Hooray! The Price Of Toilet Paper Is Going Up Again, Are You Cheering Too

Authored by Mike Shedlock via MishTalk,

The Fed is rooting for more inflation. It's coming and the Fed is cheering.

1000 Sheets Will Now Cost More

Huggies maker Kimberly-Clark announced price hikes, joining General Mills, Hormel and others in passing along added costs.

The Fed is undoubtedly pleased that Higher Commodity Costs are Now Passed on to Shoppers.

Makers of everything from diapers to cereal are starting to feel the strain of higher commodity prices, and some are passing the added cost along to consumers.

Kimberly-Clark Corp. (KMB) said Wednesday it plans to raise selling prices across much of its North America consumer-products business to help counter rising raw-material costs.

Kimberly-Clark said its increases, which will be implemented almost entirely through changes in list prices, are needed to help offset significant commodity cost inflation.

Price Hikes

-

The maker of Huggies diapers and Scott paper products said the percentage increases would be in the mid- to high-single digits and take effect in late June. They will apply to the company’s baby- and child-care, adult-care and Scott bathroom-tissue businesses.

-

Cheerios maker General Mills Inc. (GIS) said it will raise prices to partly offset higher freight and manufacturing costs, in addition to rising commodity prices. “Our competitors and retailers are facing the same thing we are,” General Mills Chief Executive Jeff Harmening said.

-

Hormel Foods Corp. (HRL)said in February it raised prices of its turkey products, such as Jennie-O ground turkey, to counter sharply higher grain costs. If the rally in the commodity markets were to continue, the company would likely pass along further increases, Chief Executive Jim Snee said. Hormel also raised prices of its Skippy peanut butter.

-

J.M. Smucker Co. (SJM) said it recently raised prices for its Jif peanut butter and that it might do the same with pet snacks because of higher shipping costs and other inflationary pressure. Smucker Chief Executive Mark Smucker said retailers are passing increases along to consumers. “We only raise prices when costs are meaningfully higher, and we partner with the retailers to make sure it’s justified and that we move together,” he said.

Hooray! Hooray! Hooray!

In addition to toilet paper, price hikes are slated for Huggies, Cheerios, peanut butter, and turkey.

No doubt, that's just a start.

The Fed is very pleased that your dollar buys less than a month ago. Are you cheering too?

Easy Money Quote of the Day: Fed "Won't Take the Punch Bowl Away"

On March 25, I noted the Easy Money Quote of the Day: Fed "Won't Take the Punch Bowl Away"

San Francisco Fed President Mary Daly won the gold medal for easy money statements. She said the central bank would show at least “a healthy dose” of patience. ”We are not going to take this punch bowl away,” said Daly.

She wants higher inflation as do four other Fed presidents I cited.

Spotlight on the Fed

Fed Chair Jerome Powell wants to let inflation run hot to make for alleged lack of inflation in the past.

In short, he is unhappy to have failed at destroying the purchasing power of your dollar fast enough.

He would not recognize inflation if it jumped off the table and spit grapefruit juice in his eyes.

As discussed previously, Inflation is Poised to Soar, 3% by June is "Almost Certain"

Historical Perspective on CPI Deflations

A BIS study of deflations shows the Fed's fear of deflation is foolish.

"Deflation may actually boost output. Lower prices increase real incomes and wealth. And they may also make export goods more competitive," concluded the study.

For discussion, please see Historical Perspective on CPI Deflations: How Damaging are They?

Japan has tried what the Fed is doing now for over a decade, with no results.

Yet, Powell hell bent on producing more than 2% inflation until the strategy "works".

It already has, using the word "works" rather loosely.

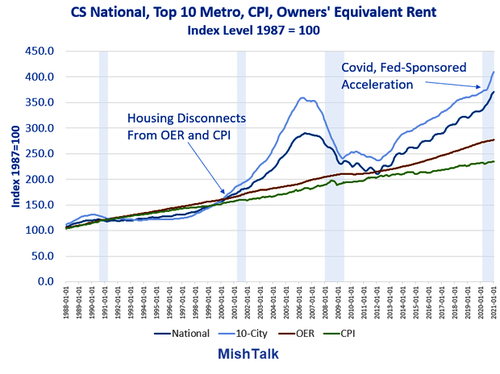

Home Prices Rise at Fastest Pace in 15 Years

Inflation is Rampant and Obvious

Yesterday I commented Hello Fed, Inflation is Rampant and Obvious, Why Can't You See It?

The national level average year-over-year increase in home prices is 11.2%.

Click on the above link for a series of 5 charts that explain what's happening.

What Would I Do?

For the answer, please see Reader Question: What Would I do Differently Than the Fed?

https://ift.tt/3mbiVHK

from ZeroHedge News https://ift.tt/3mbiVHK

via IFTTT

0 comments

Post a Comment