Signs, Signs Everywhere...

Authored by Jim Quinn via The Burning Platform blog,

“Fools, as it has long been said, are indeed separated, soon or eventually, from their money. So, alas, are those who, responding to a general mood of optimism, are captured by a sense of their own financial acumen. Thus it has been for centuries; thus in the long future it will also be.”

- John Kenneth Galbraith, A Short History of Financial Euphoria

The signs of an epic bubble of historic proportions are everywhere.

The stock market is a bubble, with valuations exceeding 2001. Margin debt is at all-time highs. The bond market is a bubble, with the Fed artificially suppressing rates and pumping trillions of QE into Wall Street. Housing is experiencing another bubble, with prices now far exceeding the 2005 peak. Bitcoin and the rest of the crypto-currencies are a bubble, being driven by the excess liquidity sloshing around the system. A joke crypto currency like Dogecoin soars into the stratosphere because money has no meaning anymore.

Corporate, government and personal debt are at all-time highs and heading higher. Clueless millennial dolts are using their stimmy checks to day trade on Robinhood. Now the shysters have come up with a ridiculous concept called Non-fungible tokens (NFT), which has created a further frenzy of greed and fleecing. We are busy selling worthless electronic concepts to each other at higher and higher prices. The world has truly gone mad.

The herd will surely be separated from their money when this everything bubble bursts. The concept of risk has been bastardized and ignored, for now. Greed will surely turn to fear and no one sees it coming. The “experts” will continue to declare “buy now or miss out on the riches”. I’m sure these bubbles will burst, but I have no idea when. It could be next week or they could grow for another few years. I don’t pretend to know, but I will not participate in the madness. Becoming debt free and more anti-fragile is my sole focus as these bubbles grow.

Even Charles MacKay’s epic tome regarding mass delusion and madness of nations fails to capture what is happening today.

“In reading The History of Nations, we find that, like individuals, they have their whims and their peculiarities, their seasons of excitement and recklessness, when they care not what they do. We find that whole communities suddenly fix their minds upon one object and go mad in its pursuit; that millions of people become simultaneously impressed with one delusion, and run after it, till their attention is caught by some new folly more captivating than the first.” ― Charles MacKay, Extraordinary Popular Delusions and the Madness of Crowds

Our nation has not just fixated upon one object, but every object that can be bought or sold for a profit. Average Americans have concluded it is a sucker’s game to work hard, build wealth through saving, delay gratification, live beneath your means and achieve happiness through non-material means. I can understand why they feel this way, as the Federal Reserve, Wall Street bankers, and corporate America have fleeced them through inflation, stagnant wages, and stealing of their wealth. When these simultaneous bubbles burst once again, for the fourth time since 2000, the citizenry will be crushed. What happens at that point is anyone’s guess. Revolution would not be out of the question.

I have two personal anecdotes which have convinced me these bubbles are all-encompassing and reaching their zenith.

I bought a condo in Wildwood back in 2004 with a friend, near the top of the housing market. The plan had been to flip it in a couple years for a nice profit. The best laid plans often go awry. We bought it for $325,000. We got plenty of use from it and were able to rent it out every summer, but it was a financial drain every year.

We put it up for sale in 2015, asking $275,000. Not a drop of interest. We kept it for sale for three years and zero offers. We lowered the price to $250,000 and eventually got an offer of $240,000 in January 2018. Fourteen years later we had sold it for a loss of $85,000. So much for real estate always appreciating. Fast forward to 2021 and the unit above ours just sold for $383,000. In just over two years the value of these condos in the eyes of current buyers rose by 60%, after sitting at $240,000 for over a decade. Nothing changed other than perception of value. Is the next stop $500,000 or $250,000? I have no idea.

Over the Christmas holiday I put together a To Do list designed to make my life more anti-fragile. Things I had put off for years now needed a sense of urgency. Tops on the list was turning TBP into an LLC, to try and shield my personal assets from the woke cancel culture crowd when they eventually try to destroy my website and my life. Also included on the list was looking into getting a stand alone back-up generator for my home, for when things go sideways. I had left my retirement funds at Wharton when I left in 2019. I finally transferred them to my IRA account where I could be in complete control of my investment choices.

The one item on the list I considered low priority and did not set in motion was selling some baseball cards I’ve had for almost 50 years. I collected cards from the age of 8 to 12 back in the early 1970s. I collected them because I loved baseball, the Phillies, and liked to trade them and pitch them in the schoolyard. I had no thoughts about them being worth something many years into the future. A couple decades ago when baseball cards were hot, I put the most valuable ones in plastic sleeves, put them in a plastic bag, and didn’t think about them for years.

