There Is Now A One-In-Three Chance Headline CPI Exceeds 3% Over The Next 5 Years

Now that the highly anticipated March payrolls report is in the bag, which contrary to some expectations was not a hammerblow to growth and tech names as it did come hot but not quite as hot as some had expected (JPM big data indicated a print of 1.8 million, double the actual number), attention again turns to the reflation trade and what the current state of economic overheating means for inflation expectations.

Here attention once again turns to the 10Y nominal yield, which as expected jumped on the payrolls report, rising by 5bps, if still a ways away from the 2.00% threshold where all hell is expected to break loose.

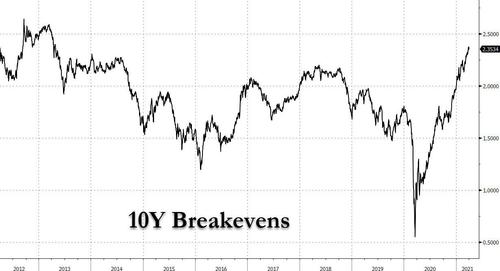

Just as closely watched are 10Y breakevens, which have continued to push to near-decade highs, last seen at 2.35%, the highest level going back to 2013.

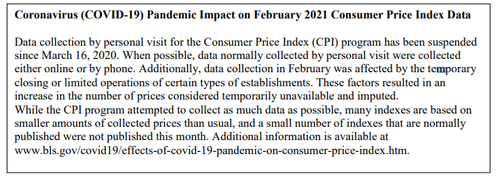

So needless to say, the market remains increasingly jittery on the reflation front, especially since it can't really trust the CPI and PCE data published by the US government, both of which have long been political tools (and choices), with the BLS no longer even bothering to mask this sad fact, and admitting last month that half the numbers feeding the US CPI basket were estimated.

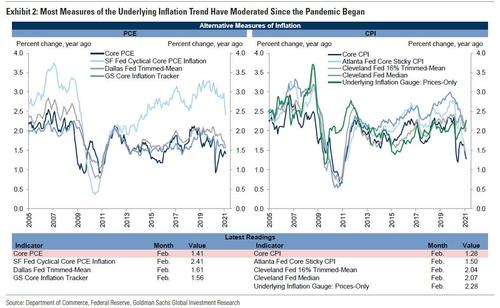

So what do non-biased, real-time inflation indicators show?

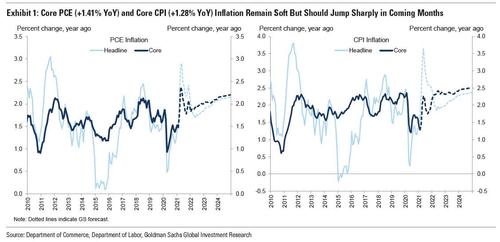

For the answer we go to Goldman, and its latest monthly inflation monitor, according to which while core PCE inflation stands at 1.41% year-on-year through February and core CPI stands at 1.28%, year-on-year inflation should rise sharply over the next few months, driven largely by base effects. As a result, Goldman expects core PCE to peak at 2.31% in April and headline PCE to peak at 2.90% in May; meanwhile on the CPI front, Goldman expects core CPI to peak at 2.26% and headline CPI to peak at 3.66%, both in May.

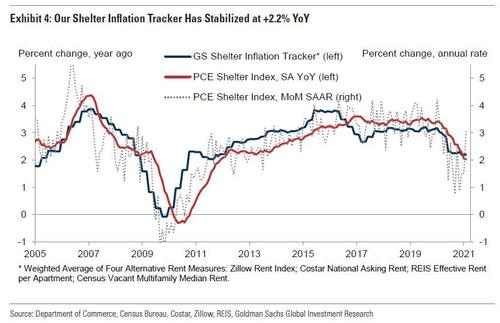

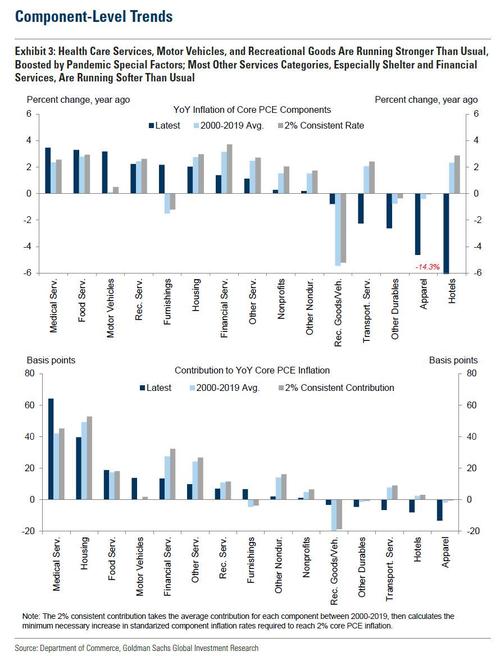

A look at the component level detail shows that health care services, motor vehicles, and recreational goods categories are running stronger than usual, boosted in part by pandemic special factors. Curiously, other services categories, especially shelter (due to plunging rents in liberal bastions like NY, Portland and San Fran) and financial services, are running softer than usual.

While rents may be sliding (if only briefly)...

... Goldman's wage tracker has risen 3.2% year-on-year, and its wage survey leading indicator has rebounded to 2.8%...

