Latest Round Of COVID Stimulus Checks Boost Savings Rather Than 'Stonks'

President Biden said on Thursday that more than 100 million stimulus checks are being delivered to needy households since the American Rescue Plan was signed into law weeks ago.

This again brings us to what Refinitiv said is the most important question: Where are stimulus checks ending up?

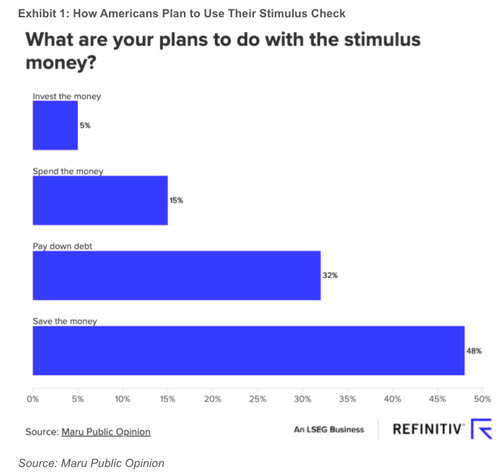

Refinitiv partnered with Maru Public Opinion, a panel and data service insight firm, and polled 1090 randomly selected adults who qualified for the stimulus program. These individuals had income less than $75,000 or combined gross income that was less than $150,000. The results were weighted by education, age, gender, and region found an overwhelming number of respondents plan to "save the money" and or "pay down debt." Only 5% of the respondents said they would buy 'stonks'.

"Refinitiv indicates that eight in 10 (80%) of Americans plan to mainly put their stimulus checks into either savings (48%) or pay down debt (32%). Of the remaining Americans, only one in five (20%) plan to mainly do otherwise by either spending (15%) or investing (5%) the amount they receive."

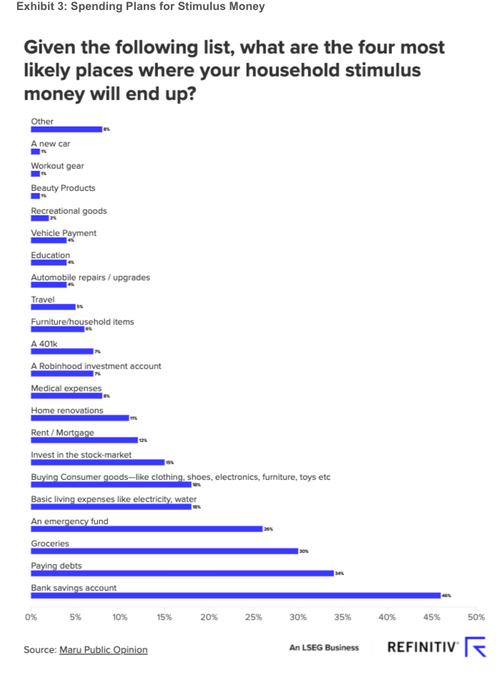

Respondents were then given the following list of questions and asked, "what are the four most likely places where your household stimulus money will end up?" Many of the respondents said they would save stimulus checks to pay down debts, buy groceries, purchase consumer goods, and pay basic living expenses. Only a small amount of respondents said they would deposit the funds in their Robinhood or 401k accounts.

The results are similar to a recent Bloomberg/Morning Consult survey where respondents said they would use the money for savings, food, and housing.

This time around, it appears Americans aren't using their stimulus checks to gamble on stocks, options, and or crypto. JPM's Peng Cheng made this conclusion "over the past week, despite the beginning of the $1,400 stimulus check disbursement, we have yet to observe a meaningful pick-up in retail trades as a % of total orders."

This makes intuitive sense for two reasons: First, the stock market has fizzled as the recent outright eruption of meme stocks and overall main equity indexes have stalled in recent weeks. The second reason is the economy is deeply scarred, with more than 18.9 million Americans receiving unemployment benefits as of the first week in March.

For the banks who wrote notes about Biden's trillions ending up in financial markets, so far, that has yet to materialize to generate another massive speculative rally.

Deutsche Bank is one of the banks that believes: "stimulus checks could accelerate the large inflows into U.S. equities."

Japanese bank Mizuho is another who found 10% of U.S. stimulus checks may be used to buy Bitcoin and stocks, equating to around $40 billion in total.

With Refinitiv finding that many people are using stimulus checks to save and pay down debt, along with JPM's analysis of limited pick-up in retail trades since the latest distribution - this could be bad news for stock inflows.

https://ift.tt/3m0BlLm

from ZeroHedge News https://ift.tt/3m0BlLm

via IFTTT

0 comments

Post a Comment