It Begins: US Treasury Balance Hits All Time High After Historic Flood Of Bill Issuance

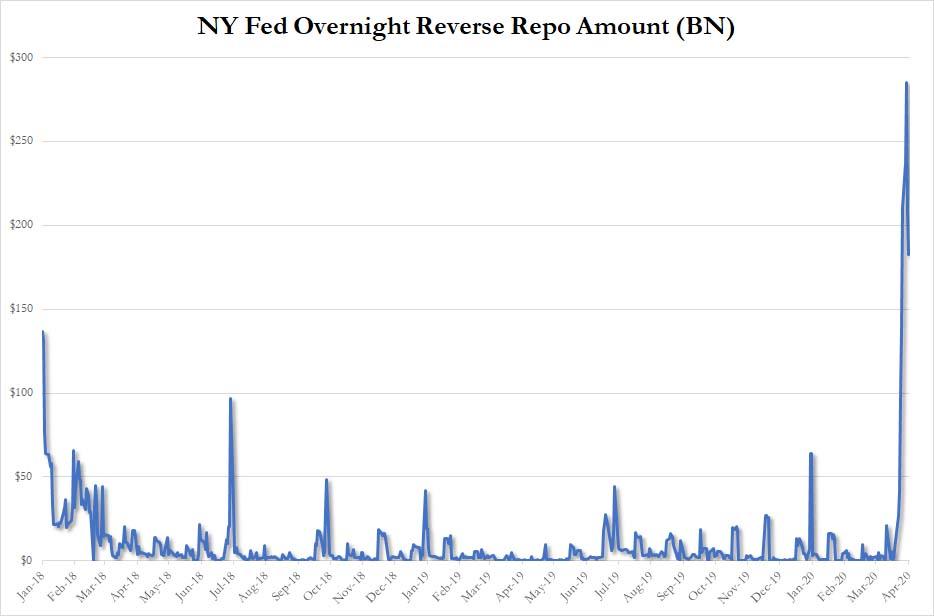

One didn't need to read our post explaining why with the Fed's reverse repo operations now much more aggressively used (and in fact seeing some $182BN of usage well into the second quarter, so much more than just a quarter-end window dressing exercise) ...

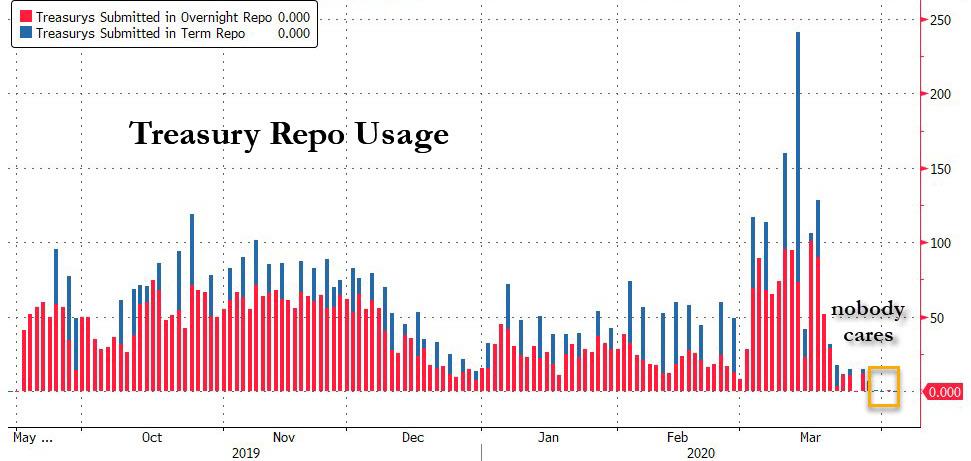

... than the Fed's recently expanded, massive repo ops, which have basically been abandoned by Dealers in the past week ...