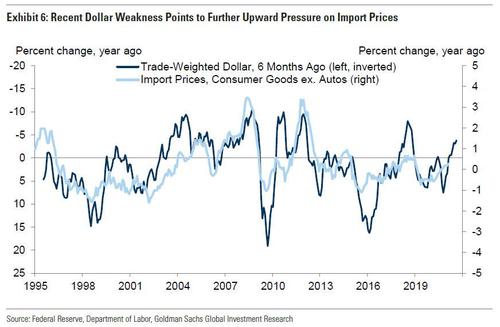

... with the bank noting that recent dollar weakness points to further moderate upward pressure on import prices.

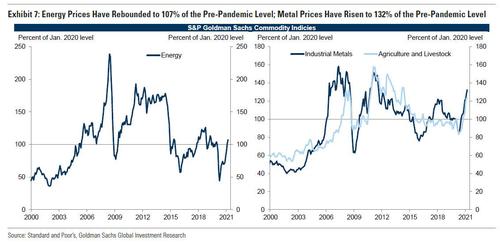

Meanwhile, as everyone knows by now, commodity prices have rebounded significantly in recent months. Energy prices rose to 107% of the pre-pandemic level in March and industrial metals rose to 132% of the pre-pandemic level.

In summary, here is a snapshot of Goldman's component level inflation trends.

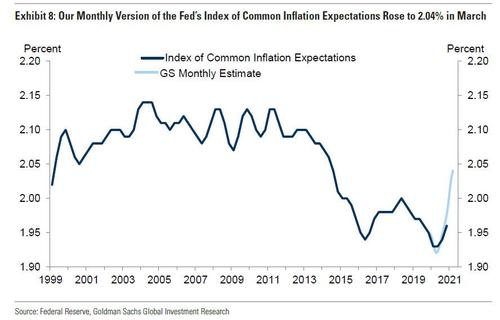

Which brings us to the all important inflation expectations measure.

According to Goldman's monthly version of the Fed’s Index of Common Inflation Expectations, the index rose to 2.04% in March, the highest level since 2014 (if below the top of the 20-year range)...

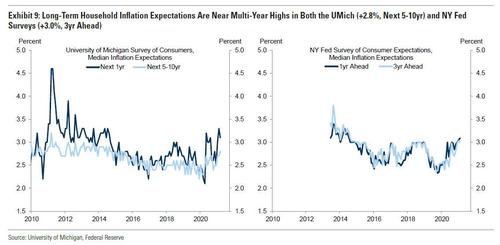

... which however is below recent household, business, and financial market-implied inflation expectations, which have all increased meaningfully over the last year. The University of Michigan’s longer-run measure has risen to 2.8%, the highest rate since 2015.

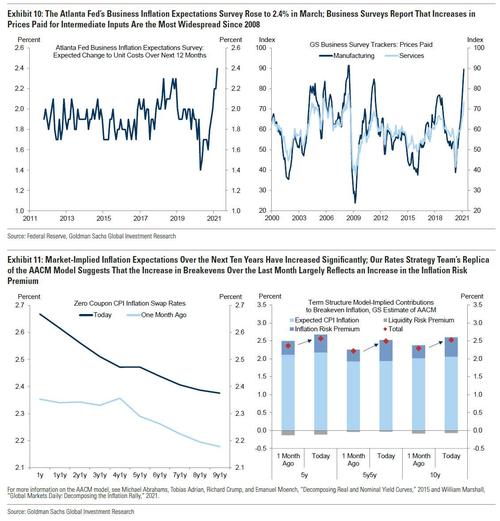

Elsewhere, the Atlanta Fed’s business inflation expectations survey increased to 2.4%, its highest rate since the series began in 2011. But the punchline is that market-implied inflation expectations for each of the next 9 years rose 20-30bp over the last month...

... and market pricing now implies a 31% chance of headline CPI inflation exceeding 3% over the next 5 years: this means that there is a non-trivial, one-in-three (and rapigly growing) chance the Fed loses control over inflation.

That said, and as we will cover in a subsequent post, Goldman is sanguine about the odds of the Fed losing control over inflation. In Goldman's latest Top of Mind periodical, the bank admits that "given its growth forecasts are at the high end among forecasters, its Fed views are at the dovish end, and yet we don’t expect problematic overheating."

The reason: according to Goldman chief economist Jan Hatzius, there is much more slack in the US economy than suggested by official estimates, which means that even the bank's high growth forecasts will generate only moderate inflationary pressures, which will lessen as this year’s temporary fiscal stimulus fades:

There's no question that the amount of stimulus set to hit the US economy this year is unprecedented outside of major wars… but the economy is coming out of a deep hole and there’s still a large gap to fill between actual and potential output… so [the stimulus] should not result in substantial overheating.

With all that in mind, and with soaring inflation expectations, what are the odds that the Fed - which has vowed it won't hike rates until 2023, will act too slowly or as Goldman puts it, "the speed of recovery, the cautious approach to tapering, and the rejection of preemptive tightening under the new framework all create some risk if inflation rises faster than we expect."

Well, according to Goldman, the risk is contained:

"If the economy did overheat, we would worry more that the cost of slowing things down would be high than that the Fed would allow an inflationary spiral."

Is that true? And is Goldman just paying lip service to a Fed that has been wrong at every corner in the past decade? We will present Goldman's complete thoughts on this matter in a subsequent post.

https://ift.tt/3mgwjdP

from ZeroHedge News https://ift.tt/3mgwjdP

via IFTTT

0 comments

Post a Comment