The Next US Recession Will Start In One Of These Four States

Submitted by Nick Colas of DataTrek

Over the course of 2019 we have been tracking three states – Michigan, Ohio and Indiana – because we believe the next US recession will start in the American upper-Midwest. Our thesis in a nutshell:

-

Every slowdown has its own particular “Patient Zero”, the economic equivalent of epidemiology’s first patient to fall ill from a new disease. Identify that source and you can begin to understand how to treat the ailment or, for our purposes, sound the recessionary alarm.

-

Marginal increases in specific state level unemployment during prior cycles correctly identified the root cause of each subsequent recession.

-

In 2000, Massachusetts and Connecticut (heavily exposed to financial services) saw increasing joblessness ahead of national trends as the dot com bubble burst. In 2007, Nevada and Florida (the bubbliest housing markets) were the first to see spiking unemployment.

-

In this cycle, states exposed to manufacturing saw the largest changes from 2009 – present in terms of unemployment, making them this cycle’s most likely candidates for Patient Zero status.

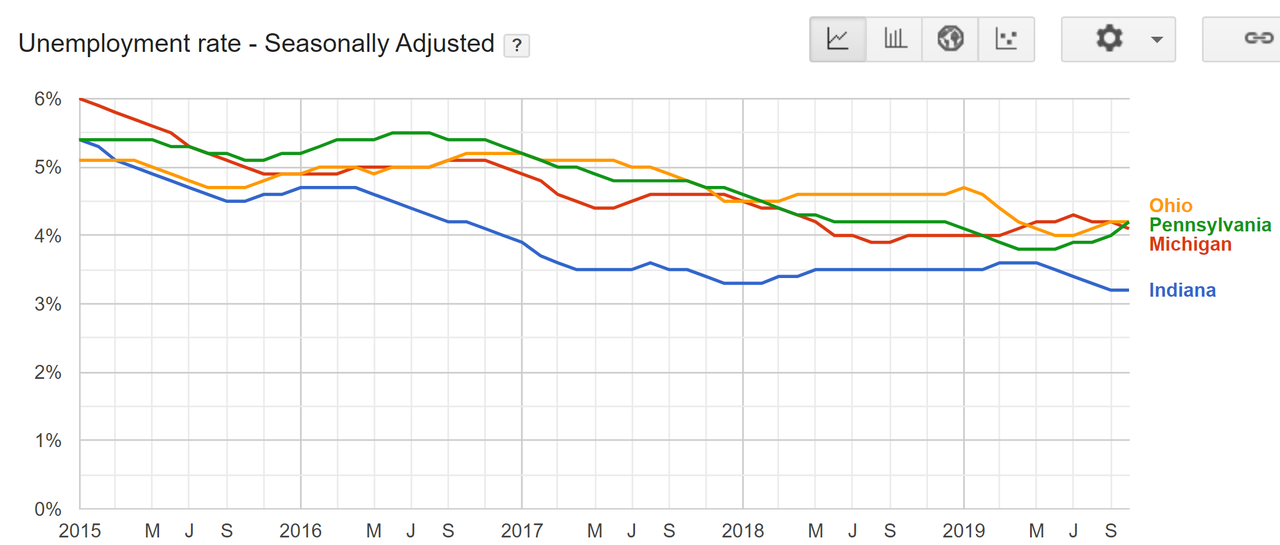

The latest state-level unemployment data (through October) is just out, and here is how it looks for MI, OH and IN, plus Pennsylvania (more on that one in a minute) from 2015 - present:

Here’s what we see in the data:

-

All 4 states have seen noticeably lower unemployment in recent years. Only one – Indiana (blue line) – is consistently below the national average, however. And its labor market remains robust today.

-

Ohio’s (orange line) current unemployment rate of 4.2% is slightly higher than the trough of 4.0% in June/July 2019 but still well below last year’s 4.6%.

-

Michigan’s (red line) unemployment rate stands at 4.1%, down from the 4.3% peak this July and basically the same as last year’s 4.0%.

-

Pennsylvania (green line) was not on our original “states to watch” list, but unemployment here is clearly moving in the wrong direction. October 2019’s reading of 4.2% is noticeably higher than earlier in the year (3.8% in Q2) and seems to be climbing quickly.

We can also use the “Sahm Recession Indicator” to evaluate this data. This rule, created by Fed economist Claudia Sahm, posits that a 0.5-point increase in unemployment over a year means a recession is coming. By that measure, Michigan, Ohio and Indiana are in the clear. Pennsylvania, however, is in some trouble.

