These Were The Best And Worst Performing Assets Of August, And YTD

August was rollercoaster month in financial markets - at least in the beginning - with the VIX briefly spiking to levels last seen in March 2020 during the Covid-19 market turmoil, before just as rapidly sinking back. The catalyst for that was a weak US jobs report, which raised fears that the US might be heading into a downturn. That interacted with an unwinding of the yen carry trade, and there was a massive slump in Japanese markets, with the TOPIX falling by over -12% in a single day on August 5. But calm swiftly returned, after better data and a dovish message from Fed Chair Powell at Jackson Hole helped to reassure investors. So despite everything, global stocks and bonds rose in August, with both the S&P 500 and US Treasuries posting a 4th consecutive monthly advance.

As DB writes in its monthly performance review note, August got off to an incredibly rough start as fears mounted about an economic slowdown in the US. The catalyst for this was the US jobs report on August 2, although there were several underlying factors that also contributed to the turmoil. The report showed that nonfarm payrolls were softer-than-expected at +114k in July (vs. consensus of +175k), and there were also downward revisions to the previous couple of months (followed by even bigger downward revisions during the annual QCEW rebenchmarking process). Significantly, the unemployment rate rose to 4.3%, which meant that the Sahm rule was breached. This suggests that a recession is underway when the 3-month average of the unemployment rate has risen by half a point within a year.

The jobs report came shortly after the Bank of Japan had hiked rates on July 31. That hike had hawkish elements, which contributed to a strengthening yen, but with the US jobs report as well, that led to further dollar depreciation as investors dialled up their expectations for rate cuts from the Fed. So investors were now reassessing the likely interest rate differentials between Japan and the US, which in turn caused significant problems for the yen carry trade. This trade relied on Japan being a lowyielding currency, as investors borrowed in yen and then invested that in highyielding currencies.

The combined effects of this led to a massive slump in Japanese markets on August 5. For instance, the TOPIX index was down -12.2% in a single day, and the TOPIX Banks index was down by -17.3%. This quickly spread across global markets, and later that day the VIX index of volatility peaked at 65.73pts, which is its highest intraday level since the market turmoil in March 2020 when the Covid-19 pandemic began. Risk assets slumped more broadly, and the S&P 500 was down -3.0% that day, marking its worst daily performance since September 2022. At the height of the turmoil, futures were even fully pricing in that the Fed would cut rates by 50bps at their next meeting in September.

But after August 5, calm immediately began to return to markets. In part, that was helped by an almost immediate capitulation by the BOJ which vowed not to raise rates again during periods of market instability, coupled with more positive data on the US economy, which helped to ease fears about an imminent recession. Indeed, markets were lifted by the weekly initial jobless claims that came out on August 8, which were lower than expected. The following week, the retail sales numbers for July were also robust (if entirely thanks to seasonal adjustments). In addition, comments from BoJ Deputy Governor Uchida helped to reassure markets, as he said that “the bank will not raise its policy interest rate when financial and capital markets are unstable.”

Later on in the month, Fed Chair Powell’s speech at Jackson Hole helped to cement investors’ conviction that rate cuts from the Fed were finally on the horizon. He delivered a dovish message, saying that “The time has come for policy to adjust.” And he also said that “We do not seek or welcome further cooling in labor market conditions.” Expectations for a rate cut got further support from the US CPI release the previous week, which showed core inflation falling to +3.2%, the lowest since April 2021. So that solidified expectations that the Fed would cut rates in September, with the potential that they could deliver larger 50bp moves if required in response to economic weakness.

With all those developments, it meant that equities actually managed to advance on the month, recovering swiftly from their slump. In the US, the S&P 500 closed up +2.4% in total return terms, marking its 4th consecutive monthly gain, while Europe’s STOXX 600 was up +1.6%. Japan’s Nikkei (-1.1%) was an underperformer given that much of the turmoil had centerd on Japan, but the general trend for risk assets was positive. That included emerging markets, where the MSCI EM Index was up +1.6%.

For sovereign bonds there were also gains as investors priced in more rate cuts. US Treasuries were up for a 4th consecutive month for the first time since July 2021, posting a +1.3% gain in total return terms, whilst Euro sovereigns were up +0.4%. Gold (+2.3%) was another beneficiary, since it tends to do well in a lower-rate environment given it doesn’t pay any interest itself, and prices exceeded $2,500/oz for the first time.

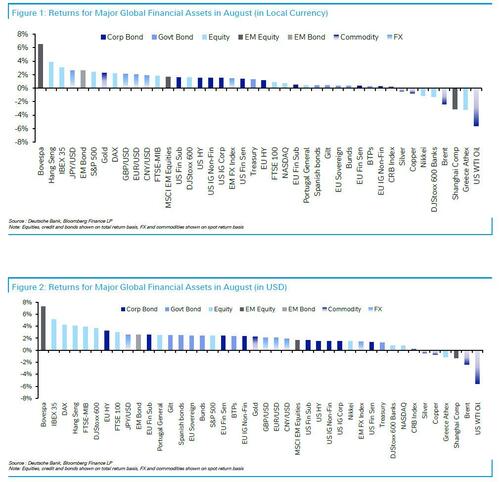

Which assets saw the biggest gains in August?

- Sovereign Bonds: With investors pricing more aggressive rate cuts, it was a strong month for sovereign bonds, and US Treasuries in particular. US Treasuries were up +1.3% over the month, and Euro sovereigns were up +0.4%.

- Equities: Despite the initial turmoil, equities were mostly higher on the month. That included the S&P 500 (+2.4%) and the STOXX 600 (+1.6%). However, it wasn’t all positive, and the Magnificent 7 (-0.4%) fell for a second consecutive month for the first time this year.

- Japanese Yen: The Japanese Yen strengthened against the US Dollar for a second consecutive month, up +2.6%.

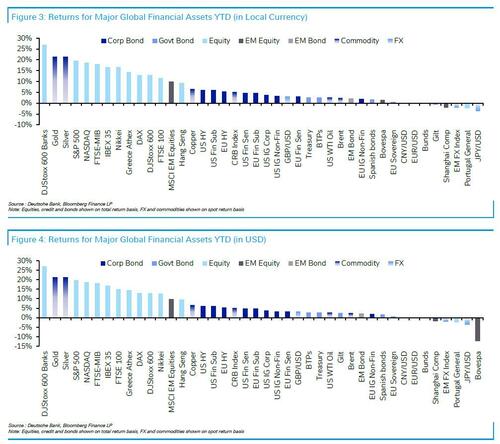

- Precious Metals: With interest rate cuts moving into view, gold moved above $2500/oz for the first time. On a YTD basis, gold and silver are among the top-performing major assets, having both risen by +21.3%.

Which assets saw the biggest losses in August?

- US Dollar: The US Dollar weakened against every other G10 currency in August, and it was the worst monthly performance for the dollar index (-2.3%) since November 2023.

- Oil: Brent crude (-2.4%) and WTI oil (-5.6%) were both down for a 2nd consecutive month in August.

And here is a snapshot of the best and worst performing assets in August, both in local currency and USD...

... and YTD:

More in the full DB note available to pro subscribers.

https://ift.tt/wDfEy4V

from ZeroHedge News https://ift.tt/wDfEy4V

via IFTTT

0 comments

Post a Comment