'Mini-Stagflation' Will End With A Financial Shock

Submitted by Dhaval Joshi via BCAResearch.com,

President Trump is hosting Prime Minister Starmer in the White House today. Yet the most pressing issue that they will likely not discuss is that both the US and the UK are staring down the barrel of what I have called a ‘mini-stagflation’ – a period of inflation stuck well above 2 percent combined with slowing growth.

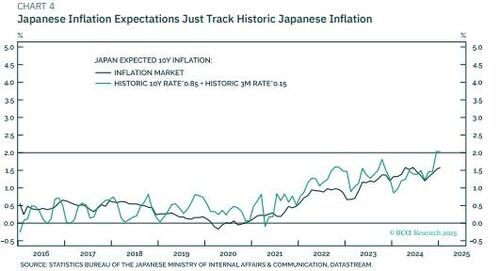

Meanwhile, in the euro area and Japan, the pre-pandemic era of ‘too low’ inflation is well and truly over as structural inflation expectations have finally lifted to 2 percent.

This setup of above-par inflation expectations in the US and UK combined with at-par inflation expectations in the euro area and Japan has major implications for relative central bank policy. Worryingly though, it also sows the seeds for the next financial shock.

Inflation Shocks Stay In The Collective Memory For A Long Time

The oft-quoted disclaimer on investment products is that past performance is a poor guide to future returns. Yet when it comes to inflation expectations, past performance is an excellent guide to future returns.

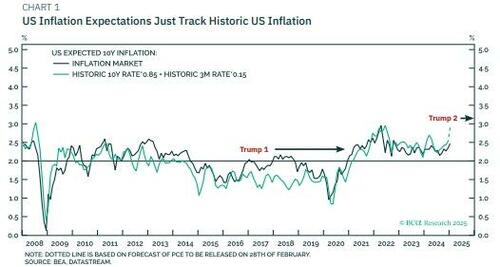

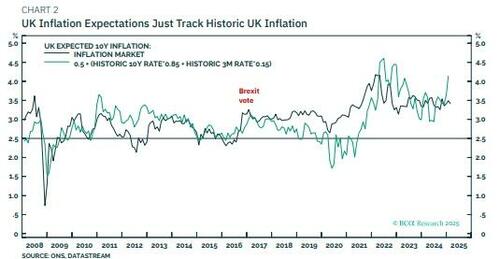

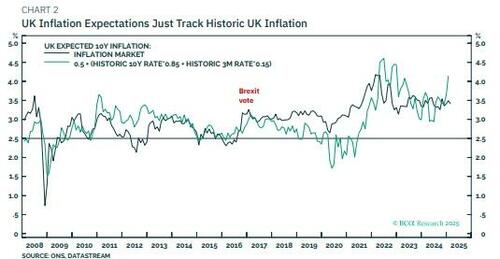

Long-term inflation expectations are nothing more than a simple weighted average of long-term historic inflation and extremely recent inflation, with the long-term historic component dominating. Specifically:

10-year expected inflation = 0.85 * 10-year inflation + 0.15 * 3-month inflation

As the charts in this report illustrate, this simple expression near perfectly explains long-term inflation expectations in the US, UK, euro area, and even in Japan!

Technical note: In the UK, as pension funds are captive buyers of inflation protected bonds, this artificially depresses UK inflation protected bond yields, and thereby artificially raises market-based UK inflation expectations by 0.5 percent versus the ‘true’ expectations. The analysis in this report adjusts for this distortion.

This basic maths for inflation expectations has a crucial takeaway. An inflation shock – such as happened post-pandemic – which lifts the long-term historic inflation rate will leave long-term inflation expectations structurally elevated.

Or, put in simple English:

Inflation (and deflation) shocks stay in the collective memory for a long time.

This leads to another crucial takeaway. For the euro area and Japan, which were experiencing chronically ‘too low’ inflation (if that isn’t an oxymoron!), the post-pandemic inflation shock has been ‘benign’ – by finally lifting structural inflation expectations to the required level of 2 percent.

However, for the US and the UK, which were experiencing broadly ‘at target’ inflation expectations, the post-pandemic inflation shock has been ‘malign’ – by elevating those structural inflation expectations to well above 2 percent.

In the case of the US and the UK, the post-pandemic inflationary shock must be neutralised by a subsequent deflationary shock to restore structural inflation expectations back to 2 percent. But as the Fed and the BoE are unlikely to engineer such a deflationary shock, it must ultimately come from another source. More about that in a moment.

