They Don't Ring A Bell But... Banks Begin Pitching First Managed Synthetic CDO Since Financial Crisis

With spreads so tight - despite credit risks (leverage) at or near record highs - it would appear the bankers have returned to what they know best to be able to keep demand for new issues high and at the same offload their exposures in case of crisis - "baffle 'em with bullshit."

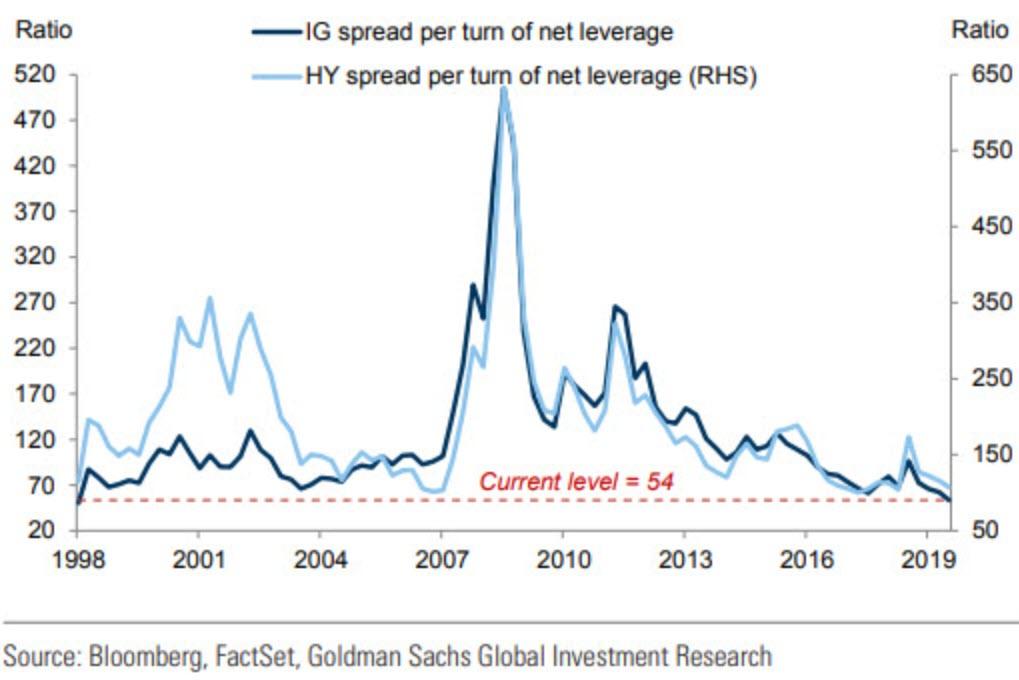

IG and HY spreads relative to turns of leverage are at their tightest levels (least risk-aware) in two decades...

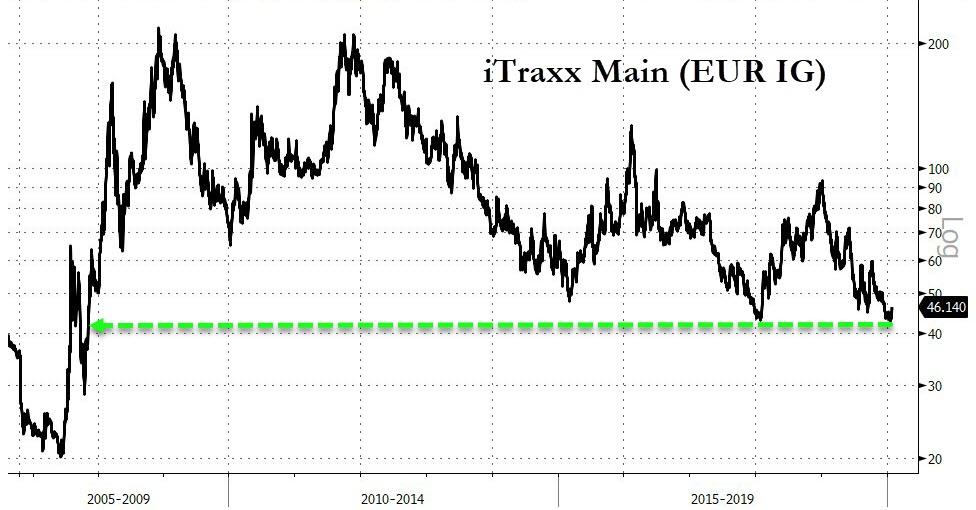

Thanks in large part to the incessant and heavy hand of The ECB on the bid for European corporate debt, credit spreads are at their tightest since 2007, and that, according to IFRE, has sparked several European banks into action.

