Economic Recovery Narrative Doomed: Fathom's China Momentum Indicator Signals More Downside Ahead

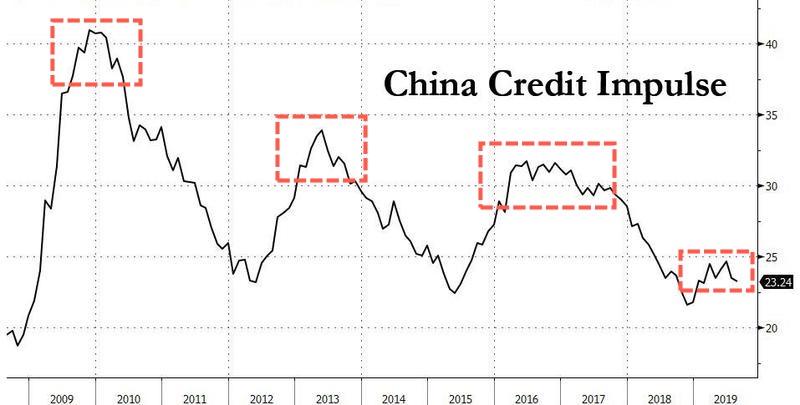

In the last 30 days, we've noted that China's credit growth rapidly decelerated to the weakest pace since at least 2017 as a continued collapse in shadow banking, weak corporate demand for credit and seasonal effects all signaled that a massive rebound in China's economy, nevertheless the global economy, in early 2020 is questionable.

Though investors around the world have bought stocks in preparation for a massive 2016-style rebound in the global economy. We've discussed that because of China's credit impulse has rolled over, the probabilities of a massive rebound in China's economy or even the rest of the world remains low -- though it's possible the global economy could stabilize, it's just the idea that a huge rebound is unlikely.