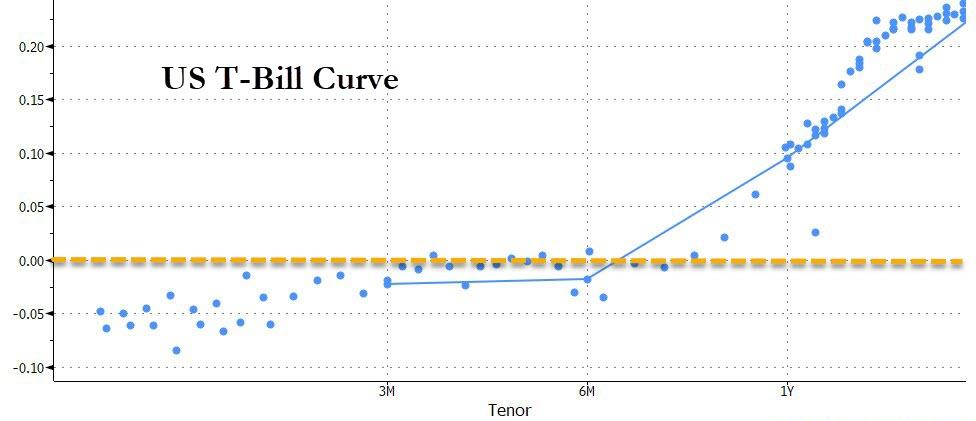

... there was now a shortage of Treasuries: a quick look at where T-bills yields were trading on Monday was sufficient - virtually every issue to the left of 3 months had a deeply negative yield, and ushered in a risk-free arb that bond traders could take advantage of to make virtually unlimited money by purchasing Bills at a 0%-yield capped auctions and then selling them in the open market above par.

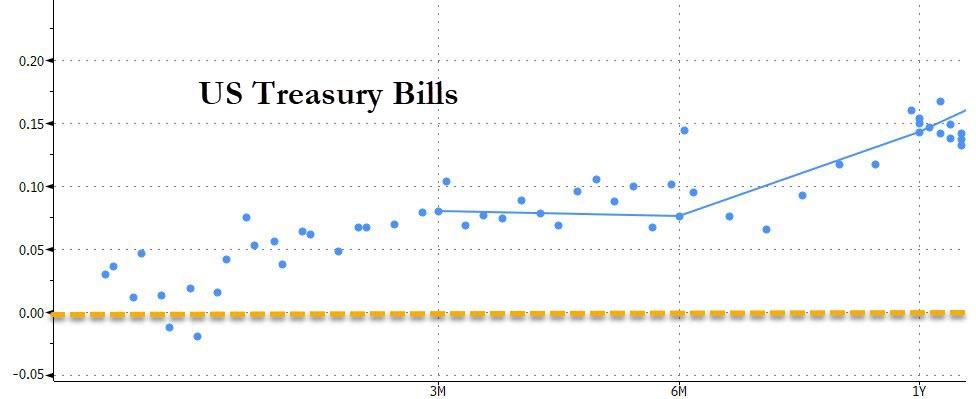

That's when Steven Mnuchin realized he had to do something to address the bond shortage which was literally taking money from the Treasury and handing it to Wall Street, and that thing was to unleash a historic flood of Bills and Cash Management Bills, something we pointed out in "Treasury To Sell Over A Quarter Trillion Bills In 48 Hours." Immediately the yields across the curve spiked, with all tenors now yielding back above 0% (the Bill arb disappearing in the process).

Yet this does not do justice to the absolute tsunami of issuance in the Bill market where the Treasury did everything in its power to not only flood the market with new debt (not that it had much of a choice) but to also prefund the Treasury's historic outflows in the coming days.

