Baltic Dry Tumbles Most Since 2008 As Tariff-Frontrunning Fades

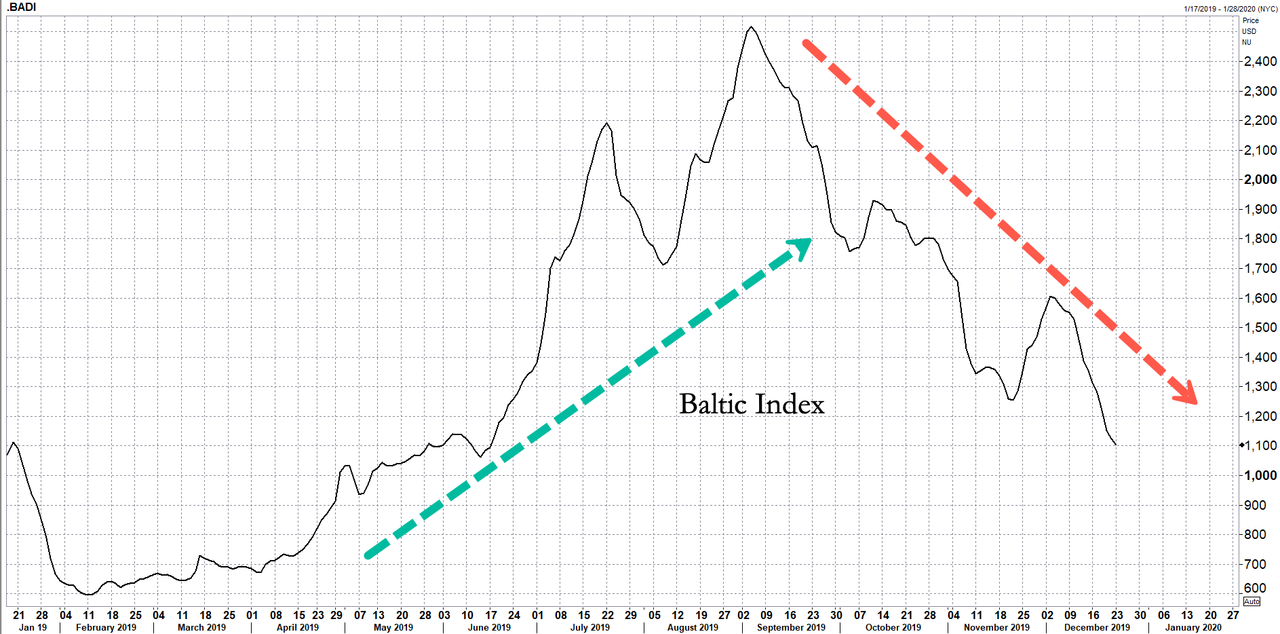

The Baltic Exchange's main sea freight index has plunged to its lowest levels in six months as world trade continues to fade amid signs the so-called “front-loading” effect ahead of tariff deadlines is starting to wane.

Chinese firms and US importers rushed to ship goods to the US through Q1 to Sept. as the US and China were engaged in a tit-for-tat trade war. The implementation of tariffs by both countries on billions of dollars in goods forced importers and exporters to increase outbound and inbound delivers before tariff deadlines went into effect.

