regain momentum and reclaim losses through a Fib retracement level at 91.729. Ahead, Chicago PMI before pending home sales and Dallas Fed manufacturing and a speech from Barkin.

- NZD/CHF/EUR/GBP - More independent traction for the Kiwi as it targets 0.7050 vs its US counterpart in wake of improvements in the NBNZ business outlook and own activity readings for November, while the Franc has taken on board a pick up in Swiss retail sales and KOF’s leading indicator slowing less than expected this month rather than mixed weekly sight deposits to maintain gains above 0.9050. Elsewhere, the Euro is making steady measured progress towards 1.2000 after eclipsing resistance at 1.1975, albeit with some assistance from reported Eur/Gbp RHS interest for month end as the cross tests 0.9000 and Cable continues to trade heavy on the 1.3300 handle amidst ongoing Brexit uncertainty and conflicting UK data (BoE consumer credit weak, mortgage lending sub-consensus, but approvals considerably higher than forecast).

- CAD/AUD - The Loonie is holding up pretty well between 1.3000-1.2970 parameters given another downturn in oil prices and Aussie also close to 0.7400 following contrasting business inventory and company profits, with similarly divergent external impulses via strength in Chinese PMIs to temper some of the pain inflicted by Beijing’s steep anti-dumping tax on wine and a fresh diplomatic twitter spat.

- JPY - A major laggard on the aforementioned lack of demand for portfolio purposes vs the Greenback, as the Yen pivots 104.00 and comfortably inside recent extremes after a raft of inconclusive Japanese data overnight.

- SCANDI/EM - The Nok is also displaying a degree of resilience against the backdrop of weaker crude and Sek is consolidating off post-Riksbank lows, while the Cnh has firmed from PBoC midpoint fix levels for the Cny with more reverse repo and MLF liquidity to compound the robust official PMIs and the Try has drawn encouragement from a more pronounced than anticipated GDP rebound in Q3, narrower trade deficit and cheaper oil.

In commodities, WTI and Brent futures trade on the backfoot in the run-up to the decision-making OPEC/OPEC+ meetings over the next two days, for which a full Newsquawk preview can be found here, whilst the Newsquawk OPEC Twitter Dashboard can be accessed here. In terms of where we stand, Sunday's impromptu meeting offered little in the way of a breakthrough, with the panel of OPEC+ ministers unable to reach an agreement on the extension of current cuts, but most participants are reportedly supporting a delay of hikes through Q1 2021. Market expectations are still leaning towards the second tranche (7.7mln BPD cuts) being extended through in the first three months of 2021, albeit with some sources suggesting an extension by 2-3 months, whilst the most recent sources suggested 3-4 months. Meanwhile, Russia is said to be advocating gradual monthly increases in output from January, according to sources. Nonetheless, futures contracts remain subdued awaiting concrete clarity, with the OPEC meeting set to commence at 13:00GMT/08:00EST and a drip-feed of to-and-fro sources likely. WTI Jan resides under USD 45/bbl (vs. high 45.42/bbl) whilst Brent Feb continues to lose ground sub-48.00/bbl (vs. high 48.04/bbl). Elsewhere, spot gold and silver trade lacklustre despite a lack of fundamental catalysts, but with month-end rotation to keep in mind - with the former struggling to gain ground after yielding the 1800/oz mark. Turning to base metals. Dalian iron ore and Shanghai copper futures extended on recent gains with traders pointing to upbeat economic data from China. LME copper meanwhile is catching tailwinds from the copper performance overnight coupled by somewhat of a recovery in stocks.

