Global Economy Will Likely Remain Sluggish Into 2020

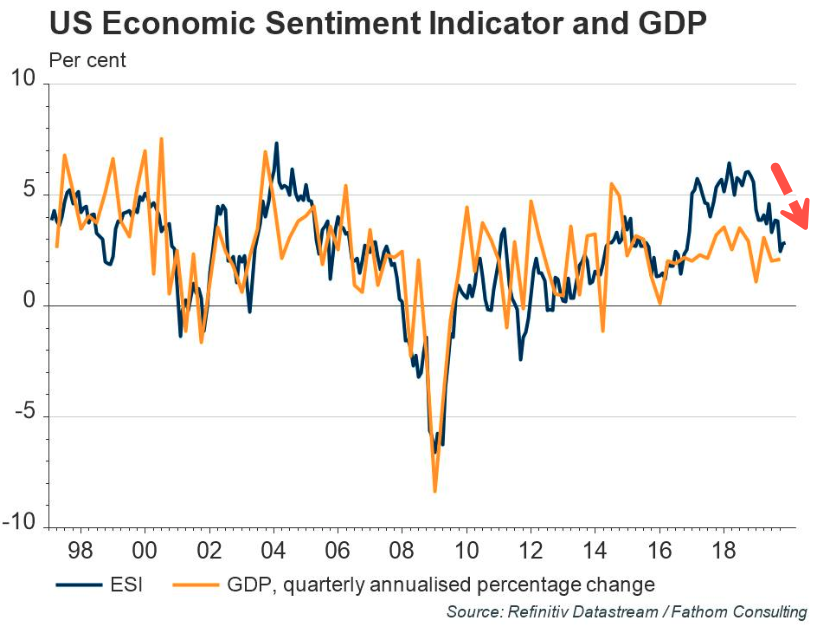

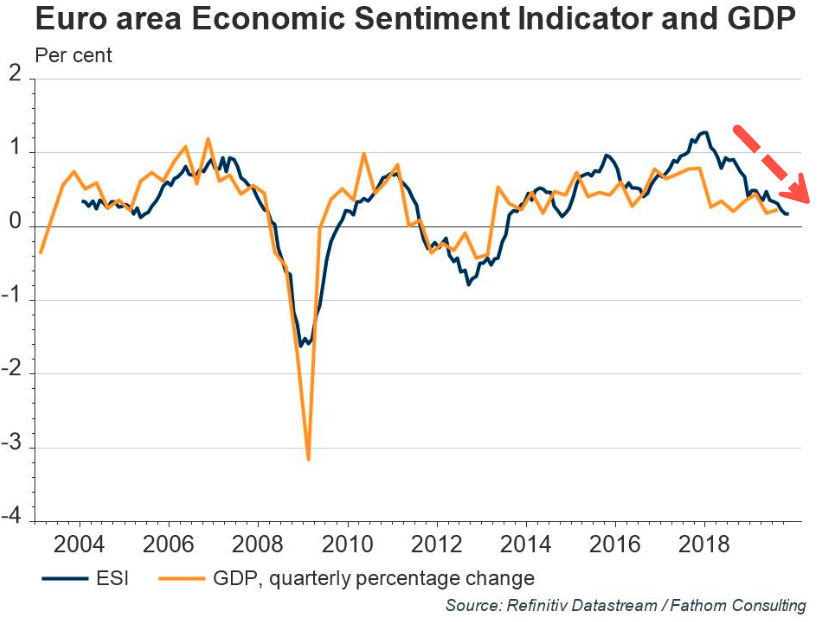

The global economy has entered a period called 'slowbalization,' which is the result of geopolitical shifts and secular trends that have slowed down globalization or, in some cases, completely reversed it. A global manufacturing recession was sparked by changes in consumer preferences that have roiled manufacturing hubs and complex supply chains in developed and emerging markets. Almost every major central bank across the world is easing at the moment in hopes of generating a mini-cycle trough to rebound growth in 2020. But new data via Fathom's monthly Economic Sentiment Indicators (ESIs) say otherwise, suggesting subdued growth will be seen rather than a significant rebound.

Fathom states that the US ESI has bottomed, with more supporting evidence from the Fathom Leading Indicator (FLI), which suggests a recession could be avoided next year. The November US ESI printed at 2.9%, up from a low of 2.4% in September but still off the 2019 high of 4.6%. The Federal Reserve's massive balance sheet expansion of 'Not QE' and excessive rate cuts have been deployed to thwart a significant downturn with the hopes of a substantial economic recovery ahead of the elections. Data shows stabilization is possible, but a turn up in growth that would support today's lofty valuations in stocks will be unlikely, setting up the real possibility that the Fed has engineered a blowoff top in markets.

Fathom's European ESI shows stabilization in November at 0.3%. Growth in the coming quarters will likely stay subdued across Germany and other major economies in the region. Again, the hopes for a massive rebound in early 2020, if it's the US and or Europe, could disappoint equity investors who've ramped global equities to new highs on to hopes of recovery early next year.

