Currency Wars Return: China Hikes FX Reserve Ratio For First Time In 14 Years In Bid To Weaken Yuan

The signs were clear last Thursday when China's PBOC held an unexpected, improvised meeting with major forex market players after which the central bank published a statement that exchange rate can’t be used as a tool to stimulate exports via depreciation nor to offset impact of rising commodity prices via appreciation. While many had been looking in the rearview mirror, discussing the recent surge in the yuan, and speculating that the PBOC meeting was merely a warning from Beijing that the marcantilist nation (which in recent years has specialized in exporting deadly viruses in the pursuit of a grand reset) wouldn't look too fondly on more appreciation...

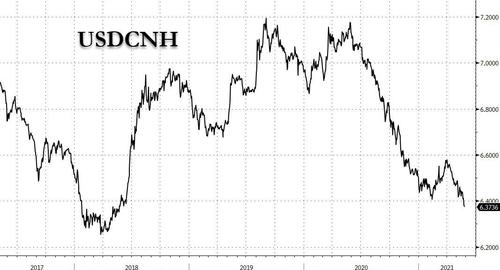

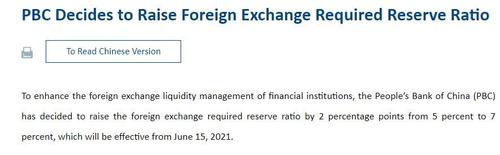

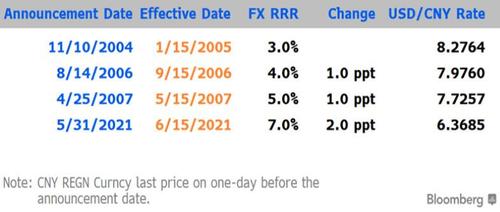

... the reality is that the PBOC's verbal jawboning against a stronger yuan (and by extension, against a weaker dollar) was a warning for more tangible action on Tuesday, when shortly after the offshore Yuan spiked above 6.36 a little after 4am ET, the PBOC unexpectedly announced that for the first time in 14 years, it would hike the required-reserve ratio on foreign currency deposits at financial institutions from 5% to 7% effective from June 15, in an attempt to slow the yuan's appreciation, in line with official rhetoric.

This was the first FX RRR hike since May 2007, after its appreciation following yuan reform in 2005.

According to Bloomberg's David Qu, "deploying a tool rarely used underscores the authorities’ determination to maintain yuan stability, a crucial factor for external trade. It signals the authorities are becoming less tolerant of yuan gains and have started to act, after verbal interventions."

Banks will now have to hold extra dollars with the PBOC instead of making loans or selling the dollars for yuan in the interbank market, with the latter likely to pressure the PBOC to absorb it in the form of funds outstanding for foreign exchange. The central bank may be reluctant to do that in order to avoid explicit FX intervention and unnecessary yuan liquidity injections in exchange.

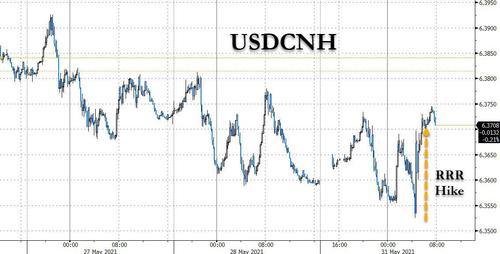

Predictably, the announcement hit the yuan, with the offshore yuan sliding from 6.355 to 6.375 before resuming its upward crawl...

... as traders realized that the RRR hike would have limited impact on the yuan’s exchange rate over the longer term, since it does not shift fundamental factors driving yuan strength, such as the difference in policy stances of the PBOC and the Federal Reserve, with China far tighter (for now).

Quantifying the move, Australia & New Zealand Banking Group head of Asia research Khoon Goh said that with total FX deposits at $1 trillion, banks will need to set aside an extra $20BN, which will tighten FX liquidity and prompt banks to buy dollars, weakening the yuan if not dramatically. Which is why according to Goh, while the PBOC has sent a strong signal that it wants to slow down the pace of yuan appreciation by raising the FX reserve requirement, the actual impact of the move is likely to be small after the initial adjustment.

Meanwhile, banks will probably reduce USD interest rates they offer to offset the increased reserve requirement, pushing the yield advantage further in favor of yuan deposits. This may encourage corporates and households to convert existing FX deposits into yuan; exporters may also decide to convert more of their foreign currency receipts into yuan rather than hold them as FX deposits.

Commenting on the move, UBS FX strategist Rohit Arora said that the weekend commentary and the USD liquidity draining move was a signal of the PBOC’s discomfort with rising one-way yuan expectations.

“China’s cyclical support is peaking -- so perhaps what’s looking like a one-way trend today will start looking different down the line when China growth is underperforming major DM economies.” And while UBS sees a possibility of a potential appreciation to low 6.20s in the near-term, the bank's year-end forecast for USD/CNY is 6.40 with some downside risks.

“It’ll be a slow grind with sustained policy restraint”, said Arora adding that “while it might be tempting to believe that the elevated inflation may have catalyzed a policy shift, one week is too small a sample set to conclude a shift in a decades-long FX regime of a ‘managed float'.”

https://ift.tt/3i6UYBl

from ZeroHedge News https://ift.tt/3i6UYBl

via IFTTT

0 comments

Post a Comment