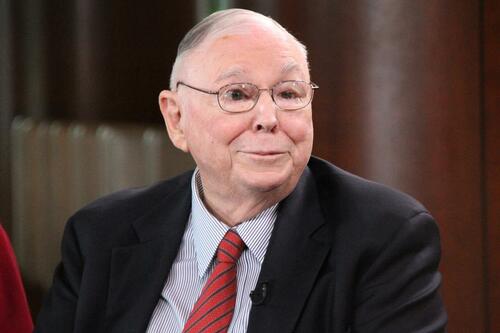

Charlie Munger Dead At 99

Berkshire Hathaway Inc. reported on Tuesday that Charlie Munger has died at the age of 99.

According to the family, he passed peacefully this morning at a California hospital. He would have been 100 on January 1st.

"Berkshire Hathaway could not have been built to its present status without Charlie’s inspiration, wisdom and participation," said Warren Buffett, CEO of Berkshire Hathaway, in a statement.

Munger, in addition to Berkshire's Vice Chairman, was a member of the Costco board, chairman and publisher of the Daily Journal Corp, a philanthropist and an architect. His fortune was estimated at $2.3 billion earlier this year (while Buffett's is estimated at around $100 billion).

Munger dropped out of college in 1943 to join WWII, serving in the US Army Air Corps. Upon his return to the states, he applied himself - taking graduate courses without an undergraduate degree, after which he was eventually accepted into Harvard Law School. He began his career at Wright & Garrett, making $3,300 per year.

Buffett and Munger met in 1959, after Munger returned to Obama following military service at the age of 35 in order to close his late father's legal practice - after his eight-year marriage ended in divorce which left him in dire financial straits because his wife received the majority of their assets.

Munger had also lost his son at the age of 9 to leukemia.

A year after his divorce, Munger faced a devastating blow when his 8-year-old son Teddy was diagnosed with leukemia. In an era devoid of medical insurance and effective treatments for the disease, Munger shouldered the medical expenses while grappling with the emotional turmoil of his son’s illness. He juggled his responsibilities as a father to his other children and his law practice, even as he watched Teddy’s health decline.

Munger’s friend Rick Guerin recalls the heart-wrenching moments Munger spent at the hospital with Teddy and his solitary walks through Pasadena, California, overwhelmed with grief. Teddy’s death at age 9 left Munger shattered. -Benzinga

And how did Munger later reflect on that period in his life?

"Envy, resentment, revenge and self-pity are disastrous modes of thought," he later said. "Self-pity gets close to paranoia. ... Every mischance in life is an opportunity to behave well and learn. It’s not to be immersed in self-pity but to utilize the blow constructively."

That year he was introduced to the then-29-year-old Buffett by one of Buffett's investment clients, and the two hit it off.

Munger served as chairman and CEO of California-based insurance and investment company Wesco Financial between 1984 and 2011, when Buffett's Berkshire purchased the remaining shares. According to Buffett, Munger convinced him to invest in higher-quality, underpriced companies as opposed to those in distress.

An early example of the shift was illustrated in 1972 by Munger’s ability to persuade Buffett to sign off on Berkshire’s purchase of See’s Candies for $25 million even though the California candy maker had annual pretax earnings of only about $4 million. It has since produced more than $2 billion in sales for Berkshire. -CNBC

"He weaned me away from the idea of buying very so-so companies at very cheap prices, knowing that there was some small profit in it, and looking for some really wonderful businesses that we could buy in fair prices," Buffett told CNBC in May 2016.

At one point Buffett started calling Munger the "abominable no-man" for his wholesale rejection of potential investments.

Charlie Munger’s formula for success is simple and perfect:

— John LeFevre (@JohnLeFevre) November 28, 2023

- Spend less than you earn

- Invest prudently

- Avoid toxic people and toxic activities

- Defer gratification

- Never stop learning pic.twitter.com/8IiJNngsdg

RIP Munger, titan of the game pic.twitter.com/uhHK4NQEeA

— Hsaka (@HsakaTrades) November 28, 2023

https://ift.tt/o6lm9j1

from ZeroHedge News https://ift.tt/o6lm9j1

via IFTTT

0 comments

Post a Comment