Authored by Jeff Thomas via InternationalMan.com,

We’re all familiar with the term, “quantitative easing.” It’s described as meaning, “A monetary policy in which a central bank purchases government securities or other securities from the market in order to lower interest rates and increase the money supply.”

Well, that sounds reasonable… even beneficial. But, unfortunately, that’s not really the whole story.

When QE was implemented, the purchasing power was weak and both government and personal debt had become so great that further borrowing would not solve the problem; it would only postpone it and, in the end, exacerbate it. Effectively, QE is not a solution to an economic problem, it’s a bonus of epic proportions, given to banks by governments, at the expense of the taxpayer.

But, of course, we shouldn’t be surprised that governments have passed off a massive redistribution of wealth from the taxpayer to their pals in the banking sector with such clever terms. Governments of today have become extremely adept at creating euphemisms for their misdeeds in order to pull the wool over the eyes of the populace.

At this point, we cannot turn on the daily news without being fed a full meal of carefully-worded mumbo jumbo, designed to further overwhelm whatever small voices of truth may be out there.

Let’s put this in perspective for a moment.

For millennia, political leaders have been in the practice of altering, confusing and even obliterating the truth, when possible. And it’s probably safe to say that, for as long as there have been media, there have been political leaders doing their best to control them.

During times of war, political leaders have serially restricted the media from simply telling the truth. During the American civil war, President Lincoln shut down some 300 newspapers and arrested some 14,000 journalists who had the audacity to contradict his statements to the public.

As extreme as that may sound, this practice has been more the rule in history than the exception.

In most countries, in most eras, some publications go against the official story line and may very well pay a price for doing so. But, other publications go along with the official story line to a greater or lesser degree and are often rewarded for doing so.

It should come as no surprise, then, that media outlets often come to report the news in a less than accurate manner.

Mark Twain is claimed to have said, “If you don’t read the newspaper, you’re uninformed. If you do read the newspaper, you’re misinformed.” Quite so.

Still, only fifty years ago, much of the then “Free World” enjoyed a relatively objective Press. Even on television, reporters such as Walter Cronkite, Huntley and Brinkley, etc. presented the news in a bland manner. It wasn’t very exciting, but at least it was relatively balanced and, to this day, most people who were around then still have no idea as to whether reporters like Walter Cronkite were liberal or conservative. Although he was a committed Democrat, he never allowed that to significantly colour his reporting.

But today, we have a very different corporate structure as regards the media. The same six corporations hold the controlling interest of over 80% of the media. And those same corporations also own a controlling interest in the military industrial complex, Wall Street, the major banks, Big Pharma, etc.

What we’re witnessing today is media having been transformed into something more akin to a three-ring circus than journalism of old. This is no accident.

The present travesty that is the 21st century media, is journalism in name only.

So, why should this be so?

Well, as it happens, people tend not to like governments dominating their lives – simple as that.

And yet, the primary objective of any government is to increase its size and power as rapidly as the populace will tolerate it. The only reason that they rarely do this quickly, is that they can’t get away with it. Like boiling a frog, it takes time to lull the populace into submission, bit by bit.

Once having had enough time to do so, there comes a point at which the government becomes woefully top-heavy, as well as unworkably autocratic. At such times, all that’s necessary to make people rebel is an economic crisis.

Such is the case in much of the world today – the EU, the US, Canada, etc.. Even in their arrogance, the powers that be have to be aware that they’re right at the tipping point. An economic crisis would almost certainly push the situation over the edge.

When truth threatens to undermine machinations for self-aggrandizement, individuals tend to obfuscate in order to delay the inevitable fallout. Governments are no different.

So it was that, in 1999, the largest banks entered into a massive lending scam that would most certainly collapse within a decade. However, before putting the scam in place, they arranged for a “bailout” by the government, which would effectively pass the bill to the taxpayer, while the banks themselves simply increased their own wealth massively.

Of course, QE, as massive as it was, was a mere Band-Aid solution. All those involved (big business and the government) understood that it would hang like a sword of Damocles over the economy until it inevitably came crashing down – a fate far worse than if QE had never been implemented.

And so, for those entities to have invested into the domination of the media was, in fact, essential. Had they not done so, it’s entirely likely that, with a free press, the man on the street would, by now, have figured out that he’d been hoodwinked.

Thus do we see the journalistic equivalent of Quantitative Brainwashing, in which the inevitable realization is delayed for as long as possible.

And, in order to make sure that the public do not figure out what’s been done to them, the news reporting becomes Orwellian in its endless repetition of a false narrative.

It is, however, true that, “You can’t fool all of the people all of the time.” Eventually, the Band-Aid peels back to reveal an infection that’s far beyond what had been generally perceived. It then falls away in layers, as increasing numbers of people become aware that they’ve been scammed – that the media is entirely corrupt and that the media’s owners – big business - have, with the enthusiastic compliance of the government, robbed them on a wholesale basis.

Historically, that’s when the jig is up. What happens then is a matter of historic record.

* * *

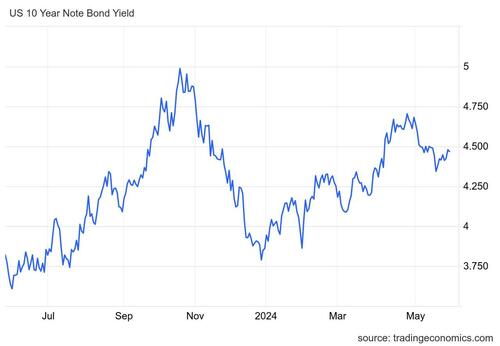

It’s clear the Fed’s money printing is about to go into overdrive. The Fed has already pumped enormous distortions into the economy and inflated an “everything bubble.” The next round of money printing is likely to bring the situation to a breaking point. We’re on the cusp of a global economic crisis that could eclipse anything we’ve seen before. That’s precisely why bestselling author and legendary speculator Doug Casey just released this urgent video. Click here to watch it now.