Market Meltup Returns As China Spreads Some Post-Christmas "Trade Deal Optimism"

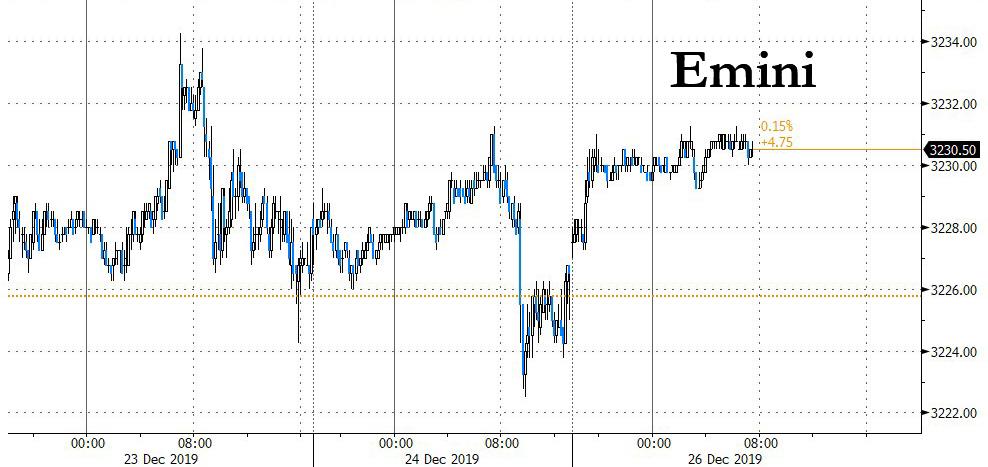

After a modest, brief, and largely inexplicable red close on Christmas Eve coming at a time when the Fed is injecting tens of billions of liquidity into the market every single day, things are back to normal on Thursday when global stocks have resumed their meltup as US index index futures reversed all of Tuesday's losses...

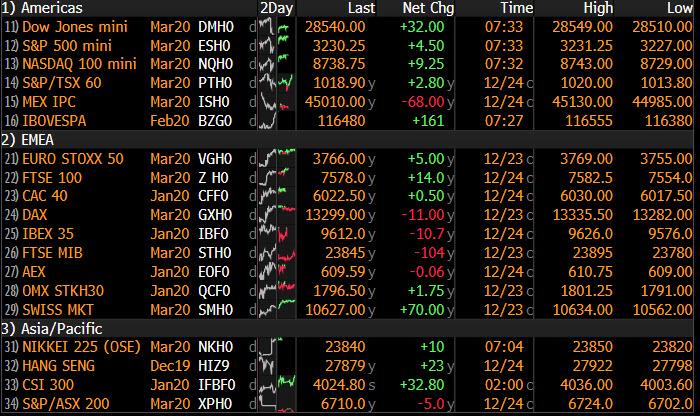

... while most of Europe was closed and Asian stocks ticked higher on Thursday in holiday-thinned trading as investors looked ahead the promised trade deal between the world’s biggest economies in January. Treasuries dipped.

Today's meltup was brought to you by more of the same: trade deal optimism, this time from China, whose commerce ministry spokesman said that "China is in close touch with the United States on signing a Phase 1 trade deal" adding that both sides are still going through necessary procedures before the signing. Somehow, algos saw this as news and decided to rip futures higher.

With most of Europe closed for holidays, the modest overnight activity was focused on Asia where shares ended the session higher in Tokyo, Shanghai and Seoul, while markets were closed in Hong Kong and Sydney. Asian stocks rose on subdued volumes ahead of the New Year’s holidays, as information technology stocks rose, while energy-related companies fell. Markets in the region were mixed, with gains in China and Japanese stocks offsetting a decline in Philippine equities. The Philippines Stock Exchange PSEi Index was down 0.4%. India’s S&P BSE Sensex India dropped by a similar magnitude. Earlier today, Japan’s chief cabinet secretary Yoshihide Suga said the country is proceeding with preparations for the establishment of casinos, while the BOJ left unchanged the planned bond-purchase ranges and frequencies for all maturities in its buying operations for January, when compared with December.

