Q1 Earnings Season Starts Off With A Bang... And The Best Beat Rate In Over 10 Years

Week after week, starting in December 2022 Morgan Stanley's Mike Wilson was swearing up and down to anyone who listened that only he sees just how bad this earnings season will be, and only he has a clue how unprepared investors are for the coming carnage. Eventually, his fire and brimstone sermon became so grating and contagious that other banks - such as Goldman - jumped on the bearish board, and eventually consensus S&P expectations did in fact drop, if nowhere near low enough to catch down to Mike Wilson's expectations. But the bottom line from a growing number of analysts and experts was clear: earnings would be terrible and possibly worse.

And then something remarkable happened: earnings in the first quarter, the quarter when according to Mike Wilson would see everything crash down (actually he said that about Q4 22 but when it didn't happen he just pushed forward his forecast one quarter up), are coming in much stronger than the morose consensus expects.

As Bank of America's Savita Subramanian writes in her first weekly Earnings Tracker for Q1 (available to pro subs in the usual place), following Week 1 in which 30 S&P 500 companies (including early reporters) comprising 10% of earnings reported...

... results have been blowout: 90% of companies beat on EPS, 73% on sales, and 67% on both, well above last quarter’s 54%/83%/46% post-Week 1 and historical average of 67%/64%/48%. Fueled by big bank beats, Q1 EPS is tracking a 30bp surprise.

Putting this in context, according to Savita this is the "best beat rate after Week 1 since at least 2012" (at least for now).

To be sure, there is a reason for this blowout start to Q1 earnings season, and it has to do with the big banks, which as we said have emerged as massive beneficiaries from the bank run that crippled that small and regional banking sector in March. Here is Savita:

Big banks’ solid results (JPM, C, WFC beat on revenue and EPS) despite March’s bank scare helped performance. JPM saw increased deposits vs. peers declining 3% in 1Q23 but warned on outflows from here. Other non-banks benefited from March’s regional outflows – e.g. mega-cap Blackrock saw $40B+ inflows into cash-management products. Banks may be tightening credit standards, but larger ones are operating with excess capital vs. prior crises. JPM/WFC bought back stock in 1Q and expect to continue in 2023, an increasingly scarce positive amid potentially slowing buybacks in general.

Still, despite reporting on what may end up being the best earnings season relative to dramatically slashed expectations in over a decade, Bank of America - which like Mike Wilson - is very bearish on the outlook, suggests that - what else - the earnings drop may not have started but it will come... eventually... the same argument Mike Wilson trots out every Monday when he has to explain to his client how he kept them out of the 3800 to 4200 rally in the past 5 months.

A massive, systemic financial confidence shock appears to have been averted, but tighter credit is manifesting in the real economy: Fastenal, an industrial bellwether, cited softer March sales especially in manufacturing, and consumption slowed in March across income cohorts. Capex, usually hit hard by a credit cycle, has remained robust and could buck trend given multiple secular tailwinds.

Tech capex and stock buybacks may be more at risk, where Tech, Communication Services, and Health Care have been the biggest beneficiaries.

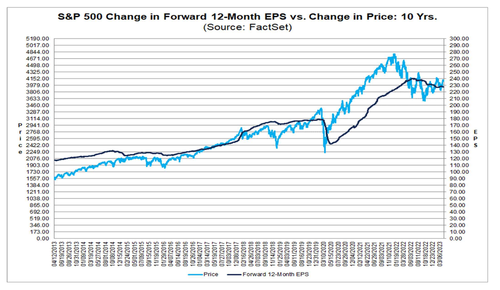

That said, Bank of America is ready to capitulate on its bearish outlook should the strength in earnings persists, and as Subramanian writes, "our 2023 EPS forecast ($200 vs. $220 consensus) could be too low if March’s events prove to be idiosyncratic and temporary." Furthermore, the recent decline in rates has catalyzed some early cycle leadership like housing, where demand is recovering. But even if 1Q YoY growth flat-lined through year-end, 2023 EPS would be just ~$203." Or as Savita rhetorically asks, "Does 2023 matter if 2024 EPS recovers quickly to 2022 levels, as history would suggest?"

Longer-term, BofA notes that automation capex bodes well for productivity (earnings positive) and mega-caps’ newfound discipline around supply, cash return and capacity rationalization argue for more earnings stability (market multiple positive).

Still, remaining true to its bearish view for now (as it has no choice for now), the bank predicts that earnings are likely to outpace the economy in 2024, as the earnings downturn began earlier than the economic downturn this cycle. Earnings also recover stronger than they fall...

... as downturns usually remove excess capacity, resulting in leaner cost structure and improved margin profiles. "But consensus 2024 EPS of $247 (+12% YoY) looks ambitious to us, especially if full-year GDP remains largely flat YoY (BofA house view)."

Ironically, earnings don't even have to be all that strong going forward: as long as they are consistently higher than consensus expectations, and as long as there is a near-record short and bearish sentiment overhang, the meltup will continue.

More in the full BofA note available to pro users in the usual place.

https://ift.tt/jVpJ1oY

from ZeroHedge News https://ift.tt/jVpJ1oY

via IFTTT

0 comments

Post a Comment