Fed's Kashkari Says It's Time For The Federal Reserve To Start Redistributing Wealth

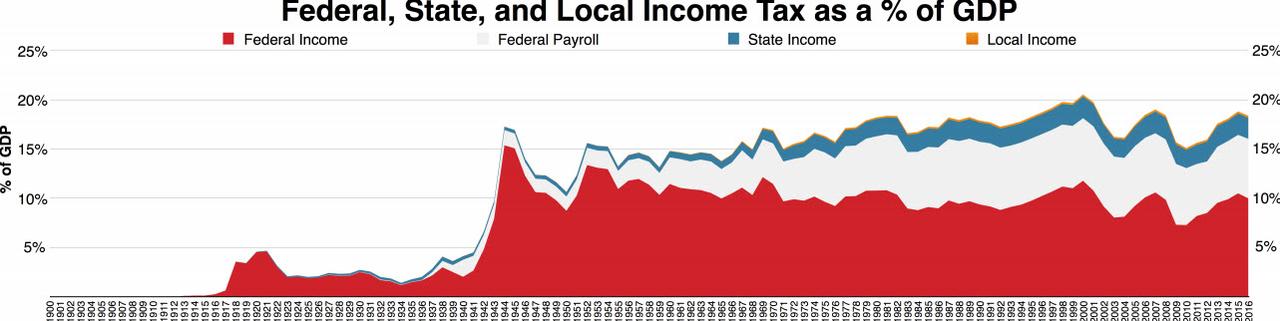

It may come as a surprise to some younger Americans, but the US did not always have income tax. In fact, one of the main catalysts behind the American Revolution and resulting War of Independence was the colonial protest against British taxation policy in the 1760s. Then, in the beginning, the independent nation collected taxes on imports, whiskey, and (for a while) on glass windows, even as states and localities collected poll taxes on voters and property taxes on land and commercial buildings. In addition, there were state and federal excise taxes. But all throughout, there was no official income tax for nearly a century and a half.

Yet while the United States imposed income taxes briefly during the Civil War and the 1890s, it was not until the 16th Amendment was ratified that the US permanently legalized a federal income tax in 1913. Incidentally, that was the same momentous year - just before the start of World War I - that another milestone event in US history took place: the birth of the Federal Reserve. Shortly thereafter, states also began collecting sales taxes in the 1930s.

Ever since then, the history of US taxation has been on of "optimal" outcomes, of progressive policies, and ultimately, of wealth redistribution according to whatever party or ideological bent was in control.

Yet no matter what one though of US tax policy, one thing was immutable: it was always and only in the hands of the Federal and State government to impose whatever taxation was deemed appropriate. For better or worse, tax was synonymous with politics.

That may be changing.

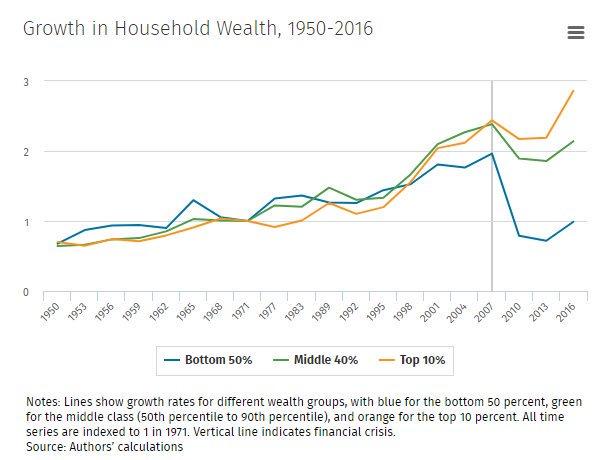

Fast forward to 2019, when after a decade of unprecedented inequality spurred by the Federal Reserve's policies, which made the rich richer, and the poor and middle classes poorer to the point that just 1% of the US population now owns as much wealth as the middle and lower classes combined...