US Event Calendar

- 9:45am: MNI Chicago PMI, est. 59, prior 61.1

- 10am: Pending Home Sales MoM, est. 1.0%, prior -2.2%

- 10am: Pending Home Sales NSA YoY, prior 21.9%

- 10:30am: Dallas Fed Manf. Activity, est. 15.8, prior 19.8

DB's Jim Reid concludes the overnight wrap

Welcome to what has become “Vaccine Monday” and also the last day of what will very likely be a record month for many equity markets. We’ll give full details tomorrow in our monthly performance review. Everyone will be waiting with baited breath though to see if there is a new vaccine efficacy release before the markets open today. It feels like the next developed world candidates are many weeks behind the three who have reported so far so we’re not expecting anything today but it wouldn’t surprise me if traders were very reluctant to go short, if that was their desire, before noon GMT / 7am NYT. Staying with vaccines, reports suggest that the U.K. will be the first country to approve the Pfizer/BioNTech vaccine, perhaps even early this week, with a view to starting inoculations as soon as next Monday. Meanwhile, the US Surgeon General Jerome Adams has said that Pfizer/ BioNTech is scheduled to submit an Emergency Use Authorization request for their vaccine on December 10 followed by Moderna on December 18 while Anthony Fauci said that vaccines would likely roll out from the middle to end of December.

Overnight we saw China’s November official PMIs with manufacturing printing at 52.1 (vs. 51.5 expected), the highest since September 2017, with services at 56.4 (vs 56.0 expected) bringing the composite reading to 55.7 (vs. 55.3 last month). This beat is leading to Chinese bourses outperforming this morning with the CSI (+0.96%), Shanghai Comp (+0.74%) and Shenzhen Comp (+0.52%) all making advances. Other indices in the region however have largely turned red after opening higher with the Nikkei (-0.61%), Hang Seng (-1.12%) and Kospi (-0.84%) all trading lower. Futures on the S&P 500 (-0.63%) have also turned lower and European ones are also pointing to a weaker open. Elsewhere, Reuters has reported that the Trump administration is adding SMIC and CNOOC Ltd. to a blacklist of “alleged Chinese military companies”.

In other weekend news an informal side OPEC+ meeting last night has seemingly failed to agree a plan to maintain production cuts through Q1. So lots at stake as we head into a two day meeting of the full group today and tomorrow. Crude oil prices are down c. -1.30% overnight. Our Oil strategist Michael Hsueh wrote a piece over the weekend (link here) suggesting that the current oil price factors in maintaining the production curbs and if we don’t get them we could see a -10% fall. So one to watch after a big bull run. Elsewhere, Bloomberg has reported overnight that S&P Global is in advanced talks to buy IHS Markit for about $44 bn and an announcement towards this could come as soon as today. If true, the tie-up would be this year’s second-biggest deal.

Now turning to the latest on the virus and the underlying message continues to remain same with new infections slowing in Europe but continuing to remain high in the US. In France, the positivity rate has now fallen to 11.1%, just over half of where it was in early November and the number of ICU patients are also on a continued decline. A similar pattern to the U.K. and Italy. Meanwhile in the US, Los Angeles and San Francisco imposed tighter restrictions but NYC schools will begin to reopen from December 7 despite the 3% positive test rate breach which had led to closures in the last couple of weeks. Across the other side of the world, South Korea has tightened social restrictions outside of the Seoul area which already had tighter restrictions in place. Hong Kong has said that it will suspend face-to-face classes at kindergartens, primary and secondary schools as cases are on a clear rising trajectory in the city.

Looking forward now and It’s a fairly busy week for data but how much markets will care is a moot point as everyone knows we’re on a short-term path to a double dip but that the short to medium term is a path covered in potential golden vaccine petals.

Data releases include the US jobs report (Friday) and the November PMIs (tomorrow and Thursday), while Fed Chair Powell and ECB President Lagarde will both be speaking through the week. Otherwise, attention will remain on the Brexit negotiations, with just a month remaining until the year-end deadline and less time given any deal has to be ratified across the continent.