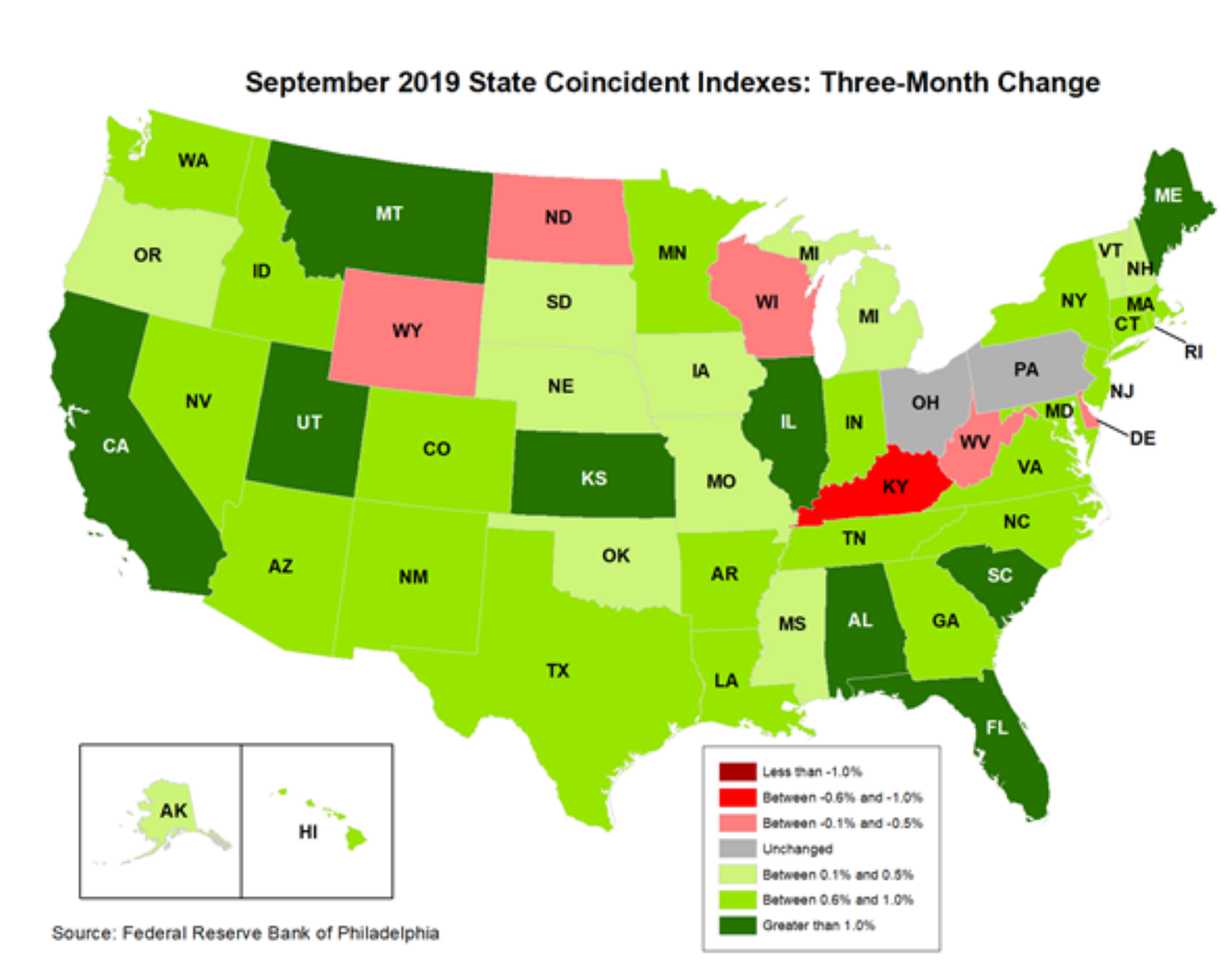

As a second data point on this topic, consider the Philadelphia Fed’s State Coincident Indexes. These use a combination of unemployment and wage data to measure the 3-month change in a state’s economic health.

Here is the current 50-state map of that data, coded by shades of green (growing economies), grey (flat) and red (shrinking economies):

This graphic shows a similar story to the rolling changes in unemployment data:

-

Indiana is doing the best of our 4-state focus group.

-

Michigan, despite the GM strike, is still marginally positive.

-

Ohio and Pennsylvania are flat, the only 2 US states currently stuck in neutral.

-

While there are 4 US states seeing outright contraction – Wyoming, North Dakota, Kentucky and West Virginia – we would note that 2 (WY, ND) have populations well below 1 million people.

The bottom line to both these cuts of the state-level data: there is little risk of an imminent US recession. Things could be better in Ohio and Pennsylvania, to be sure, and we’ll have to keep watching those states. Michigan is better than we would have thought given the US-China trade war and wavering demand for light vehicles. Indiana is doing just fine. Our Patient Zero may not be in exactly rude health, but they are still getting around just fine.

https://ift.tt/2sdvsCO

from ZeroHedge News https://ift.tt/2sdvsCO

via IFTTT

0 comments

Post a Comment