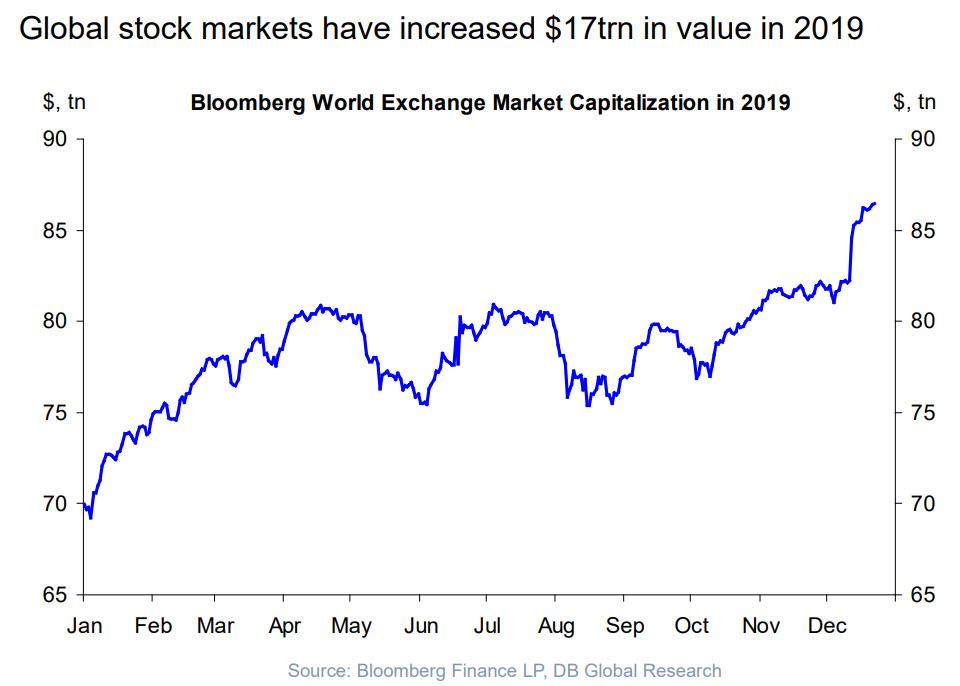

Global stocks have enjoyed an impressive meltup to close the year, with the Bloomberg world exchange market cap hitting an all time high of $87 trillion, while the $51 trillion MSCI ACWI Index of world stocks has jumped more than 8% in the final three months of the year, a quarterly performance that has rarely if ever been bested.

Of course, by now everyone knows what is behind the nearly 30% rise in equities - a 30% expansion in PE multiples, confirming that this is all central banks. Indeed, this year’s central bank balance-sheet expansion “is providing a deluge of liquidity for institutional investors to gorge on,” said Stephen Innes, chief Asia market strategist at Axitrader. "When you combine this cash bonanza with the probable economic bounce from a tariff reversal, it gives more than reasonable cause to own risk assets."

In rates, ten-year Treasury yields moved slightly higher with 2-year and 10-year yields rise 1bp as markets re-open after being closed Wednesday for Christmas Day, while the dollar fluctuated versus its major peers before U.S. jobless claims data due later Thursday. The Japanese yen headed for its biggest drop in almost two weeks, as optimism over improving U.S.-China trade relations damps demand for haven assets. The pound erased earlier gains, following two sessions of modest strengthening.

In commodities, crude oil climbed further above $61 a barrel in New York. Gold advanced back above $1,500 an ounce, having increased in every session this week.

Expected data include initial jobless claims and mortgage applications. No major company is reporting earnings

Market Snapshot

- S&P 500 futures up 0.1% to 3,230.50

- MXAP up 0.2% to 170.17

- MXAPJ up 0.09% to 550.67

- Nikkei up 0.6% to 23,924.92

- Topix up 0.6% to 1,731.20

- Shanghai Composite up 0.9% to 3,007.35

- Sensex down 0.7% to 41,171.06

- Kospi up 0.4% to 2,197.93

- Brent Futures up 0.3% to $67.41/bbl

- Gold spot up 0.3% to $1,503.97

- U.S. Dollar Index down 0.01% to 97.62

Top Overnight News

- China’s policy makers will unveil a three-year action plan in early 2020 on the reform of state enterprises, with an aim to improve the performance of the sector and create world-class champions, according to state-owned newspapers

- China’s imports of U.S. soybeans surge rose to the highest in almost two years after more American cargoes cleared customs ahead of the signing of a partial trade deal in January

- Senator Lisa Murkowski of Alaska revealed the first public qualms with Mitch McConnell’s vow to coordinate with the White House on a quick impeachment trial for President Trump

- China’s financial regulators are calling for more transparent and fair handling of defaults to restore investor confidence in the world’s second-largest bond market, after repayment failures hit a record high this year.

- Turkey dug into its refusal to abandon its new Russian missile defense, saying it won’t bow to threat of crippling U.S. sanctions or trade the S-400s for an American system.

- Pro- democracy demonstrations have been called for the afternoon of Boxing Day at shopping centers in Hong Kong after the territory descended into a flurry of tear gas and arrests as police clashed with protesters in neighborhoods around the city

- Oil rose a third day as an industry report showed American inventories shrunk and as optimism over a partial U.S.-China trade deal grew

Top Asian News

- Hong Kong’s Malls Targeted by Protesters During Christmas Break

- China Plans New Push to Revamp State Firms Starting Next Year

- BOJ Maintains Buying Ranges for All Bond Maturities for January

- Abe, Kuroda Mount Pressure on Japanese Businesses to Lift Wages

Top European News

- Turkey to Submit Libya Troop Motion to Parliament: Erdogan

In FX, the Bloomberg Dollar Spot Index was little changed. The British pound gained 0.1%. The euro was little changed at $1.1087. The Japanese yen weakened 0.2% to 109.58 per dollar. The onshore yuan depreciated 0.2% to 7.001 per dollar.

In commodities, West Texas Intermediate crude increased 0.3% to $61.28 a barrel. Gold gained 0.4% to $1,505.35 an ounce. Silver rose 1.3% to $18 per ounce.

US Event Calendar

- 7am: MBA Mortgage Applications, prior -5.0%

- 8:30am: Initial Jobless Claims, est. 220,000, prior 234,000

- 8:30am: Continuing Claims, est. 1.69m, prior 1.72m

- 9:45am: Bloomberg Consumer Comfort, prior 61.1

https://ift.tt/39gfKaP

from ZeroHedge News https://ift.tt/39gfKaP

via IFTTT

0 comments

Post a Comment