Putin & Powell Pummel Markets; Gold Jumps, Yield-Curve Inversion Nears Volcker Lows

Wooosh...Total chaos across markets as Putin's escalating global war rhetoric and Powell's nuclear bomb drop of 'higher for longer' rates smashed into extreme positioning, negative gamma, and low liquidity

Before we get to the main event, we note that during the Congressional hearings this morning, JPMorgan CEO offered a reality check for policy-makers and pollyannas:

"...there's a small chance of a soft landing, and then there's also a chance there's a mild recession. There’s a chance it could be much worse given the war in Ukraine and all the other global political uncertainties. He says everyone should prepare for all these possibilities."

“Many Americans are feeling the pain, and consumer confidence continues to drop.”

"I don't think you can spend $6 trillion and not expect inflation"

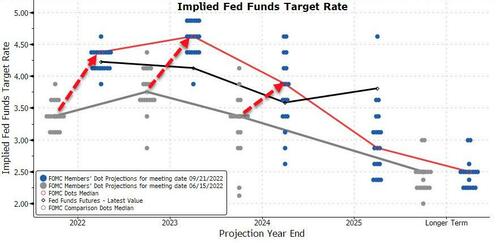

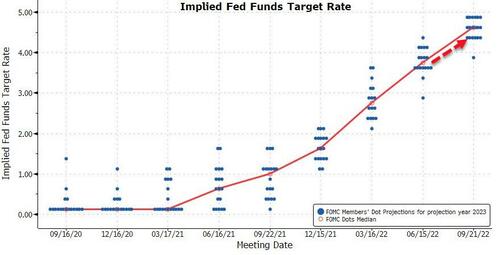

The Fed hiked 75bps (as expected) but drastically shifted its rate trajectory expectations in a hawkish direction...

Powell's press conference offered some hope for bulls (data dependent), but he did warn "the historical record cautions against premature rate-cuts," and admitted that it is "very likely there will be a softening in the labor market."

Senator Warren jumped on that fast:

.@federalreserve’s Chair Powell just announced another extreme interest rate hike while forecasting higher unemployment.

— Elizabeth Warren (@SenWarren) September 21, 2022

I’ve been warning that Chair Powell’s Fed would throw millions of Americans out of work — and I fear he’s already on the path to doing so.

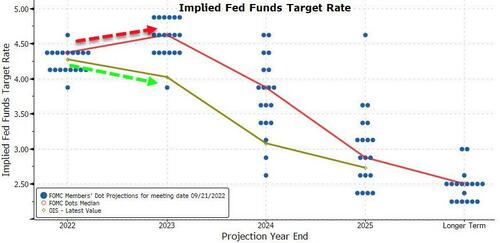

For good form, and to offer the algos some hope, Powell reiterated that The Fed "may slow the pace of hikes at some point to assess effects," but as a reminder, the dot-plot tells you what The Fed members' forecasts are and they don't see any 'easing' anytime soon.

Ha-ha, you fool! You fell victim to one of the classic blunders, the most famous of which is “Never trust the post-FOMC kneejerk reaction" pic.twitter.com/mKTqS5Mo1A

— zerohedge (@zerohedge) September 21, 2022

Finally, Jane Edmondson, CEO of EQM Capital summarized the precarious situation:

“Today’s 75 bps hike was obviously in line with expectations. But here is what is worrying me and others -

1) Fed QT started in September.

2) There is a lag effect of these rate hikes, which has not been fully digested by the economy yet.

3) Concern the Fed is oversteering (that is what Gundlach calls it) and will drive us into recession.

And I question if these rate hikes can even control inflation.

Housing is the perfect example. One of the biggest increases in CPI in August was housing - which of course if being driven by higher interest rates.

I don’t have a lot of confidence that the Fed’s actions are going to be the cure for inflation. Maybe 4-5% inflation is the new normal. And that would be OK in the short-term.”

As Powell admitted "there isn't a painless way to get inflation behind us."

So where did the equity market end today (remember historically the 'day of' has been bid and the 'day after' offered)? The algos had it after Powell's "pause" comments but then he stole the jam out of the market's donut at the end of the presser by admitting that "the housing market may have to go through a correction."

All the majors closed at the lows of the day...

The S&P 500 broke back below 3800 - its lowest since 7/14...

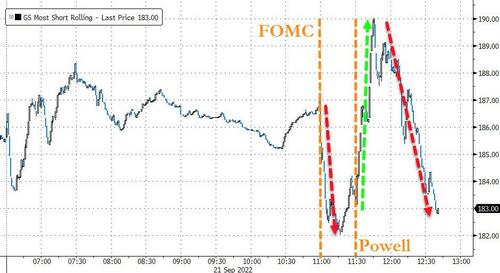

Short-squeeze attempts were made at the start of Powell's Presser... but failed (for the 4th straight day)...

Source: Bloomberg

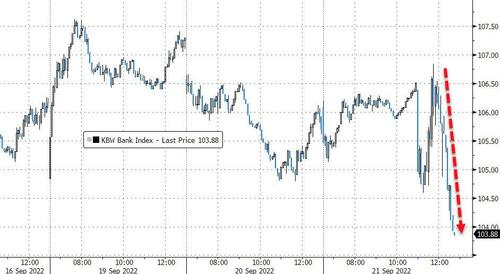

Bank stocks were pummeled after Powell admitted a housing correction was coming (and they weren't helped by the inverting-erer yield curve)...

