Guggenheim’s Minerd Warns Of A Nearing 'Minsky Moment' That Could "Reset" Asset Prices

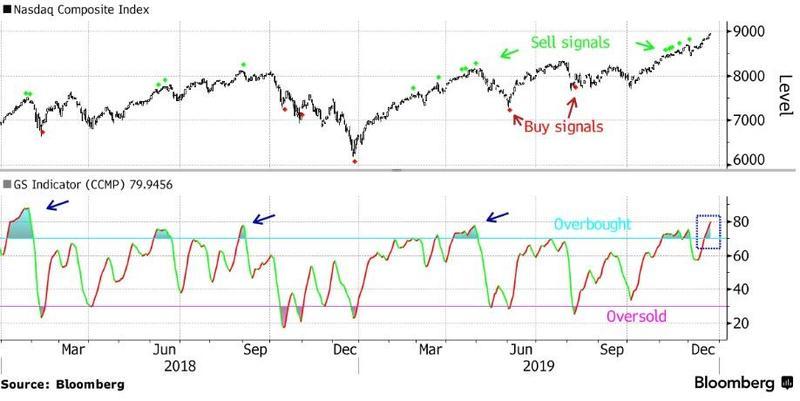

Guggenheim Partners' Scott Minerd warned in a new market outlook titled "From the Desk of the Global CIO: Risk and Reward of Successful 'Mid-Cycle' Rate Cuts" that recent 75bps rate cuts by the Jerome Powell–run Federal Reserve had created a similar environment today to 1998 when central banks created a "liquidity-driven rally that caused the Nasdaq index to double within a year before the bubble finally burst."

The 1998-scenario has already been playing out through 2019, as shown in the chart below, with global central banks plowing liquidity into financial markets.

Minerd suggests that a Minsky moment could be nearing as a period of financial distortions will eventually be unwound in a very violent fashion.

Minerd wasn't entirely clear how long the Fed's bubble-blowing could last but said today's environment will eventually "lead to a significant widening of credits."

Minerd said he'd already taken pre-emptive action to "preserve capital" for the inevitable correction in risk assets: "Thus, while the Fed has prolonged the expansion, the reality is that it is also the start of silly season in risk assets. By heeding the lessons of the past we continue to position defensively so that we can preserve capital and be prepared to take advantage of opportunities when asset prices inevitably reset."

He said cracks have already started to surface in the corporate debt markets. In particular, the spread between the high-yield debt and government debt, indicate tighter spreads have pushed investors extremely far out on the risk curve at a time where they need to be more defensive.

He said the best strategy to navigate markets today is "capital preservation in a market where the risk/reward trade-off looks unattractive in many credit sectors."

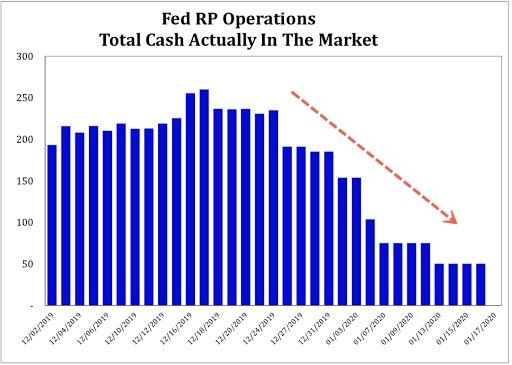

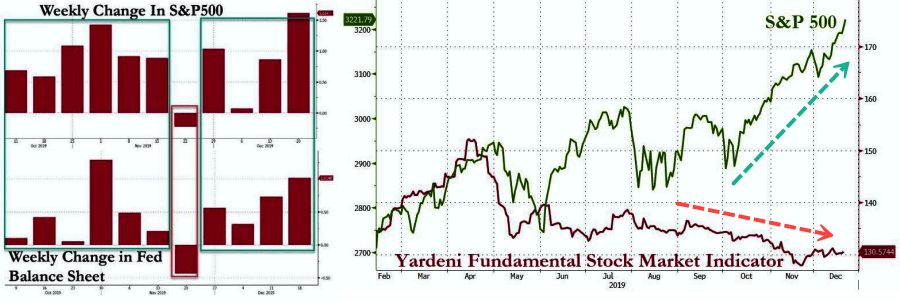

And maybe Minerd's Minksy moment is coming a lot sooner than the market believes, considering repo operations via the Fed could be wound down in the coming weeks.

With the possibility of a less accommodative Fed into the near term and declining stock market fundamentals -- does this set up the case for a blowoff top in the making?

https://ift.tt/2ZoYU5p

from ZeroHedge News https://ift.tt/2ZoYU5p

via IFTTT

0 comments

Post a Comment