China's E-Commerce Giant JD.Com Starts Paying Some Workers In Digital Yuan

China's e-commerce giant, JD.com which directly competes with Jack Ma's Alibaba, said on Sunday that it has started paying some staff in digital yuan, the virtual version of the country’s physical currency which according to some is set to overtake the US dollar and become the world's next reserve currency.

JD said that it has provided technology and service support for China’s e-CNY trial programs in Suzhou, Beijing and Chengdu, since partnering with the People’s Bank of China last September.

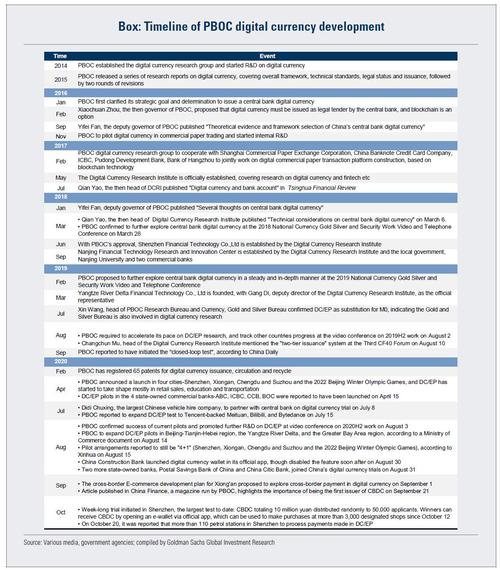

As we have reported extensively, China has been busy experimenting with digital currency over the past few months and is on track to become the world’s first major economy to issue a digital version of its fiat money, which could see a wider rollout at the 2022 Winter Olympics in Beijing. In October, Shenzhen, a southern city known for its progressive economic policies, doled out 10 million yuan worth of digital currency to 500,000 residents, who could then use the money to shop at certain online and offline retailers.

Several other large Chinese cities have followed Shenzhen’s suit. The residents in these regions must apply through selected banks to start receiving and paying by digital yuan.

As TechCrunch notes, the electronic yuan initiative is a collective effort involving China’s regulators, commercial banks and technology solution providers. At first glance, the scheme still mimics how physical yuan is circulating at the moment; under the direction of the central bank, the six major commercial banks in China, including ICBC, distribute the digital yuan to smaller banks and a web of tech solution providers, which could help bring more use cases to the new electronic money.

Of course, that means that the digital yuan is anything but a cryptocurrency, and is merely a more digital version of the currency already in circulation. In fact, all that the digital yuan is achieving is the forced conversion of all paper currency into digital token format, which allows Beijing infinitesimal control over every single transaction, and revealing the identity of every single currency holder - precisely the opposite of what cryptos stand for.

Of course, since China is an authoritarian regime where companies have to comply with Beijing's demands to be "Jack Ma'd", China’s major tech companies have actively participated in the buildout of the digital yuan ecosystem, which will help the central government better track money flows even better.

Aside from JD.com, video streaming platform Bilibili, on-demand services provider Meituan and ride-hailing app Didi have also begun accepting digital yuan for user purchases. Gaming and social networking giant Tencent became one of the “digital yuan operators” and will take part in the design, R&D and operational work of the electronic money. Jack Ma’s Ant Group, which is undergoing a major overhaul following a stalled IPO, has also joined hands with the central bank to work on building out the infrastructure to move money digitally. Huawei, the telecom equipment titan debuted a wallet on one of its smartphone models that allows users to spend digital yuan instantaneously even if the device is offline.

https://ift.tt/32PQ9nl

from ZeroHedge News https://ift.tt/32PQ9nl

via IFTTT

0 comments

Post a Comment