Until a deflationary shock arrives though:

The US and UK will be stuck with elevated structural inflation expectations.

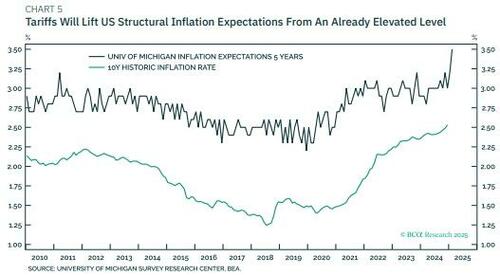

Tariffs will only make matters worse. Past performance is an excellent guide to inflation expectations, provided the economy has not experienced a paradigm-shift that makes history a poor guide to the future.

In the UK, Brexit was such a paradigm-shift. Hence, after the 2016 vote to leave the EU, UK inflation expectations briefly broke upwards from the historical experience. In the US, a less pronounced break upwards happened after Trump’s first election victory in 2016, reflecting that a Trump presidency can be regarded as a paradigm-shift. To the extent that the same is true for Trump’s second presidency, the risk is that it will lift US structural inflation expectations from an already elevated level.

The Next Financial Shock Could Come From Japan

The setup of above-par inflation expectations in the US and UK combined with at-par inflation expectations in the euro area and Japan has major implications for relative central bank policy.

Absent a new deflationary shock, the Fed and the BoE have very limited scope to cut interest rates. The ECB, by contrast, has more scope to unwind its post-pandemic tightening.

Most significant though is the development in Japan. With inflation expectations back at 2 percent, a zero-interest rate policy is no longer fit for purpose. The BoJ must rapidly normalise interest rates to its estimate of neutral at 1-2.5 percent.[1]

Importantly, the mini-stagflation in the US will facilitate such a normalisation, because as BoJ Governor Kazuo Ueda explains, the BoJ must carefully consider “developments in overseas economies, especially the US economy, and their impact on financial and foreign exchange markets”. In plain English, this means that a Fed on hold because of a mini-stagflation opens the door for the BoJ to normalise interest rates.

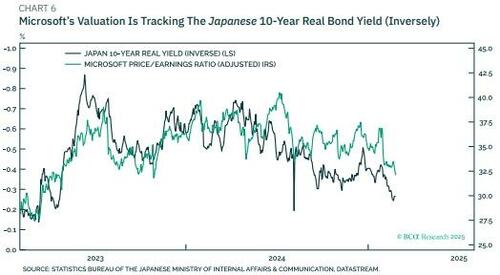

Therein lies a potential source of the next financial shock. As I have consistently highlighted – for example, in More On The Yen Carry Trade… And Unsustainable Extremes | BCA Research – Japan’s deeply negative real rates have inflated the AI bubble. Therefore, the normalisation of Japanese interest rates is a prime candidate to burst it.

In fact, the yen carry trade is reflexive. It needs a funding currency with stably low or negative yields (the yen); and a destination investment with stably high returns (AI stocks). So, the bubble could burst: either if the stably low yield on the yen funding ends; or if the euphoria around AI stocks is shattered.

Observe that since early-2023 there has been a great (inverse) fit between bellwether stock Microsoft’s valuation and the Japanese 10-year real bond yield.

Looking at this chart:

The Japanese real bond yield turning positive would constitute a meaningful shock for the global stock market.

Some people have asked for a critical level for the dollar/yen exchange rate as it is easier to watch. Monitoring the yen’s appreciation is fine, provided it is understood that the overarching driver is Japan’s real bond yield rising, and the exchange rate is just the effect. That said, if dollar/yen fell below 145 it would almost certainly coincide with an air-pocket in the global stock market.

To sum up, the US (and the UK) is staring down the barrel of a mini-stagflation until a deflationary shock, potentially emanating from Japan, neutralises it. But the timing of this deflationary shock is uncertain.

The good news is that three investment conclusions hold true irrespective of how long it takes for a deflationary shock to end the US (and the UK) mini-stagflation:

-

Overweight the yen.

-

Underweight the euro.

-

Underweight US stocks in a global portfolio.

https://ift.tt/CfuAYPT

from ZeroHedge News https://ift.tt/CfuAYPT

via IFTTT

0 comments

Post a Comment