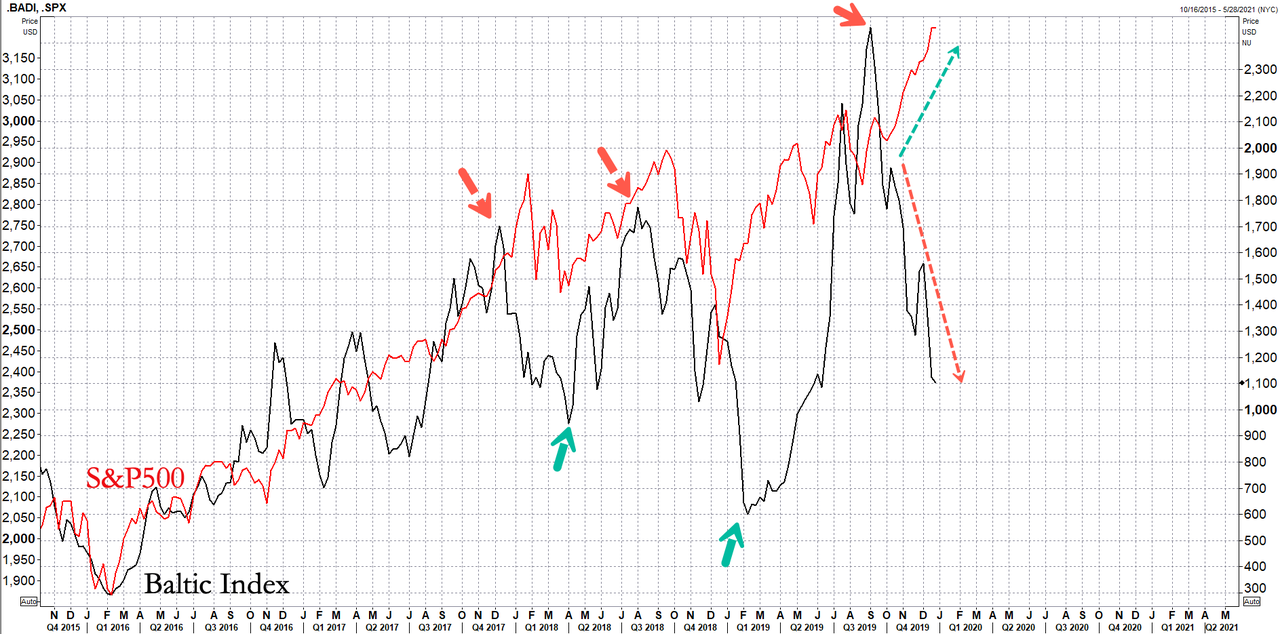

As a result of trade policy change, demand for bulk carriers increased throughout the year, raising the Baltic index +318% from Jan. to Sept.

Trade war sentiment improved into Sept. and into Q4 with a phase one deal between both countries -- tariff front-loading declined late into year driving demand lower for bulk carriers.