Looking into more detail, the US jobs report for October on Friday sees consensus at +500k and a fall in the unemployment rate to 6.8% from 6.9%. Though this would be further progress from the situation in the spring, it would still be the slowest monthly jobs growth since the massive contractions in March and April, and leave the total nonfarm payrolls number over 9.5m beneath its pre-Covid peak back in February. Of some concern is the recent weekly initial jobless claims trend which have risen more than expected for the last couple of weeks. So it feels like a difficult month or so ahead for the US economy.

Meanwhile on the PMIs, the flash readings we’ve already had showed a noticeable deterioration in Europe as much of the continent headed into renewed lockdowns. It’ll be interesting to gauge what’s happening in the countries where there aren’t flash readings however, including a number of emerging markets. Also in focus will be the Euro Area’s flash CPI estimate for November tomorrow as for the previous 3 months it’s been in deflationary territory.

Elsewhere on Brexit I won’t say this is a crucial week as I’ve said this many times before and nothing much has happened. However it probably is now that face to face talks are back and that we’ll are running low on days to ratify a deal. In terms of the current state of play, it has been reported that the last big remaining obstacle in the talks is fishing rights with the UK Foreign Secretary Dominic Raab asking the EU to recognise that regaining control over British waters is a question of sovereignty for the UK. Meanwhile, on other key obstacles of competition rules and state aid, Raab said that he could see “a landing zone”. If fishing is truly now the only stumbling block this is very good news as the numbers here are minuscule compared to the cost of no deal. Sterling is up +0.21% to 1.3339 overnight.

Finally, there are a number of important central bank speakers this week, with Fed Chair Powell and Treasury Secretary Mnuchin appearing before the Senate Banking Committee tomorrow and the House Financial Services Committee on Wednesday. Meanwhile ECB President Lagarde will be speaking today at the European Policy Center Forum, before she appears at an Atlantic Council event tomorrow. The Fed will also be releasing their Beige Book on Wednesday.

To recap the week just gone, risk assets had yet another strong performance and global equity markets soared to all-time highs, with markets buoyed by further positive vaccine news and increasing signs that there’ll be a smooth transition of power in the United States. By the end of the week, the S&P 500 had advanced +2.27% (+0.24% Friday) to hit a new record, as did the MSCI World Index which rose +2.42% (+0.44% Friday) in its 4thconsecutive week higher. In Europe, the STOXX 600 was up +0.93% (+0.41% Friday) at its highest level since the pandemic, while the DAX rose +1.51% (+0.37% Friday) to move back into positive territory on a YTD basis. The moves higher for risk assets coincided with increasingly subdued volatility (at least by 2020 standards), with the VIX index falling -2.86pts last week (-0.41pts Friday) to 20.84pts, which is its lowest closing level since late February. Furthermore, Bloomberg’s index of US financial conditions eased to its most accommodative level since late February too.

Core sovereign bonds saw little movement last week, with yields on 10yr US Treasuries up just +1.3bps (-4.4bps Friday) to 0.84%. That said, there were some notable moves in southern Europe, with yields on 10yr Italian BTPs falling to an all-time low of 0.59%, as yields on 10yr Portuguese debt closed just shy of negative territory at 0.01%. That’s a far cry from the peak of the sovereign debt crisis earlier this decade when the Portuguese 10yr yield spent more than a year above 10% in 2011/12. Some milestones were also reached in FX, where the dollar index fell -0.65% (-0.22% Friday) to reach a 2-year low, while the Euro strengthened +0.89% (+0.42% Friday) to reach a 2-year high against the US Dollar of $1.196. Finally there were some strong performances in the commodities sphere, with Brent Crude oil prices up +7.16% (+0.79% Friday) as they moved higher for a 4th consecutive week, while the industrial bellwether of copper climbed +3.30% (+2.72% Friday) to reach a 6-year high.

Finally Bitcoin declined -8.5% over the week with c. -10% coming through on Thursday/Friday partly due to worries over the prospect of tighter crypto rules in the US.

https://ift.tt/2HQ5ZHB

from ZeroHedge News https://ift.tt/2HQ5ZHB

via IFTTT

0 comments

Post a Comment