"The Scope For Pain Is Immense" - China's Consumer Default Tsunami Has Started

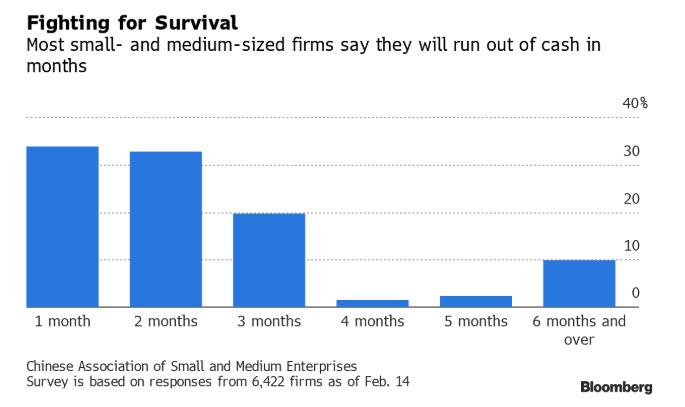

One month ago we reported that "China Faces Financial Armageddon With 85% Of Businesses Set To Run Out Of Cash In 3 Months", in which we explained that while China's giant state-owned SOEs will likely have enough of a liquidity lifeblood to last them for 2-3 quarters, it is the country's small businesses that are facing a head on collision with an iceberg, because according to the Nikkei, over 85% of small businesses - which employ 80% of China's population - expect to run out of cash within three months, and a third expect the cash to be all gone within a month.

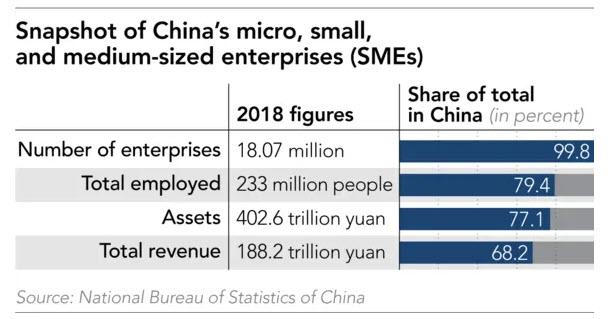

To be sure, the stakes could not be higher: These smaller employers account for 99.8% of registered companies in China and employ 79.4% of workers. They contribute more than 60% of gross domestic product and, for the government, more than 50% of tax revenue. In short: they are the beating heart of China's economy.

In short, should this default tsunami start, not only will China's economy collapse, but China's $40 trillion financial system will disintegrate, as it is suddenly flooded with trillions in bad loans.

* * *

Well, it is now one month later, and as we feared, and as the SCMP reports, "a global consumer default wave is just getting started in China" as overdue credit-card debt in China has soared by about 50% in February, while researchers at the Peterson Institute warn (as we did in February) that what is happening now in China is "a preview of what we should expect throughout the world."

Take the case of Zhang Chunzi - like millions of people around the world, she borrowed money she thought she would be able to repay before the coronavirus changed everything. Now laid off from her job at an apparel exporter in Hangzhou, the prosperous capital of east China’s Zhejiang province, the 23-year-old is missing payments on 12,000 yuan (US$1,700) of debt on her credit card and an online lending platform operated by Ant Financial.

"I’m late on all the bills and there’s no way I can pay my debt in full,” Zhang said.

Zhang’s story is playing out in similar ways across China (and soon, across the world), where the virus outbreak has been taking lives and ravaging the economy for more than three months. As Covid-19 works its way through the rest of Asia, Europe and the Americas – forcing countries into lockdown, driving up unemployment and pummeling small-business owners – analysts say it is only a matter of time before stretched households globally start to default on their loans.

To be sure, the early indicators from China are not pretty. Overdue credit-card debt in February rose by about 50% from a year earlier, according to executives at two banks who asked not to be named. Qudian, a Beijing-based online lender, said its delinquency ratio jumped to a staggering 20% in February, from 13% at the end of last year.

For some the shock from the economic slowdown is so big, they have had no choice but to hit pause. China Merchants Bank, one of the country’s biggest providers of consumer credit, said this month that it “pressed the pause button” on its credit-card business after a significant increase in past-due loans as an estimated 8 million people in China lost their jobs in February.

“These issues in China are a preview of what we should expect throughout the world,” said Peterson Institute for International Economics research fellow Martin Chorzempa.

And while the extent of the squeeze on consumers and their lenders will depend on the effectiveness of government efforts to contain the virus and shore up economies, "the scope for pain is immense" the SCMP warns ominously.

