The Used Car Loan Business Is Scorching

Used car auto lenders are falling ass backward into business as the global semi shortage and supply chain bottlenecks have caused used-car prices to rocket.

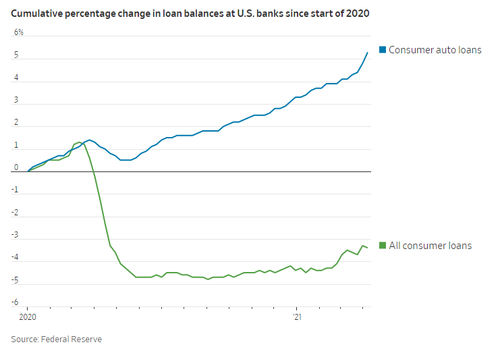

This is also creating a boom for the banks that involve themselves into used car loans, which generally have higher yields than traditional new-car loans, the Wall Street Journal reported on Tuesday.

Institutions like Ally Financial are benefiting from the shift. It says it'll see yields on auto originations jump to the 7% range for the rest of 2021, up from a 6.66% average in Q1. The bank's auto leasing yields have also surged, jumping to 8.6% in the most recent quarter in 2021 from 5.2% at the beginning of 2020.

Both rises in rates are happening as benchmark rates remain low.

Dealers usually borrow to finance their floor inventory, the Journal notes, and when there's supply chain disruption - as there is now - it can hurt banks' loan growth. But as supply picks up and used car prices start to fall, "for banks there may be an offset in the form of faster dealer floor-plan loan growth."

But it isn't all blue skies and rainbows for lenders: this type of environment can prompt intense competition, and automakers saw their captive financing arms gain share in the used-car loan market versus banks in 2020.

Average rates on used car loans last year were 8.4%, down from over 9% in 2019. And the average loan term hit a record high last year. With shares of names like Ally and Capital One trading "at or above their highest price-to-book ratios in years" and potential looming credit risk, stocks of used-car loan players may already be robustly valued.

https://ift.tt/3xoDnu3

from ZeroHedge News https://ift.tt/3xoDnu3

via IFTTT

0 comments

Post a Comment