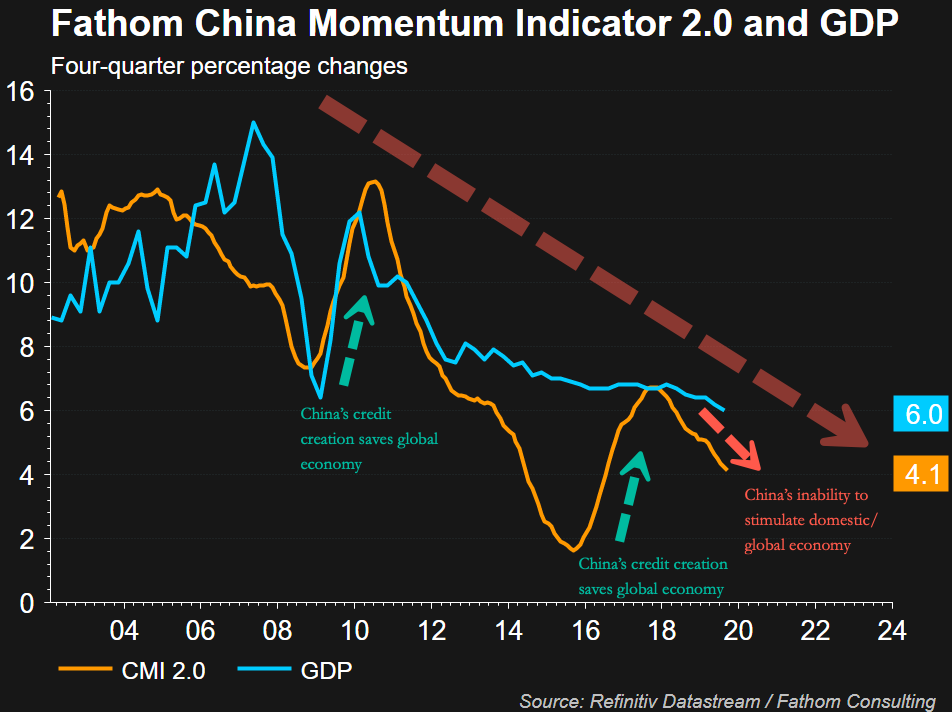

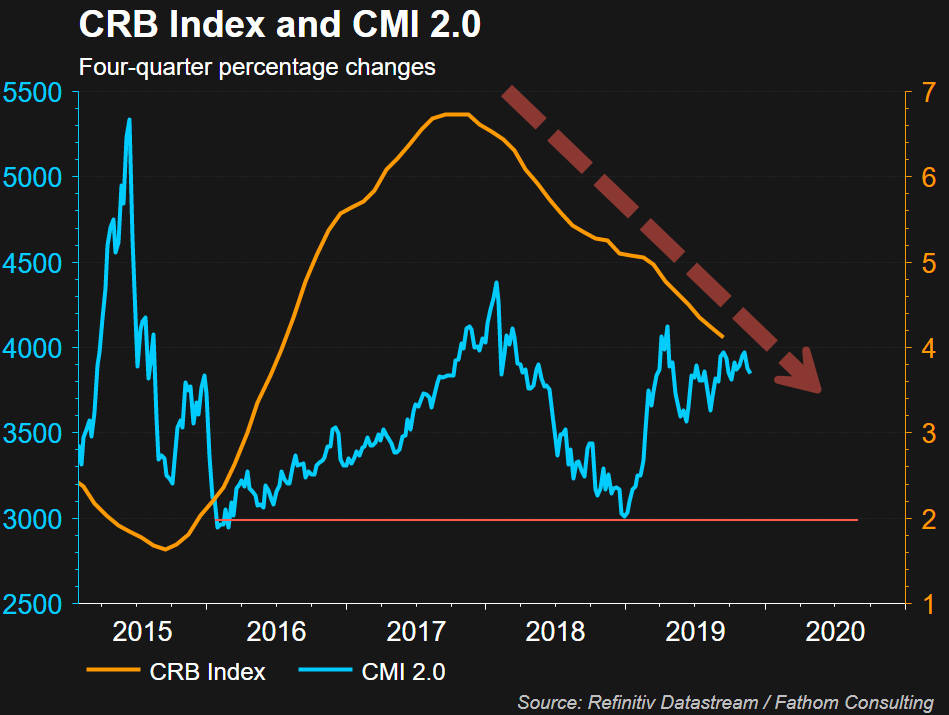

Fathom Consulting's China Momentum Indicator 2.0 (CMI 2.0) provides a more in-depth view of China's economic activity than official Chinese GDP statistics.

CMI 2.0 is based on ten alternative indicators for economic activity; some of those indicators include railway freight, electricity consumption, and the issuance of bank loans.

Fathom has stated that in CMI 2.0, the calculation of the index avoids measuring construction activity, and instead focuses on shadow measures of economic activity. The consulting group says this allows the index to be "less prone to manipulation than the headline GDP figures."

"In 2014, when China's traditional growth model was running out of steam and vulnerabilities were rising, authorities toyed with credit tightening and an enforced rebalancing. But at the end of 2015, when growth slowed too sharply, they quickly threw in the towel, resorting to the old growth model of credit-fuelled growth. With growth once again slowing, and past precedent suggesting credit has neared its limit, China finds itself at a crossroad," Fathom recently said.

China is undoubtedly at "crossroads," as Fathom suggests, because of its inability to stoke economic growth via credit, this means China isn't going to bail out the world again like it did in 2008 and 2015/16.

