Goldman Prime: Massive Short Covering Leads To Biggest Hedge Fund Rout Since March

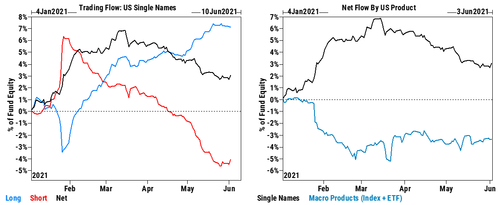

This will hardly come as a surprise to anyone who followed the manic reddit-driven action over the past 48 hours: according to Goldman's Prime Brokerage, we just witnessed the "largest US single stock short covering since mid-March amid a sharp rally in High Retail Sentiment stocks" and while US stocks saw modest net buying yesterday, it was driven by risk-off flows "with short covers outpacing long sales 3 to 1."

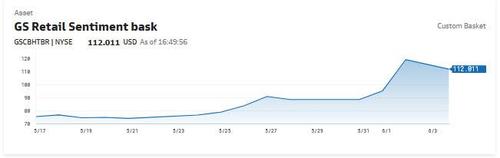

The catalyst is well known: a furious, face-ripper of a rally in the heavily-shorted meme stocks, which pushed the Goldman Retail Sentiment Basket, (GSCBHTBR) i.e., the retail favorite stocks up +25% yesterday and up +61% over the last 7 sessions!

Some more granular details as GS Prime saw them:

- 10 of 11 sectors saw net covers (Real Estate the sole exception) led in $ terms by Comm Svcs, Consumer Disc, Info Tech, Health Care, and Energy.

- US Single Stock shorts are now down -1.6% week/week but still up +6% month/month and up +3.4% YTD.

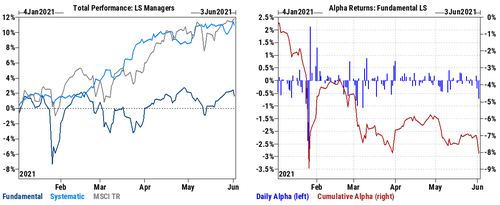

It will also not come as a surprise, that most long/short managers underperformed yesterday, in what Goldman said was the "Worst Fundamental LS alpha day in nearly three months"

Yesterday (June 2nd)

- Fundamental LS -0.8% (alpha -0.7%) vs MSCI TR +0.1%.

- Fundamental LS managers experienced the worst 1-day alpha drawdown in nearly three months, driven by losses from Size, Momentum, Concentrated Longs, and Asset Selection on the short side.

- Systematic LS -0.5% driven by losses from Momentum, Volatility, and Crowded Longs.

June MTD:

- Fundamental LS -0.6% (alpha -1.1%) vs MSCI TR +0.4%

- Systematic LS +0.2%

2021 YTD:

- Fundamental LS +1.7% (alpha -8.0%) vs MSCI TR +11.8%

- Systematic LS +10.9%

And here's the kicker: yes, yesterday was a massive short squeeze, and yes it hurt hedge funds a lot... but compared to what happened at the end of January, it was a walk in the park: as Goldman Prime notes, "for perspective, the large single stock short covering that took place back on Jan 27th was a 10.6 SDs move (vs. 1.5 SDs yesterday)."

This means that if we get a squeeze that is similar to the January frenzy, it would be roughly 7 times stronger...

https://ift.tt/3vLsBga

from ZeroHedge News https://ift.tt/3vLsBga

via IFTTT

0 comments

Post a Comment