The AMC "Gamma Squeeze" Post Mortem

“Gamma Squeeze” was grabbing headlines again this past week after AMC and GameStop (GME) both surged in price. While GME returned +22% for the week, it was AMC that had blow-out returns of +103% and we think much of this price action was driven by a call options gamma squeeze.

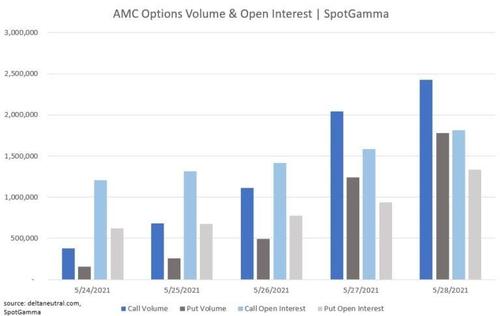

The graph below lays out options volume and open interest changes for AMC. You can see that daily call volumes (dark blue) were up nearly 500% over the week, and it was not until Thursday or Friday that put volumes picked up. This surge in call volumes can lead to options market makers (MM) having to purchase shares of stock, which can drive the stock price higher.

To place this call activity in context, the table below shows the largest volume stocks/ETF’s for the week of 5/24. As you can see, AMC’s total volume is only second to the massive SPY ETF. Also, for perspective, note that AMC’s call volume is nearly double that of TSLA, which is the 3rd largest ticker by volume.

To have a “gamma squeeze” there first needs to be a “delta squeeze”. When new options positions are traded, MM may need to immediately hedge the risk generated by these new trades. This initial hedge is called a “delta hedge” and can result in large amounts of stock being purchased. As the stock price moves around, MM may need to adjust their hedge positions, which is called a “gamma hedge”.

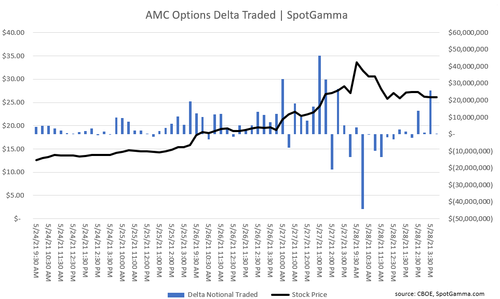

What you can see below is the estimated delta hedge requirement (blue bars) that resulted from AMC options volume. In theory large increases in delta mean that large amounts of call options have traded, and MM need to buy shares of AMC. Note that as the delta increases in size it appears that the stock price (black line) rises higher, too.

The “delta hedge” simply addresses new options trades, however its likely that MM have a substantial existing call position. Therefore as the stock rises, MM need to buy more shares of AMC to stay hedged on their existing position. This hedge adjustment is where “gamma” and the gamma squeeze comes into play. As new call buyers come in and the stock price rises, MM have to buy more and more shares of AMC to control their risk exposure.

On Friday, 5/28, the delta chart above also shows some large negative bars. This implies that traders came in to either sell large call positions, or buy large put positions. This happened when the stock reached its high price for this week of ~$32/share. This negative delta options volume likely meant that MM could sell off large amounts of their long stock hedges, which could have pressured the stock back down to $27/share.

For more information, check out this this video which discusses a few more of the dynamics at play, and what we see happening into next week.

https://ift.tt/3i4X8BG

from ZeroHedge News https://ift.tt/3i4X8BG

via IFTTT

0 comments

Post a Comment