Gucci Crisis Drags Kering Shares To Largest Annual Drop Since 2008

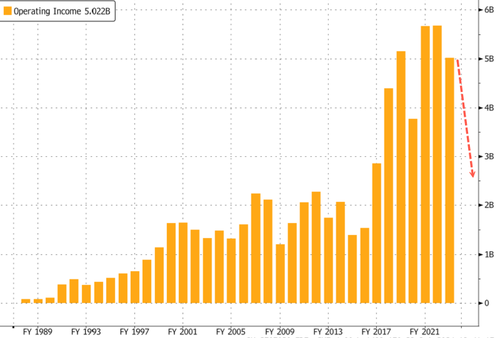

Gucci owner Kering SA's problems in mainland China are worsening by the month. After issuing a profit warning earlier this year, the company now expects its annual profits to hit their lowest level since 2016, driven by weak demand from the world's second-largest economy. Shares have plunged by over 40% this year, marking the steepest annual decline since the GFC in 2008.

Kering booked revenue of 3.79 billion euros ($4.09 billion) in the third quarter, down 15% year-over-year and missed the average estimate tracked by Bloomberg of 3.96 billion euros. On a comparable basis, revenue slid by 16%, much worse than the -10.9% estimate.

Here's a snapshot of third-quarter earnings (courtesy of Bloomberg):

Comparable revenue -16%, estimate -10.9%

Gucci revenue on a comparable basis -25%, estimate -20.7%

Yves Saint Laurent revenue on a comparable basis -12%, estimate -9.94%

Bottega Veneta revenue on a comparable basis +5%, estimate +4.1%

Other Houses revenue on a comparable basis -14%, estimate -3.74%

Eyewear & corporate revenue on a comparable basis +7%, estimate +6.13%

Revenue EU3.79 billion, -15% y/y, estimate EU3.96 billion

Gucci revenue EU1.64 billion, -26% y/y, estimate EU1.75 billion

Yves Saint Laurent revenue EU670 million, -13% y/y, estimate EU688.1 million

Bottega Veneta revenue EU397 million, +4.2% y/y, estimate EU391.1 million

Other Houses revenue EU686 million, -15% y/y, estimate EU774.5 million

Eyewear & corporate revenue EU440 million, +32% y/y, estimate EU395.4 million

Kering blamed "major uncertainties" weighing on consumers in its major retail markets worldwide for a dismal third-quarter report and expects recurring operating income for the year to fall to around 2.5 billion euros, or the lowest level since 2016.

"The results show how tricky it has become for Kering to reset its flagship brand amid a demand slowdown for high-end goods, particularly in China," Bloomberg noted.

One week ago, the world's largest luxury goods company, LVMH Moët Hennessy Louis Vuitton, commonly known as LVMH, unexpectedly reported lower sales in the third quarter, primarily due to the pullback in Chinese luxury demand.

Back to Kering, where shares in Paris are down 42% on the year. This would be the worst annual decline since the 2008 GFC if these losses hold.

Besdies luxury, the automotive industry across the West is being crushed by the China slowdown. Even though Beijing has unleashed the monetary stimuli bazooka, the slowdown appears not to be ending anytime soon.

https://ift.tt/nLFGIH5

from ZeroHedge News https://ift.tt/nLFGIH5

via IFTTT

0 comments

Post a Comment