Food Inflation Is The Litmus Test

By Russell Clark published on the Capital Flows and Asset Markets substack

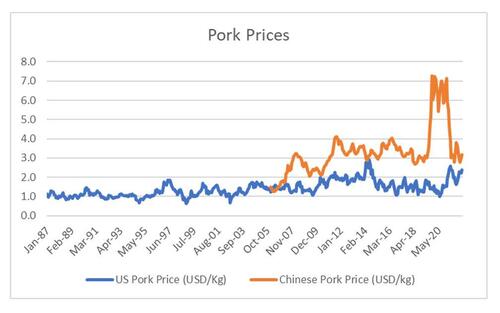

The original cause of food inflation was African Swine Flu (ASF) that sent Chinese pig prices soaring, and incentivised Chinese farmers to import grain. However, with the rebuilding of the pig herd in China, pork prices have fallen back to levels seen before the ASF outbreak.

I have added in US pork prices to give some context. In early 2020, Chinese pork prices were nearly 7 times that of the US. Now, the difference is more in line with historical averages.

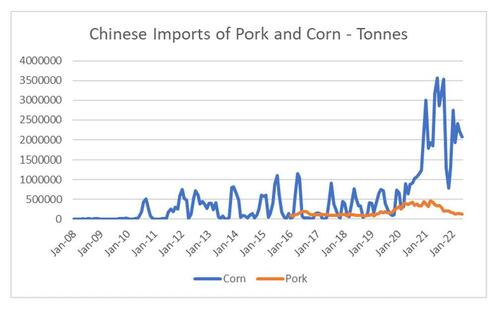

This led to a surge in corn and pork imports to China. I have left pork on the same scale as you need four tonnes of corn to make one tonne of pork, so you can see that pork imports were also a big deal. China was by far the biggest importer of corn and pork at peak import levels.

Weak Chinese pork prices has occurred at the same time corn prices have been soaring due to the Russian/Ukrainian war. Chinese pork prices relative to Chinese corn prices are now at close to the lowest ratio ever, implying significant losses for pig farmers. Or to put in another way, either the pork price is too low, or the corn price is to high.

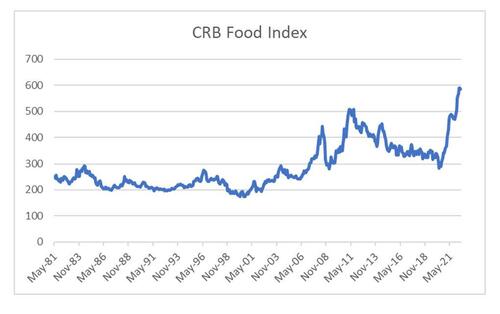

If I take a look at the CRB Food index, which is a good proxy for agricultural products, and at all time highs, with my “free market hat” on - I would say that agricultural products like corn should be a short here. Chinese pork production has recovered, pork prices have normalised, and pig farmers can’t make money here. Ag prices “must” fall - in a free market.

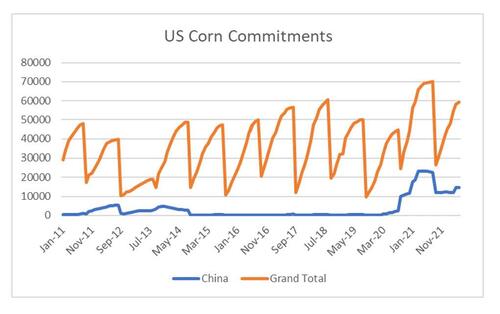

But here is the rub. China has always placed food self sufficiency as a very high political priority. Now the African Swine Flu was hopefully a one off crisis, that required China to draw upon the agriculture surplus of the world. But the fact is that even with pork prices back at low levels, China is still heavily reliant on US corn imports.

To try and bring about more domestic production, Chine has been increasing subsidies to Chinese farmers, and placing tariffs on US imports, which has meant that Chinese prices are consistently higher than US prices.

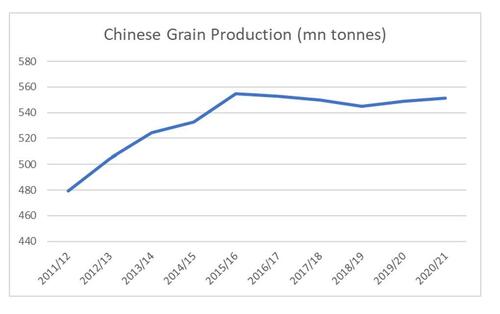

If you look at the graphs above, you need to get bearish on US corn prices when Chinese imports of corn fall. So how likely is its that China becomes self sufficient in corn again? The biggest problem China faces is that to total grain production has been stagnating for seven years now. This is largely due to lack of arable land, that can be brought onstream.

So how can China guarantee food supply? Well it needs to keep domestic prices high, and most likely keep world prices high, to promote more production from areas other than the US, most likely Brazil and Argentina. Suddenly the dip in food prices is offering up a litmus test for my new investing process, which incorporates politics. If buy the dip works with ags, then we have truly left the free market macro era behind.

https://ift.tt/CuUMdZa

from ZeroHedge News https://ift.tt/CuUMdZa

via IFTTT

0 comments

Post a Comment