Source: Bloomberg

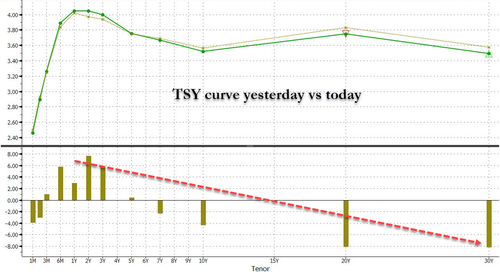

Bond markets were just as jumpy with yield flying all over the place but settling with a major flattening of the curve as 2Y yields jumped 7bps and 30Y yields fell 8bps...

Source: Bloomberg

A dramatic flattening of the yield curve...

Source: Bloomberg

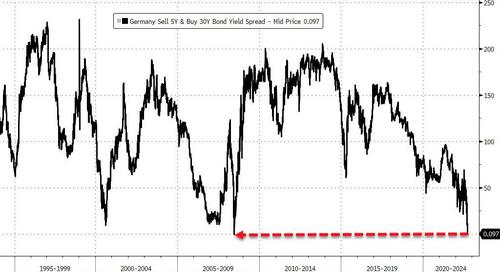

German yield curve 5s30s tumbled to the most-inverted ever.

Source: Bloomberg

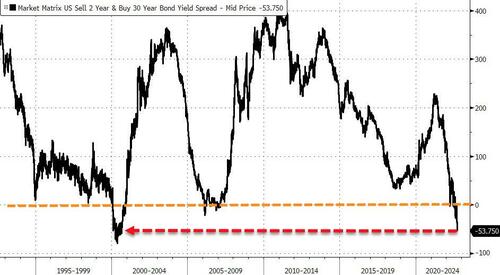

UST yield curve 2s30s collapsed to its most-inverted since 2000

Source: Bloomberg

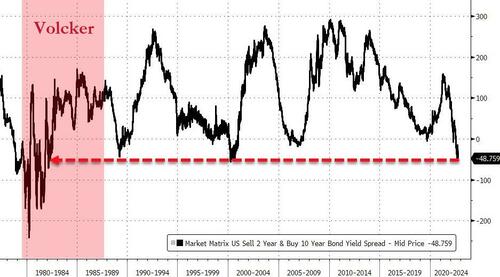

The 2s10s curve hit -52bps intraday, very close its most inverted since 1982 (during Volcker)...

Source: Bloomberg

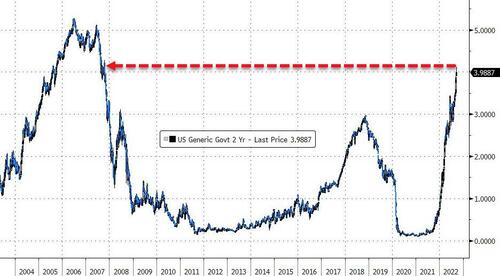

2Y Yields topped 4.00% for the first time since Oct 2007 (hitting 4.11% intraday high before fading back)...

Source: Bloomberg

The dollar had another big rally day - after some flight to safety bid from Putin. The post-FOMC performance ended going higher but was very choppy...

Source: Bloomberg

The euro plunged further below parity with the dollar after Putin's comments... and went further on Powell...

Source: Bloomberg

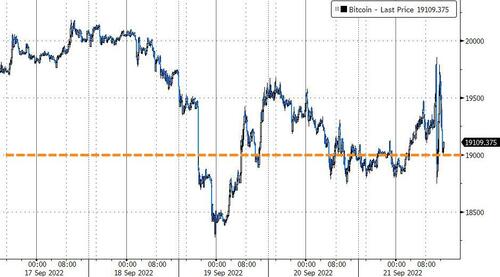

Bitcoin ended the day unchanged, holding $19,000 after some wild rips and dips intraday...

Source: Bloomberg

Oil ended the day practically unchanged as the global war premium from Putin was erased by inflation-fighting fears...

Gold surged back up near $1700 - erasing the post-CPI plunge...

Finally, The Fed continued to rapidly adjust upward its 2023 (terminal) rate expectations...

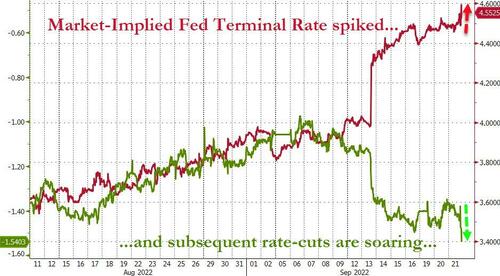

And the market is now pricing in 75bps for November, 50bps for December, and 25bps for Feb 2023... pushing the terminal rate above 4.60% (and also sending subsequent rate-cut expectations soaring)...

Source: Bloomberg

Simply put, the market is calling The Fed's bluff in 2023 - pricing in rate-cuts (after The Fed triggers a recession) while The Fed still expects rates to stay higher for longer...

Source: Bloomberg

We leave you with this this take from Derek Tang, an economist at LH Meyer in Washington:

“This is supposed to send the message, we mean it this time, we’re not pussyfooting or fooling or messing around this time. The mistake up to now has been to walk on eggshells in fear of a recession. The higher unemployment forecasts are fair warning they will inflict pain and this has just begun.”

Just remember the mantra of the last decade - don't fight The Fed. Place your bets.

https://ift.tt/pyIQKaF

from ZeroHedge News https://ift.tt/pyIQKaF

via IFTTT

0 comments

Post a Comment