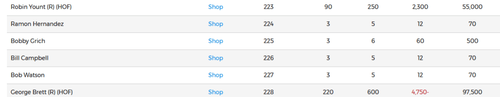

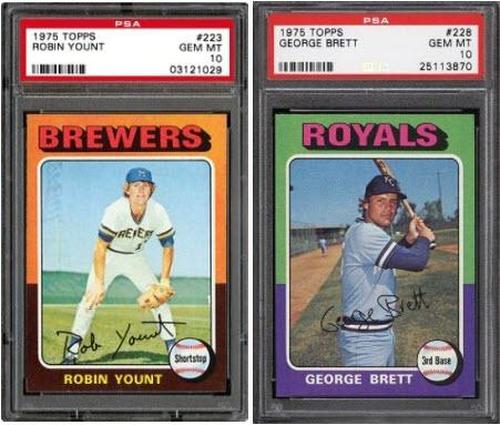

For the last year I’ve sensed this financial madness might offer an opportunity to sell a few pieces of cardboard for prices that will never materialize again. I have hundreds of cards, mostly from 1975. Included in this set are 3 Robin Yount rookie cards and 2 George Brett rookie cards. There is a company called PSA that charges you to grade the cards. This then sets a selling price for the cards. I have no idea what constitutes a near perfect card with a 10 grade from a near mint card with a grade of 7, but the price difference is vast, as you can see here from their website.

A Robin Yount grade 10 card is worth $55,000 and a George Brett grade 10 cards is worth $97,500. I find this utterly ridiculous, but it is certainly worth exploring for that kind of money. Even getting a couple hundred for a grade 7 card would be fine. I don’t see any imperfections in my cards, but who am I to judge.

Back in December when I went to the site, it seemed like a pain in the ass to go through the grading process and I was confused by their pricing scheme. Life got busy, so I forgot about it until this week. I decided I was going to send the cards in and see what they concluded. I went to the PSA site and got this message from the CEO of PSA:

Hello PSA Customers,

Since my last update, the momentum behind the hobby has only accelerated. In fact, our Collectors Universe President and CEO, Joe Orlando, recently shared the reality of the surge of submissions to PSA.

I’ll try to further illustrate what has happened. The sheer volume of orders that PSA received in early March has fundamentally changed our ability to service the hobby. The reality is that we recently received more cards in three days than we did during the previous three months. Even after the surge, submissions continue at never-before-seen levels.

Given our growing backlog, it would be disingenuous for us to continue to accept submissions for cards that we will be unable to process in the foreseeable future. It’s an unpleasant conclusion, especially after the March 1 price increase, but it is necessary to properly serve the customers who have already submitted to PSA.

Effective immediately, PSA is temporarily suspending our Value, Regular and Express service levels. This will allow us to fully unbox and receive the recent surge of orders and focus on our most impacted service lines.

We will take a tiered approach to reintroducing these service levels. Our goal is to bring all suspended service levels back by July 1, 2021.

There is now a baseball card bubble frenzy, on par with stocks, bonds, real estate, crypto, art, used cars, lumber, NFTs, and just about anything not tied down. With my investing luck, the baseball card market will surely collapse before July 1. So anyone willing to take chance can contact me. I’ll sell you all three Robin Younts for $55,000 and the two George Bretts for $97,500. Sometimes the stupidity of the masses exceeds my lowest expectations.

In my view, the signs are everywhere. Getting rich quick has engulfed the entire nation in a madness never seen before in human history. Effortless enrichment is a delusion. And all delusions end in tears. An entire nation was convinced, by those controlling the narrative, the annual flu was a pandemic by giving it a new name, marketing the hell out of it, using a faulty test to artificially inflate cases, and understanding they were dealing with compliant obedient sheep. If they can make you believe that, they can make you believe anything.

“The recurrent and sadly erroneous belief that effortless enrichment is an entitlement associated with what is thought to be exceptional financial perspicacity and wisdom is not something that yields to legislative remedy.” ― John Kenneth Galbraith, A Short History of Financial Euphoria

The signs are everywhere, but few will heed them.

-----------------------------------------------------

The corrupt establishment will do anything to suppress sites like the Burning Platform from revealing the truth. The corporate media does this by demonetizing sites like mine by blackballing the site from advertising revenue.

https://ift.tt/3dSmVul

from ZeroHedge News https://ift.tt/3dSmVul

via IFTTT

0 comments

Post a Comment