Squeezed For Decades, America's Working Class Is Finally Up Against The Wall

Authored by Charles Hugh Smith via OfTwoMinds blog,

The net result is America's working class is up against the wall, maxed out.

Let's start by defining the working class in a meaningful way rather than by tossing around meaningless income metrics which implicitly suggest that exceeding some semi-arbitrary income bracket will magically lift a working class household into the middle class.

In the real world, in terms of class status it doesn't matter whether the household income is $30,000 or $130,000; what matters is 1) ownership of assets that have bubbled higher in the Everything Bubble which then provide a buffer of wealth that can be tapped when misfortune strikes, and 2) a cost of living that is consistently and significantly lower than net income, enabling regular savings.

In other words, a household earning $130,000 that owns negligible assets / wealth buffers and consumes every dollar of income just to service its debts and pay all the other bills is working class, while the household earning $30,000 that owns meaningful assets and frugally gets by on $20,000 a year is middle class. The household that earns $130,000 (generally considered a middle class income) but has a net worth is $2 million, no debt and an annual cost of living of $90,000 is upper middle class.

Income by itself misses what's truly important: wealth buffers and a lifestyle that leaves surplus income to be consistently saved and invested.

While we focus on the alarming leap in the cost of living over the past three years, we lose focus on the larger issue: America's working class has been squeezed for decades by the relentless decline in the purchasing power of wages. I explained how to calculate this in We Feel Poorer Because We Are Poorer: Here's Proof (December 4, 2023).

The devastating decline in the purchasing power of wages since 1975 is beyond dispute. As I noted in the above post: "The status quo cheerleaders in the Ministry of Truth ignore the $5,000 annual cost increases in essentials while trumpeting the $100 decline in occasional discretionary purchases. Your rent costs you 100 more hours of work, but you save $100 on airfare, so it all evens out. Um, no."

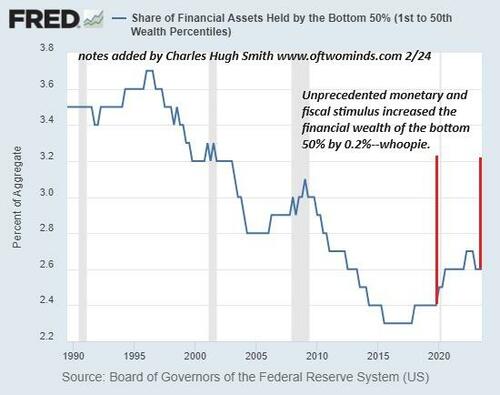

This chart reveals that the decades of hyper-globalization-hyper-financialization transferred trillions of dollars from wage earners to owners of capital. I explained this in Labor Rising: Will Class Identity Finally Matter Again? (May 1, 2024).

As the purchasing power of wages fell and costs increased, it became more difficult to save earnings and climb the ladder of social mobility. The net result is the bottom 50%'s share of the nation's financial wealth has plummeted to a rounding error / signal noise: 2.6%. A great many of the bottom 80% households have little financial wealth to serve as buffers when misfortune strikes.

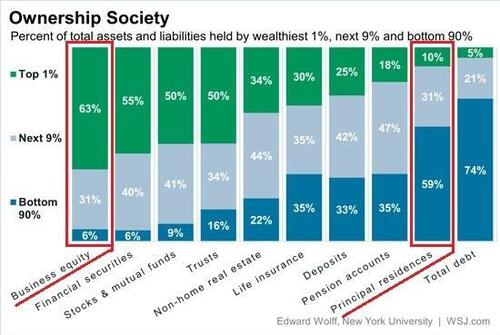

Many of the bottom 90% of households own a family home....

But "ownership" doesn't measure equity or mortgage debt. This chart shows that the bottom 90% "own" the majority of debt that drains income, while the wealthy own income-producing assets:

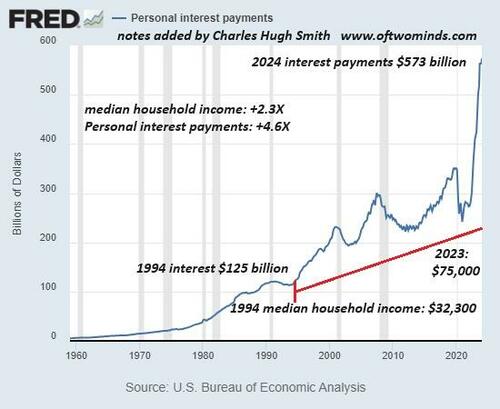

Meanwhile, with interest rates rising, the cost of servicing debts is soaring: since the majority of debt is "owned" by the working class and middle class, the higher interest payments burden the many, not the few.

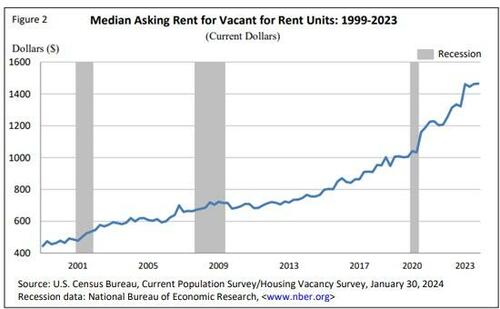

The working class households which don't own a home are being squeezed by sharply higher rents: as for buying a house now, that is a luxury only affordable to the top layer of American households.

The net result is America's working class is up against the wall, maxed out: whatever lines of credit that were available have been tapped (credit cards, "buy now, pay later" credit, etc.) and wage increases are soaked up immediately by higher costs for virtually everything.

The ladder of universally accessible social mobility has been broken. The stresses generated are already visible, but the political-social consequences are still ahead, and once they manifest, economic earthquakes will follow.

* * *

https://ift.tt/9qAOI2r

from ZeroHedge News https://ift.tt/9qAOI2r

via IFTTT

0 comments

Post a Comment