The Catalyst For The Next Leg Higher: Buyback Blackout Period Just Ended

Now that even Wall Street's perennial permabull, JPMorgan, has joined most other major banks including Goldman, Deutsche and Morgan Stanley in warning that the coming weeks and months could be treacherous for stocks (DB went so far as predicting a 10%+ correction in the next three months), and saying on Friday that "easy equity gains for the broad market are likely behind us" and as a result its "bullish conviction is now lower", a caution which spooked retail and hedge fund investors alike, with Goldman Prime reported on Friday that its book "saw the largest net selling in 5 weeks (-2.1 SDs), driven by short sales and long sales (4 to 1) and equally by Single Names and Macro Products."

Yet despite the selling stocks have continued to confound everyone, thanks to what we said would be yet another short squeeze, and rose back to all time highs amid mounting bearish sentiment.

And just to add to the confusion, a new catalyst has emerged which is almost assured to push the S&P decisively into record territory.

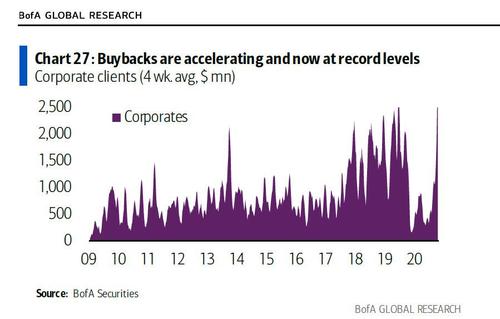

According to Goldman's John Flood, the Buyback blackout period ended on Friday, with the strategist noting what we previously discussed, namely that buyback authorizations "are already up meaningfully vs prior year YTD values." To wit, "2021 YTD authorizations are +75% vs 2020 YTD auths, +24% vs 2019 auths, and +26% vs 2018 auths (reminder, 2018 was a record buyback year)."

Of course, we already knew this as we reported last month that "Stock Buybacks Soar To All Time High"...

... a reminder of just how short collective memory is, as barely a year ago, the media, Congress and the broader public all rightfully slammed US corporations for having spent the bulk of their cash in the past decade on stock buybacks, and not on building a rainy day fund... which is why everyone demanded a government bailout in the immediate aftermath of the covid crisis.

And since nothing ever changes on Wall Street, expect another burst in buybacks in the coming weeks - much of it funded by the trillions in new corporate debt issued over the past year - not only propping up risk but pushing it to a new all time high.

How high? Here are the details in terms of Goldman desk flows: "we are currently running 1.6x vs 2020 FY ADTV, 1.0x vs 2019 FY ADTV, and 0.9x vs 2018 FY ADTV and we expect this to continue to pick up as we move into open window starting next week. So in other words, 2021 has more authorizations than 2018 (record buyback year), but is only pacing .9x the ADTV (actual purchases) of 2018 so far. That could suggest more purchases to come, or corporates saving their ammo."

What could they be saving their ammo for? Why the next 5-10% pullback of course, at which point they will instruct their banks - such as Goldman - to lift every offer, quickly recovering all losses and pushing the market to its next all time high.

https://ift.tt/3gCdb9p

from ZeroHedge News https://ift.tt/3gCdb9p

via IFTTT

0 comments

Post a Comment