Needless to say, what is coming across the globe is unprecedented: household debt-to-GDP ratios in countries including France, Switzerland, New Zealand and Nigeria have never been higher, according to a January report from the Institute of International Finance. In Australia, which has the highest household debt levels among G20 nations, the country’s largest lender said on Thursday that its financial assistance lines were receiving eight times the normal call volume.

A similar surge in queries has flooded lenders in the United States, where credit-card balances rose to an unprecedented US$930 billion last year and almost 3.3 million people filed for jobless benefits during the week ended March 21 – quadruple the previous record.

However, not even the US has seen as big a jump in consumer borrowing in recent years than China, where household debt including mortgages soared to a record 55 trillion yuan (almost $8 trillion) last year. That figure has nearly doubled since 2015, thanks to a housing boom and the rise of online lenders like Ant Financial. While the firm’s risk models rely on reams of payments data, they have yet to be tested by a major economic downturn. Many consumers who take out these short-term, high-interest loans – typically funded by banks through Ant’s Alipay smartphone app – have minimal income and virtually no credit history.

“Since 2015, banks have kept lowering their criteria to compete,” said Zhang Shuaishuai, an analyst at China International Capital. “The virus outbreak accelerated their exposure to risks. It will only get worse if unemployment climbs further.”

Meanwhile, consumer default rates at some banks have already increased to as high as 4%, from about 1% before the outbreak, according to Zhao Jian, head of Atlantis Financial Research, who cited a survey of lenders. An executive at a major Chinese bank said his firm was taking steps to tighten credit card loans or even drop some clients after seeing a rapid increase in overdue payments.

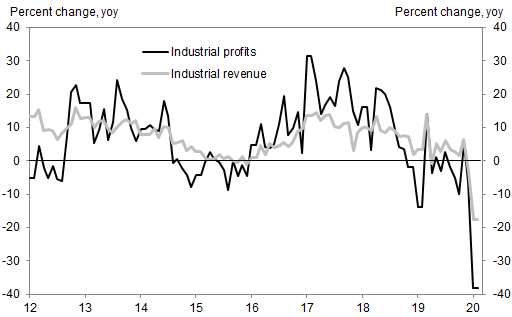

With corporate delinquencies rising as well, banks could face a 5.2 trillion yuan surge in total non-performing loans and an unprecedented 39 per cent slump in profits this year, according to a worst-case scenario outlined by UBS. As reported last week, China's industrial profits just crashed the most on record, plunging -38.3% Y/Y, and far worse from the -6.3%Y/Y decline in December.

Some hope that massive government stimulus will help ease the blow. Most countries have announced plans for economic support measures in recent months, including a US$2 trillion package in the US that will provide direct payments to lower- and middle-income Americans. Some of the biggest US lenders have pledged to offer grace periods for mortgage borrowers affected by the crisis.

In China, authorities have flooded the financial system with liquidity and encouraged banks to step up their lending to small businesses that employ about 80 per cent of the nation’s workforce. While most banks have yet to offer debt relief to consumers outside those living in cities like Wuhan that were hit especially hard by the virus, UBS predicts China’s government will do more if needed to help people find jobs and pay their bills. Bloomberg Economics estimates that about 85 per cent of the economy was back online in the week ending March 20, excluding the original virus epicentre in Hubei province, although we believe those numbers are strongly gamed to represent to the world that the economy has rebounded when the reality is a mirror image.

That said, as UBS analyst May Yan correctly notes, "a large scale increase in unemployment, and resulting high delinquencies on retail loans won’t be tolerated by authorities as social stability is their bottom line,” although it is unclear what it can do to preserve stability if tens of millions lost their jobs.

Of course, stimulus is unlikely to tide over everyone, particularly in places like China where household finances are stretched like never before. The country’s consumer debt-to-income ratio surged to 92% at the end of 2018, from 30% a decade ago, surpassing that of Germany and closing in on levels in the US and Japan, according to IIF.

The risk is that a prolonged economic slump and weak real estate market will force more people to renege on their loans.

That moment has already arrived for Yin Weijun, a 27-year-old who recently lost his job as a hotel chef in Wenzhou, in Zhejiang.

“I’m like a refugee from debt,” he said. “I had never missed a payment in my life, but the virus left me with no choice. Even if they give me an extra one or two months, I still can’t pay.”

https://ift.tt/2ydy8mM

from ZeroHedge News https://ift.tt/2ydy8mM

via IFTTT

0 comments

Post a Comment