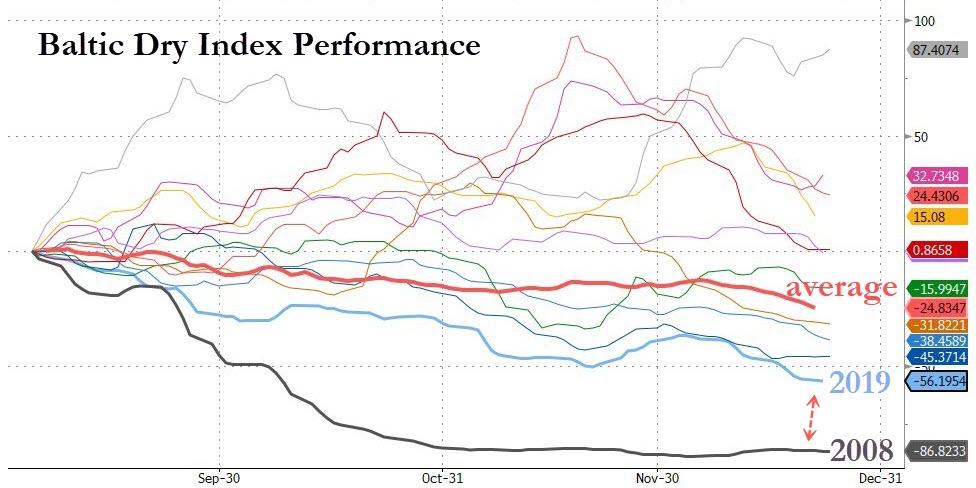

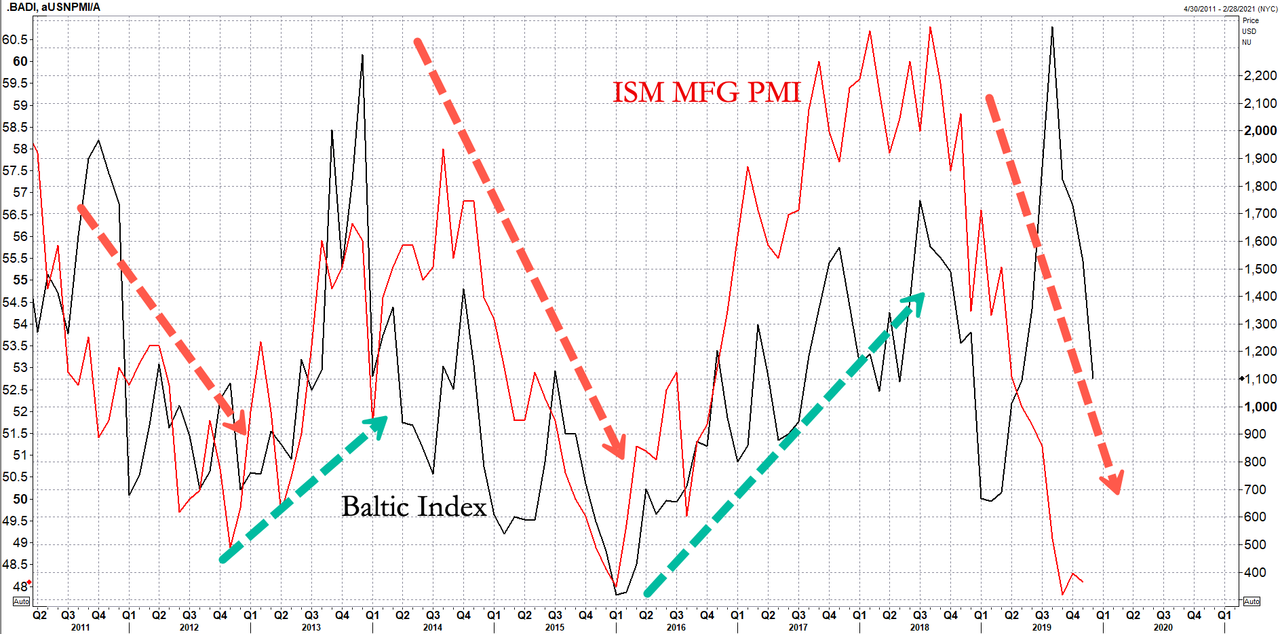

Historically, The Baltic Dry Index has weakened (seasonally) from May through August, but as the chart below makes clear, this year saw the exact opposite as the 'front-running' sparked an optically-bullish surge in demand for shipping (ahead of the expected tariff rises that would eventually not come to pass).

The index has since tumbled the most since 2008.

Along with front-loading in decline, reduced seasonal trends has also drug down demand for bulk carriers leading to lower rates across all vessel segments.

Reuters breaks down the latest shipping report that saw weakness for all capesize, panamax and supramax vessels that haul bulk commodities:

- The Baltic index .BADI, which tracks rates for capesize, panamax and supramax vessels that ferry dry bulk commodities, fell 20 points, or 1.8%, to 1,103, its lowest since June 17.

- The main index was down for a fourteenth-straight session.

- The capesize index .BACI dipped 4 points, to 1,954 — its lowest in more than six months.

- Average daily earnings for capesizes, which typically transport 170,000-180,000 tonne cargoes including iron ore and coal, slid $85 to $14,366.

- The panamax index .BPNI dropped 47 points, or 3.9%, to 1,154, its lowest since Nov. 27.

- Average daily earnings for panamaxes, which usually carry coal or grain cargoes of about 60,000 tonnes to 70,000 tonnes, decreased $384 to $9,228.

- The supramax index .BSIS fell 15 points to 728.

