Diamond Offshore Files For Bankruptcy

Once upon a time, it was the most admired offshore drilling company in the US, and a perennial LBO candidate due to its rock-solid cashflows. A little over a decade later, the cashflows are gone, and Houston’s Diamond Offshore Drilling has just filed for bankruptcy listing debts of more than $2.6 billion, blaming the “unprecedented” impact of an oil price war and the coronavirus pandemic. It joins a list of other companies that have cited the coronavirus in recent chapter 11s filings.

Coronavirus-related challenges have been cited in recent chapter 11s filed by companies in the retail, medical device and coal production industries: pic.twitter.com/Bv8aYrXF8Y

— First Day by Reorg (@ReorgFirstDay) March 11, 2020

The implosion of the company comes 10 days after it missed an interest payment on $500 million worth of bonds and said it was working with advisers on various options for its future.

In its Chapter 11 filing filed with Houston’s bankruptcy court, the company listed $5.8 billion of assets and $2.6 billion of debt, as well as $434.9 million of cash on hand. Diamond said conditions in its "highly competitive and cyclical industry” had “worsened precipitously in recent months" and while the company had taken "various actions" to shore up its finances, including borrowing $400MM under a revolving credit facility in March, Chapter 11 bankruptcy represented the best return to stakeholders.

Well, maybe the bondholders, as we somehow doubt the equity, which last traded at 93 cents will be delighted. Major equity holders include NYSE-listed Loews Corporation, which owns 53% of Diamond, 2,500 staff who work there, and bondholders who are owed more than $2BN.

Diamond owns deepwater rigs that can drill in water more than two miles deep. But offshore oil is among the most expensive to produce, putting the company at a disadvantage when prices plunged to less than $30 a barrel. While newer deepwater projects are less expensive, they still take longer to develop than shale wells and they still can’t compete on costs.

In an April 16 note downgrading Diamond’s debt to the deep junky Ca2, Moody’s said the oilfield services sector would be "one of the sectors most significantly affected” by the “severe and extensive” shock from the coronavirus pandemic, falling oil pries and asset price declines.

"There is a high likelihood that the company restructures its debts, either through an out-of-court settlement with its creditors or through the bankruptcy process," Moody’s analysts stressed and they were right. S&P also downgraded the company on the same day, citing “the strong likelihood the outcome will result in a selective default or Chapter 11 bankruptcy.”

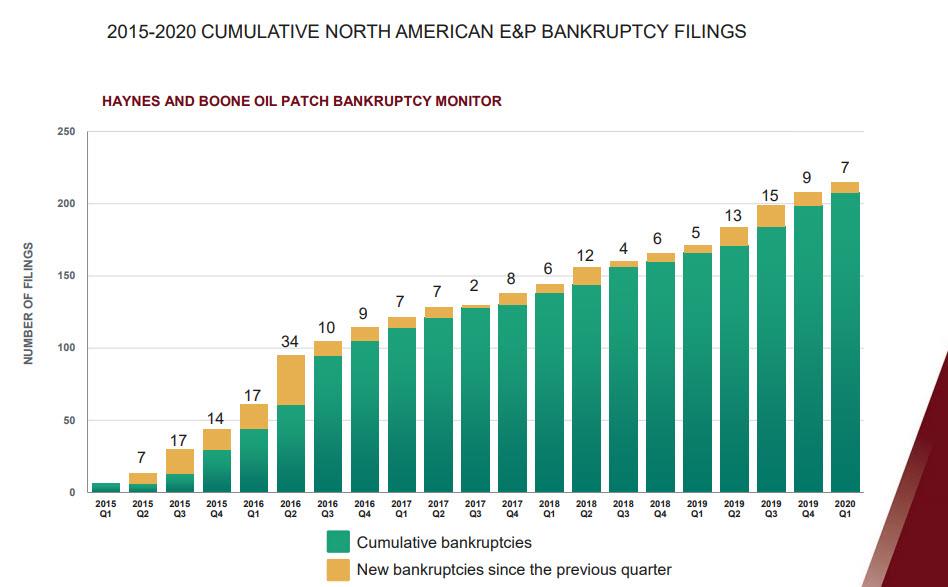

Diamond Offshore adds to the more than 200 oilpatch bankruptcies dating from 2015, according to a tally by the Haynes & Boone law firm.

About 2,500 jobs could be at stake at Diamond. The case is Diamond Offshore Drilling Inc., 20-32307, U.S. Bankruptcy Court for the Southern District of Texas (Houston).

https://ift.tt/2W23KnO

from ZeroHedge News https://ift.tt/2W23KnO

via IFTTT

0 comments

Post a Comment