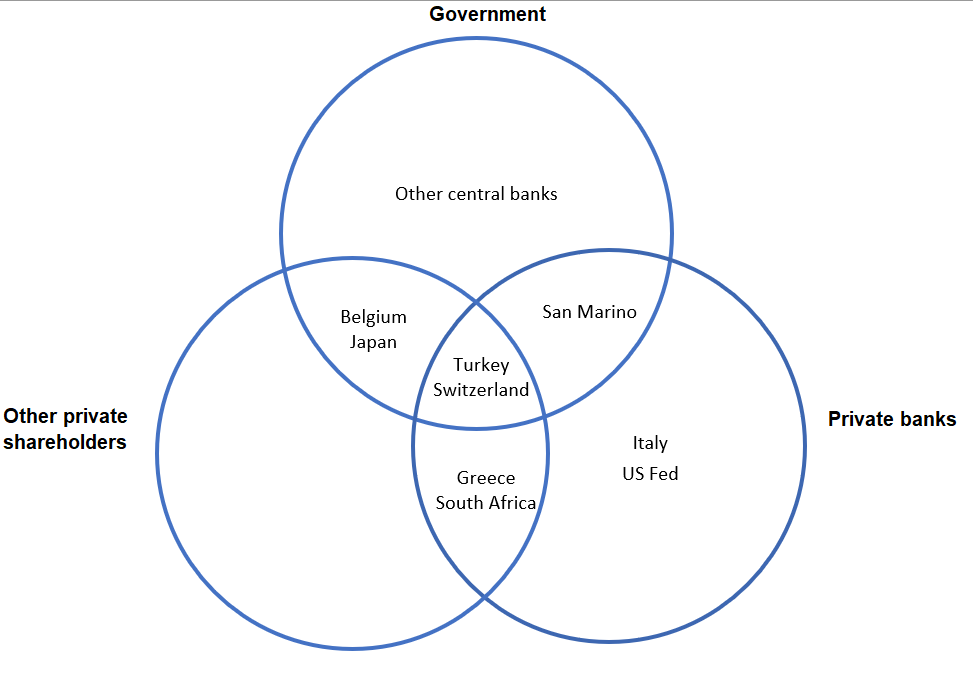

... the same "apolitical", private Federal Reserve, which is owned by a handful of commercial banks and whose members have never been subject to election by the general population...

... now wishes to formalize its wealth redistribution agenda, and effectively become a political force which determines who gets richer and who gets poorer.

As Bloomberg News reports today (now that it can no longer report on the travails of either its boss, Michael Bloomberg or his challengers for the Democratic primary even if it still has free reign to bash Donald Trump each and every day), Neel Kashkari, the former Goldman employee who was instrumental in the drafting of TARP and the bailout of the US financial system, and outspoken dove at the Minneapolis Fed, said "monetary policy can play the kind of redistributing role once thought to be the preserve of elected officials." And as Bloomberg notes, "while that likely remains a minority view among U.S. central bankers, Kashkari has helped lay the groundwork for a shift in Fed communication this year."

Needless to say, while Kashkari is all for deciding who gets what - arguably the most political of positions - he is very much against being subject to a periodic popular vote. Because, you know, the Fed knows best, and once you permit a democratic choice, the whole myth of an omnipotent Fed falls apart. As such, what Kashkari is proposing is despotism, pure and simple, one where a group of unelected career economists and various other bureaucrats has the final say on not only the price of money (determined by the Fed Funds rate), but also who ends up getting that money!