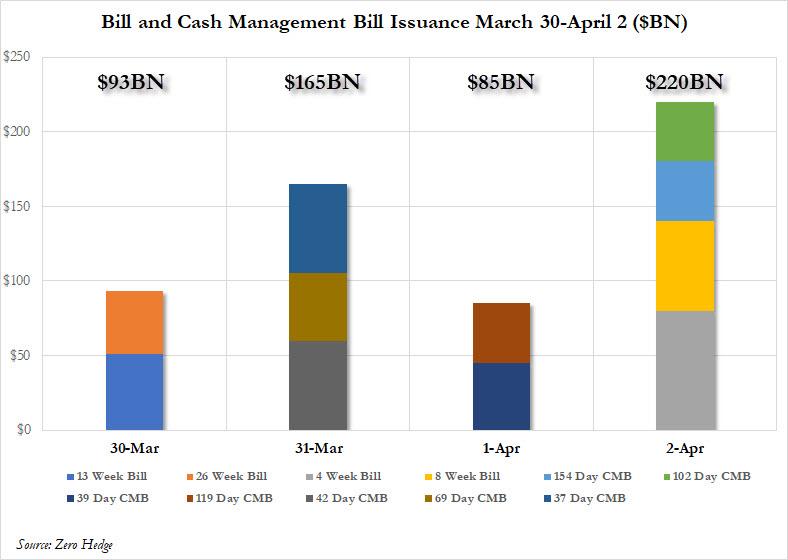

As shown in the chart below, in addition to the previously discussed Bills and CMBs, this week's Treasury has been on an absolute tear and in just the past 4 days has issued, in addition to the regularly scheduled 4-Week, 8-Week, 3-Month and 6-Month Bills, also 154 Day, 102 Day, 39 Day, 119 Day, 42 Day, 69 Day, and 37 Day Cash Management Bills, as shown in the chart below.

This $563 billion in gross Bill issuance ($93BN on Monday, $154BN on Tuesday, $85BN on Wednesday, $220BN on Thursday), is more than anything ever seen previously in a 4 day period. And while a portion of this gross issuance went to offset current maturities, the net effect was massive nonetheless, and nowhere more so than the Treasury's cash balance (i.e. the Federal Reserve Account).

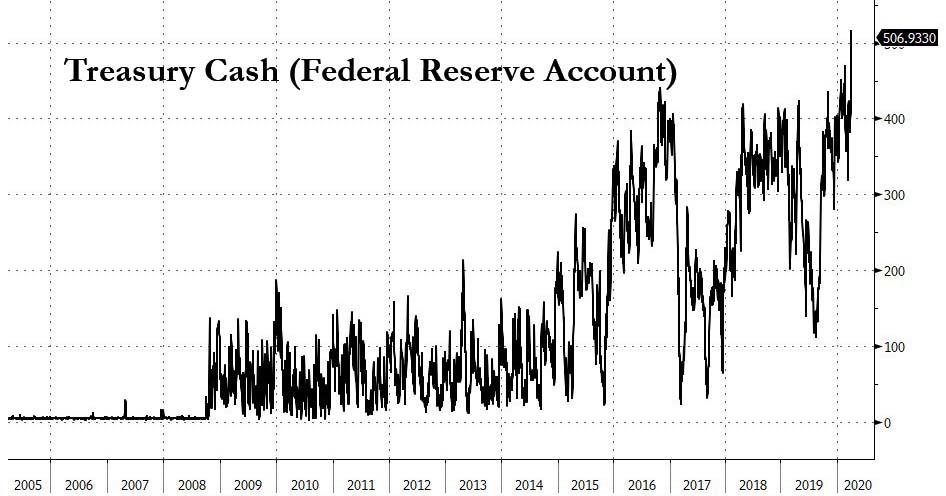

And, as shown in the final chart, the result of this Bill issuance flood is that the cash balance of the Treasury (i.e. the US government) just hit a record $515 billion, the highest on record.

Why? Because tomorrow is the day the crisis response officially begins as hundreds of billions in small, medium and very large business bailout demands hit the Treasury as up to $2 trillion in funds are handed out across the economy over the coming weeks.

As such, the half a trillion dollars held electronically at the US Treasury is just the beginning.

And here a quick aside: consider the path the money is taking before ending up in Joe Sixpack's pocket: a desk worker at the Treasury punches a few buttons and sells electronic certificates which mature in a few weeks and are backstopped by the US government and which in turn fund the Treasury's account with electronic dollars which were paid by some investor who similarly punched a few buttons on his computer and in hopes of parking his cash somewhere safe, handed over his electronic money to the Treasury desk worker. As a result of this transaction, hundreds of millions will receive a small amount of electronic ones and zeros in the next few days, which for countless people will mean the difference between disaster and survival.

https://ift.tt/3dSYE5a

from ZeroHedge News https://ift.tt/3dSYE5a

via IFTTT

0 comments

Post a Comment