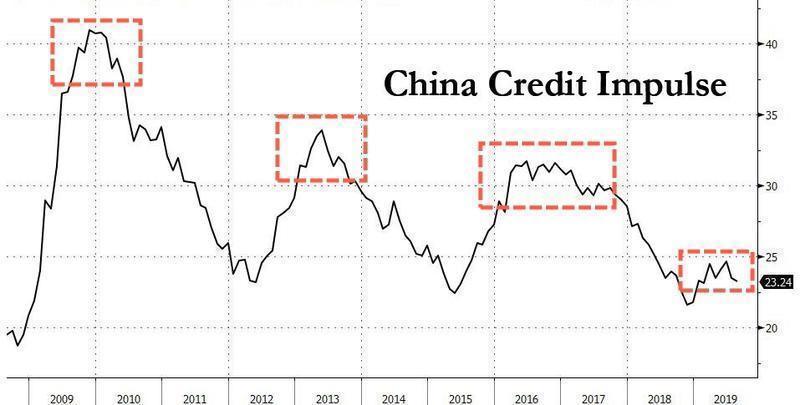

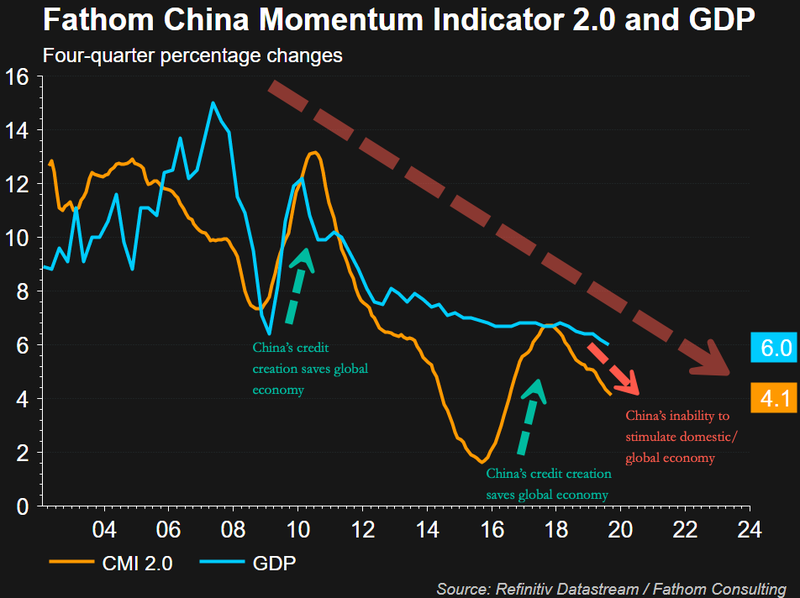

And with the US and Europe trapped in a low-growth period, the economic driver of the world, China, will also see economic deceleration. Without China, who produced 60% of the world's debt in the last decade, the global economy will have difficulty rebounding.

Even Chinese Premier Li Keqiang warned that China's economy could face tremendous downward pressure in 2020.

An advisor to the People's Bank of China (PBoC) warned earlier this month that the country's GDP would decelerate through 2025.

Last month, we noted that China's credit growth plunged to the weakest pace since 2017 as a continued collapse in shadow banking, weak corporate demand for credit, and seasonal effects all signaled that China's economy would slow through 2020.

China's failure to stimulate its economy suggests the global economy will continue to decelerate in the quarters ahead.

Without China, the probabilities of an economic rebound in the US and Europe early next year are low.

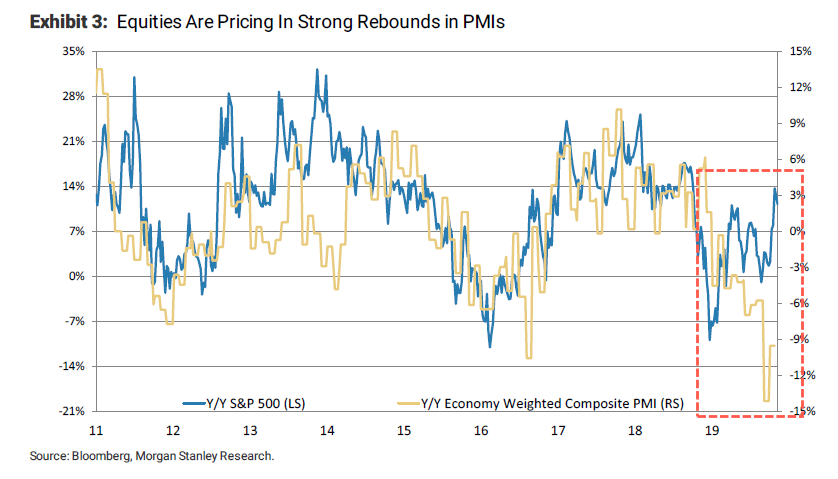

The world has stumbled into a period of low-growth with limited policy prescriptions to revive the global economy. Equity bulls have already priced in a huge recovery in stocks so far - the only problem: if growth doesn't arrive/ or the prospects dim, another repricing event could be nearing.

https://ift.tt/375J2ag

from ZeroHedge News https://ift.tt/375J2ag

via IFTTT

0 comments

Post a Comment