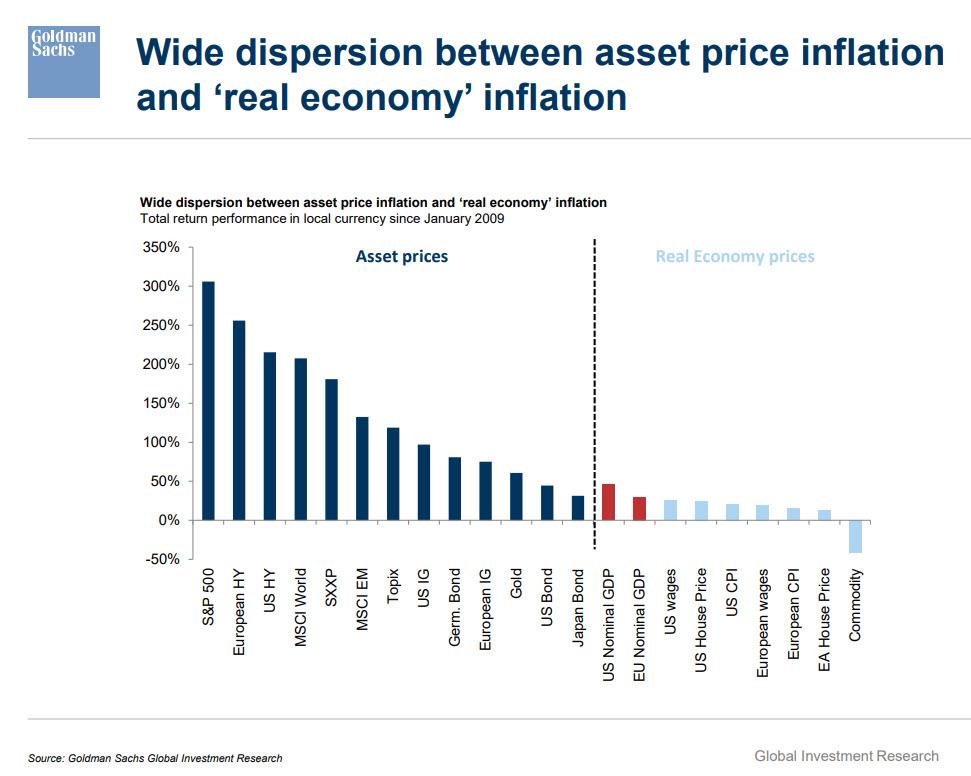

While the Fed sternly refuses to acknoleldge that the rotting cancer at the heart of its chronic inability to correctly diagnose the US economy (just over a year ago, we were a "long way away from neutral"... then just a few months later, the Fed flipped a U-turn and not only started slashing rates but launched QE4) is its inability to correctly measure inflation, and specifically admit that asset price inflation matters just as much as "economic" inflation...

... even as it chronically underestimates just how disproportionately more rising prices impact poorer Americans compared to richer ones (as we discussed previously here), it appears to be more than happy to propose expanding its role, and besides determining monetary policy, it is now generously willing to also opine on proper wealth distribution, read keeping rates low forever, and dooming all those who save to financial extinction.

Enter former Goldmanite and PIMCOite, Neel Kashkari, who believes he is the man best suited for the monumental task of singlehandedly deciding an outcome best left for the entire economy.

When Kashkari, a year into his job, launched an in-house effort in 2017 to examine widening disparities in the economy, yet clearly failing to realize the Fed's own massive contribution to the record wealth inequality between the rich and poor, as it was the Fed's policies that made those handful of Americans who owned financial assets richer than ever, while "redistributing" wealth away from savers and the rest of the American population, he was expecting to generate research that might inform lawmakers’ decisions, rather than the Fed’s.

"We had historically said: distributional outcomes, monetary policy has no role to play," Kashkari told Bloomberg in an October interview. "That was kind of the standard view at the Fed, and I came in assuming that. I now think that’s wrong.”

For those confused by this word salad, what Kashkari now thinks is that it is right for the Fed to have a role in deciding distribution outcome!

The Bloomberg article then launches into an extended report of just how Kashkari hopes to legitimize his effort of elevating the Fed to the rank of supreme US despot, an emperor's circle of unelected, career economists who take central planning in the US to a level the USSR never even conceived of, and we are confident readers can go through it on their own, especially since it includes such phrases as "paradigm shift" which is what the Bloomberg writer decided to throw in to indicate just how above the average reader he himself is, what we will say is this: trickle-down economics has failed every single time.

And now, instead of finally admitting that this core premise behind its 106 years of failed monetary policies which have made the bubble-bust mentality the norm and which guarantee that the next crash may well wipe out not only the Fed itself but western civilization as we know it, the Fed's proposal is a "modest" one - give it even more power to determine who is rich, and who is poor, and asks just one thing: trust it that this time it will get it right.

Of course, the real motive behind Kashkari's modest proposal is even more nefarious: the eventual fusion of monetary and fiscal policy, which in turn will greenlight the direct monetization of US debt by some super-governmental authority, call it the Treasury or whatever - one which we are confident will also be headed by a group of people who will never be subject to a popular vote - in hopes of allowing the US to effectively issue unlimited amounts of debt, i.e., launch MMT, in the process sparking enough inflation to finally inflate away America's staggering debt load.

This will go on as long as the US Dollar maintains its reserve status, a process that will be vastly accelerated should Kashkari's proposal - which one can comfortably argue is far more aligned with what Putin could desire in terms of destroying America's superpower status than anything Trump has done to date - get solid footing among the "intellectual elite" of the United States.

Of course, long before the collapse of the dollar, it will also result in civil war, because if there is one thing the Fed knows how to do - and we say this without jest of sarcasm - is to make the rich even richer and the poor poorer. However, it is safe to say that US society is already nearing its breaking point, and should the Fed officially (rather than just unofficially) enter the wealth redistribution process, that would without doubt be the straw that finally breaks the American camel's back.

https://ift.tt/2s969BG

from ZeroHedge News https://ift.tt/2s969BG

via IFTTT

0 comments

Post a Comment