Japanese 10Y Blows Out Above YCC Barrier, But In The US Yields Are Already Sliding

Earlier we noted that despite an aggressive attempt by Australia's central bank to enforce its recently launched yield curve control, including a $3BN POMO yesterday - triple the amount it bought on Monday and the most since the bond market turbulence during the COVID-19 panic last March - followed by another $3BN POMO on Friday, the Australian 3Y had blown out to 0.13% earlier today then rose as high as 0.154% a few hours ago, before retracing and last trading at 0.116% still above the 0.10% "controlled" max yield on the security.

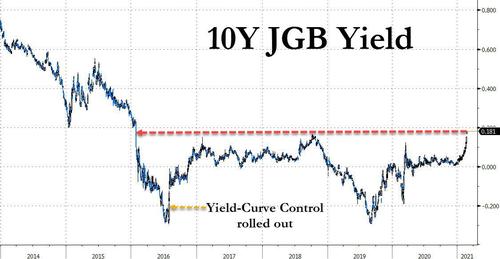

Australia was just the start: shortly after Asia reopened following today's blowout, Japan followed suit and saw its 10Y surge above 0.18%, the highest level since early 2016, well before the BOJ implemented Yield Curve Control in September of the same year, which changed the bank's policy framework to target the yield on ten-year government bonds at “around zero percent.”

Well, with today's blowout past the highest level reached during the YCC period, one can conclude that YCC is starting to fail across the globe, first in Australia and now in Japan.

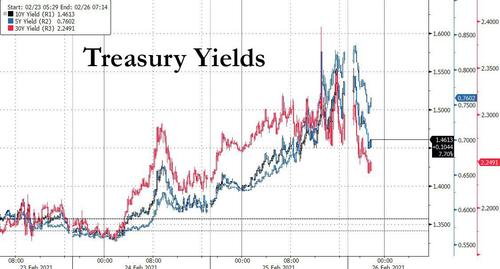

But while yields were surging across the globe in sympathy with the epic rout that took place in US bonds earlier in the day, when a catastrophic 7Y auction sent the 10Y soaring by 10bps in seconds, rising as high as 1.60%, US Treasurys have since faded much of the move as traders are now rushing to buy the dip.

As JPMorgan writes in its end of day market recap, "today there were many multi-month/multi-year levels that were broken and now the question is now where can markets find a level. Today was the first day in the recent sell-off that felt distinctly defensive in nature. Equity markets are taking cues from bond markets and today we took out our firm’s forecast for mid-year 10Y yield. In the face of another slug of almost $2T in fiscal and a third vaccine, how much farther can yields run?"

While one would think that the answer is "a lot", JPM then notes that its "Equity Derivatives team saw buyers of interest rate products, betting that yields have moved too far."

There's more: as JPM strategist Jay Barry adds in a valientattempt to find dip buyers, Treasury yields are somewhat "mispriced" at current levels with the first hike baked in for March 2023, which is out of line with fundamentals according to the JPM trader. And while Barry expects to ultimately see higher yields and steeper curves from current levels, in the latest moves fundamentals have been taking a back seat to technicals and are now well below fair value.

This, to JPM, presents the short-term opportunity to add duration. Given there are over 50bp of hikes priced by early 2024, there is value in intermediate Treasuries, and JPM recommend tactical long positions in 5- year notes at 0.796%.

Others echoed JPM's sentiment that the bond rout is a dip buying opportunity, and according to Mitsubishi UFJ Kokusai Asset Management, investors will consider buying Treasuries after 10-year U.S. yields rose above the closely watched level of 1.5%.

"Looking at the current levels, it’ll be hard for investors to stay bearish and they’ll start to think about dip-buying opportunities," said the bank's Akio Kato, who may have been stating his wishes instead of his "objective" assessment.

He added that "Treasury yields are overshooting as Fed officials have been refraining from commenting directly about them" and noted that "the pick up in momentum reflects strong economic signals from U.S. indicators."

Finally, keep in mind that as recently as Monday JPM calculated that due to month-end pension rebalancing, around $90bn of equity selling was expected by balanced mutual funds for February month-end. Well, following today's bond rout, funds may instead reverse and opt to buy bonds in the next three days ahead of month end to take advantage of the sharply lower prices which have not been matched by a similar decline in stocks.

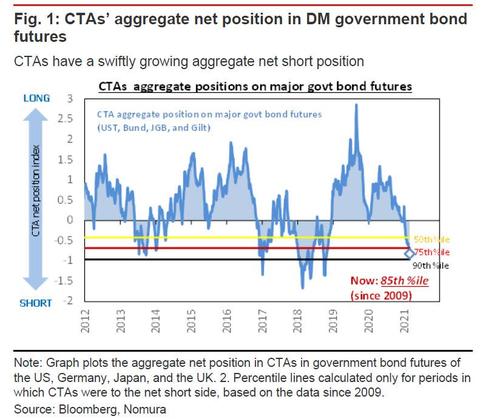

In short, we wouldn't be surprised to see a vicious snapback rally in the coming days, especially if some CTAs close out their shorts, which are currently the highest in 2 years...

... and turn long duration. In fact, one look at the aggressive buying of Treasurys in the overnight session, it appears that this may have already started.

https://ift.tt/3qW225B

from ZeroHedge News https://ift.tt/3qW225B

via IFTTT

0 comments

Post a Comment