Source: Bloomberg

JP Morgan, Nomura and BNP Paribas are among the banks racing to sell the first managed synthetic collateralised debt obligation since the financial crisis, according to people familiar with the matter, with sources signalling that a deal could land in the first quarter of the year.

Such a move, as IFRE points out so accurately, would represent a further landmark in the rehabilitation of this controversial breed of structured credit investment that many associate with the kind of excessive financial engineering that led to the financial crisis of 2008.

As a reminder, a synthetic CDO, sometimes called a CSO, invests in a portfolio of single-name CDS, not mortgages to obtain a supposedly diversified portfolio of fixed-income exposure. The returns of that portfolio of premiums is then divided (or tranched) up to meet investors' needs from a demand vs risk perspective (high yields and higher risk, low yields and relative safety) which typically - thanks to the magic of leverage and some financial engineering -can outdo the more generic sources of income available to investors.

Volumes of collateralised synthetic obligations have surged in recent years as historically low interest rates have encouraged money managers to delve into more complex investments. But a subsequent decline in the returns CSOs offer has encouraged banks to find ways to make them more appealing to investors.

And that is why the shift to 'managed' CSOs is so notable, as until now have mainly been short-dated (up to two years in maturity) and static. That means the hedge fund investors that mostly buy these products cannot substitute credits in the underlying portfolio of CDS.

As IFRE details, banks are looking to change that by crafting longer-dated, managed CSOs that would offer meatier yields. Funds including Apollo Global Management and CQS are considering participating if such deals were to come to fruition, sources say.

Allowing the investor in the riskiest portion of the CSO to swap credits in and out of the portfolio should help mitigate the increased risk of defaults that comes with longer-dated investments. These structures would also bear a closer resemblance to the more mainstream collateralised loan obligation market, potentially bringing in a wider range of investors.

"There's definitely a focus on getting the first transaction completed. We're hoping that once we do a managed deal, the investor base can expand – the traditional CLO investors will look at CSOs too," said Sukho Lee, an executive director in structured credit trading at Nomura.

Translation:

"baffle 'em with enough bullshit and offer enough juice and we can sell 'em anything we need to offload."

As a reminder, the synthetic CDO machine loomed large over credit markets in the run-up to the financial crisis, helping to fuel the extraordinary growth in credit derivatives over that period. The CDS market expanded more than fourfold in the space of two years to reach a peak of US$58trn in 2007, according to the Bank for International Settlements, before shrinking back to US$8trn by mid-2019.

Another driver of longer-dated CSOs is that spreads have compressed so much that it's become very difficult to place two-year deals.

"The five-year product helps execution as you’re trading the more liquid part of the curve, but this obviously brings added risk of losses due to the longer duration,” said Ben Hammond, an executive director in credit structuring at Nomura.

“As a result, equity [investors] in particular are keen to look at transactions where they can substitute names over the life of the trade.”

Investment banks have a strong incentive to make these deals work so they can keep the CSO machine running. That means it could be a matter of when, not if, the first managed CSO comes back to the market.

"If dealers can demonstrate that it’s not their trading desk selecting the names but credit managers... that could help banks get more investors involved,” said Christian Adler.

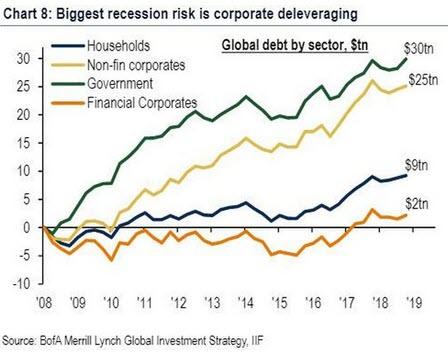

And while the equity tranche of these deals will soak up 5% to 10% of default losses (and pay a chunky 1000bps for that risk), the state of the corporate debt markets suggests, sooner rather than later, losses will far exceed that.

Finally, we note that with central banks expected to support government debt, BofA warns that "the biggest recession risk is disorderly rise in credit spreads & corporate deleveraging."

Even the World Bank's vice president for equitable growth, finance and institutions, Ceyla Pazarbasioglu is worried that the dangers were building up.

"History shows that large debt surges often coincide with financial crises in developing countries, at great cost to the population," she said.

And maybe the renaissance of managed CSOs is the canary... now we just have to wait for CDO-squared to make an appearance to 'sell, Mortimer, sell'!

https://ift.tt/2ObWEtD

from ZeroHedge News https://ift.tt/2ObWEtD

via IFTTT

0 comments

Post a Comment