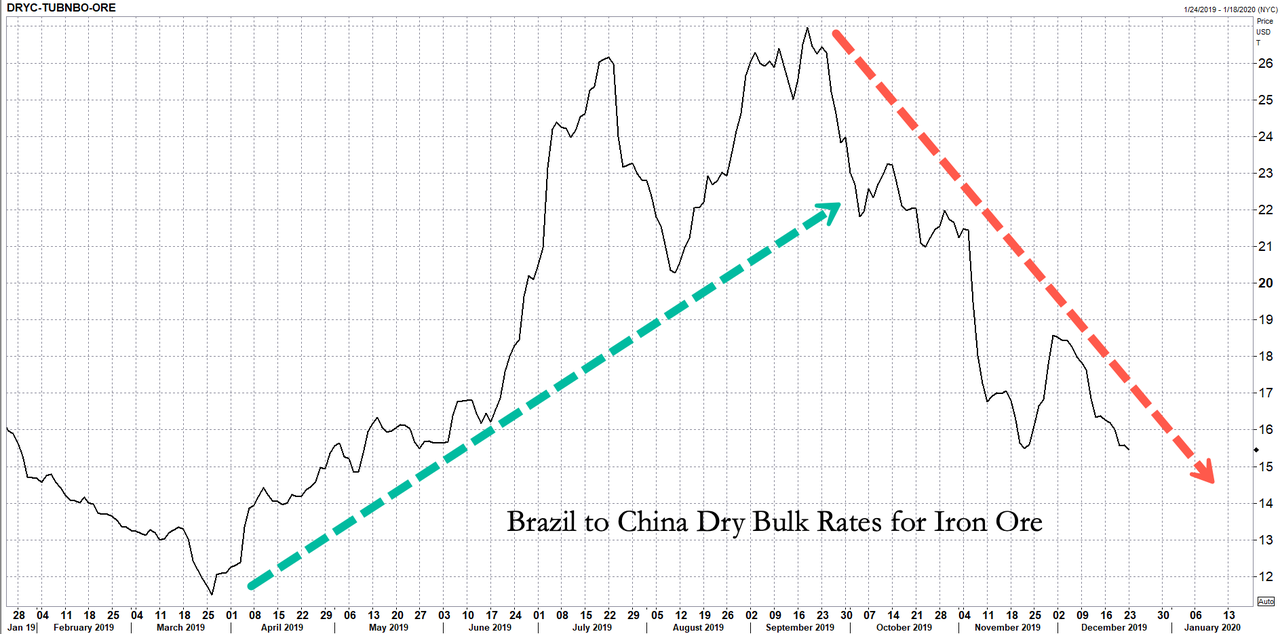

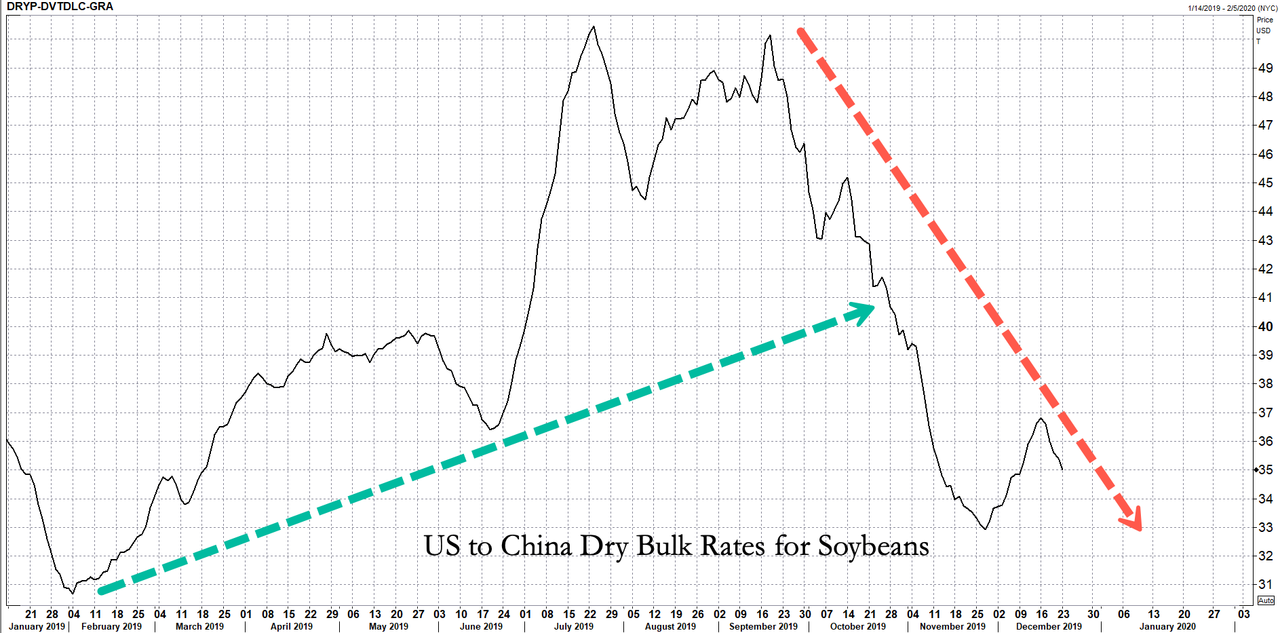

Scanning global dry bulk shipping lanes across the world. We find depressing rates into the late-year that suggests a massive rebound in the global economy might not be imminent as many on Wall Street are predicting.

Brazil to China dry bulk rates for iron ore have seen rates nearly halved since peaking in Sept.

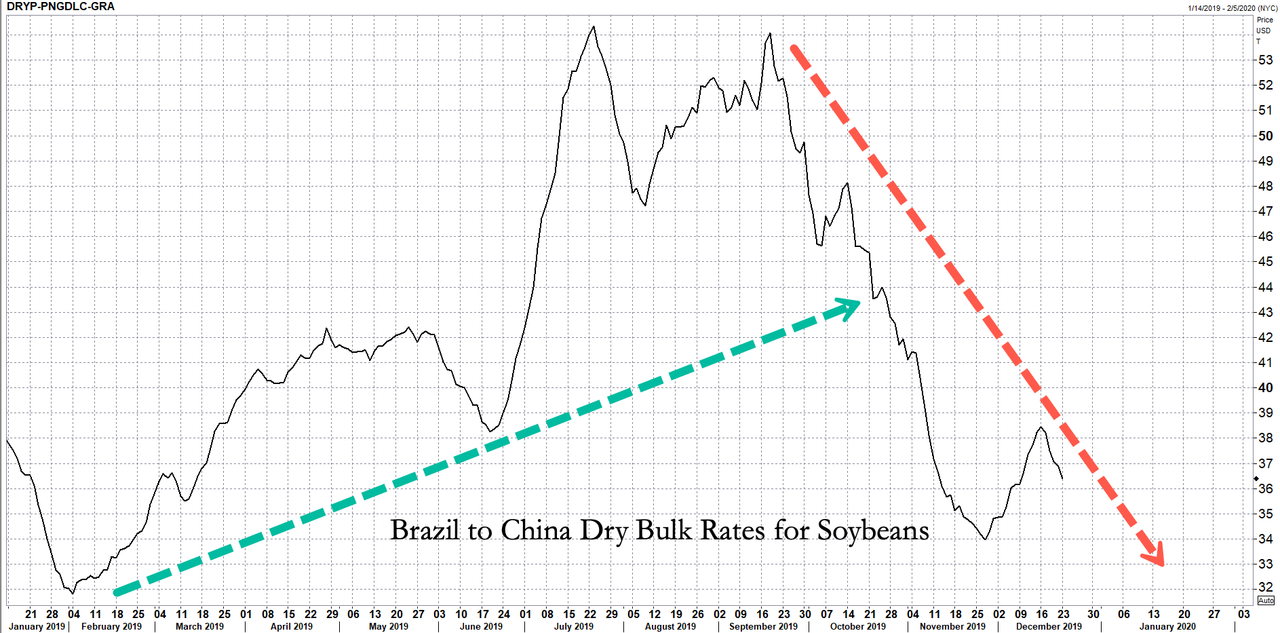

The US to China dry bulk rates for soybeans have also tumbled into the late year.

And even though Brazil and China have signed a recent soybean trade deal and ramped up shipments -- rates between both countries continue to slip for the fourth month.

With the US economy continuing to decelerate and a manufacturing recession deepening -- shipping rates prematurely jumped earlier in the year on artificial demand via front-loading but it seems that the shipping industry is catching down to the reality that not just the US economy is trouble but the rest of the world is entering a new era of low-growth.

So what does that mean for stocks?

https://ift.tt/2ZlhaMK

from ZeroHedge News https://ift.tt/2ZlhaMK

via IFTTT

0 comments

Post a Comment