Coronavirus Could Shock World Into Recession, Stephen Roach Warns

Former Morgan Stanley Asia chairman Stephen Roach published an op-ed on Monday (Jan. 27) via Project Syndicate and also appeared on CNBC's "Trading Nation" to warn about how the global economy could already be in a period of vulnerability, where an exogenous shock, such as the coronavirus, could be the trigger for the next worldwide recession.

Roch reminds us that a shock of some sort is usually the cause of most recessions that propagates through the economy. For several years, the Federal Reserve's tightening, which started in late 2017 and ended in the summer of 2019, slowed the global economy. Then the trade war blew up complex supply chains and weakened developed and emerging economies even more, from 1Q18 through 3Q19. These two forces opened a cycle of vulnerability for the global economy that would make it susceptible to a shock. However, it was anyone's guess what that shock would be until now.

"With the world economy operating dangerously close to stall speed, the confluence of ever-present shocks and a sharply diminished trade cushion raises serious questions about financial markets' increasingly optimistic view of global economic prospects," Roach said via his op-ed in Project Syndicate.

On Trading Nation, Roach said, "big shocks for weak economies" could trigger a recession.

He cautioned that coronavirus could remain a problem in the months ahead.

"It's a frightening outbreak, especially when it spreads this rapidly," he said.

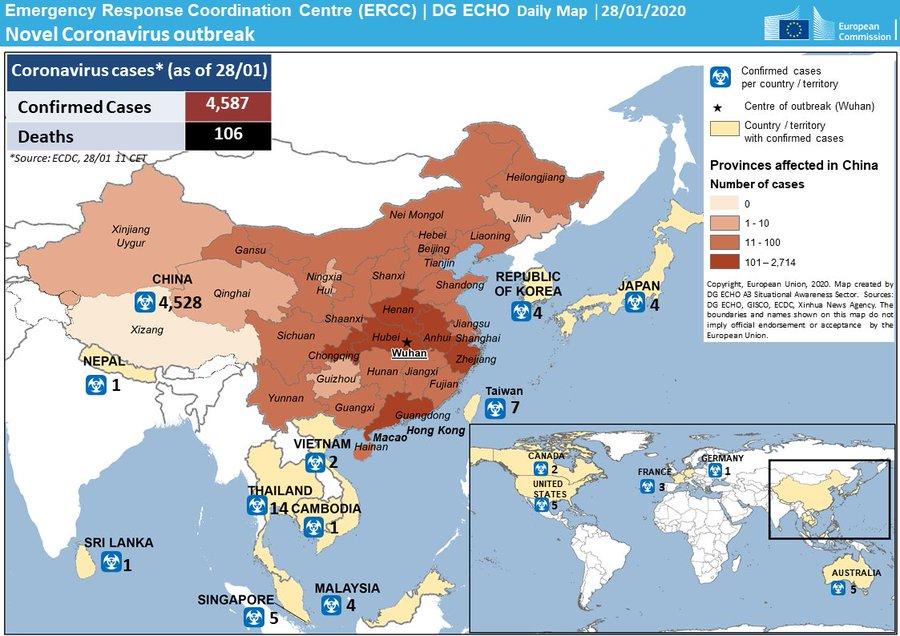

So far, more than a dozen Chinese cities are locked down, tens of millions of people are confined to their homes, and factories and businesses are closed, as the world's second-largest economy grinds to a halt.

And perhaps Roach has found the root cause of the next global recession: coronavirus.

As he ominously concludes, it won't take much to knock this over the edge:

Historically, the rapid expansion of cross-border trade has been an important part of the global growth cushion that shields the world economy from all-too-frequent shocks. From 1990 to 2008, annual growth in world trade was fully 82% faster than world GDP growth.

Now, however, reflecting the unusually sharp post-crisis slowdown in global trade growth, this cushion has shrunk dramatically, to just 13% over the 2010-19 period. With the world economy operating dangerously close to stall speed, the confluence of ever-present shocks and a sharply diminished trade cushion raises serious questions about financial markets’ increasingly optimistic view of global economic prospects.

https://ift.tt/2RB4zTB

from ZeroHedge News https://ift.tt/2RB4zTB

via IFTTT

0 comments

Post a Comment