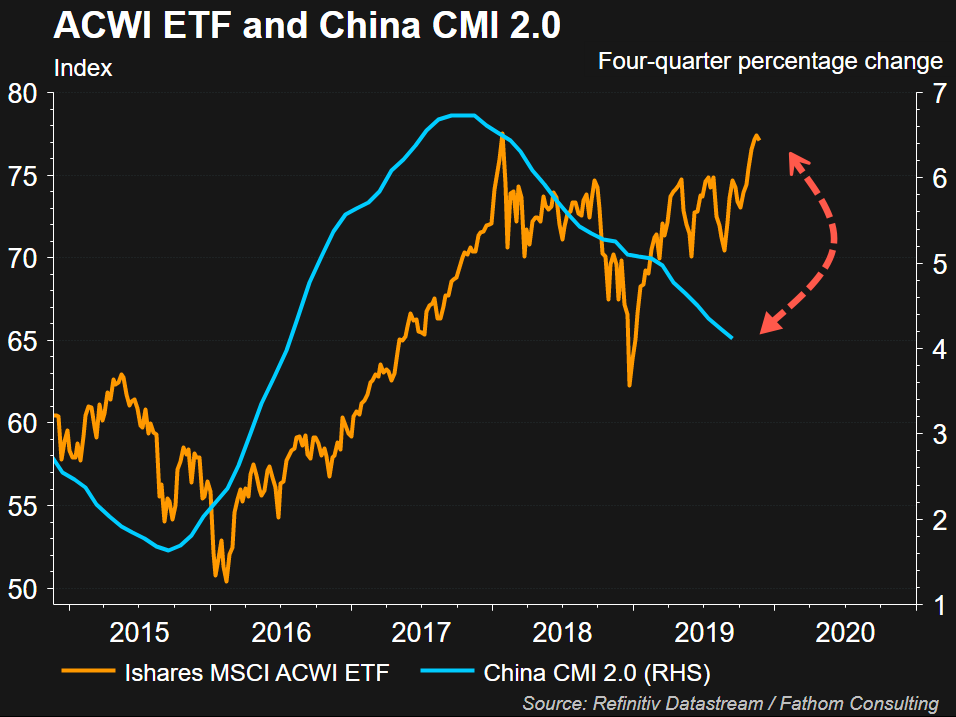

Global stocks are expecting China CMI 2.0 to soar in the coming months, but if that doesn't happen, global stocks are likely to see a significant correction in the months ahead.

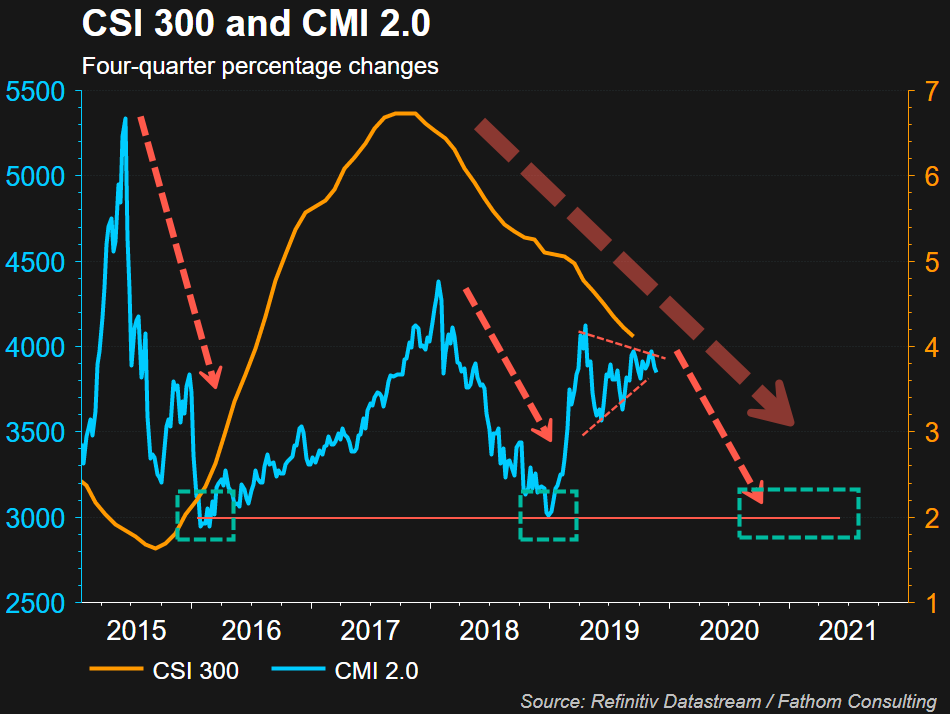

And with China's economic activity decelerating, China's CSI 300 Index could retest around the 3,000 level.

Commodities remain depressed because China's economic activity continues to decelerate.

Without China - which has created 60% of all new global debt over the past decade - there can be no global recovery.

In other words, enjoy the current growth delusion while it lasts... some time into Q2 2020 when the Fed's NOT QE will fade to nothing.

https://ift.tt/2OHHITr

from ZeroHedge News https://ift.tt/2OHHITr

via IFTTT

0 comments

Post a Comment