As Tapering Nears, Beijing Drains Dollar Liquidity

By Ye Xie, Bloomberg reporter and Markets Live commentator

Good economic news is bad news for markets now.

A better-than-expected ADP jobs report sent the dollar and bond yields higher and stocks lower Thursday. A strong payroll report Friday would give more ammunition for folks calling for earlier QE tapering. In a sense, policy normalization has already started after the Fed announced plans to wind down its emergency corporate-credit facility. From that perspective, the peak of liquidity is near.

In China, the authorities are already mopping up the dollar liquidity awash in its domestic market. On Thursday, two Chinese policy banks, China Development Bank and the Export-Import Bank of China, announced selling of dollar notes in the onshore market, the first such sales in years. It followed a move Monday when the PBOC required lenders to hold more foreign currencies in reserve.

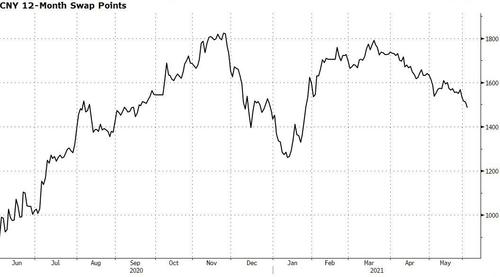

Both aim to reduce the dollar supply and ease pressure for yuan appreciation. As a result, one-year yuan swap points dropped to the lowest since January, reflecting higher dollar funding costs. The yuan rally has also stalled.

Neither of these moves was large in size. It’s the signaling effect that matters. Beijing doesn’t want a currency overshoot so that when the Fed takes away the punch bowl, it will be less volatile and painful for Chinese markets.

In other news, President Biden amended a ban on U.S. investment in Chinese companies, naming 59 companies with ties to China’s military or in the surveillance industry. Since many of the companies were already on the Trump administration’s list, the market impact was largely a shrug.

It’s worth noting that the trade and economic dialog seem to be back on track after Vice Premier Liu He held “candid and constructive” talks with Treasury Secretary Janet Yellen and Trade Representative Katherine Tai. The two moves -- sanctions and dialog -- are carried on separate tracks, as was during the trade war in the Trump era. In other words, sanctioning Chinese companies may not necessarily spoil trade talks.

As far as the markets are concerned, the latter is more important.

https://ift.tt/3wWGpEY

from ZeroHedge News https://ift.tt/3wWGpEY

via IFTTT

0 comments

Post a Comment